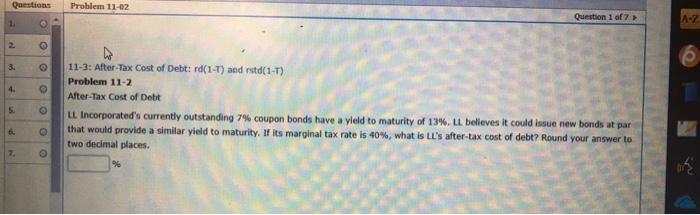

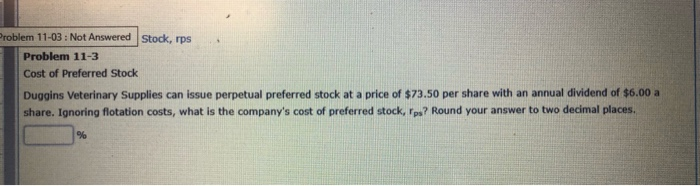

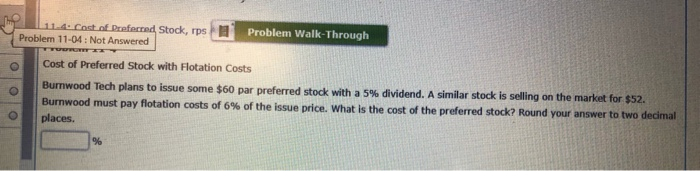

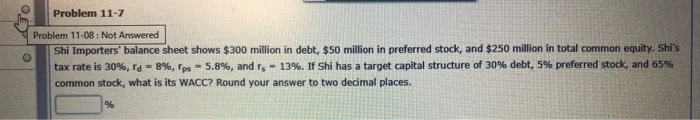

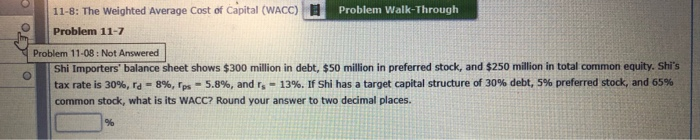

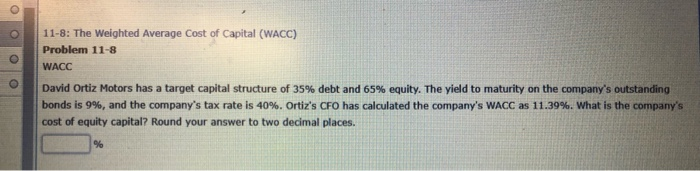

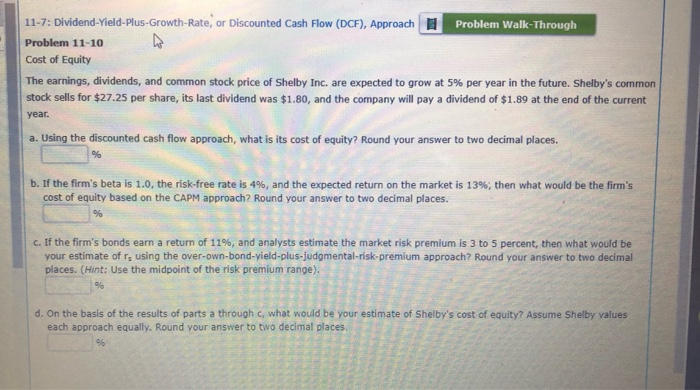

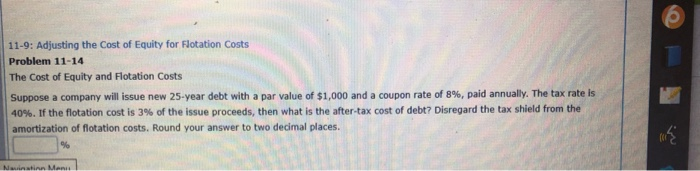

Question 1 of 2 11-3: After-Tax Cost of Debt: rd(1-T) and rstd(1-T) Problem 11-2 After-Tax Cost of Debt LL Incorporated's currently outstanding 7% coupon bonds have a yield to maturity of 13%. LL believes it could issue new bonds at par that would provide a similar yield to maturity. If its marginal tax rate is 40%, what is 's after-tax cost of debt? Round your answer to two decimal places. roblem 11-03 : Not Answered Stock, rps Problem 11-3 Cost of Preferred Stock Duggins Veterinary Supplies can issue perpetual preferred stock at a price of $73.50 per share with an annual dividend of $6.00 a share. Ignoring flotation costs, what is the company's cost of preferred stock, Tes? Round your answer to two decimal places 11.4. Cost of Deferred Stock, rps Problem 11-04 : Not Answered Problem Walk-Through Cost of Preferred Stock with Flotation Costs Burwood Tech plans to issue some $60 par preferred stock with a 5% dividend. A similar stock is selling on the market for $52. Burnwood must pay flotation costs of 6% of the issue price. What is the cost of the preferred stock? Round your answer to two decimal places. Problem 11-7 Problem 11-08 : Not Answered Shi Importers' balance sheet shows $300 million in debt, $50 million in preferred stock, and $250 million in total common equity. Shi's tax rate is 30%, rg - 8%, tps - 5.8%, and is - 13%. If Shi has a target capital structure of 30% debt, 5% preferred stock, and 65% common stock, what is its WACC? Round your answer to two decimal places. 11-8: The Weighted Average Cost of Capital (WACC) Problem Walk-Through Problem 11-7 Problem 11-08 : Not Answered Shi Importers' balance sheet shows $300 million in debt, $50 million in preferred stock, and $250 million in total common equity. Shi's tax rate is 30%, rg - 8%, ps - 5.8%, and T, - 13%. If Shi has a target capital structure of 30% debt, 5% preferred stock, and 65% common stock, what is its WACC? Round your answer to two decimal places. 11-8: The Weighted Average Cost of Capital (WACC) Problem 11-8 WACC David Ortiz Motors has a target capital structure of 35% debt and 65% equity. The yield to maturity on the company's outstanding bonds is 9%, and the company's tax rate is 40%. Ortiz's CFO has calculated the company's WACC as 11.39%. What is the company's cost of equity capital? Round your answer to two decimal places. 11-7: Dividend-Yield-Plus-Growth-Rate, or Discounted Cash Flow (DCF), Approach Problem Walk-Through Problem 11-10 Cost of Equity The earnings, dividends, and common stock price of Shelby Inc. are expected to grow at 5% per year in the future. Shelby's common stock sells for $27.25 per share, its last dividend was $1.80, and the company will pay a dividend of $1.89 at the end of the current year. a. Using the discounted cash flow approach, what is its cost of equity? Round your answer to two decimal places. b. If the firm's beta is 1.0, the risk-free rate is 4%, and the expected return on the market is 13%; then what would be the firm's cost of equity based on the CAPM approach? Round your answer to two decimal places. C. If the firm's bonds earn a return of 11%, and analysts estimate the market risk premium is 3 to 5 percent, then what would be your estimate of rs using the over-own-bond-yield-plus-judgmental-risk-premium approach? Round your answer to two decimal places. (Hint: Use the midpoint of the risk premium range). d. On the basis of the results of parts a through what would be your estimate of Shelby's cost of equity Assume Shelby values each approach equally. Round your answer to two decimal places. 11-9: Adjusting the Cost of Equity for Rotation Costs Problem 11-14 The Cost of Equity and Flotation Costs Suppose a company will issue new 25-year debt with a par value of $1,000 and a coupon rate of 8%, paid annually. The tax rate is 40%. If the flotation cost is 3% of the issue proceeds, then what is the after-tax cost of debt? Disregard the tax shield from the amortization of flotation costs. Round your answer to two decimal places