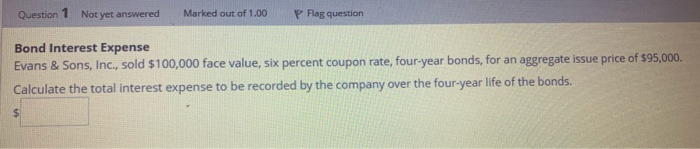

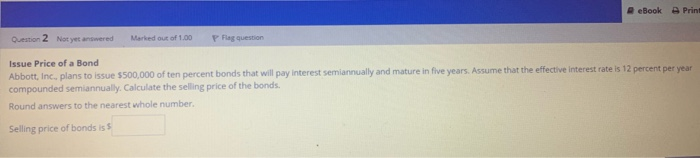

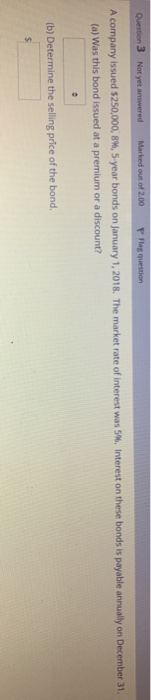

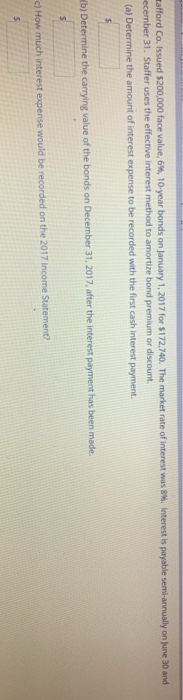

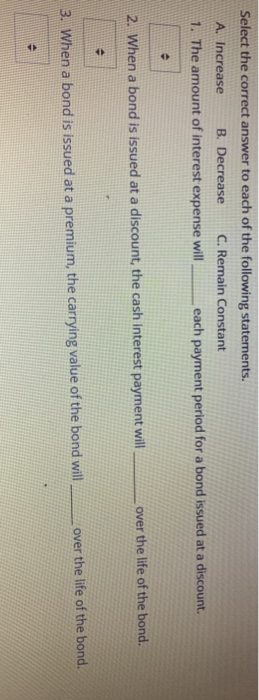

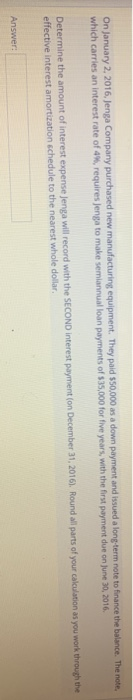

Question 1 Not yet answered Marked out of 1.00 P Flag question Bond Interest Expense Evans & Sons, Inc., sold $100,000 face value, six percent coupon rate, four-year bonds, for an aggregate issue price of 595,000. Calculate the total interest expense to be recorded by the company over the four-year life of the bonds. eBook Prin Question 2 Not yet answered Marked out of 1.00 P Flag question Issue Price of a Bond Abbott, Inc, plans to issue $500,000 of ten percent bonds that will pay interest semiannually and mature in five years. Assume that the effective interest rate is 12 percent per year compounded semiannually. Calculate the selling price of the bonds. Round answers to the nearest whole number. Selling price of bonds is 5 Question 3 Not yet answered Marked out of 2.00 P Flag question A company issued $250,000,8%, 5-year bonds on January 1, 2018. The market rate of interest was 5%. Interest on these bonds is payable annually on December 31. (a) Was this bond issued at a premium or a discount? (b) Determine the selling price of the bond. tafford Co. Issued $200,000 face value, 6%, 10-year bonds on January 1, 2017 for $172,740. The market rate of interest was 8%. Interest is payable semi-annually on June 30 and ecember 31. Staffer uses the effective interest method to amortize bond premium or discount (a) Determine the amount of interest expense to be recorded with the first cash interest payment. b) Determine the carrying value of the bonds on December 31, 2017 after the interest payment has been made. c) How much interest expense would be recorded on the 2017 Income Statement? Select the correct answer to each of the following statements. A. Increase B. Decrease C. Remain Constant 1. The amount of interest expense will each payment period for a bond issued at a discount. 2. When a bond is issued at a discount, the cash interest payment will over the life of the bond. over the life of the bond. 3. When a bond is issued at a premium, the carrying value of the bond will On January 2, 2016, Jenga Company purchased new manufacturing equipment. They paid $50,000 as a down payment and issued a long-term note to finance the balance. The note. which carries an interest rate of 4%, requires Jenga to make semiannual loan payments of $35,000 for five years, with the first payment due on June 30, 2016 Determine the amount of interest expense Jenga will record with the SECOND interest payment on December 31, 2016). Round all parts of your calculation as you work through the effective interest amortization schedule to the nearest whole dollar