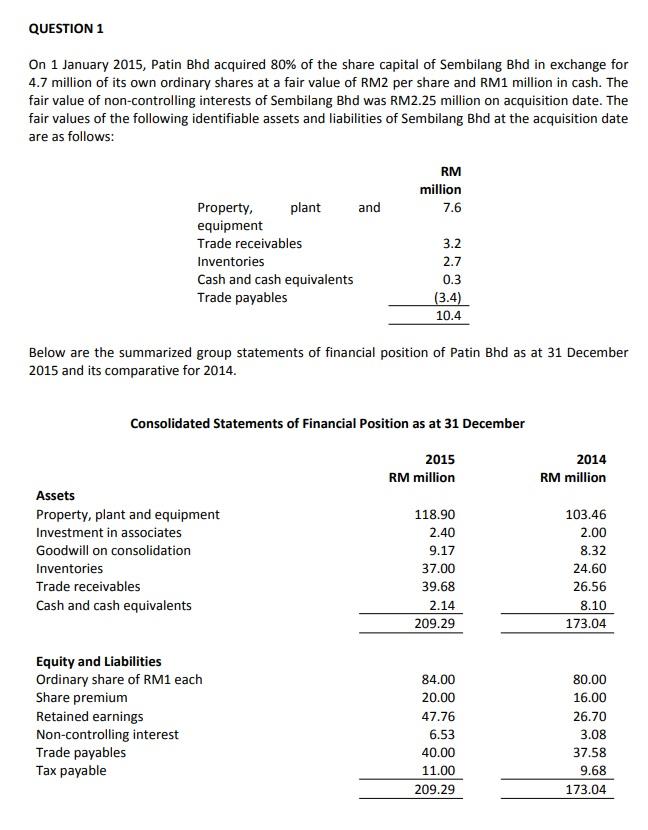

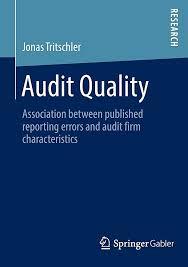

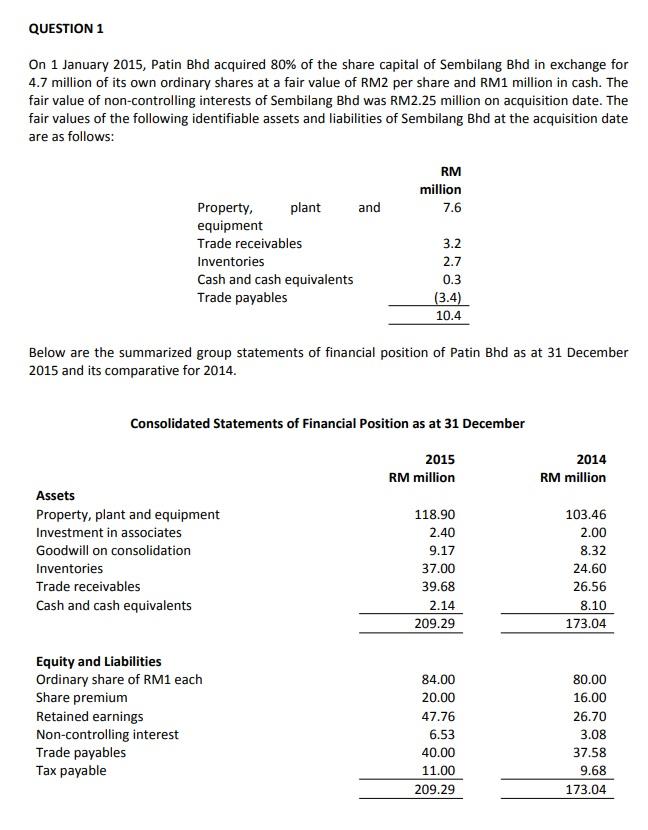

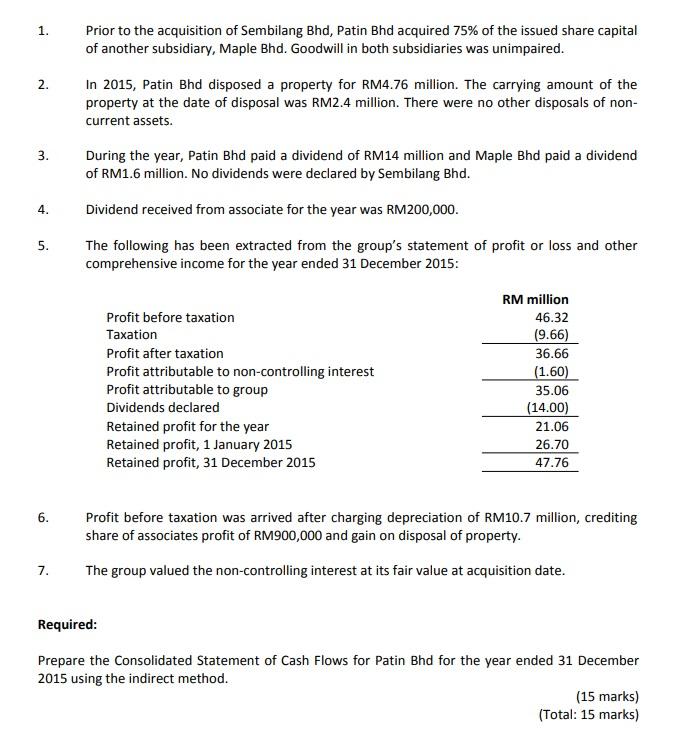

QUESTION 1 On 1 January 2015, Patin Bhd acquired 80% of the share capital of Sembilang Bhd in exchange for 4.7 million of its own ordinary shares at a fair value of RM2 per share and RM1 million in cash. The fair value of non-controlling interests of Sembilang Bhd was RM2.25 million on acquisition date. The fair values of the following identifiable assets and liabilities of Sembilang Bhd at the acquisition date are as follows: RM million 7.6 Property, plant and equipment Trade receivables Inventories Cash and cash equivalents Trade payables 3.2 2.7 0.3 (3.4) 10.4 Below are the summarized group statements of financial position of Patin Bhd as at 31 December 2015 and its comparative for 2014. Consolidated Statements of Financial Position as at 31 December 2015 RM million 2014 RM million Assets Property, plant and equipment Investment in associates Goodwill on consolidation Inventories Trade receivables Cash and cash equivalents 118.90 2.40 9.17 37.00 39.68 2.14 209.29 103.46 2.00 8.32 24.60 26.56 8.10 173.04 Equity and Liabilities Ordinary share of RM1 each Share premium Retained earnings Non-controlling interest Trade payables Tax payable 84.00 20.00 47.76 6.53 40.00 11.00 209.29 80.00 16.00 26.70 3.08 37.58 9.68 173.04 1. Prior to the acquisition of Sembilang Bhd, Patin Bhd acquired 75% of the issued share capital of another subsidiary, Maple Bhd. Goodwill in both subsidiaries was unimpaired. In 2015, Patin Bhd disposed a property for RM4.76 million. The carrying amount of the property at the date of disposal was RM2.4 million. There were no other disposals of non- current assets. 2. 3. During the year, Patin Bhd paid a dividend of RM14 million and Maple Bhd paid a dividend of RM1.6 million. No dividends were declared by Sembilang Bhd. 4. Dividend received from associate for the year was RM200,000. 5. The following has been extracted from the group's statement of profit or loss and other comprehensive income for the year ended 31 December 2015: Profit before taxation Taxation Profit after taxation Profit attributable to non-controlling interest Profit attributable to group Dividends declared Retained profit for the year Retained profit, 1 January 2015 Retained profit, 31 December 2015 RM million 46.32 (9.66) 36.66 (1.60) 35.06 (14.00) 21.06 26.70 47.76 6. Profit before taxation was arrived after charging depreciation of RM10.7 million, crediting share of associates profit of RM900,000 and gain on disposal of property. The group valued the non-controlling interest at its fair value at acquisition date. 7. Required: Prepare the Consolidated Statement of Cash Flows for Patin Bhd for the year ended 31 December 2015 using the indirect method. (15 marks) (Total: 15 marks)