Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 National Express reports the following costs and expenses in June 2020 for its delivery service. Indirect materials $6,500 Drivers salaries $16,100 Depreciation on

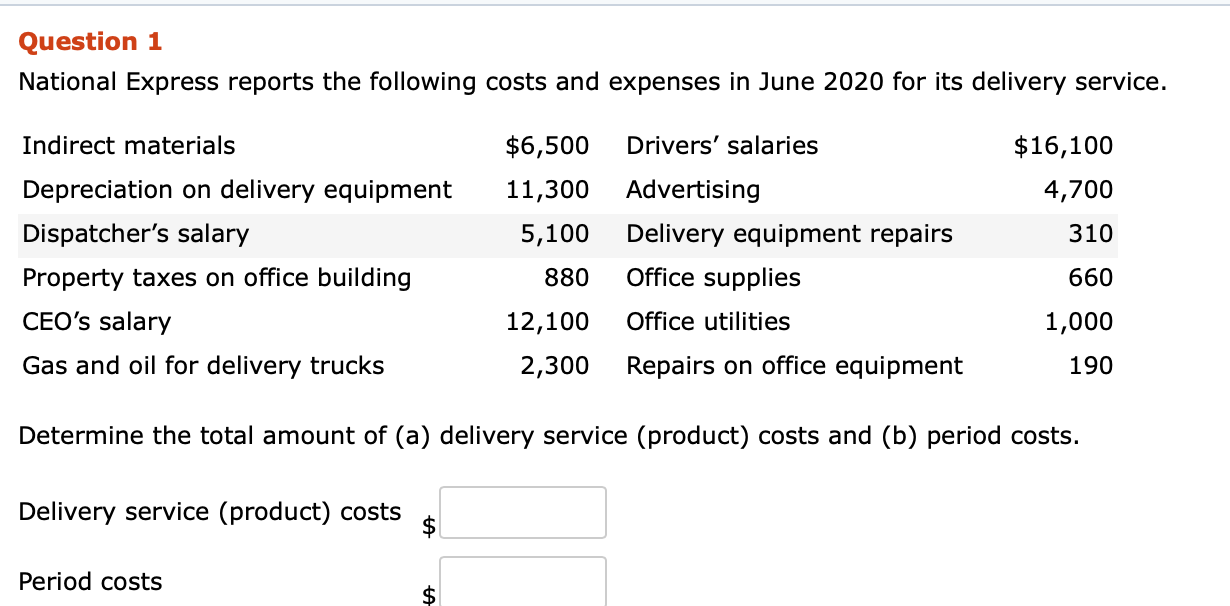

Question 1 National Express reports the following costs and expenses in June 2020 for its delivery service. Indirect materials $6,500 Drivers salaries $16,100 Depreciation on delivery equipment 11,300 Advertising 4,700 Dispatchers salary 5,100 Delivery equipment repairs 310 Property taxes on office building 880 Office supplies 660 CEOs salary 12,100 Office utilities 1,000 Gas and oil for delivery trucks 2,300 Repairs on office equipment 190 Determine the total amount of (a) delivery service (product) costs and (b) period costs.

Question 1 National Express reports the following costs and expenses in June 2020 for its delivery service. Indirect materials $6,500 Drivers salaries $16,100 Depreciation on delivery equipment 11,300 Advertising 4,700 Dispatchers salary 5,100 Delivery equipment repairs 310 Property taxes on office building 880 Office supplies 660 CEOs salary 12,100 Office utilities 1,000 Gas and oil for delivery trucks 2,300 Repairs on office equipment 190 Determine the total amount of (a) delivery service (product) costs and (b) period costs.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started