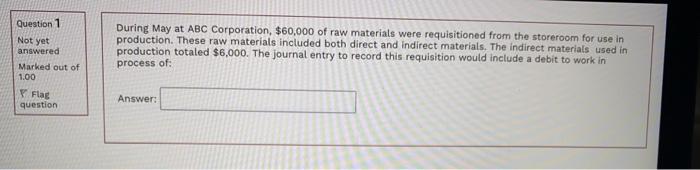

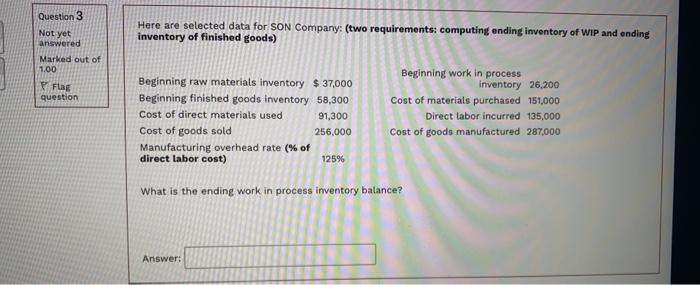

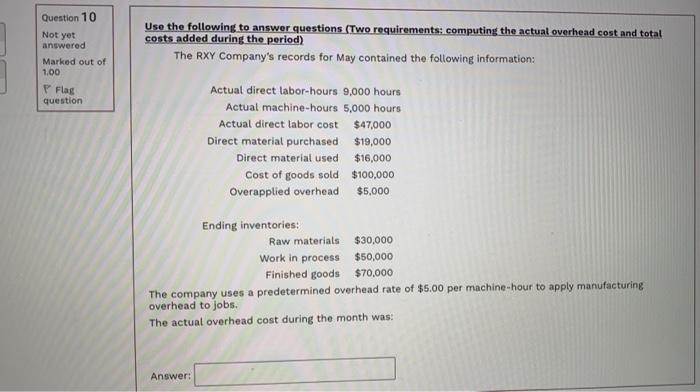

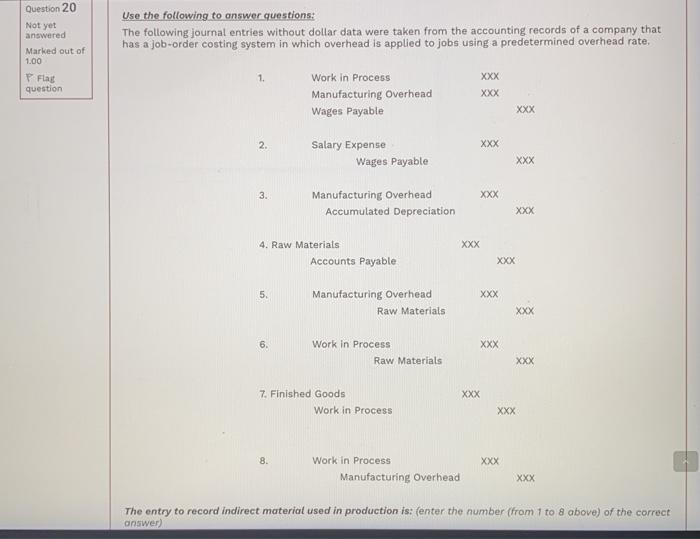

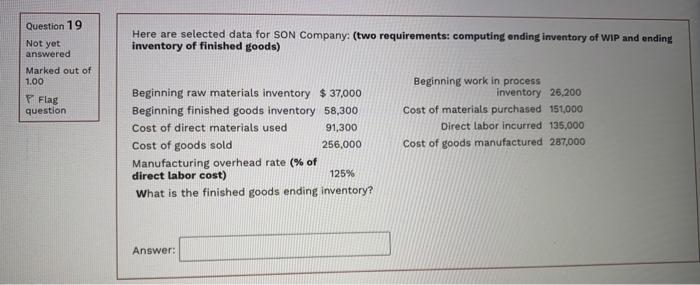

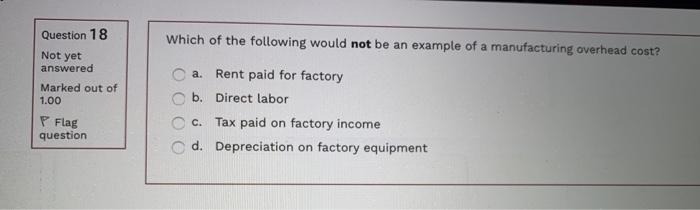

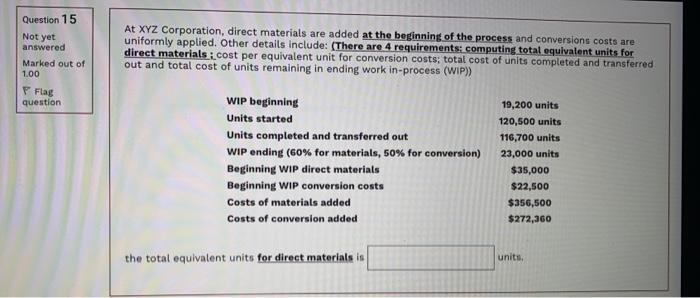

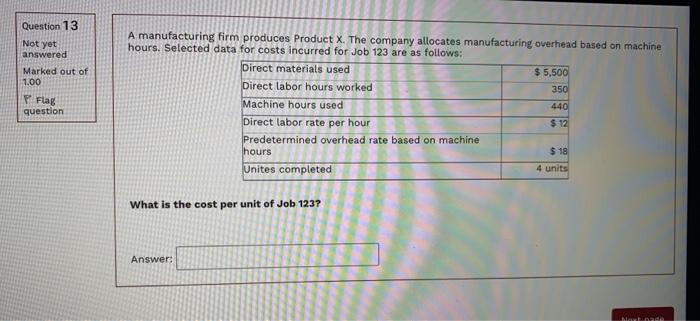

Question 1 Not yet answered Marked out of 1.00 Flag question During May at ABC Corporation, $60,000 of raw materials were requisitioned from the storeroom for use in production. These raw materials included both direct and indirect materials. The indirect materials used in production totaled $6,000. The journal entry to record this requisition would include a debit to work in process of: Answer: Question 3 Not yet Here are selected data for SON Company: (two requirements: computing ending inventory of WIP and ending inventory of finished goods) answered Marked out of 1.00 Flag question Beginning raw materials inventory $ 37,000 Beginning finished goods inventory 58,300 Cost of direct materials used 91,300 Cost of goods sold 256,000 Manufacturing overhead rate (% of direct labor cost) 12596 Beginning work in process Inventory 26,200 Cost of materials purchased 151,000 Direct labor incurred 135,000 Cost of goods manufactured 287,000 What is the ending work in process inventory balance? Answer: Question 10 Not yet answered Marked out of 1.00 Use the following to answer questions (Two requirements: computing the actual overhead cost and total costs added during the period) The RXY Company's records for May contained the following information: Flas question Actual direct labor-hours 9,000 hours Actual machine-hours 5,000 hours Actual direct labor cost $47.000 Direct material purchased $19,000 Direct material used $16,000 Cost of goods sold $100,000 Overapplied overhead $5,000 Ending inventories: Raw materials $30,000 Work in process $50,000 Finished goods $70,000 The company uses a predetermined overhead rate of $5.00 per machine-hour to apply manufacturing overhead to jobs. The actual overhead cost during the month was: Answer: Question 20 Not yet answered Marked out of Use the following to answer questions: The following journal entries without dollar data were taken from the accounting records of a company that has a job-order costing system in which overhead is applied to jobs using a predetermined overhead rate, 1.00 1 XXX P Flag question Work in Process Manufacturing Overhead Wages Payable XXX XXX 2. XXX Salary Expense Wages Payable XXX 3. XXX Manufacturing Overhead Accumulated Depreciation XXX XXX 4. Raw Materials Accounts Payable XXX 5. XXX Manufacturing Overhead Raw Materials XXX 6. XXX Work in Process Raw Materials XXX XXX 7. Finished Goods Work in Process XXX 8. XXX Work in Process Manufacturing Overhead XXX The entry to record indirect material used in production is: (enter the number (from 1 to a above) of the correct answer) Question 19 Not yet answered Here are selected data for SON Company: (two requirements: computing ending inventory of WIP and ending inventory of finished goods) Marked out of 1.00 F Flag question Beginning raw materials inventory $ 37,000 Beginning finished goods inventory 58,300 Cost of direct materials used 91,300 Cost of goods sold 256.000 Manufacturing overhead rate (% of direct labor cost) 125% What is the finished goods ending inventory? Beginning work in process inventory 26,200 Cost of materials purchased 151,000 Direct labor incurred 135.000 Cost of goods manufactured 287,000 Answer: Question 18 Which of the following would not be an example of a manufacturing overhead cost? Not yet answered Marked out of 1.00 a. Rent paid for factory b. Direct labor C. Tax paid on factory income d. Depreciation on factory equipment Flag question Question 15 Not yet answered Marked out of 1.00 At XYZ Corporation, direct materials are added at the beginning of the process and conversions costs are uniformly applied. Other details include: (There are 4 requirements: computing total equivalent units for direct materials: cost per equivalent unit for conversion costs; total cost of units completed and transferred out and total cost of units remaining in ending work in process (WIP)) Flag question WIP beginning Units started Units completed and transferred out WIP ending (60% for materials, 50% for conversion) Beginning WIP direct materials Beginning WIP conversion costs Costs of materials added Costs of conversion added 19,200 units 120,500 units 116,700 units 23,000 units $35,000 $22,500 $356,500 $272,360 the total equivalent units for direct materials is units. Question 13 Not yet answered Marked out of 1.00 P Flag A manufacturing firm produces Product X. The company allocates manufacturing overhead based on machine hours. Selected data for costs incurred for Job 123 are as follows: Direct materials used $ 5,500 Direct labor hours worked 350 Machine hours used 440 Direct labor rate per hour $ 12 Predetermined overhead rate based on machine hours $18 Unites completed 4 units question What is the cost per unit of Job 123? Answer: wa