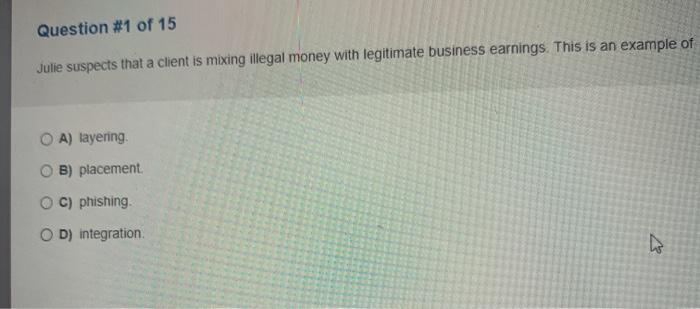

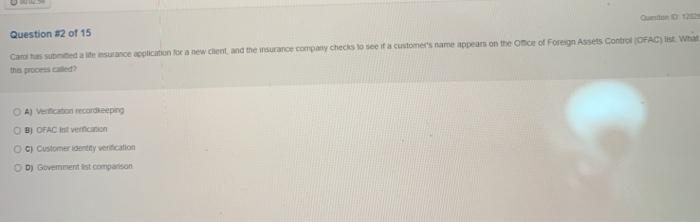

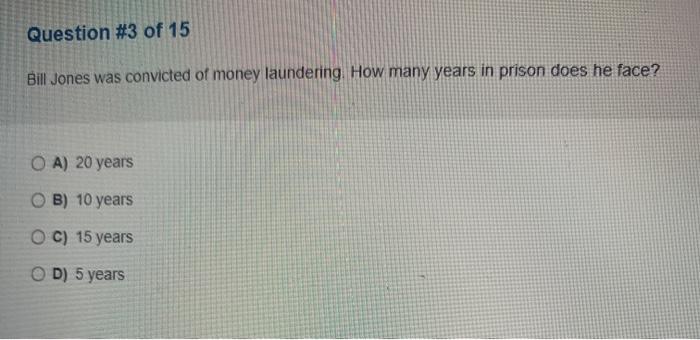

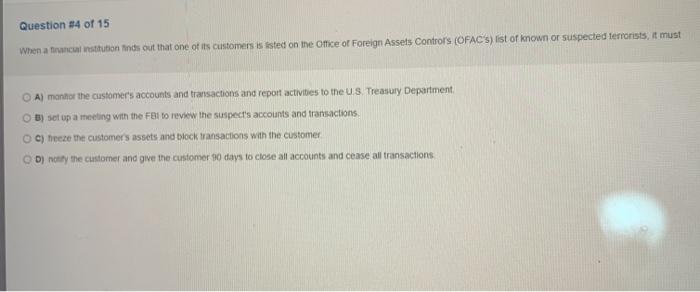

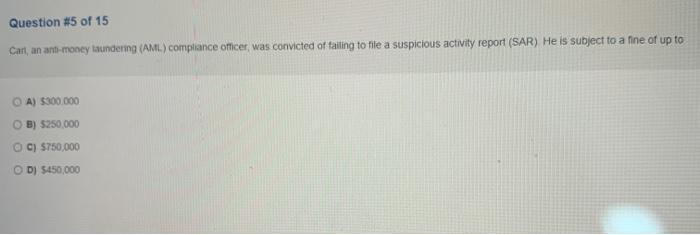

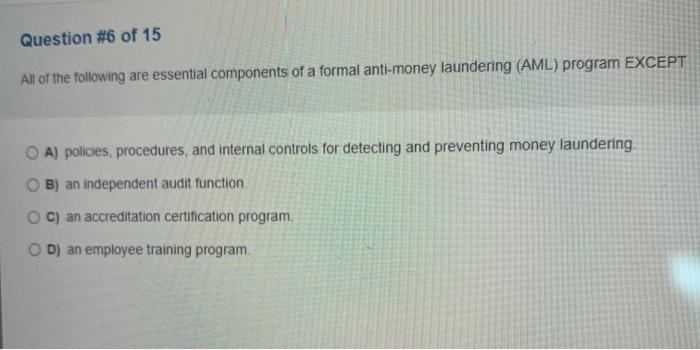

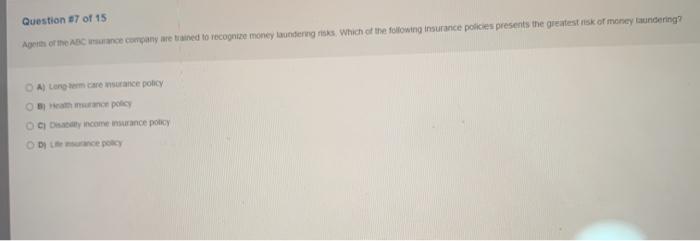

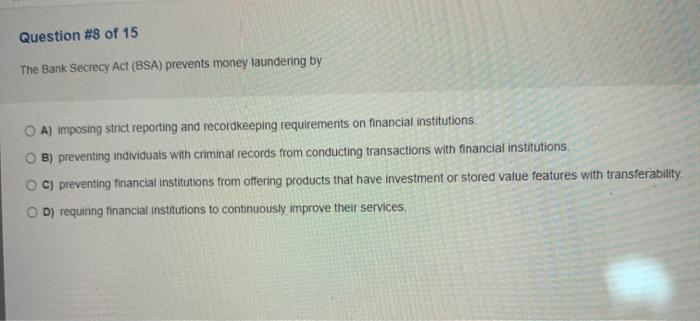

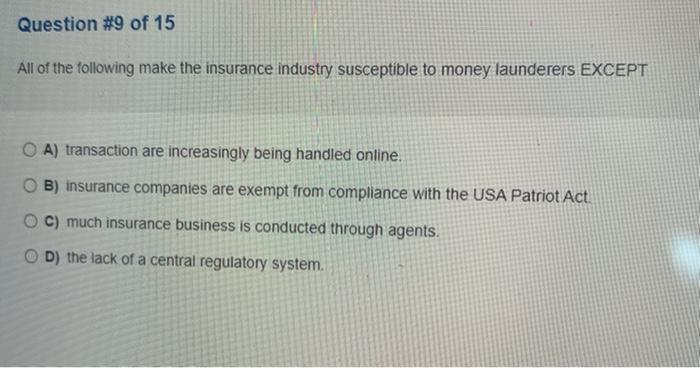

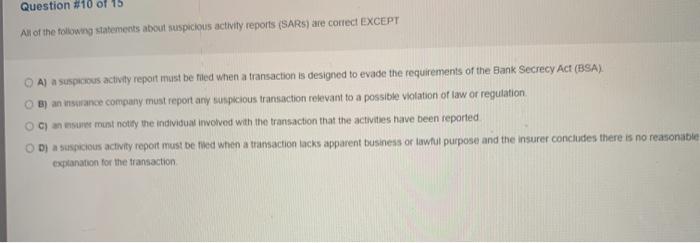

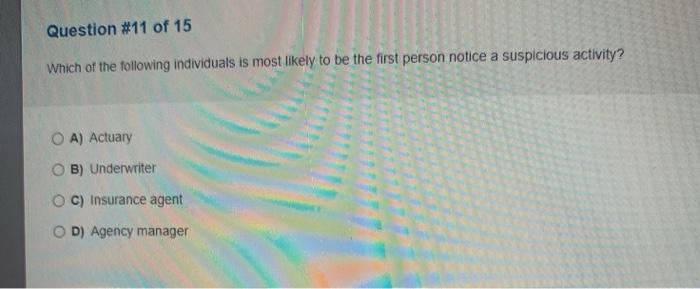

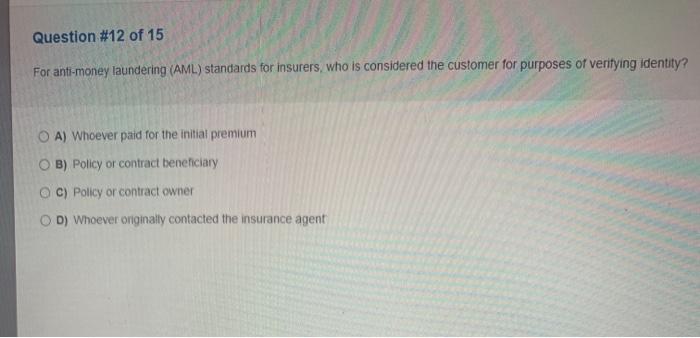

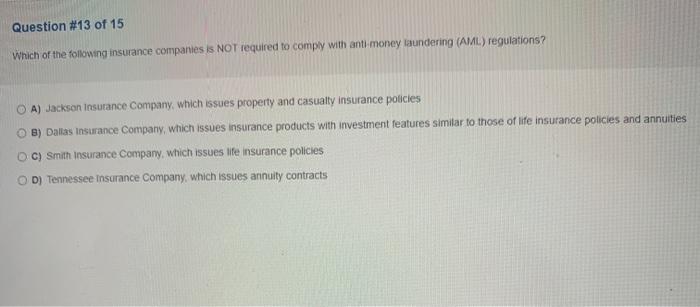

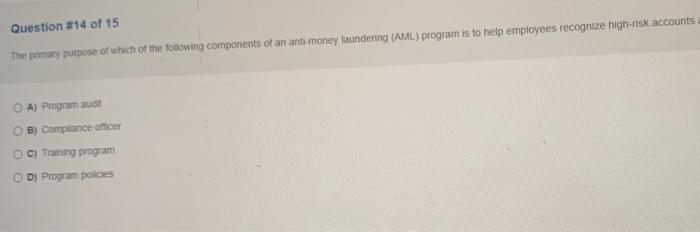

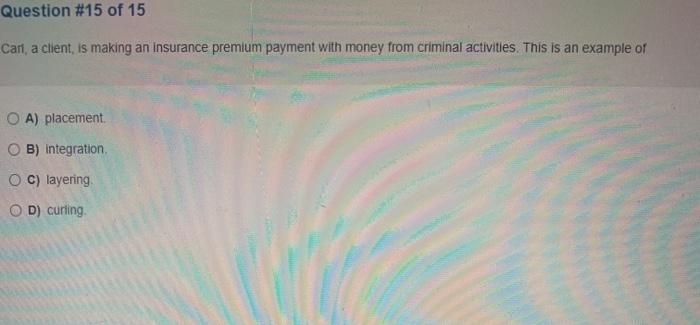

Question #1 of 15 Julie suspects that a client is mixing illegal money with legitimate business earnings. This is an example of A) layering OB) placement OC) phishing OD) integration a Question 2 of 15 Cartus supredence plication for a new client and the insurance company checks to see if a customer's name appear on the one of Foreign Assets Control (OFAC) What the proced A) Von recordieping B) OFAC Instveno Ocj Customer daty ventication D) Govement est comparison Question #3 of 15 Bill Jones was convicted of money laundering How many years in prison does he face? O A) 20 years OB) 10 years OC) 15 years OD) 5 years Question 34 of 15 when a francial institution finds out that one of its customers is isted on the Office of Foreign Assets Controls (OFAC's) list of known or suspected terrorists, it must OA) manhor the customer's accounts and transactions and report activities to the us. Treasury Department OB) set up a meeting with the FBI to review the suspect's accounts and transactions OC) heeze the customers assets and block transactions with the customer D) netly the customer and give the customer 90 days to close all accounts and cease all transactions Question #5 of 15 Cart, an anti-money laundering (AML) compliance officer, was convicted of failing to file a suspicious activity report (SAR) He is subject to a fine of up to A) $300.000 B) $250.000 C) $750,000 OD $450,000 Question #6 of 15 All of the following are essential components of a formal anti-money laundering (AML) program EXCEPT OA) policies, procedures, and internal controls for detecting and preventing money laundering. OB) an independent audit function OC) an accreditation certification program, OD) an employee training program Question 17 of 15 Age of ABC e company are trained to recognize money laundering Which of the following insurance policies presents the greatest risk of money laundering A) Long term care sunce policy Hammer policy C by income insurance policy Depy Question #8 of 15 The Bank Secrecy Act (BSA) prevents money laundering by OA) imposing strict reporting and recordkeeping requirements on financial institutions OB) preventing individuals with criminal records from conducting transactions with financial institutions C) preventing financial institutions from offering products that have investment or stored value features with transferability. D) requiring financial institutions to continuously improve their services. Question #9 of 15 All of the following make the insurance industry susceptible to money launderers EXCEPT OA) transaction are increasingly being handled online. OB) insurance companies are exempt from compliance with the USA Patriot Act. C) much insurance business is conducted through agents. OD) the lack of a central regulatory system. Question #10 of 15 All of the following statements about suspicious activity reports (SARS) are correct EXCEPT O A) a suspicious activity report must be tied when a transaction is designed to evade the requirements of the Bank Secrecy Act (BSA) B) an insurance company must report any suspicious transaction relevant to a possible violation of law or regulation OC) anstre must notify the individual involved with the transaction that the activities have been reported DJ a suspicious activity report must be fiked when a transaction tacks apparent business or towiul purpose and the insurer concludes there is no reasonable explanation for the transaction Question #11 of 15 Which of the following individuals is most likely to be the first person notice a suspicious activity? OA) Actuary OB) Underwriter OC) Insurance agent OD) Agency manager Question #12 of 15 For anti-money laundering (AML) standards for insurers, who is considered the customer for purposes of veritying identity? O A) Whoever paid for the initial premium B) Policy or contract beneficiary C) Policy or contract owner D) Whoever originally contacted the insurance agent Question #13 of 15 Which of the following insurance companies is NOT required to comply with anti-money laundering (AML) regulations? OA) Jackson Insurance Company, which issues property and casualty insurance policies OB) Dallas Insurance Company, which issues insurance products with investment features similar to those of life insurance policies and annuities OC) Smith Insurance Company, which issues life insurance policies D) Tennessee Insurance Company, which issues annuity contracts 0 Question $14 of 15 The primary purpose of which of the following components of an anti-money laundering (AML) program is to help employees recognize high-risk accounts A) Program audit OB) Compliance unicer OC) Training program OD) Program policies Question #15 of 15 Cani, a client, is making an insurance premium payment with money from criminal activities. This is an example of OA) placement O B) integration c) layering OD) curling