Answered step by step

Verified Expert Solution

Question

1 Approved Answer

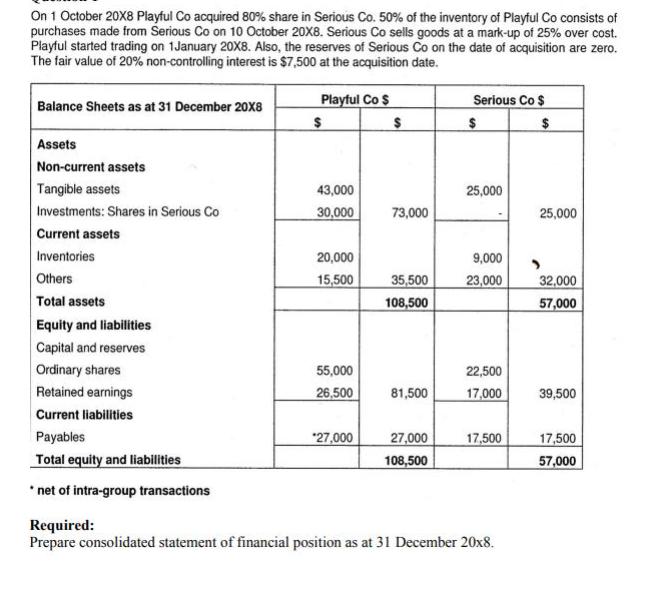

On 1 October 20X8 Playful Co acquired 80% share in Serious Co. 50% of the inventory of Playful Co consists of purchases made from

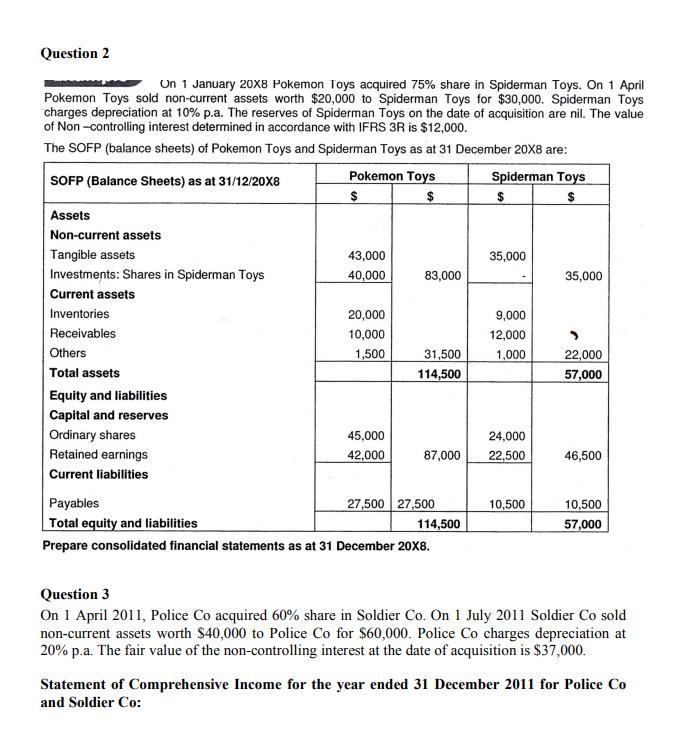

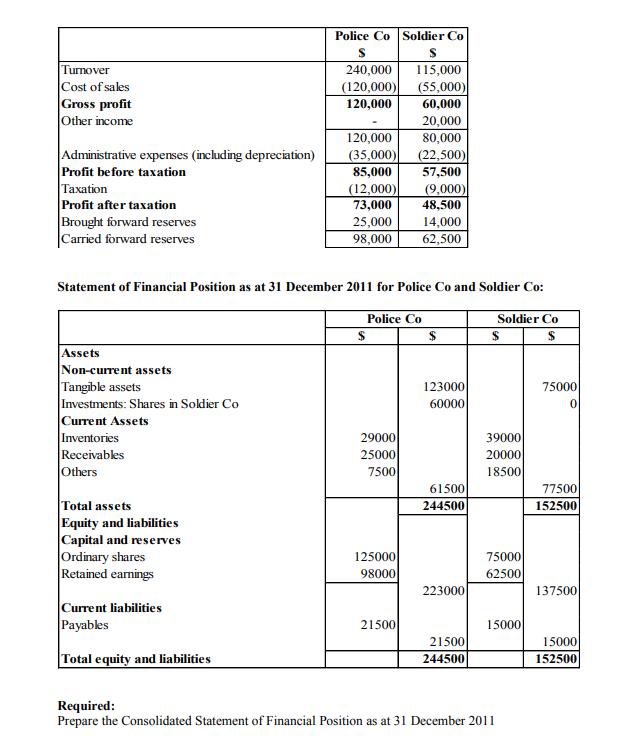

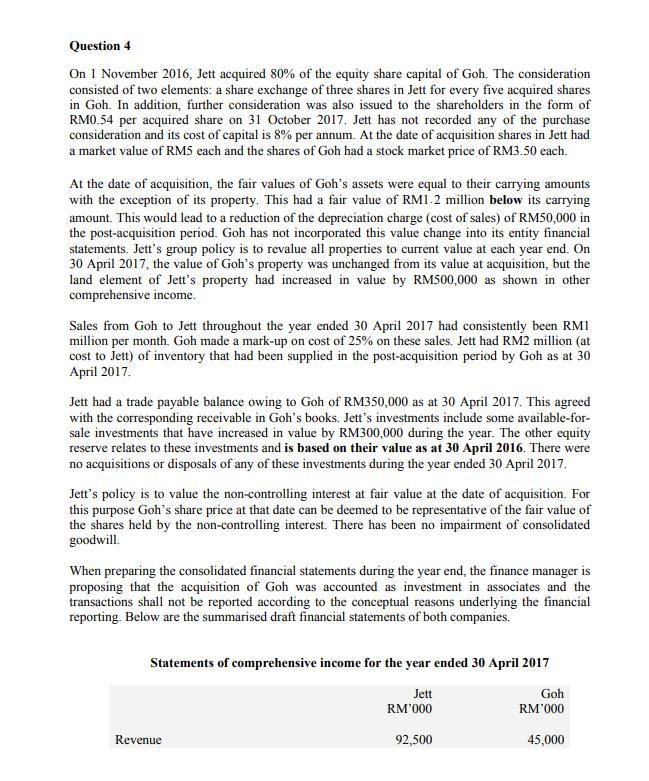

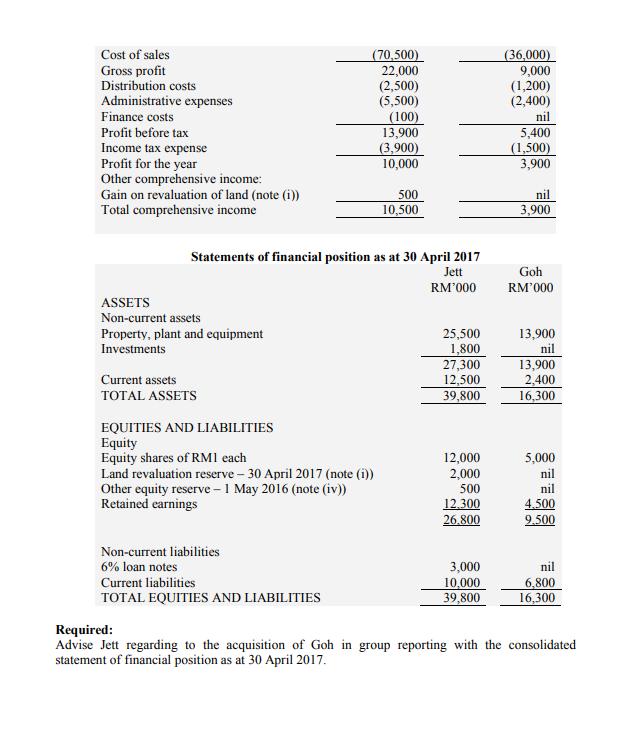

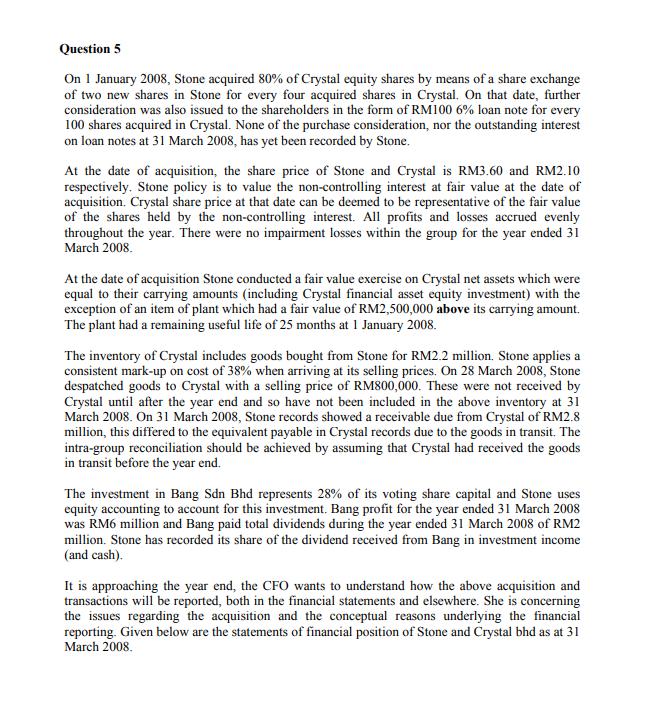

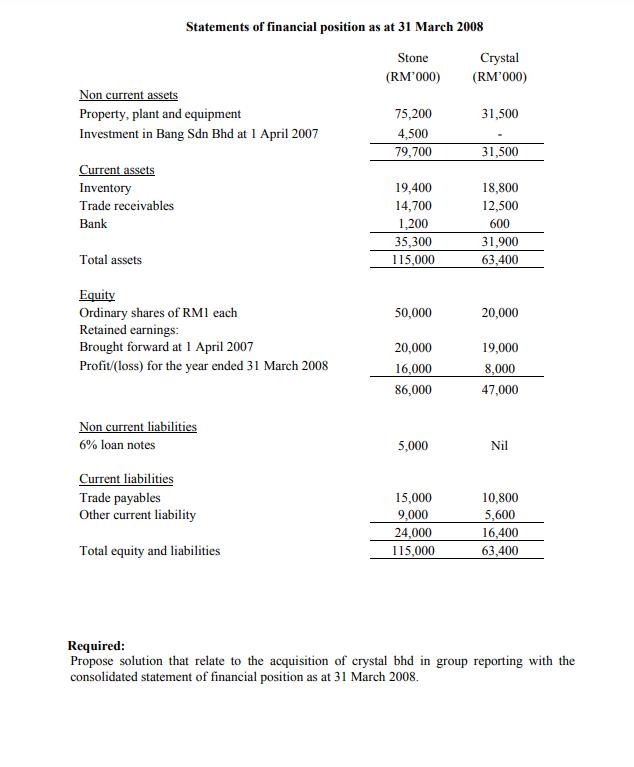

On 1 October 20X8 Playful Co acquired 80% share in Serious Co. 50% of the inventory of Playful Co consists of purchases made from Serious Co on 10 October 20X8. Serious Co sells goods at a mark-up of 25% over cost. Playful started trading on 1 January 20X8. Also, the reserves of Serious Co on the date of acquisition are zero. The fair value of 20% non-controlling interest is $7,500 at the acquisition date. Balance Sheets as at 31 December 20X8 Playful Co $ $ 43,000 30,000 Assets Non-current assets Tangible assets Investments: Shares in Serious Co Current assets Inventories Others Total assets Equity and liabilities Capital and reserves Ordinary shares Retained earnings Current liabilities Payables Total equity and liabilities *net of intra-group transactions Required: Prepare consolidated statement of financial position as at 31 December 20x8. 20,000 15,500 55,000 26,500 $ *27,000 73,000 35,500 108,500 81,500 Serious Co $ $ $ 27,000 108,500 25,000 9,000 23,000 22,500 17,000 17,500 25,000 32,000 57,000 39,500 17,500 57,000 Question 2 On 1 January 20X8 Pokemon Toys acquired 75% share in Spiderman Toys. On 1 April Pokemon Toys sold non-current assets worth $20,000 to Spiderman Toys for $30,000. Spiderman Toys charges depreciation at 10% p.a. The reserves of Spiderman Toys on the date of acquisition are nil. The value of Non-controlling interest determined in accordance with IFRS 3R is $12,000. The SOFP (balance sheets) of Pokemon Toys and Spiderman Toys as at 31 December 20X8 are: SOFP (Balance Sheets) as at 31/12/20X8 Pokemon Toys $ $ Assets Non-current assets Tangible assets Investments: Shares in Spiderman Toys Current assets Inventories Receivables Others Total assets Equity and liabilities Capital and reserves Ordinary shares Retained earnings Current liabilities 43,000 40,000 20,000 10,000 1,500 45,000 42,000 83,000 31,500 114,500 Payables Total equity and liabilities 114,500 Prepare consolidated financial statements as at 31 December 20X8. Spiderman Toys $ $ 27,500 27,500 35,000 24,000 87,000 22,500 9,000 12,000 1,000 10,500 35,000 22,000 57,000 46,500 10,500 57,000 Question 3 On 1 April 2011, Police Co acquired 60% share in Soldier Co. On 1 July 2011 Soldier Co sold non-current assets worth $40,000 to Police Co for $60,000. Police Co charges depreciation at 20% p.a. The fair value of the non-controlling interest at the date of acquisition is $37,000. Statement of Comprehensive Income for the year ended 31 December 2011 for Police Co and Soldier Co: Turnover Cost of sales Gross profit Other income Administrative expenses (including depreciation) Profit before taxation Taxation Profit after taxation Brought forward reserves Carried forward reserves Assets Non-current assets Tangible assets Investments: Shares in Soldier Co Current Assets Inventories Receivables Others Total assets Equity and liabilities Capital and reserves Ordinary shares Retained earnings Police Co Soldier Co S 240,000 (120,000) 120,000 Statement of Financial Position as at 31 December 2011 for Police Co and Soldier Co: Current liabilities Payables Total equity and liabilities 120,000 (35,000) 85,000 (12,000) (9,000) 73,000 48,500 25,000 14,000 98,000 62,500 $ S 115,000 (55,000) 60,000 20,000 Police Co 29000 25000 7500 80,000 (22,500) 57,500 125000 98000 21500 $ 123000 60000 61500 244500 223000 21500 244500 Soldier Co $ $ 39000 20000 18500 75000 62500 15000 Required: Prepare the Consolidated Statement of Financial Position as at 31 December 2011 75000 0 77500 152500 137500 15000 152500 Question 4 On 1 November 2016, Jett acquired 80% of the equity share capital of Goh. The consideration consisted of two elements: a share exchange of three shares in Jett for every five acquired shares in Goh. In addition, further consideration was also issued to the shareholders in the form of RM0.54 per acquired share on 31 October 2017. Jett has not recorded any of the purchase consideration and its cost of capital is 8% per annum. At the date of acquisition shares in Jett had a market value of RM5 each and the shares of Goh had a stock market price of RM3.50 each. At the date of acquisition, the fair values of Goh's assets were equal to their carrying amounts with the exception of its property. This had a fair value of RM1.2 million below its carrying amount. This would lead to a reduction of the depreciation charge (cost of sales) of RM50,000 in the post-acquisition period. Goh has not incorporated this value change into its entity financial statements. Jett's group policy is to revalue all properties to current value at each year end. On 30 April 2017, the value of Goh's property was unchanged from its value at acquisition, but the land element of Jett's property had increased in value by RM500,000 as shown in other comprehensive income. Sales from Goh to Jett throughout the year ended 30 April 2017 had consistently been RMI million per month. Goh made a mark-up on cost of 25% on these sales. Jett had RM2 million (at cost to Jett) of inventory that had been supplied in the post-acquisition period by Goh as at 30 April 2017. Jett had a trade payable balance owing to Goh of RM350,000 as at 30 April 2017. This agreed with the corresponding receivable in Goh's books. Jett's investments include some available-for- sale investments that have increased in value by RM300,000 during the year. The other equity reserve relates to these investments and is based on their value as at 30 April 2016. There were no acquisitions or disposals of any of these investments during the year ended 30 April 2017. Jett's policy is to value the non-controlling interest at fair value at the date of acquisition. For this purpose Goh's share price at that date can be deemed to be representative of the fair value of the shares held by the non-controlling interest. There has been no impairment of consolidated goodwill. When preparing the consolidated financial statements during the year end, the finance manager is proposing that the acquisition of Goh was accounted as investment in associates and the transactions shall not be reported according to the conceptual reasons underlying the financial reporting. Below are the summarised draft financial statements of both companies. Statements of comprehensive income for the year ended 30 April 2017 Jett RM'000 Revenue 92,500 Goh RM'000 45,000 Cost of sales Gross profit Distribution costs Administrative expenses Finance costs Profit before tax Income tax expense Profit for the year Other comprehensive income: Gain on revaluation of land (note (i)) Total comprehensive income ASSETS Non-current assets Property, plant and equipment Investments Current assets TOTAL ASSETS Statements of financial position as at 30 April 2017 Jett RM'000 EQUITIES AND LIABILITIES Equity Equity shares of RM1 each (70,500) 22,000 (2,500) (5,500) Land revaluation reserve - 30 April 2017 (note (i)) Other equity reserve- 1 May 2016 (note (iv)) Retained earnings Non-current liabilities 6% loan notes Current liabilities TOTAL EQUITIES AND LIABILITIES (100) 13,900 (3,900) 10,000 500 10,500 25,500 1,800 27,300 12,500 39,800 12,000 2,000 500 12.300 26.800 3,000 10,000 39,800 (36,000) 9,000 (1,200) (2,400) nil 5,400 (1,500) 3,900 nil 3,900 Goh RM'000 13,900 nil 13,900 2,400 16,300 5,000 nil nil 4.500 9.500 nil 6,800 16,300 Required: Advise Jett regarding to the acquisition of Goh in group reporting with the consolidated statement of financial position as at 30 April 2017. Question 5 On 1 January 2008, Stone acquired 80% of Crystal equity shares by means of a share exchange of two new shares in Stone for every four acquired shares in Crystal. On that date, further consideration was also issued to the shareholders in the form of RM100 6% loan note for every 100 shares acquired in Crystal. None of the purchase consideration, nor the outstanding interest on loan notes at 31 March 2008, has yet been recorded by Stone. At the date of acquisition, the share price of Stone and Crystal is RM3.60 and RM2.10 respectively. Stone policy is to value the non-controlling interest at fair value at the date of acquisition. Crystal share price at that date can be deemed to be representative of the fair value of the shares held by the non-controlling interest. All profits and losses accrued evenly throughout the year. There were no impairment losses within the group for the year ended 31 March 2008. At the date of acquisition Stone conducted a fair value exercise on Crystal net assets which were equal to their carrying amounts (including Crystal financial asset equity investment) with the exception of an item of plant which had a fair value of RM2,500,000 above its carrying amount. The plant had a remaining useful life of 25 months at 1 January 2008. The inventory of Crystal includes goods bought from Stone for RM2.2 million. Stone applies a consistent mark-up on cost of 38% when arriving at its selling prices. On 28 March 2008, Stone despatched goods to Crystal with a selling price of RM800,000. These were not received by Crystal until after the year end and so have not been included in the above inventory at 31 March 2008. On 31 March 2008, Stone records showed a receivable due from Crystal of RM2.8 million, this differed to the equivalent payable in Crystal records due to the goods in transit. The intra-group reconciliation should be achieved by assuming that Crystal had received the goods in transit before the year end. The investment in Bang Sdn Bhd represents 28% of its voting share capital and Stone uses equity accounting to account for this investment. Bang profit for the year ended 31 March 2008 was RM6 million and Bang paid total dividends during the year ended 31 March 2008 of RM2 million. Stone has recorded its share of the dividend received from Bang in investment income (and cash). It is approaching the year end, the CFO wants to understand how the above acquisition and transactions will be reported, both in the financial statements and elsewhere. She is concerning the issues regarding the acquisition and the conceptual reasons underlying the financial reporting. Given below are the statements of financial position of Stone and Crystal bhd as at 31 March 2008. Non current assets Property, plant and equipment Investment in Bang Sdn Bhd at 1 April 2007 Current assets Inventory Trade receivables Bank Statements of financial position as at 31 March 2008 Stone (RM'000) Total assets Equity Ordinary shares of RM1 each Retained earnings: Brought forward at 1 April 2007 Profit/(loss) for the year ended 31 March 2008 Non current liabilities 6% loan notes Current liabilities Trade payables Other current liability Total equity and liabilities 75,200 4,500 79,700 19,400 14,700 1,200 35,300 115,000 50,000 20,000 16,000 86,000 5,000 15,000 9,000 24,000 115,000 Crystal (RM'000) 31,500 31,500 18,800 12,500 600 31,900 63,400 20,000 19,000 8,000 47,000 Nil 10,800 5,600 16,400 63,400 Required: Propose solution that relate to the acquisition of crystal bhd in group reporting with the consolidated statement of financial position as at 31 March 2008.

Step by Step Solution

★★★★★

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To assist you effectively I will need to address each of the questions sequentially However youve provided multiple scenarios each requiring a detailed response Due to the complexity and depth of the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started