Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 Not yet answered Marked out of 1.00 Flag question MERA & Yara a US corporation made a sale to a foreign customer on

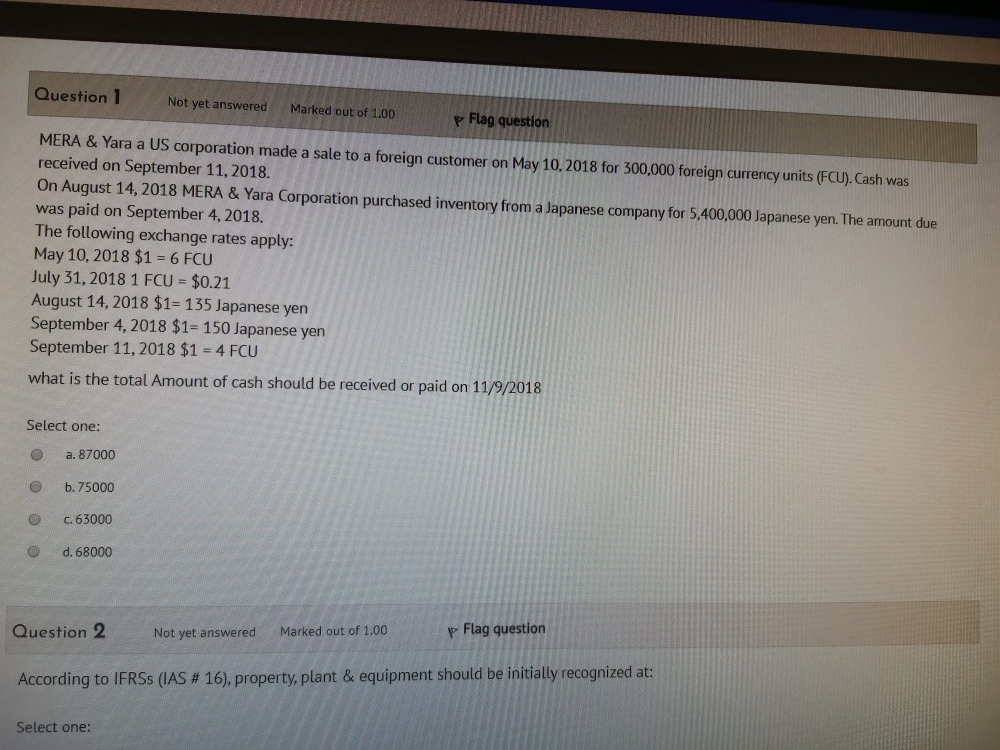

Question 1 Not yet answered Marked out of 1.00 Flag question MERA & Yara a US corporation made a sale to a foreign customer on May 10, 2018 for 300,000 foreign currency units (FCU).Cash was received on September 11, 2018. On August 14, 2018 MERA & Yara Corporation purchased inventory from a Japanese company for 5,400,000 Japanese yen. The amount due was paid on September 4, 2018. The following exchange rates apply: May 10, 2018 $1 = 6 FCU July 31, 2018 1 FCU = $0.21 August 14, 2018 $1= 135 Japanese yen September 4, 2018 $1= 150 Japanese yen September 11, 2018 $1 = 4 FCU what is the total Amount of cash should be received or paid on 11/9/2018 Select one: a. 87000 b. 75000 C.63000 d.68000 Flag question Question 2 Not yet answered Marked out of 1.00 According to IFRSs (IAS # 16). property, plant & equipment should be initially recognized at: Calect one

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started