Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 1 On 1 January 2021, Lucky Bhd enters into a five-year non-cancellable lease agreement with Health Bhd to lease a customised printing machine. The

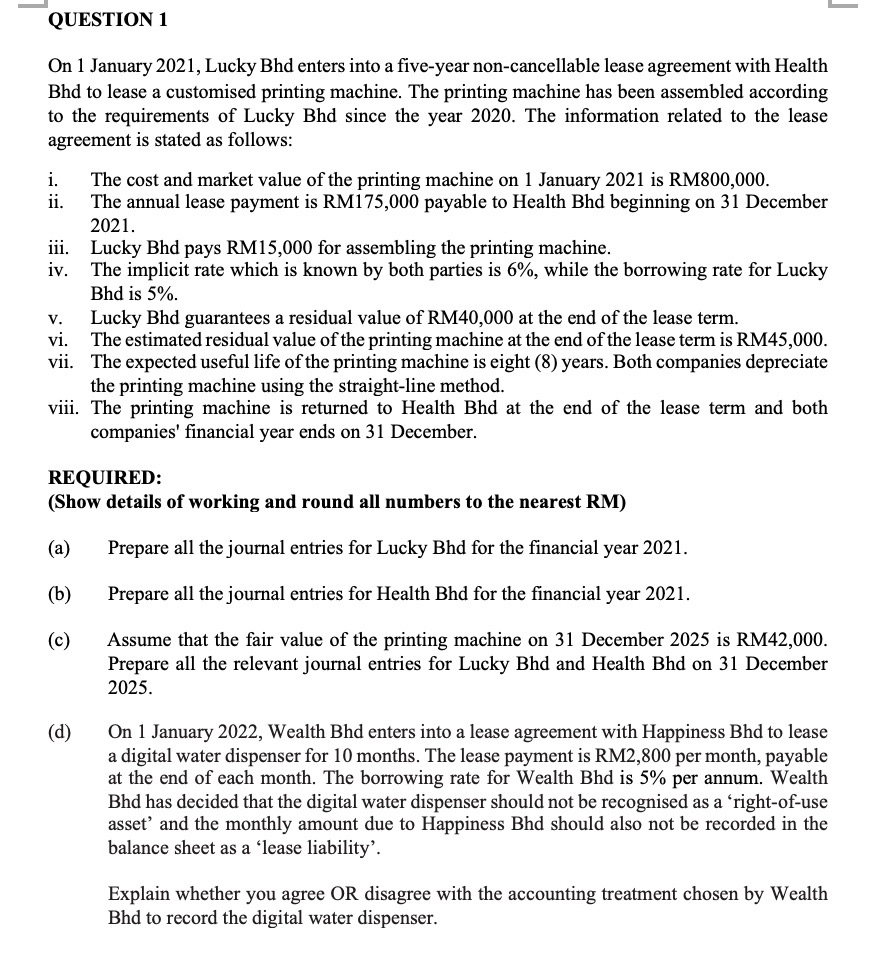

QUESTION 1 On 1 January 2021, Lucky Bhd enters into a five-year non-cancellable lease agreement with Health Bhd to lease a customised printing machine. The printing machine has been assembled according to the requirements of Lucky Bhd since the year 2020. The information related to the lease agreement is stated as follows: i. The cost and market value of the printing machine on 1 January 2021 is RM800,000. ii. The annual lease payment is RM175,000 payable to Health Bhd beginning on 31 December 2021. iii. Lucky Bhd pays RM15,000 for assembling the printing machine. iv. The implicit rate which is known by both parties is 6%, while the borrowing rate for Lucky Bhd is 5%. v. Lucky Bhd guarantees a residual value of RM40,000 at the end of the lease term. vi. The estimated residual value of the printing machine at the end of the lease term is RM45,000. vii. The expected useful life of the printing machine is eight (8) years. Both companies depreciate the printing machine using the straight-line method. viii. The printing machine is returned to Health Bhd at the end of the lease term and both companies' financial year ends on 31 December. REQUIRED: (Show details of working and round all numbers to the nearest RM) (a) Prepare all the journal entries for Lucky Bhd for the financial year 2021. (b) Prepare all the journal entries for Health Bhd for the financial year 2021. (c) Assume that the fair value of the printing machine on 31 December 2025 is RM42,000. Prepare all the relevant journal entries for Lucky Bhd and Health Bhd on 31 December 2025. (d) On 1 January 2022, Wealth Bhd enters into a lease agreement with Happiness Bhd to lease a digital water dispenser for 10 months. The lease payment is RM2,800 per month, payable at the end of each month. The borrowing rate for Wealth Bhd is 5% per annum. Wealth Bhd has decided that the digital water dispenser should not be recognised as a 'right-of-use asset' and the monthly amount due to Happiness Bhd should also not be recorded in the balance sheet as a 'lease liability'. Explain whether you agree OR disagree with the accounting treatment chosen by Wealth Bhd to record the digital water dispenser

QUESTION 1 On 1 January 2021, Lucky Bhd enters into a five-year non-cancellable lease agreement with Health Bhd to lease a customised printing machine. The printing machine has been assembled according to the requirements of Lucky Bhd since the year 2020. The information related to the lease agreement is stated as follows: i. The cost and market value of the printing machine on 1 January 2021 is RM800,000. ii. The annual lease payment is RM175,000 payable to Health Bhd beginning on 31 December 2021. iii. Lucky Bhd pays RM15,000 for assembling the printing machine. iv. The implicit rate which is known by both parties is 6%, while the borrowing rate for Lucky Bhd is 5%. v. Lucky Bhd guarantees a residual value of RM40,000 at the end of the lease term. vi. The estimated residual value of the printing machine at the end of the lease term is RM45,000. vii. The expected useful life of the printing machine is eight (8) years. Both companies depreciate the printing machine using the straight-line method. viii. The printing machine is returned to Health Bhd at the end of the lease term and both companies' financial year ends on 31 December. REQUIRED: (Show details of working and round all numbers to the nearest RM) (a) Prepare all the journal entries for Lucky Bhd for the financial year 2021. (b) Prepare all the journal entries for Health Bhd for the financial year 2021. (c) Assume that the fair value of the printing machine on 31 December 2025 is RM42,000. Prepare all the relevant journal entries for Lucky Bhd and Health Bhd on 31 December 2025. (d) On 1 January 2022, Wealth Bhd enters into a lease agreement with Happiness Bhd to lease a digital water dispenser for 10 months. The lease payment is RM2,800 per month, payable at the end of each month. The borrowing rate for Wealth Bhd is 5% per annum. Wealth Bhd has decided that the digital water dispenser should not be recognised as a 'right-of-use asset' and the monthly amount due to Happiness Bhd should also not be recorded in the balance sheet as a 'lease liability'. Explain whether you agree OR disagree with the accounting treatment chosen by Wealth Bhd to record the digital water dispenser Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started