Question

Question 1 On 1 October 2020, Vanguard Ltd acquired 75% of Jupiter Ltds equity shares by means of share exchange of two new shares in

Question 1

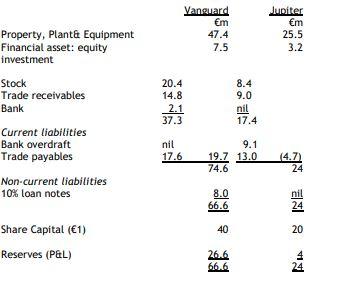

On 1 October 2020, Vanguard Ltd acquired 75% of Jupiter Ltds equity shares by means of share exchange of two new shares in Vanguard Ltd for every five acquired shares in Jupiter. In addition, Vanguard issued to the shareholders of Jupiter a 100 10% loan note for every 1,000 shares it acquired in Jupiter. Vanguard has not recorded any of the purchase consideration, although it does have other 10% loan notes already in issue. The market value of Vanguards shares at 1 October 2020 was 2 each. The summarised statements of financial position of the two companies as at 31 March 2021 are:

The following information is relevant:

1) At the date of acquisition (1 October 2020), Jupiter has a negative balance on revenue reserves of 6 million. Also at the date of acquisition, Vanguard conducted a fair value exercise on Jupiters net assets which were equal to their carrying amount (including Jupiters financial assets equity investment) with the exception of an item of plant which had a fair value of 3 million below its carrying amount. The plant had a remaining economic life of three years at 1 October 2020 and depreciation is charged on a straight-line basis

2) Each month since acquisition, Vanguard's sales to Jupiter were consistently 4.6 million. Vanguards had marked these up by 15% on cost. Jupiter had one months supply (4.6 million) of these goods in inventory at 31 March 2021. Vanguards normal mark-up (to third party customers) is 40%.

3) Jupiters trade payable balance with Vanguard at 31 March 2021 was 2.8 million, which did not agree with Vanguards equivalent trade receivable due to a payment of 900,000 made by Jupiter on 28 March 2021. It was not received by Vanguard until 3 April 2021.

4) There was no impairment loss within the group during the year ended 31 March 2021

Required:

(a) Produce the consolidated statement of financial position for Vanguard Group as at 31 March 2021 consistent with international accounting standards.

(b) Vanguard has a strategy of buying struggling businesses, reversing their decline and then selling them on at a profit within a short period of time. Vanguard is hoping to do this with Jupiter. As an adviser to a prospective purchase of Jupiter, explain any concerns you would raise about basing an investment decision on all the information available.

(c) Appraise the need for consolidated financial statements, and discuss why equity accounting was not the appropriate treatment for Jupiter in the consolidated financial statements.

Vanguard m 47.4 7.5 Jupiter m 25.5 3.2 Property, Plant& Equipment Financial asset: equity investment Stock Trade receivables Bank 20.4 14.8 2.1 37.3 8.4 9.0 nil 17.4 nit 17.6 Current liabilities Bank overdraft Trade payables Non-current liabilities 10% loan notes 9.1 19.7 13.0 74.6 (4.7) 24 8.0 66.6 nil 24 40 20 Share Capital (1) Reserves (P&L) 26.6 66.6 4 24

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started