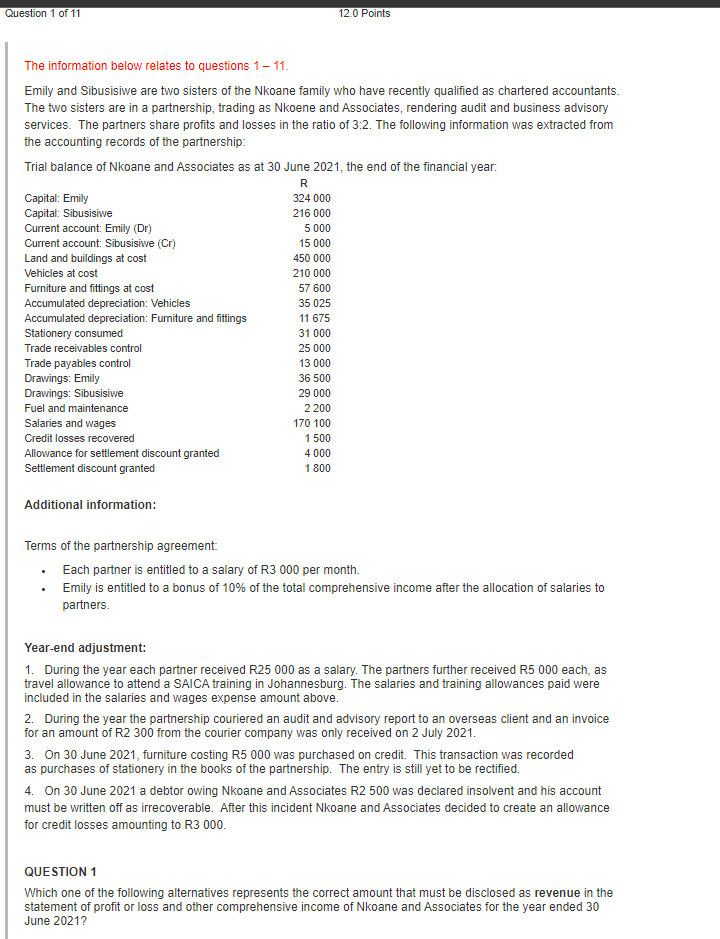

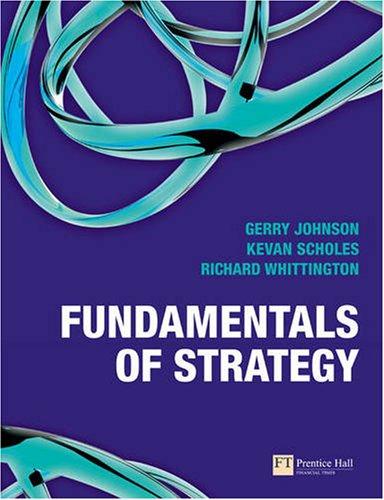

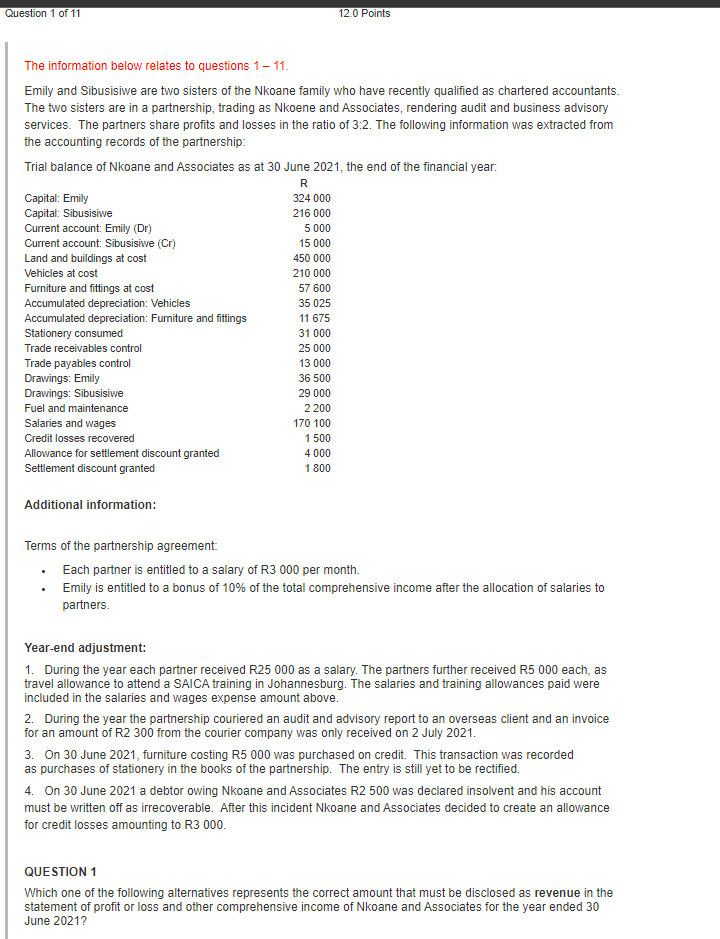

Question 1 of 11 12.0 Points The information below relates to questions 1 - 11. Emily and Sibusisiwe are two sisters of the Nkoane family who have recently qualified as chartered accountants. The two sisters are in a partnership, trading as Nkoene and Associates, rendering audit and business advisory services. The partners share profits and losses in the ratio of 3:2. The following information was extracted from the accounting records of the partnership: Trial balance of Nkoane and Associates as at 30 June 2021, the end of the financial year: R Capital: Emily 324 000 Capital: Sibusisiwe 216 000 Current account: Emily (Dr) 5 000 Current account: Sibusisiwe (Cr) 15 000 Land and buildings at cost 450 000 Vehicles at cost 210 000 Furniture and fittings at cost 57 600 Accumulated depreciation: Vehicles 35 025 Accumulated depreciation: Furniture and fittings 11 675 Stationery consumed 31000 Trade receivables control 25 000 Trade payables control 13 000 Drawings: Emily 36 500 Drawings: Sibusisiwe 29 000 Fuel and maintenance 2 200 Salaries and wages 170 100 Credit losses recovered 1 500 Allowance for settlement discount granted 4 000 Settlement discount granted 1 800 Additional information: Terms of the partnership agreement: Each partner is entitled to a salary of R3 000 per month. Emily is entitled to a bonus of 10% of the total comprehensive income after the allocation of salaries to partners. Year-end adjustment: 1. During the year each partner received R25 000 as a salary. The partners further received R5 000 each, as travel allowance to attend a SAICA training in Johannesburg. The salaries and training allowances paid were included in the salaries and wages expense amount above. 2. During the year the partnership couriered an audit and advisory report to an overseas client and an invoice for an amount of R2 300 from the courier company was only received on 2 July 2021. 3. On 30 June 2021, furniture costing R5 000 was purchased on credit. This transaction was recorded as purchases of stationery in the books of the partnership. The entry is still yet to be rectified. 4. On 30 June 2021 a debtor owing Nkoane and Associates R2 500 was declared insolvent and his account must be written off as irrecoverable. After this incident Nkoane and Associates decided to create an allowance for credit losses amounting to R3 000. QUESTION 1 Which one of the following alternatives represents the correct amount that must be disclosed as revenue in the statement of profit or loss and other comprehensive income of Nkoane and Associates for the year ended 30 June 2021? QUESTION 1 Which one of the following alternatives represents the correct amount that must be disclosed as revenue in the statement of profit or loss and other comprehensive income of Nkoane and Associates for the year ended 30 June 2021? A. 396 200 . B. 410 800 C. 420 400 D. 300 000 E. 550 500