Answered step by step

Verified Expert Solution

Question

1 Approved Answer

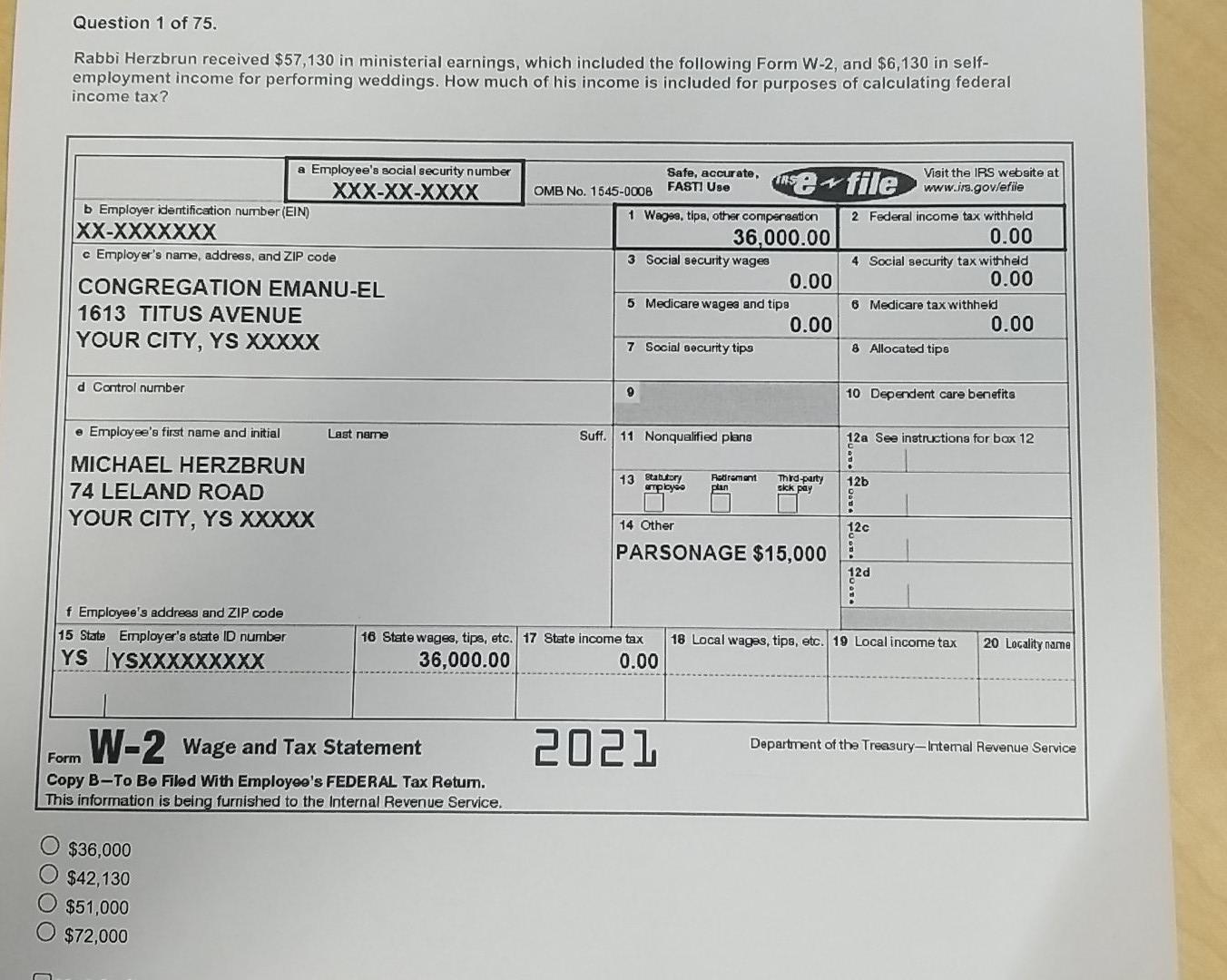

Question 1 of 75. Rabbi Herzbrun received $57,130 in ministerial earnings, which included the following Form W-2, and $6,130 in self- employment income for performing

Question 1 of 75. Rabbi Herzbrun received $57,130 in ministerial earnings, which included the following Form W-2, and $6,130 in self- employment income for performing weddings. How much of his income is included for purposes of calculating federal income tax? na file Visit the IRS website at www.irs.gov/efile a Employee's social security number XXX-XX-XXXX b Employer identification number (EIN) XX-XXXXXXX c Employer's name, address, and ZIP code Safe, accurate, TRS OMB No. 1545-0006 FASTI Use 1 Wages, tipa, other compensation 36,000.00 3 Social security wages 0.00 5 Medicare wages and tips 0.00 7 Social security tips CONGREGATION EMANU-EL 1613 TITUS AVENUE YOUR CITY, YS XXXXX 2 Federal income tax withheld 0.00 4 Social security tax withheld 0.00 6 Medicare tax withheld 0.00 8 Allocated tips d Control number 9 10 Dependent care benefits e Employee's first name and initial Last name Suff. 11 Nonqualified plana 12a See instructions for box 12 8 125 MICHAEL HERZBRUN 74 LELAND ROAD YOUR CITY, YS XXXXX 13 Statutory artployee Retirement plen Third-party sick pay 14 Other PARSONAGE $15,000 12c 8 120 f Employee's address and ZIP code 15 State Employer's state ID number YS YSXXXXXXXXX 18 Local wages, tips, etc. 19 Local income tax 16 State wages, tips, etc. 17 State income tax 36,000.00 0.00 20 Locality name W-2 2021 Department of the Treasury-Internal Revenue Service Wage and Tax Statement Form Copy B-To Be Filed With Employee's FEDERAL Tax Return. This information is being furnished to the Internal Revenue Service. O $36,000 O $42,130 O $51,000 O $72,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started