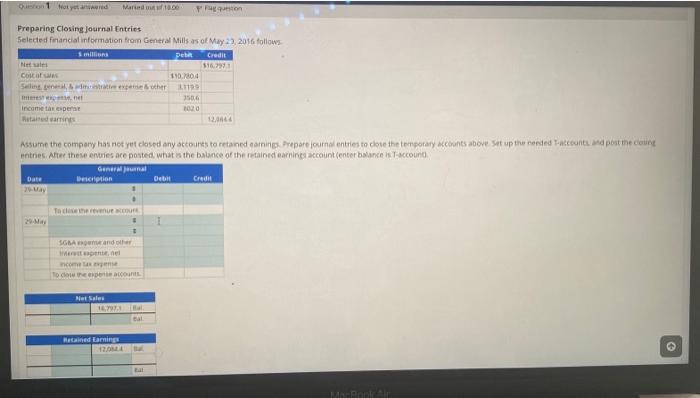

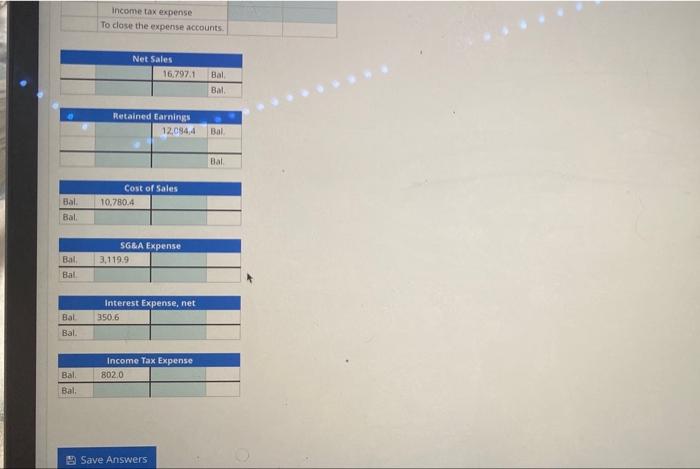

Question 1 Not yet answered Marked out of 10.00- Fag question Preparing Closing Journal Entries Selected financial information from General Mills as of May 23, 2016 follows 1 millions Debit Credit $16.797.1 Net sales Cost of sales 1107804 Selling general, &admistrative expense & other 31199 Interest expense net 3506 Income tax expense Retained earnings 12,0644 Assume the company has not yet closed any accounts to retained earnings. Prepare journal entries to close the temporary accounts above Set up the needed T-accounts and post the closing entries. After these entries are posted, what is the balance of the retained earnings account (enter balance is T-account General Journal Date Description Debit Credit 29-May To close the revenue account 29-May 1 SGBA expense and other interact sapente, nel income tax expense To close the expense accounts Net Sales 16,797.3 Bal Bal Retained Earnings 120MA MacBook Air Bat Bal. Bal. Bal Bal Bal. Bal. Bal. income tax expense To close the expense accounts. Net Sales 16,797.1 Bal. Bal. Retained Earnings 12,084,4 Bal Bal. Cost of Sales SG&A Expense 3,119.9 Interest Expense, net 350.6 Income Tax Expense 802.0 Save Answers 10,780.4 Question 1 Not yet answered Marked out of 10.00- Fag question Preparing Closing Journal Entries Selected financial information from General Mills as of May 23, 2016 follows 1 millions Debit Credit $16.797.1 Net sales Cost of sales 1107804 Selling general, &admistrative expense & other 31199 Interest expense net 3506 Income tax expense Retained earnings 12,0644 Assume the company has not yet closed any accounts to retained earnings. Prepare journal entries to close the temporary accounts above Set up the needed T-accounts and post the closing entries. After these entries are posted, what is the balance of the retained earnings account (enter balance is T-account General Journal Date Description Debit Credit 29-May To close the revenue account 29-May 1 SGBA expense and other interact sapente, nel income tax expense To close the expense accounts Net Sales 16,797.3 Bal Bal Retained Earnings 120MA MacBook Air Bat Bal. Bal. Bal Bal Bal. Bal. Bal. income tax expense To close the expense accounts. Net Sales 16,797.1 Bal. Bal. Retained Earnings 12,084,4 Bal Bal. Cost of Sales SG&A Expense 3,119.9 Interest Expense, net 350.6 Income Tax Expense 802.0 Save Answers 10,780.4