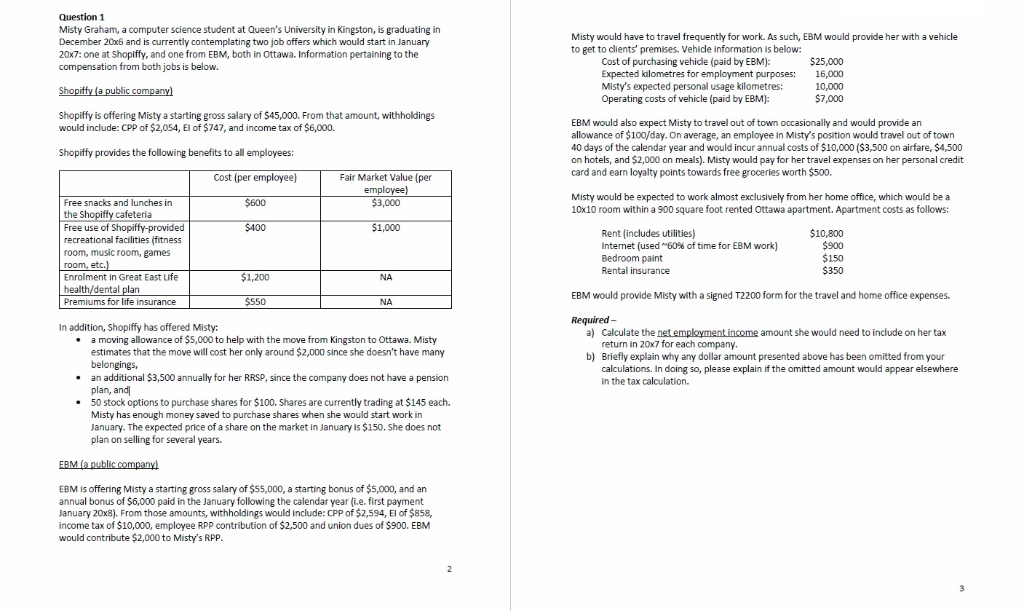

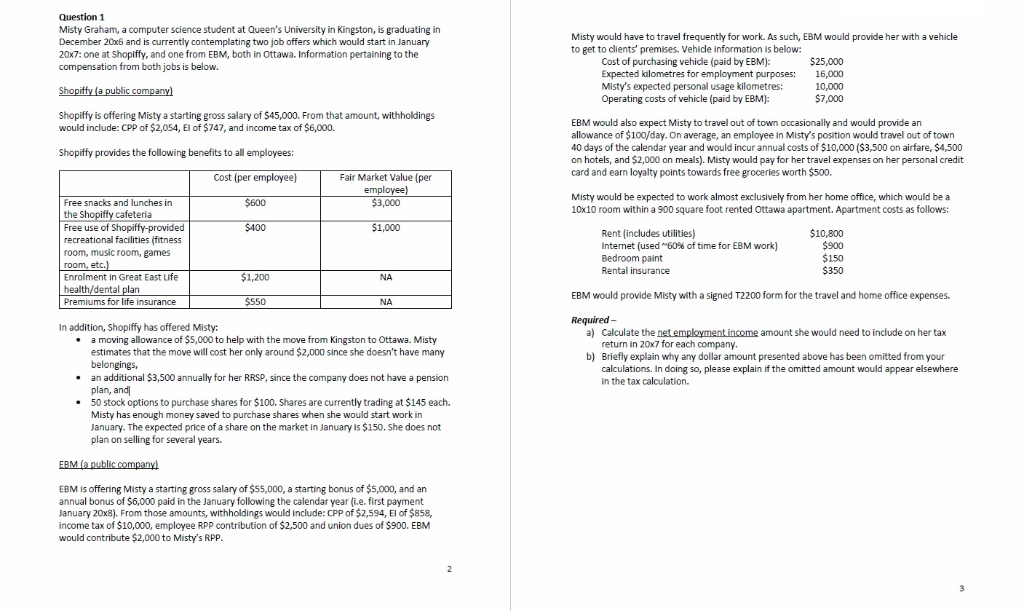

Question 1 Misty Graham, a computer science student at Queen's University in Kingston, is graduating in December 20x6 and is currently contemplating two job offers which would start in January 20x7: one at Shopiffy, and one from EBM, both in Ottawa. Information pertaining to the compensation from both jobs is below. Misty would have to travel frequently for work. As such, EBM would provide her with a vehicle to get to clients' premises. Vehicle information is below: Cost of purchasing vehidle (paid by EBM): Expected kalometres for employment purposes: Misty's expected personal usage kilometres: Operating costs of vehicle (paid by EBM]: $25,000 16,000 10,000 Shopiffy is offering Misty a starting gross salary of $45,000. From that amount, withholdings would include: CPP of $2,054, El of $747, and income tax of $6,000. EBM would also expect Misty to travel out of town occasionally and would provide an allowance of $100/day. On average, an employee in Misty's position would travel out of town 40 days of the calendar year and would incur annual costs of $10,000 ($3,500 on airfare, $4,500 on hotels, and $2,000 on meals). Misty would pay for her travel expenses on her personal credit card and earn loyalty points towards free groceries worth $500. Shopiffy provides the following benefits to all employees: Cost (per employee) $600 $400 Fair Market Value (per 3,000 $1,000 Misty would be expected to work almost exclusively from her home office, which would be a 10x10 room within a 900 square foot rented Ottawa apartment. Apartment costs as follows: Free snacks and lunches in cafeteria Free use of Shopiffy-provided recreational facilities (fitness room, music room, games Rent (includes utilities) Internet (used ~60% of time for EBM work) Bedroom paint Rental insurance $10,800 $900 150 350 Enrolment in Great East Life health/dental Premiums for life insurance $1,200 NA EBM would provide Misty with a signed T2200 form for the travel and home office expenses. $550 NA Required- a) In addition, Shopiffy has offered Misty: a moving allowance of $5,000 to help with the move from Kingston to Ottawa. Misty estimates that the move will cost her only around $2,000 since she doesn't have many belongings an additional $3,500 annually for her RRSP, since the company does not have a pension plan, and Calculate the net employment income amount she would need to include on her tax return in 20x7 for each company. Briefly explain why any dollar amount presented above has been omitted from your calculations. In doing so, please explain if the omitted amount would appear elsewhere in the tax calculation. b) . .50 stock options to purchase shares for $100. Shares are currently trading at $145 each. Misty has enough money saved to purchase shares when she would start work in January. The expected price of a share on the market in January is $150. She does not plan on selling for several years. EBM is offering Misty a starting gross salary of $55,000, a starting bonus of $5,000, and an annual bonus of $6,000 paid in the January following the calendar year (i.e. first payment January 20x8). From those amounts, withholdings would Include: CPP of $2,594, El of $858, income tax of $10,000, employee RPP contribution of $2,500 and union dues of $900. EBAM would contribute $2,000 to Misty's RPP Question 1 Misty Graham, a computer science student at Queen's University in Kingston, is graduating in December 20x6 and is currently contemplating two job offers which would start in January 20x7: one at Shopiffy, and one from EBM, both in Ottawa. Information pertaining to the compensation from both jobs is below. Misty would have to travel frequently for work. As such, EBM would provide her with a vehicle to get to clients' premises. Vehicle information is below: Cost of purchasing vehidle (paid by EBM): Expected kalometres for employment purposes: Misty's expected personal usage kilometres: Operating costs of vehicle (paid by EBM]: $25,000 16,000 10,000 Shopiffy is offering Misty a starting gross salary of $45,000. From that amount, withholdings would include: CPP of $2,054, El of $747, and income tax of $6,000. EBM would also expect Misty to travel out of town occasionally and would provide an allowance of $100/day. On average, an employee in Misty's position would travel out of town 40 days of the calendar year and would incur annual costs of $10,000 ($3,500 on airfare, $4,500 on hotels, and $2,000 on meals). Misty would pay for her travel expenses on her personal credit card and earn loyalty points towards free groceries worth $500. Shopiffy provides the following benefits to all employees: Cost (per employee) $600 $400 Fair Market Value (per 3,000 $1,000 Misty would be expected to work almost exclusively from her home office, which would be a 10x10 room within a 900 square foot rented Ottawa apartment. Apartment costs as follows: Free snacks and lunches in cafeteria Free use of Shopiffy-provided recreational facilities (fitness room, music room, games Rent (includes utilities) Internet (used ~60% of time for EBM work) Bedroom paint Rental insurance $10,800 $900 150 350 Enrolment in Great East Life health/dental Premiums for life insurance $1,200 NA EBM would provide Misty with a signed T2200 form for the travel and home office expenses. $550 NA Required- a) In addition, Shopiffy has offered Misty: a moving allowance of $5,000 to help with the move from Kingston to Ottawa. Misty estimates that the move will cost her only around $2,000 since she doesn't have many belongings an additional $3,500 annually for her RRSP, since the company does not have a pension plan, and Calculate the net employment income amount she would need to include on her tax return in 20x7 for each company. Briefly explain why any dollar amount presented above has been omitted from your calculations. In doing so, please explain if the omitted amount would appear elsewhere in the tax calculation. b) . .50 stock options to purchase shares for $100. Shares are currently trading at $145 each. Misty has enough money saved to purchase shares when she would start work in January. The expected price of a share on the market in January is $150. She does not plan on selling for several years. EBM is offering Misty a starting gross salary of $55,000, a starting bonus of $5,000, and an annual bonus of $6,000 paid in the January following the calendar year (i.e. first payment January 20x8). From those amounts, withholdings would Include: CPP of $2,594, El of $858, income tax of $10,000, employee RPP contribution of $2,500 and union dues of $900. EBAM would contribute $2,000 to Misty's RPP