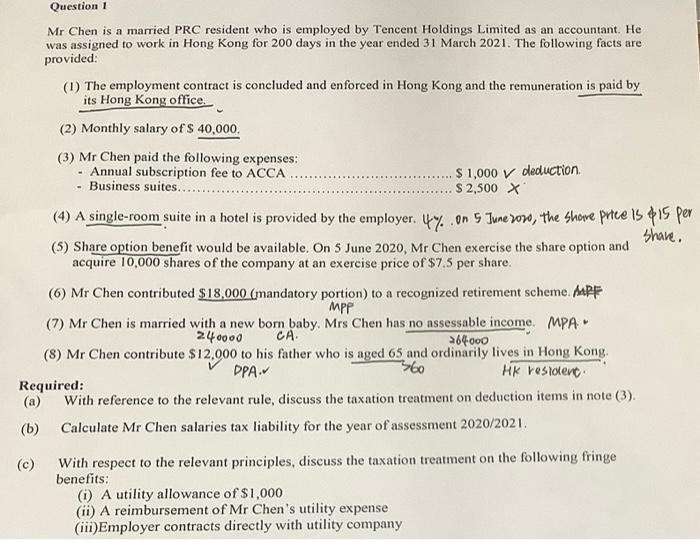

Question 1 Mr Chen is a married PRC resident who is employed by Tencent Holdings Limited as an accountant. He was assigned to work in Hong Kong for 200 days in the year ended 31 March 2021. The following facts are provided (1) The employment contract is concluded and enforced in Hong Kong and the remuneration is paid by its Hong Kong office. (2) Monthly salary of S 40,000. (3) Mr Chen paid the following expenses: Annual subscription fee to ACCA $1,000 v deduction - Business suites... $ 2,500 X (4) A single-room suite in a hotel is provided by the employer. 47.on 5 June 20w, the showe putee 15 pls per Share. (5) Share option benefit would be available. On 5 June 2020, Mr Chen exercise the share option and acquire 10,000 shares of the company at an exercise price of $7.5 per share. (6) Mr Chen contributed $18,000 (mandatory portion) to a recognized retirement scheme. AMPF MPP (7) Mr Chen is married with a new born baby. Mrs Chen has no assessable income. MPA 240000 . 364000 (8) Mr Chen contribute $12,000 to his father who is aged 65 and ordinarily lives in Hong Kong DPA. 560 HK resident Required: (a) With reference to the relevant rule, discuss the taxation treatment on deduction items in note (3). (b) Calculate Mr Chen salaries tax liability for the year of assessment 2020/2021. (c) With respect to the relevant principles, discuss the taxation treatment on the following fringe benefits: (1) A utility allowance of $1,000 (ii) A reimbursement of Mr Chen's utility expense (iii)Employer contracts directly with utility company Question 1 Mr Chen is a married PRC resident who is employed by Tencent Holdings Limited as an accountant. He was assigned to work in Hong Kong for 200 days in the year ended 31 March 2021. The following facts are provided (1) The employment contract is concluded and enforced in Hong Kong and the remuneration is paid by its Hong Kong office. (2) Monthly salary of S 40,000. (3) Mr Chen paid the following expenses: Annual subscription fee to ACCA $1,000 v deduction - Business suites... $ 2,500 X (4) A single-room suite in a hotel is provided by the employer. 47.on 5 June 20w, the showe putee 15 pls per Share. (5) Share option benefit would be available. On 5 June 2020, Mr Chen exercise the share option and acquire 10,000 shares of the company at an exercise price of $7.5 per share. (6) Mr Chen contributed $18,000 (mandatory portion) to a recognized retirement scheme. AMPF MPP (7) Mr Chen is married with a new born baby. Mrs Chen has no assessable income. MPA 240000 . 364000 (8) Mr Chen contribute $12,000 to his father who is aged 65 and ordinarily lives in Hong Kong DPA. 560 HK resident Required: (a) With reference to the relevant rule, discuss the taxation treatment on deduction items in note (3). (b) Calculate Mr Chen salaries tax liability for the year of assessment 2020/2021. (c) With respect to the relevant principles, discuss the taxation treatment on the following fringe benefits: (1) A utility allowance of $1,000 (ii) A reimbursement of Mr Chen's utility expense (iii)Employer contracts directly with utility company