Answered step by step

Verified Expert Solution

Question

1 Approved Answer

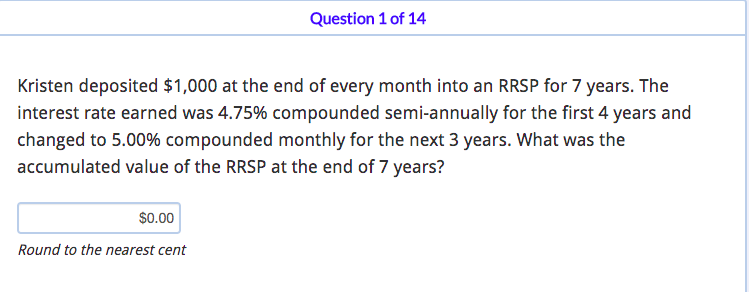

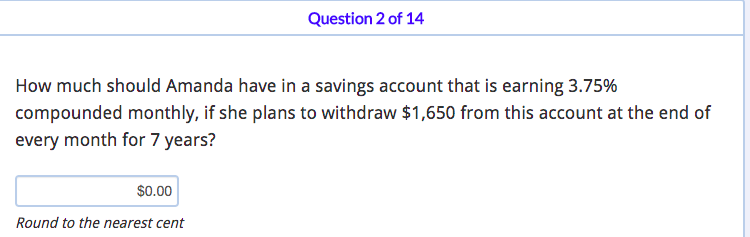

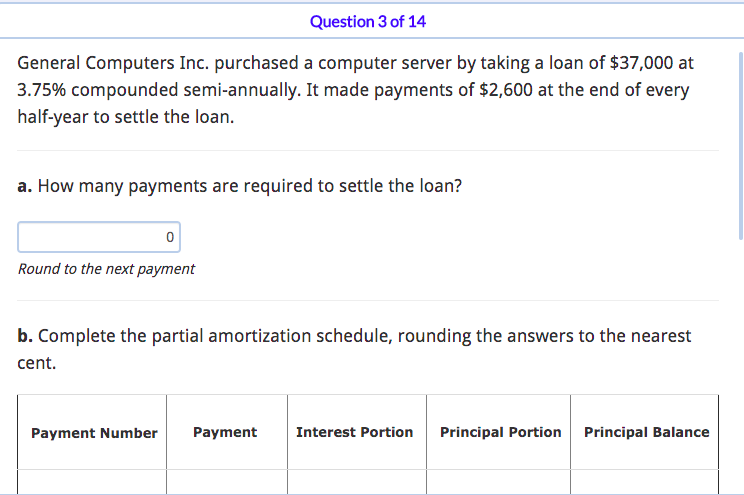

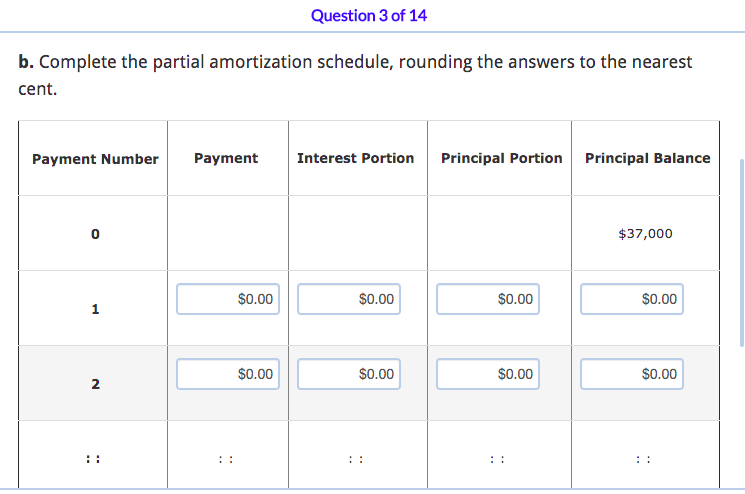

Question 1 of 14 Kristen deposited $1,000 at the end of every month into an RRSP for 7 years. The interest rate earned was

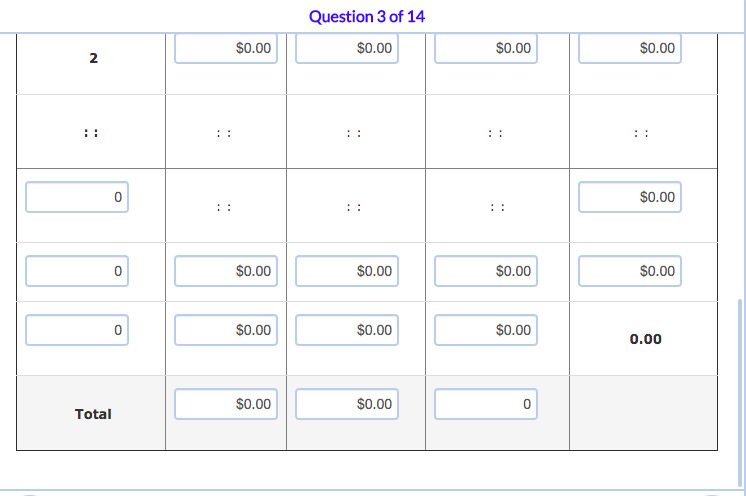

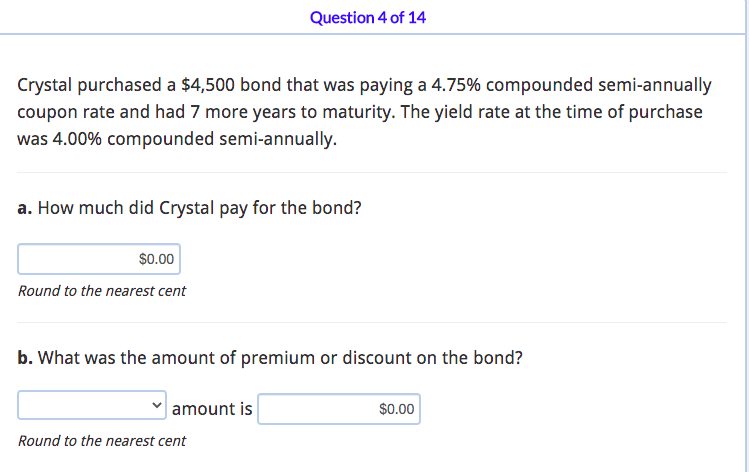

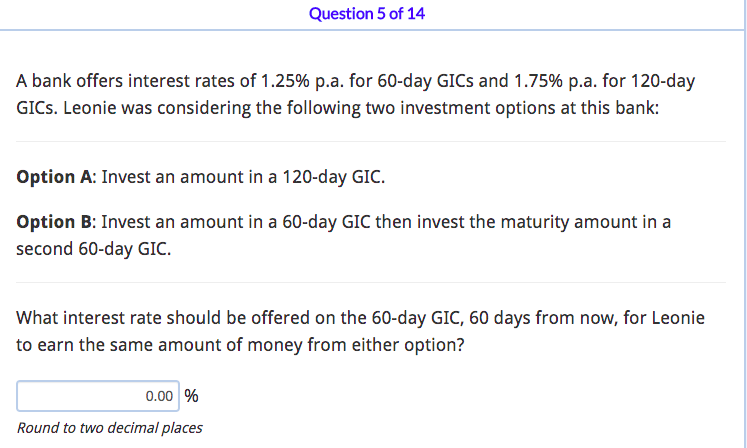

Question 1 of 14 Kristen deposited $1,000 at the end of every month into an RRSP for 7 years. The interest rate earned was 4.75% compounded semi-annually for the first 4 years and changed to 5.00% compounded monthly for the next 3 years. What was the accumulated value of the RRSP at the end of 7 years? $0.00 Round to the nearest cent Question 2 of 14 How much should Amanda have in a savings account that is earning 3.75% compounded monthly, if she plans to withdraw $1,650 from this account at the end of every month for 7 years? $0.00 Round to the nearest cent Question 3 of 14 General Computers Inc. purchased a computer server by taking a loan of $37,000 at 3.75% compounded semi-annually. It made payments of $2,600 at the end of every half-year to settle the loan. a. How many payments are required to settle the loan? 0 Round to the next payment b. Complete the partial amortization schedule, rounding the answers to the nearest cent. Payment Number Payment Interest Portion Principal Portion Principal Balance Question 3 of 14 b. Complete the partial amortization schedule, rounding the answers to the nearest cent. Payment Number Payment Interest Portion Principal Portion Principal Balance $37,000 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 2 0 Question 3 of 14 $0.00 $0.00 $0.00 $0.00 :: 0 $0.00 $0.00 $0.00 $0.00 0 $0.00 $0.00 $0.00 0.00 $0.00 $0.00 Total Question 4 of 14 Crystal purchased a $4,500 bond that was paying a 4.75% compounded semi-annually coupon rate and had 7 more years to maturity. The yield rate at the time of purchase was 4.00% compounded semi-annually. a. How much did Crystal pay for the bond? $0.00 Round to the nearest cent b. What was the amount of premium or discount on the bond? amount is Round to the nearest cent $0.00 Question 5 of 14 A bank offers interest rates of 1.25% p.a. for 60-day GICs and 1.75% p.a. for 120-day GICs. Leonie was considering the following two investment options at this bank: Option A: Invest an amount in a 120-day GIC. Option B: Invest an amount in a 60-day GIC then invest the maturity amount in a second 60-day GIC. What interest rate should be offered on the 60-day GIC, 60 days from now, for Leonie to earn the same amount of money from either option? 0.00 % Round to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the accumulated value of Kristens RRSP at the end of 7 years we need to calculate the future value of the monthly deposits using the given interest rates for each period For the first 4 y...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started