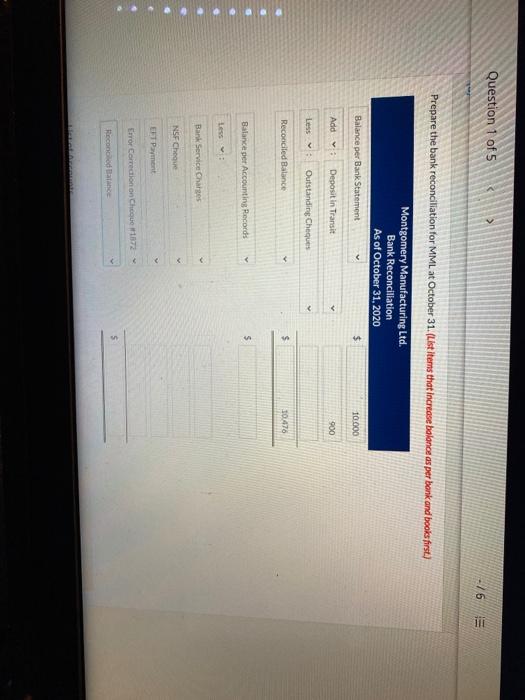

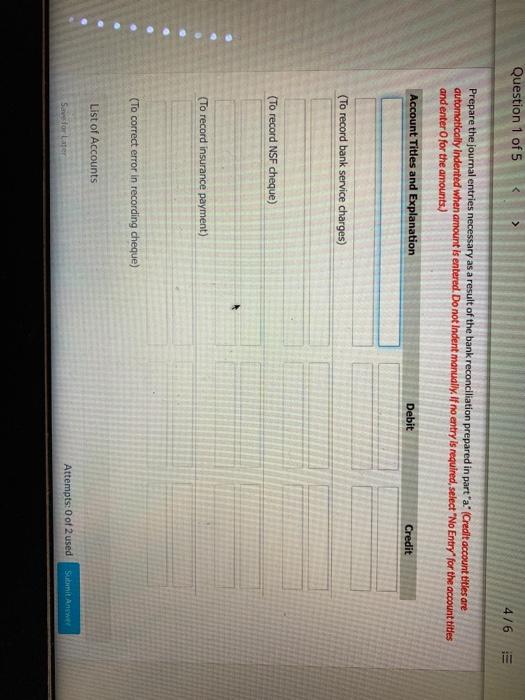

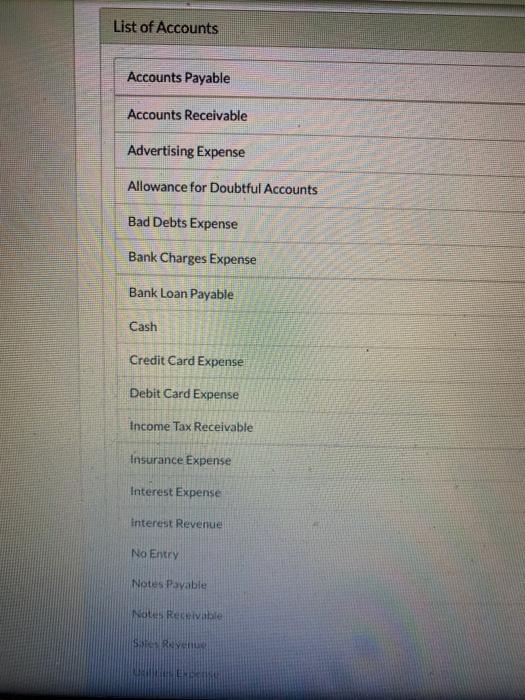

Question 1 of 5 -/6 Current Attempt in Progress On October 31, 2020, Montgomery Manufacturing Ltd. (MML) received its bank statement from the Big Bank. It stated that MML had a balance of $10,000 at October 31. The company's general ledger showed a cash balance of $10.476 at that date. A comparison of the bank statement and the accounting records revealed the following information: Bank service charges for the month were $50. The company had written and mailed out cheques with a value of $1,600 that had not yet cleared the bank. A cheque from one of MML's customers in the amount of $900 that had been deposited during the last week of October was returned with the bank statement as NSF. A payment of $246 for monthly insurance expense was automatically deducted from MML's bank account on October 22. MML's bookkeeper had forgotten to record this transaction. During the month, the company's bookkeeper had recorded a cheque (#1872) paid for utilities as $575 rather than $755 (which was the amount written on the cheque and processed by the bank) The cash receipts for October 31 amounted to $700 and had been deposited in the night drop slot at the bank on the evening of October 31. These were not reflected on the bank statement for October (a) Prepare the bank reconciliation for MML at October 31 (List items that increase balonce as per bank and books first) Montgomery Manufacturing Ltd. Bank Reconciliation As of October 31, 2020 10.000 Balancer Bal Statement Question 1 of 5 -76 111 Prepare the bank reconciliation for MML at October 31. (List items that increase balance as per bank and books first.) Montgomery Manufacturing Ltd. Bank Reconciliation As of October 31, 2020 Balance per Bank Statement $ 10 000 Add Deposit in Transit 900 Outstanding Cheques Reconciled Balance 10.476 Balance per Accounting Records 5 . a a a Bank Service Charges NSF Choose ET Payment Error Correction on Choue 1872 5 Recondo la Question 1 of 5 4/6 Prepare the journal entries necessary as a result of the bank reconciliation prepared in part *a(Credit account titles are automatically indented when amount is entered. Do not Indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts.) Account Titles and Explanation Debit Credit (To record bank service charges) (To record NSF cheque) (To record insurance payment) (To correct error in recording cheque) List of Accounts Safor Later Attempts: 0 of 2 used Submit Answer List of Accounts Accounts Payable Accounts Receivable Advertising Expense Allowance for Doubtful Accounts Bad Debts Expense Bank Charges Expense Bank Loan Payable Cash Credit Card Expense Debit Card Expense Income Tax Receivable Insurance Expense Interest Expense interest Revenue No Entry Notes Payable Not Receivable SRAY ENERO