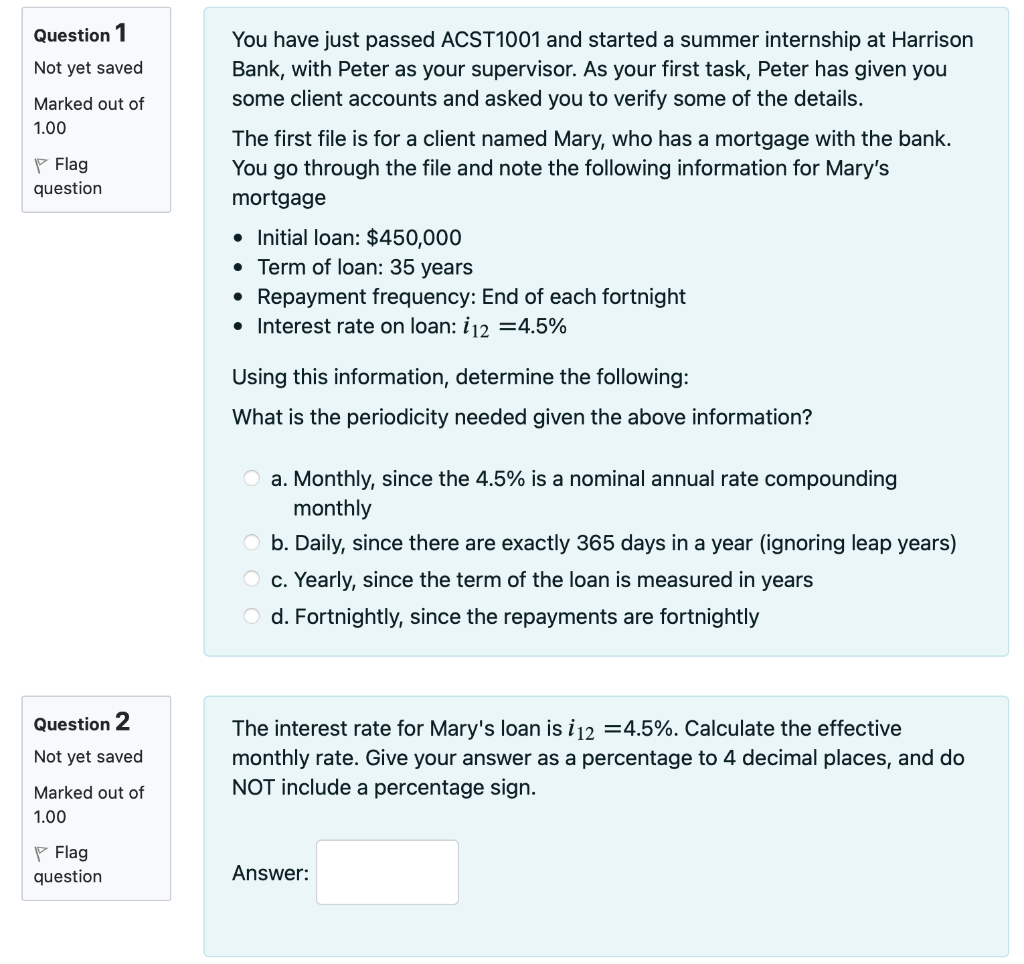

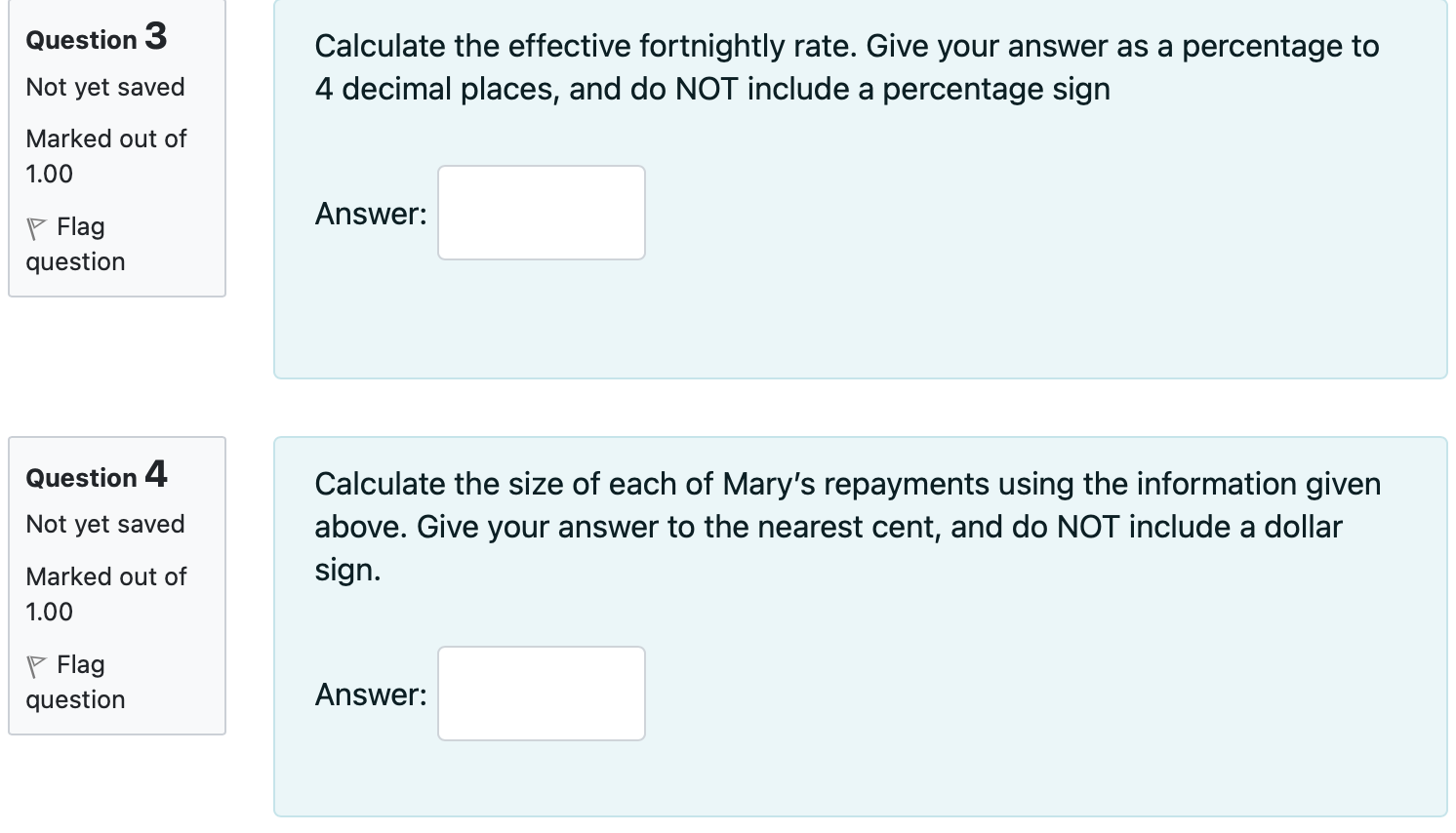

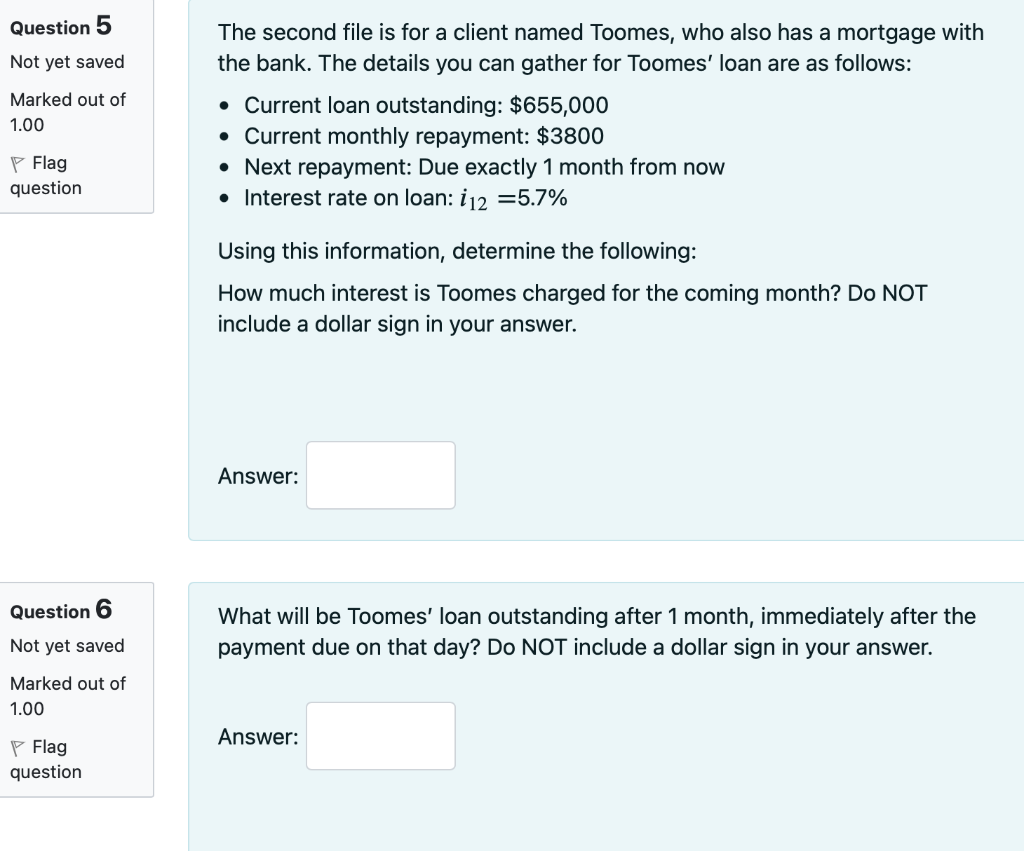

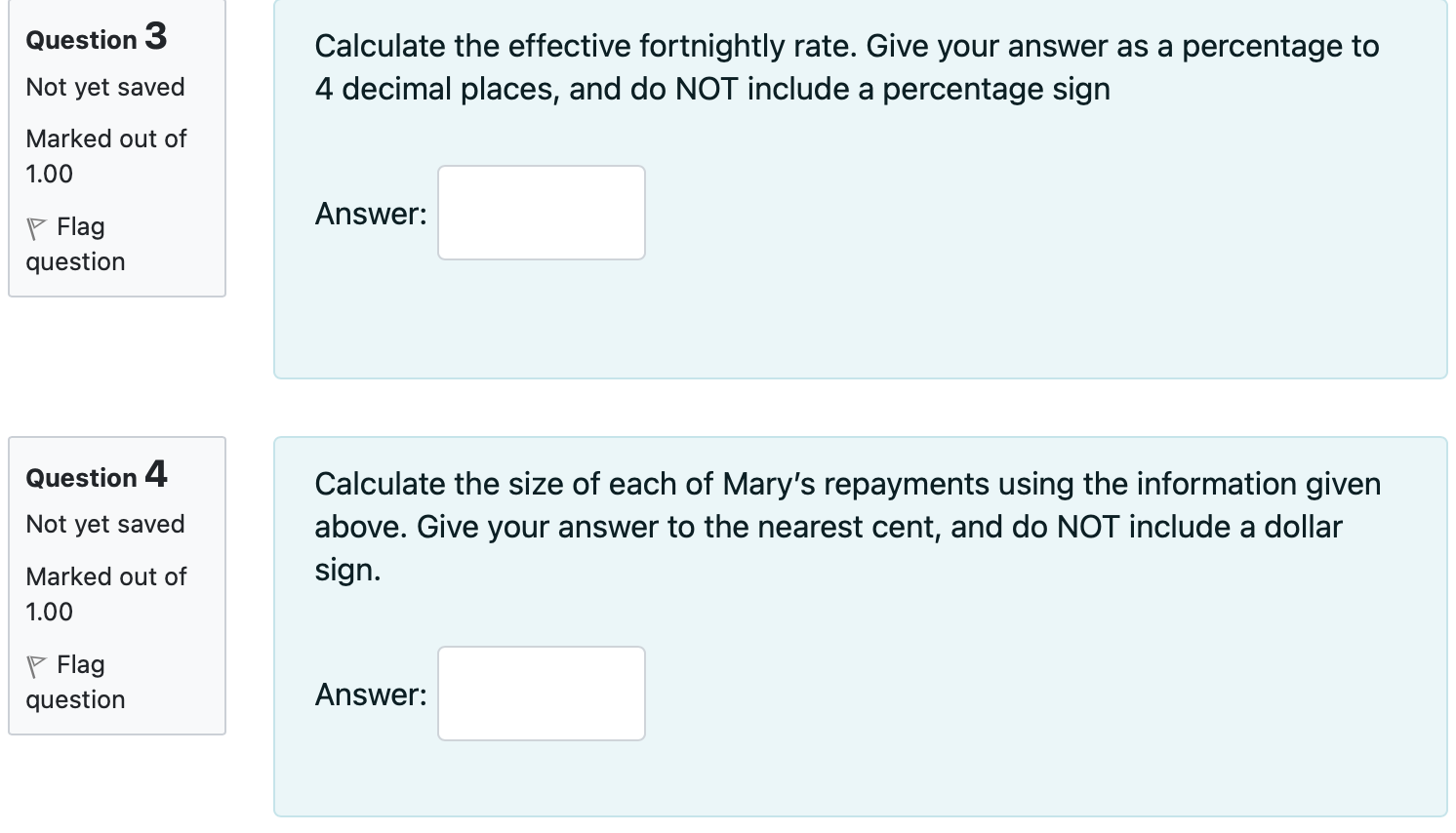

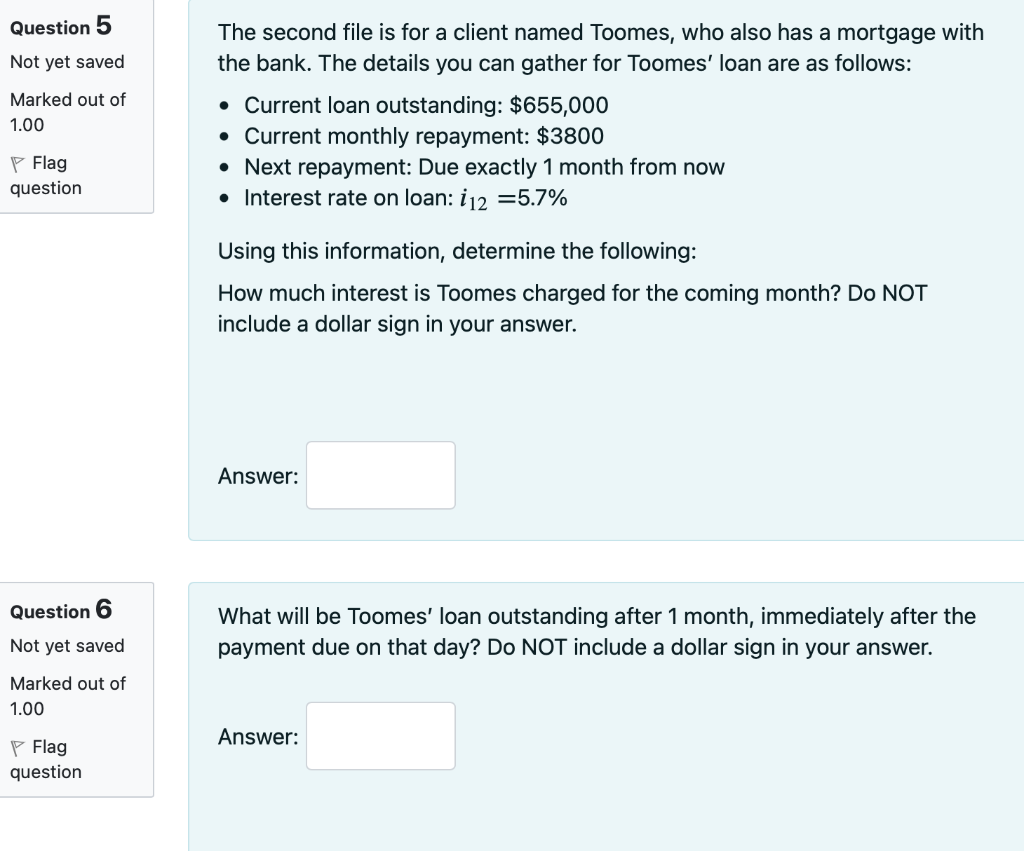

Question 1 Not yet saved Marked out of 1.00 Flag question You have just passed ACST1001 and started a summer internship at Harrison Bank, with Peter as your supervisor. As your first task, Peter has given you some client accounts and asked you to verify some of the details. The first file is for a client named Mary, who has a mortgage with the bank. You go through the file and note the following information for Mary's mortgage Initial loan: $450,000 Term of loan: 35 years Repayment frequency: End of each fortnight Interest rate on loan: 112 =4.5% Using this information, determine the following: What is the periodicity needed given the above information? a. Monthly, since the 4.5% is a nominal annual rate compounding monthly b. Daily, since there are exactly 365 days in a year (ignoring leap years) c. Yearly, since the term of the loan is measured in years d. Fortnightly, since the repayments are fortnightly Question 2 Not yet saved The interest rate for Mary's loan is 112 =4.5%. Calculate the effective monthly rate. Give your answer as a percentage to 4 decimal places, and do NOT include a percentage sign. Marked out of 1.00 Flag question Answer: Question 3 Calculate the effective fortnightly rate. Give your answer as a percentage to 4 decimal places, and do NOT include a percentage sign Not yet saved Marked out of 1.00 Answer: P Flag question Question 4 Not yet saved Calculate the size of each of Mary's repayments using the information given above. Give your answer to the nearest cent, and do NOT include a dollar sign. Marked out of 1.00 P Flag question Answer: Question 5 Not yet saved Marked out of 1.00 The second file is for a client named Toomes, who also has a mortgage with the bank. The details you can gather for Toomes' loan are as follows: Current loan outstanding: $655,000 Current monthly repayment: $3800 Next repayment: Due exactly 1 month from now Interest rate on loan: 112 =5.7% P Flag question Using this information, determine the following: How much interest is Toomes charged for the coming month? Do NOT include a dollar sign in your answer. Answer: Question 6 What will be Toomes' loan outstanding after 1 month, immediately after the payment due on that day? Do NOT include a dollar sign in your answer. Not yet saved Marked out of 1.00 Answer: Flag