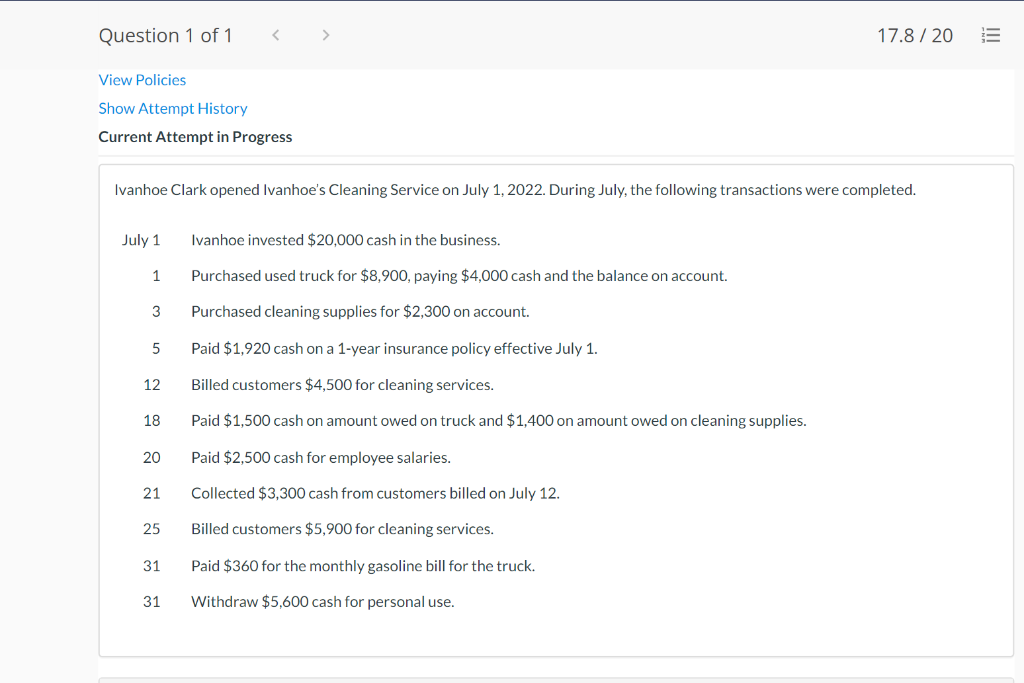

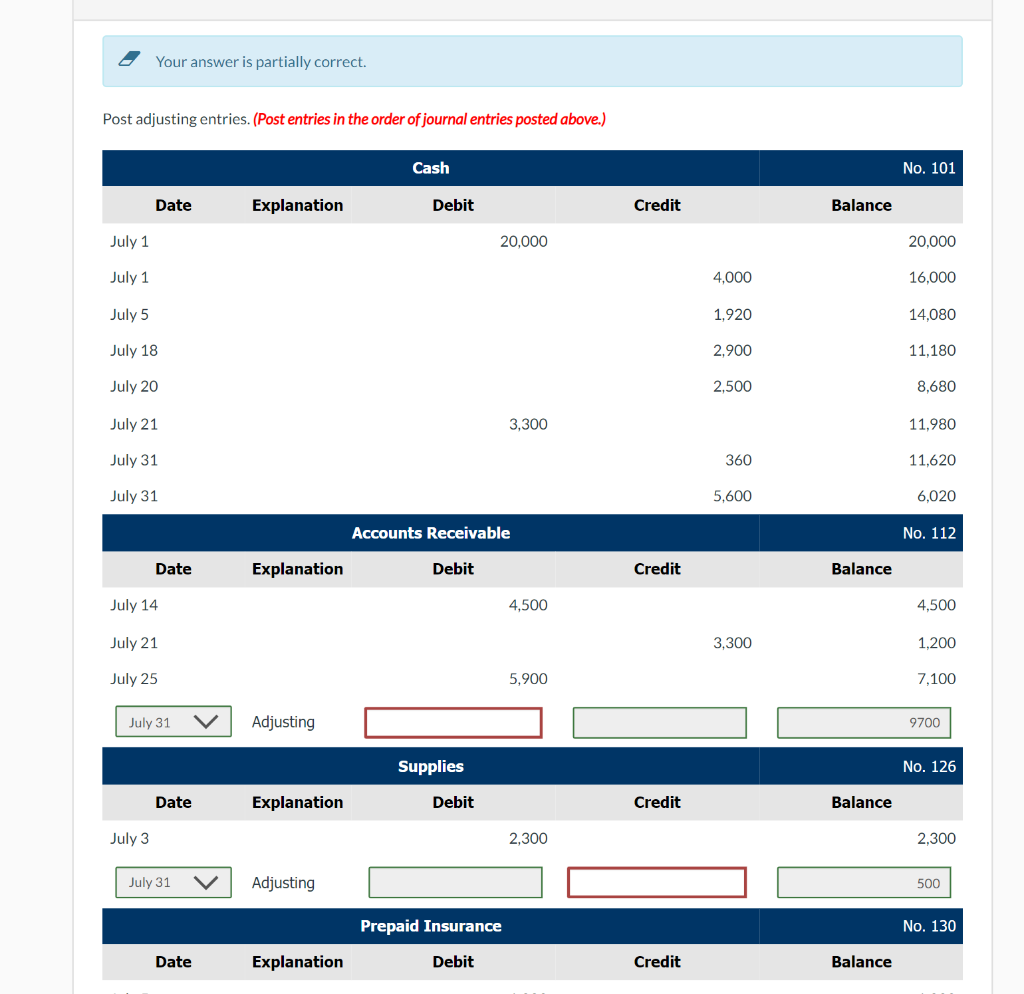

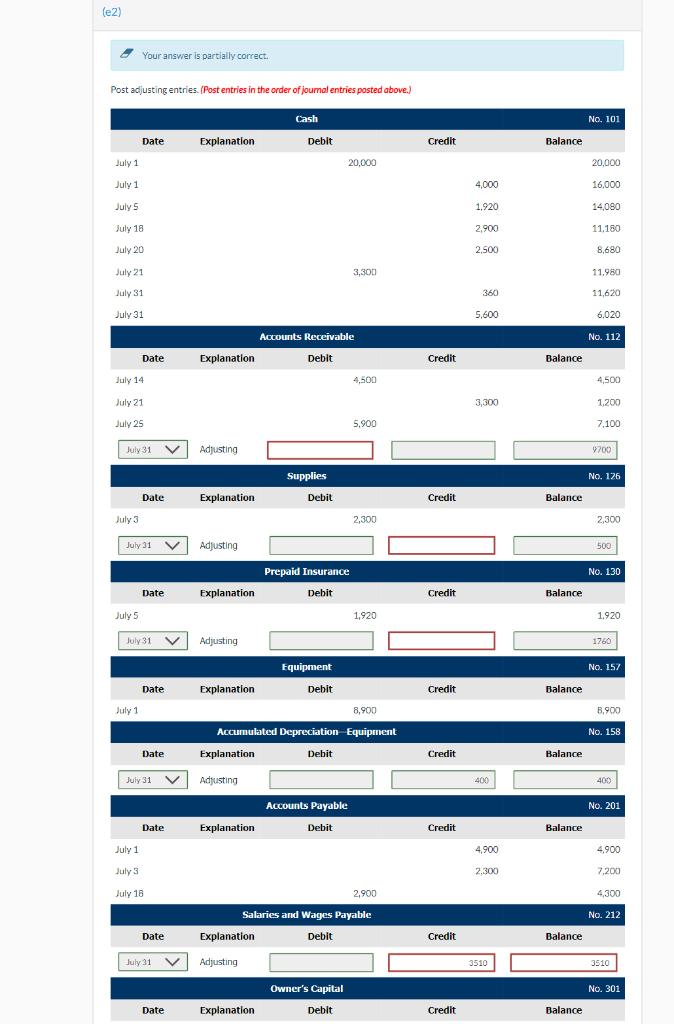

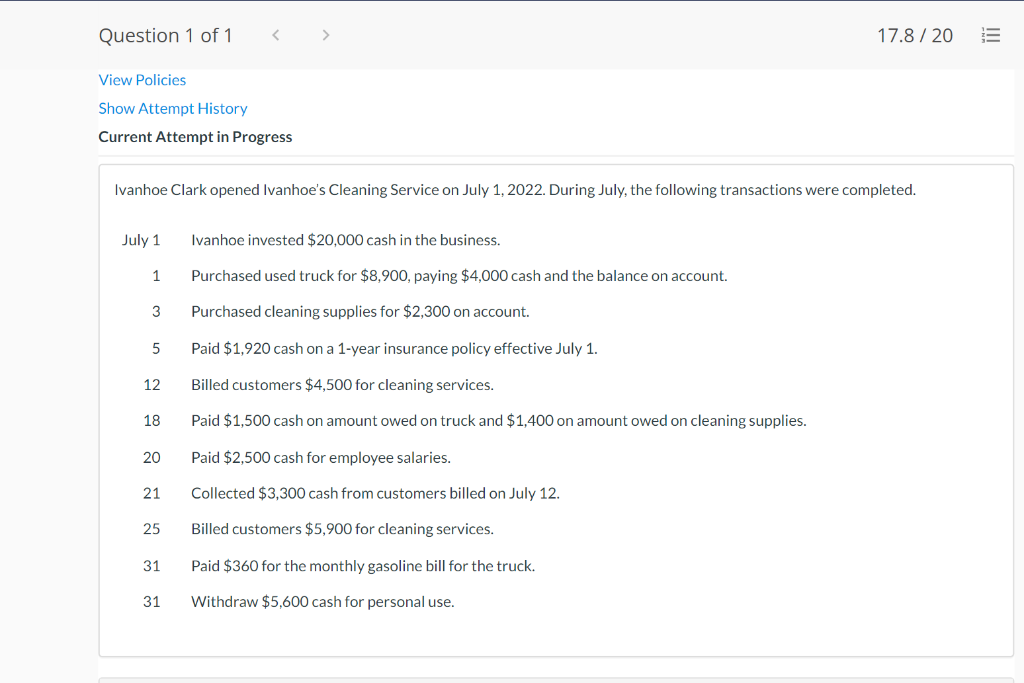

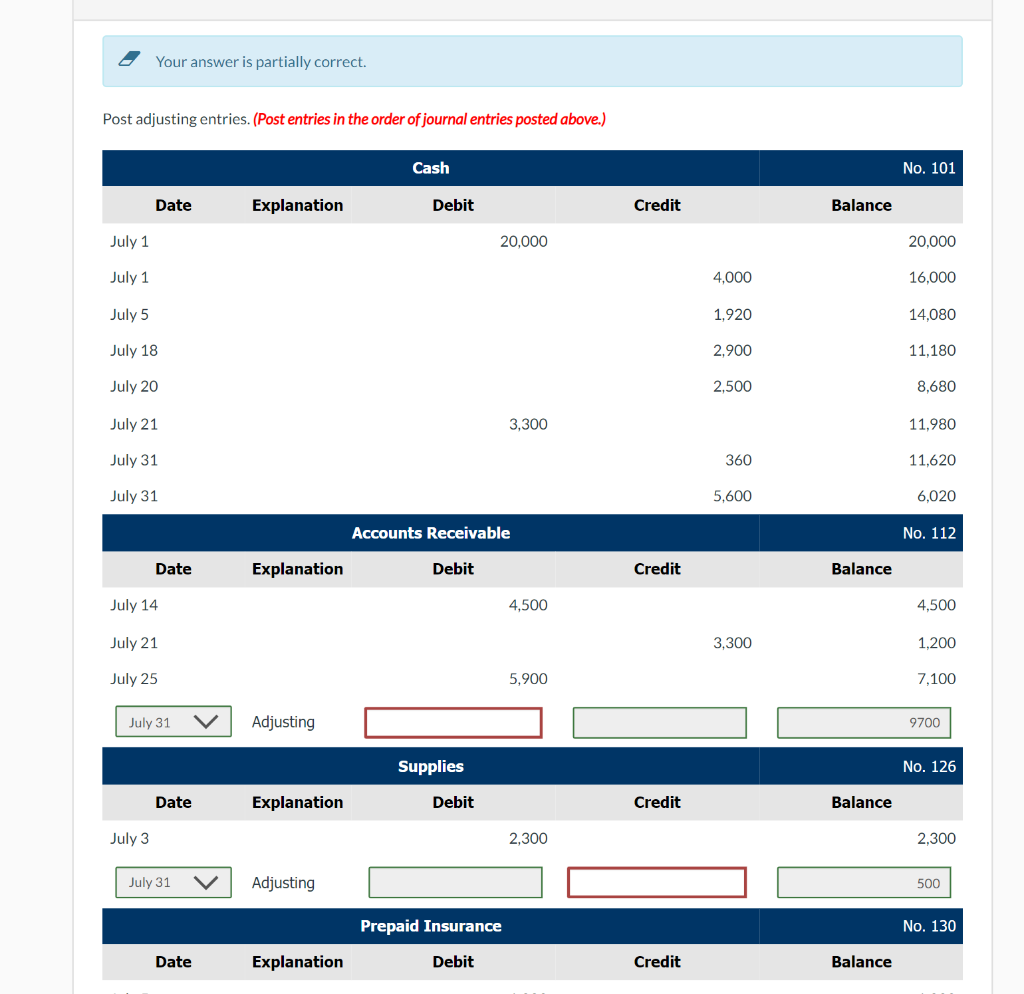

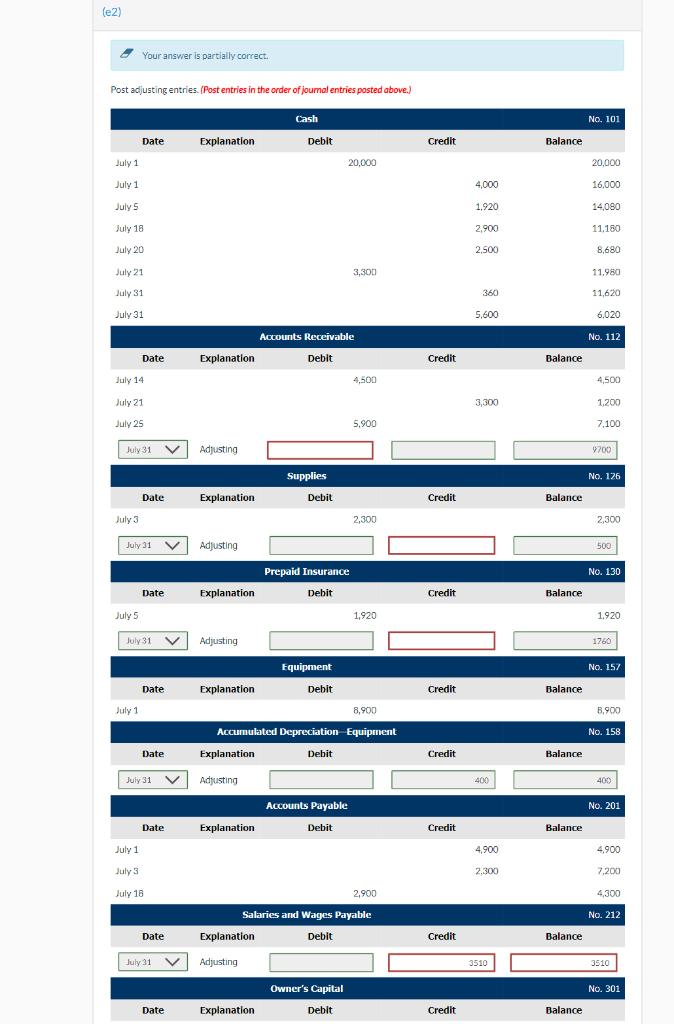

Question 1 of 1 17.8 / 20 2 View Policies Show Attempt History Current Attempt in Progress Ivanhoe Clark opened Ivanhoe's Cleaning Service on July 1, 2022. During July, the following transactions were completed. July 1 Ivanhoe invested $20,000 cash in the business. 1 Purchased used truck for $8,900, paying $4,000 cash and the balance on account. 3 Purchased cleaning supplies for $2,300 on account. 5 Paid $1,920 cash on a 1-year insurance policy effective July 1. 12 Billed customers $4,500 for cleaning services. 18 Paid $1,500 cash on amount owed on truck and $1,400 on amount owed on cleaning supplies. 20 Paid $2,500 cash for employee salaries. 21 Collected $3,300 cash from customers billed on July 12. 25 Billed customers $5,900 for cleaning services. 31 Paid $360 for the monthly gasoline bill for the truck. 31 Withdraw $5,600 cash for personal use. Your answer is partially correct. Post adjusting entries. (Post entries in the order of journal entries posted above.) Cash No. 101 Date Explanation Debit Credit Balance July 1 20,000 20.000 July 1 4,000 16,000 July 5 1,920 14,080 July 18 2,900 11.180 July 20 2,500 8,680 July 21 3,300 11,980 July 31 360 11,620 July 31 5,600 6,020 Accounts Receivable No. 112 Date Explanation Debit Credit Balance July 14 4,500 4,500 July 21 3,300 1,200 July 25 5,900 7,100 July 31 V Adjusting 9700 Supplies No. 126 Date Explanation Debit Credit Balance July 3 2.300 2,300 July 31 Adjusting 500 Prepaid Insurance No. 130 Date Explanation Debit Credit Balance (e2) Your answer is partially correct. . Post adjusting entries. (Post entries in the order of journal entries posted above.) Cash No. 101 Date Explanation Debit Credit Balance July 1 20,000 20,000 July 1 4,000 16,000 July 1.920 14,080 July 18 2,900 11,180 July 20 2,500 8,680 July 21 3,300 11,980 July 31 360 11,620 July 31 5,600 6,020 Accounts Receivable No. 112 Date Explanation Debit Credit Balance July 14 4,500 4,500 July 21 3,300 1,200 July 25 5.900 7,100 July 31 Adjusting 9700 Supplies No. 126 Date Explanation Debit Credit Balance July 3 2,300 2,300 July 31 V Adjusting 500 Prepaid Insurance No. 130 Date Explanation Debit Credit Balance July 5 1,920 1.920 July 31 Adjusting 1760 Equipment No. 157 Date Explanation Debit Credit Balance July 1 8,900 6.900 Accumulated Depreciation Equipment No. 158 Date Explanation Debit Credit Balance July 31 V Adjusting 400 400 Accounts Payable No. 201 Date Explanation Debit Credit Balance July 1 4,900 4,900 July 3 2,300 7,200 July 18 2,900 4,300 No. 212 Salaries and Wages Payable Explanation Debit Date Credit Balance July 31 V Adjusting 3510 3510 Owner's Capital No. 301 Date Explanation Debit Credit Balance Question 1 of 1 17.8 / 20 2 View Policies Show Attempt History Current Attempt in Progress Ivanhoe Clark opened Ivanhoe's Cleaning Service on July 1, 2022. During July, the following transactions were completed. July 1 Ivanhoe invested $20,000 cash in the business. 1 Purchased used truck for $8,900, paying $4,000 cash and the balance on account. 3 Purchased cleaning supplies for $2,300 on account. 5 Paid $1,920 cash on a 1-year insurance policy effective July 1. 12 Billed customers $4,500 for cleaning services. 18 Paid $1,500 cash on amount owed on truck and $1,400 on amount owed on cleaning supplies. 20 Paid $2,500 cash for employee salaries. 21 Collected $3,300 cash from customers billed on July 12. 25 Billed customers $5,900 for cleaning services. 31 Paid $360 for the monthly gasoline bill for the truck. 31 Withdraw $5,600 cash for personal use. Your answer is partially correct. Post adjusting entries. (Post entries in the order of journal entries posted above.) Cash No. 101 Date Explanation Debit Credit Balance July 1 20,000 20.000 July 1 4,000 16,000 July 5 1,920 14,080 July 18 2,900 11.180 July 20 2,500 8,680 July 21 3,300 11,980 July 31 360 11,620 July 31 5,600 6,020 Accounts Receivable No. 112 Date Explanation Debit Credit Balance July 14 4,500 4,500 July 21 3,300 1,200 July 25 5,900 7,100 July 31 V Adjusting 9700 Supplies No. 126 Date Explanation Debit Credit Balance July 3 2.300 2,300 July 31 Adjusting 500 Prepaid Insurance No. 130 Date Explanation Debit Credit Balance (e2) Your answer is partially correct. . Post adjusting entries. (Post entries in the order of journal entries posted above.) Cash No. 101 Date Explanation Debit Credit Balance July 1 20,000 20,000 July 1 4,000 16,000 July 1.920 14,080 July 18 2,900 11,180 July 20 2,500 8,680 July 21 3,300 11,980 July 31 360 11,620 July 31 5,600 6,020 Accounts Receivable No. 112 Date Explanation Debit Credit Balance July 14 4,500 4,500 July 21 3,300 1,200 July 25 5.900 7,100 July 31 Adjusting 9700 Supplies No. 126 Date Explanation Debit Credit Balance July 3 2,300 2,300 July 31 V Adjusting 500 Prepaid Insurance No. 130 Date Explanation Debit Credit Balance July 5 1,920 1.920 July 31 Adjusting 1760 Equipment No. 157 Date Explanation Debit Credit Balance July 1 8,900 6.900 Accumulated Depreciation Equipment No. 158 Date Explanation Debit Credit Balance July 31 V Adjusting 400 400 Accounts Payable No. 201 Date Explanation Debit Credit Balance July 1 4,900 4,900 July 3 2,300 7,200 July 18 2,900 4,300 No. 212 Salaries and Wages Payable Explanation Debit Date Credit Balance July 31 V Adjusting 3510 3510 Owner's Capital No. 301 Date Explanation Debit Credit Balance