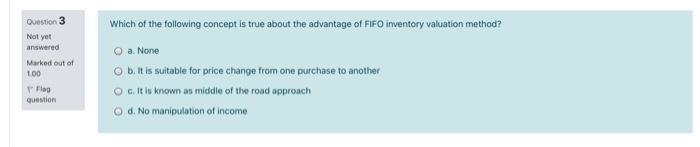

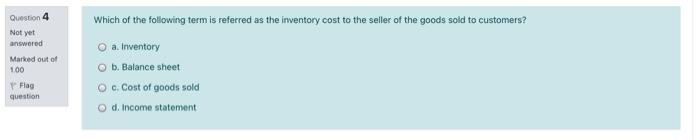

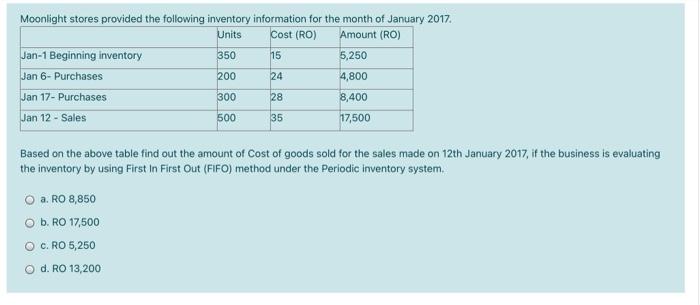

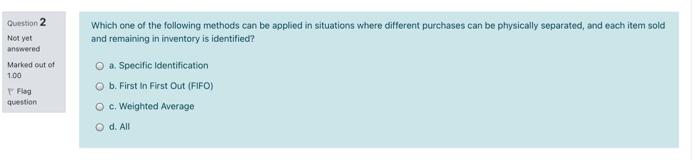

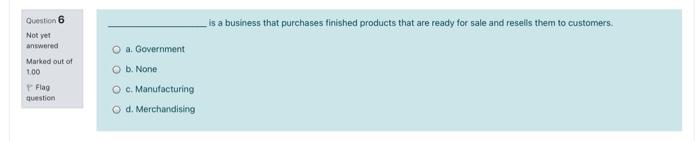

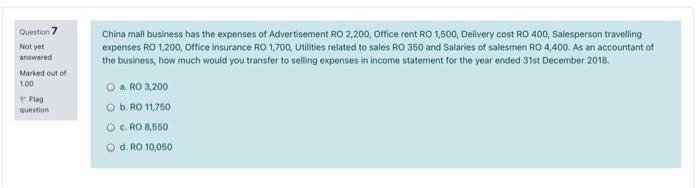

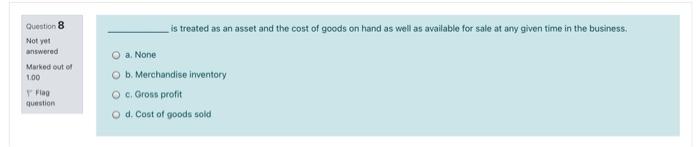

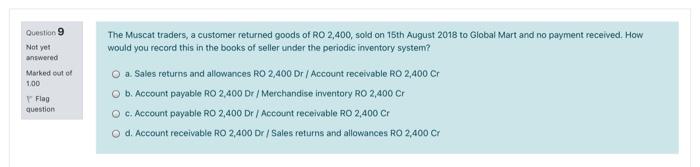

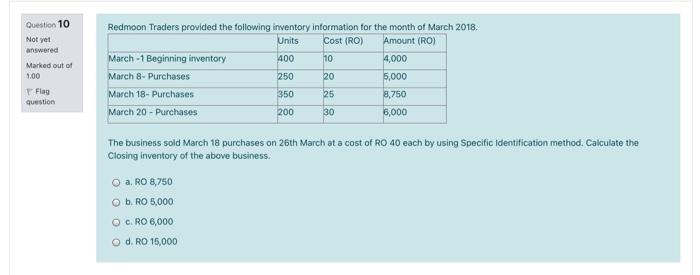

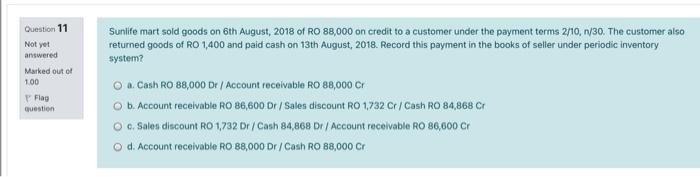

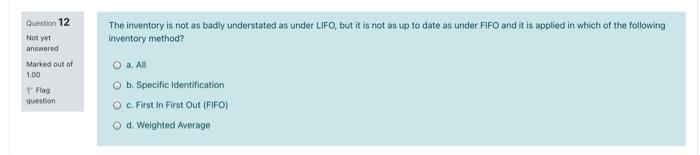

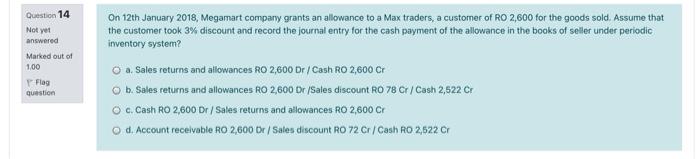

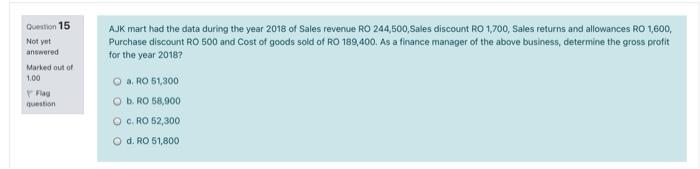

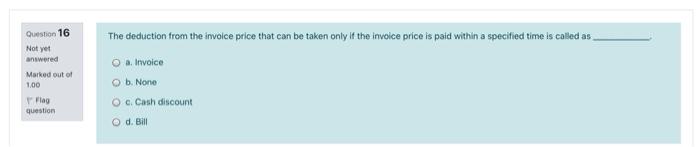

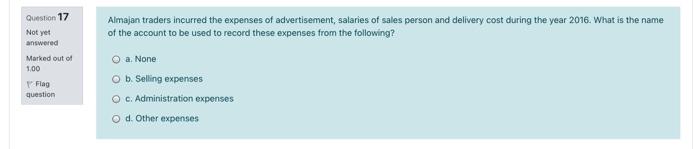

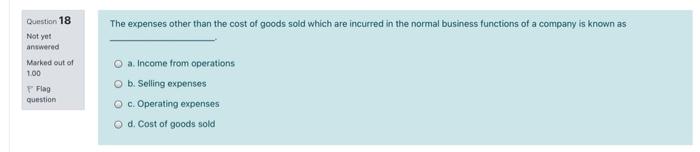

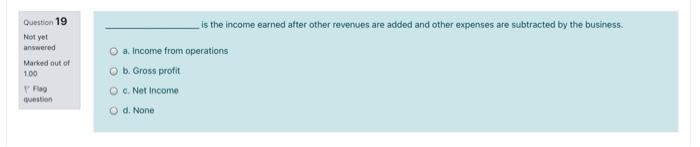

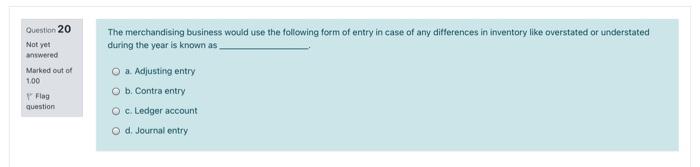

Question 1 Not yet answered Marked out of 100 Flag question The inventory system in which the merchandise inventory account provides close control by showing the cost of the goods at any time and maintain a detailed unit record is? a. Periodic inventory system O b. Weighted average method O c. Perpetual inventory system O d. None Question 3 Not yet answered Marked out of 100 Tag question Which of the following concept is true about the advantage of FIFO inventory valuation method? O a None ob. It is suitable for price change from one purchase to another O c. It is known as middle of the road approach O d. No manipulation of income Question 4 Not yet answered Marked out of 100 Which of the following term is referred as the inventory cost to the seller of the goods sold to customers? a. Inventory O b. Balance sheet O c. Cost of goods sold Flag question d. Income statement Moonlight stores provided the following inventory information for the month of January 2017 Units Cost (RO) Amount (RO) Jan-1 Beginning inventory 350 15 5,250 Jan 6-Purchases 200 4,800 Jan 17- Purchases 300 28 8,400 Jan 12 - Sales 500 35 17,500 24 Based on the above table find out the amount of Cost of goods sold for the sales made on 12th January 2017, if the business is evaluating the inventory by using First In First Out (FIFO) method under the Periodic inventory system O a. RO 8,850 O b. RO 17,500 C.RO 5,250 d. RO 13,200 Question 2 Not yet answered Marked out of 1.00 Which one of the following methods can be applied in situations where different purchases can be physically separated, and each item sold and remaining in inventory is identified? a. Specific Identification O b. First In First Out (FIFA) O c. Weighted Average Flag question d. All is a business that purchases finished products that are ready for sale and resells them to customers. Question 6 Not yet answered Marked out of O a. Government 100 b. None Flag O c. Manufacturing question O d. Merchandising Question 7 Not yet answered Marked out of 100 China mall business has the expenses of Advertisement RO 2,200, Office rent RO 1,500, Delivery cost RO 400, Salesperson travelling expenses RO 1,200, Office insurance RO 1,700, Utilities related to sales RO 350 and Salaries of salesmen RO 4,400. As an accountant of the business, how much would you transfer to selling expenses in income statement for the year ended 31st December 2018. a. RO 3,200 b. RO 11,750 O G. RO 8,660 d. RO 10,050 question Question 8 is treated as an asset and the cost of goods on hand as well as available for sale at any given time in the business answered O a None Marked out of 1.00 Flag question O b. Merchandise inventory O c. Gross profit O d. Cost of goods sold Question 9 Not yet answered Marked out of 100 The Muscat traders, a customer returned goods of RO 2,400, sold on 15th August 2018 to Global Mart and no payment received. How would you record this in the books of seller under the periodic inventory system? O a Sales returns and allowances RO 2,400 Dr / Account receivable RO 2,400 Cr O b. Account payable RO 2,400 Dr / Merchandise inventory RO 2,400 Cr c. Account payable RO 2,400 Dr / Account receivable RO 2,400 Cr O d. Account receivable RO 2,400 Dr / Sales returns and allowances RO 2,400 Cr Flag question Question 10 Not yet answered Marked out of 100 Flag question Redmoon Traders provided the following inventory information for the month of March 2018. Units Cost (RO) Amount (RO) March - 1 Beginning inventory 400 10 4,000 March 8-Purchases 250 20 5,000 March 18- Purchases 350 25 8.750 March 20 - Purchases 200 30 6,000 The business sold March 18 purchases on 26th March at a cost of RO 40 each by using Specific identification method. Calculate the Closing inventory of the above business. a, RO 8,750 O b. RO 5,000 OC RO 6,000 O d.RO 15,000 Question 11 Not yet answered Marked out of 100 Sunlife mart sold goods on 6th August, 2018 of RO 88,000 on credit to a customer under the payment terms 2/10, 1/30. The customer also returned goods of RO 1,400 and paid cash on 13th August, 2018. Record this payment in the books of seller under periodic inventory system? Flag question a Cash RO 88,000 Dr / Account receivable RO 88,000 CH O b. Account receivable RO 86,600 Dr/Sales discount RO 1,732 Cr/Cash RO 84,868 C c. Sales discount RO 1,732 Dr/Cash 84,868 Dr / Account receivable RO 86,600 Cr O d. Account receivable RO 88,000 Dr / Cash RO 88,000 C Question 12 Not yet answered The inventory is not as badly understated as under LIFO, but it is not as up to date as under FIFO and it is applied in which of the following inventory method? Marked out of 1,00 Flag question O a. All O b. Specific Identification First in First Out (FFO) O d. Weighted Average Question 13 Ibri mart purchased goods on 12th March, 2018 for RO 84,000 from Nizwa mart. If the credit term is followed as 3/EOM, Calculate the discount amount paid by the business. answered Marked out of 100 O a RO 84,000 O b. RO 81,480 OG RO 2,520 Flag question O d.RO 86,520 Question 14 Not yet answered Marked out of 1,00 Flag question On 12th January 2018, Megamart company grants an allowance to a Max traders, a customer of RO 2,600 for the goods sold. Assume that the customer took 3% discount and record the journal entry for the cash payment of the allowance in the books of seller under periodic inventory system? O a Sales returns and allowances RO 2,600 Dr / Cash RO 2,600 Cr b. Sales returns and allowances RO 2,600 Dr /Sales discount RO 78 Cr/Cash 2,522C oc. Cash RO 2,600 Dr / Sales returns and allowances RO 2,600 Cr O d. Account receivable RO 2,600 Dr / Sales discount RO 72 Cr Cash RO 2,622 Cr Question 15 Not yet answered Marked out of 1.00 AJK mart had the data during the year 2018 of Sales revenue RO 244,500, Sales discount RO 1,700, Sales returns and allowances RO 1,600, Purchase discount RO 600 and Cost of goods sold of RO 189,400. As a finance manager of the above business, determine the gross profit for the year 2018? O a RO 61,300 O b. RO 58,900 Flag question O C. RO 52,300 O d. RO 51,800 Question 16 Not yet answered Marked out of 1,00 Flag question The deduction from the involce price that can be taken only if the invoice price is paid within a specified time is called as O a Invoice ob. None O c. Cash discount d. Bill Question 17 Not yet answered Marked out of 100 Flag question Almajan traders incurred the expenses of advertisement, salaries of sales person and delivery cost during the year 2016. What is the name of the account to be used to record these expenses from the following? O a None Ob Selling expenses O c. Administration expenses O d. Other expenses Question 18 The expenses other than the cost of goods sold which are incurred in the normal business functions of a company is known as Not yet answered Marked out of 100 Flag Question a. Income from operations O b. Selling expenses O c. Operating expenses d. Cost of goods sold Question 19 Not yet answered Marked out of 100 Flag Is the income earned after other revenues are added and other expenses are subtracted by the business. a. Income from operations O b. Gross profit O G. Net Income Question d. None Question 20 Not yet answered Marked out of 100 The merchandising business would use the following form of entry in case of any differences in inventory like overstated or understated during the year is known as a. Adjusting entry O b. Contra entry O c. Ledger account O d. Journal entry Y Flag