Answered step by step

Verified Expert Solution

Question

1 Approved Answer

question 1: need help on 2. question:2 need help on 3-b On January 1, 2021, The Donut Stop purchased a patent for $73,000. At that

question 1: need help on 2.

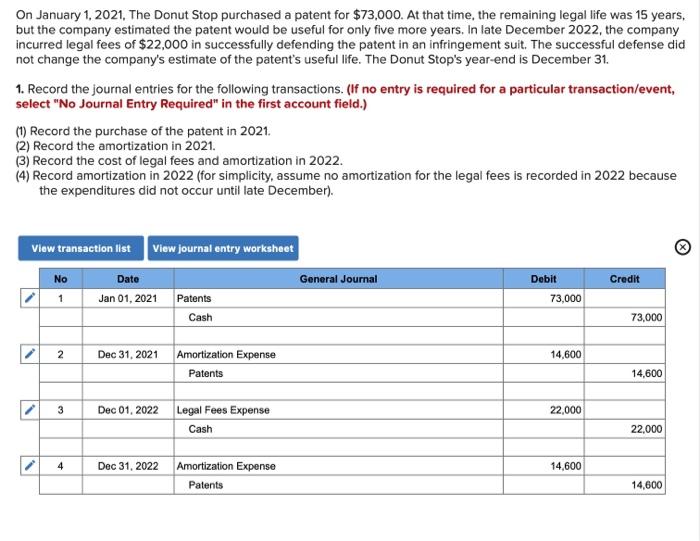

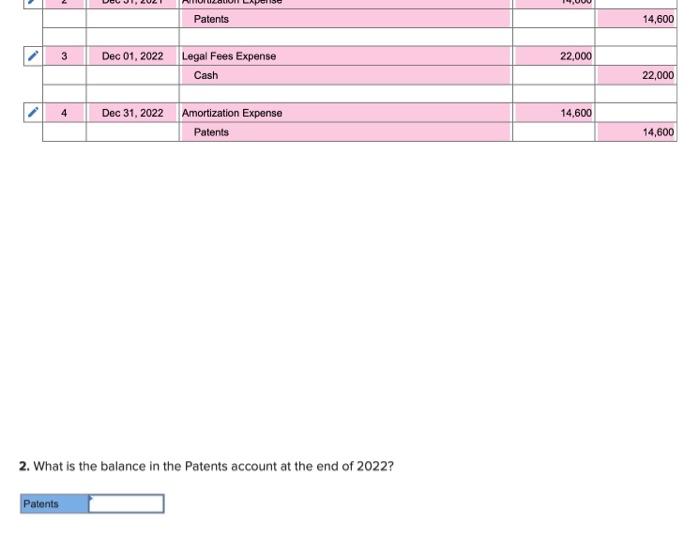

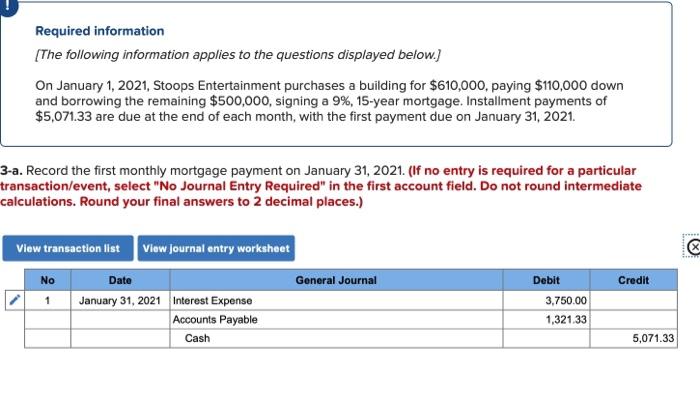

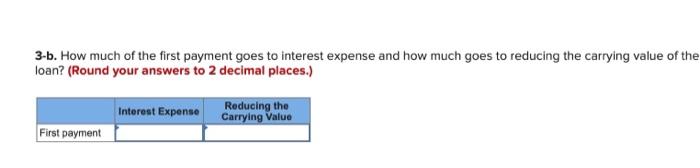

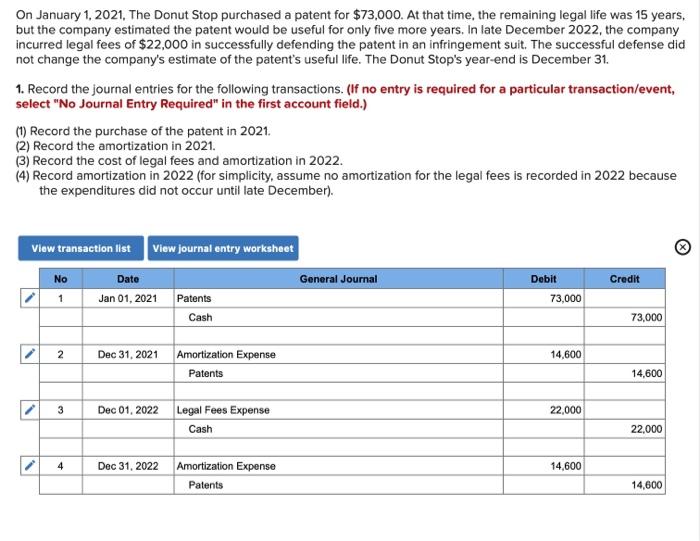

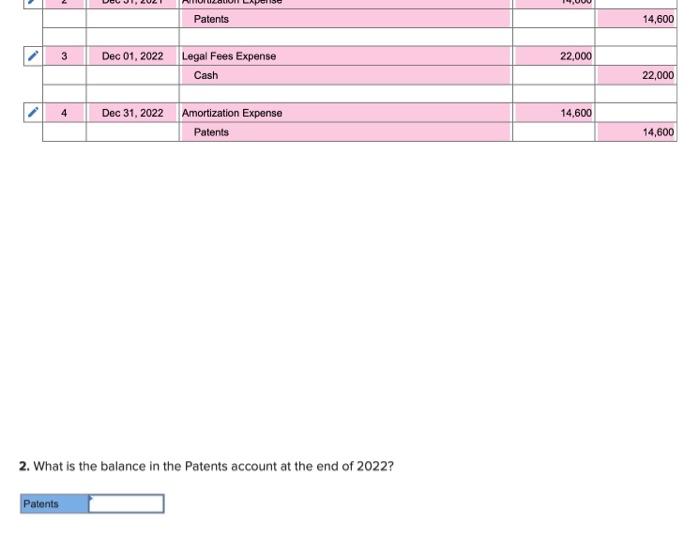

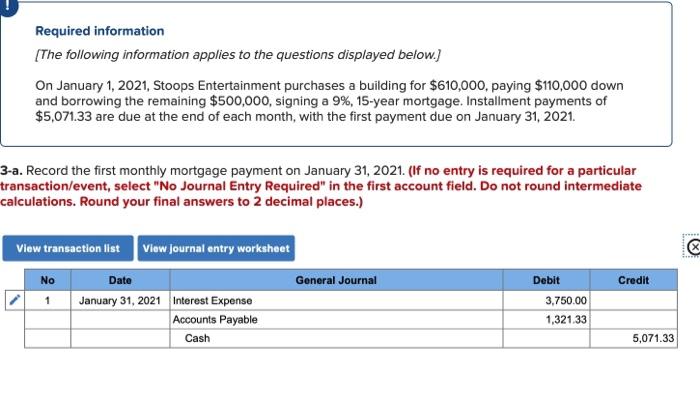

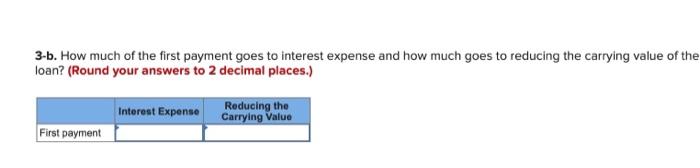

On January 1, 2021, The Donut Stop purchased a patent for $73,000. At that time, the remaining legal life was 15 years, but the company estimated the patent would be useful for only five more years. In late December 2022, the company incurred legal fees of $22,000 in successfully defending the patent in an infringement suit. The successful defense did not change the company's estimate of the patent's useful life. The Donut Stop's year-end is December 31 1. Record the journal entries for the following transactions. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) (1) Record the purchase of the patent in 2021. (2) Record the amortization in 2021. (3) Record the cost of legal fees and amortization in 2022. (4) Record amortization in 2022 (for simplicity, assume no amortization for the legal fees is recorded in 2022 because the expenditures did not occur until late December). View transaction list View journal entry worksheet Date General Journal Jan 01, 2021 Patents Cash No Credit Debit 73,000 1 73,000 2 Dec 31, 2021 14,600 Amortization Expense Patents 14,600 3 22,000 Dec 01, 2022 Legal Fees Expense Cash 22.000 4 Dec 31, 2022 14,600 Amortization Expense Patents 14,600 Patents 14,600 3 22,000 Dec 01, 2022 Legal Fees Expense Cash 22,000 14,600 Dec 31, 2022 Amortization Expense Patents 14,600 2. What is the balance in the Patents account at the end of 2022? Patents Required information [The following information applies to the questions displayed below.) On January 1, 2021, Stoops Entertainment purchases a building for $610,000, paying $110,000 down and borrowing the remaining $500,000, signing a 9%, 15-year mortgage. Installment payments of $5,071.33 are due at the end of each month, with the first payment due on January 31, 2021. 3-a. Record the first monthly mortgage payment on January 31, 2021. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Do not round intermediate calculations. Round your final answers to 2 decimal places.) Credit View transaction list View journal entry worksheet No Date General Journal 1 January 31, 2021 Interest Expense Accounts Payable Cash Debit 3.750.00 1,321,33 5,071.33 3-b. How much of the first payment goes to interest expense and how much goes to reducing the carrying value of the loan? (Round your answers to 2 decimal places.) Interest Expense Reducing the Carrying Value First payment

question:2 need help on 3-b

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started