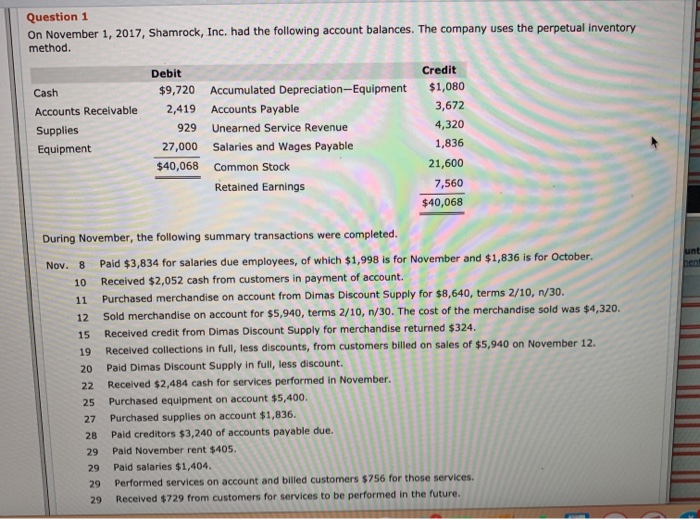

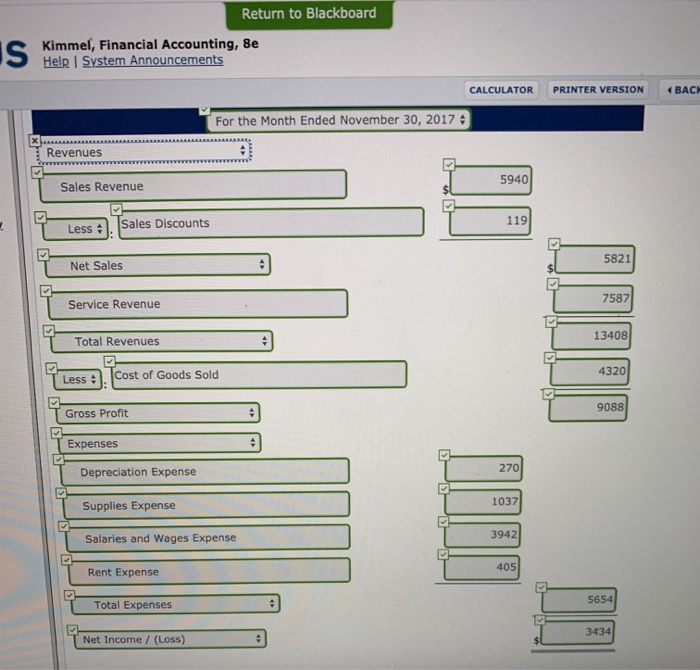

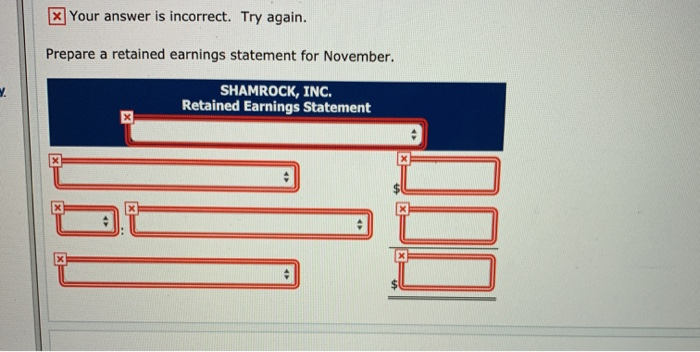

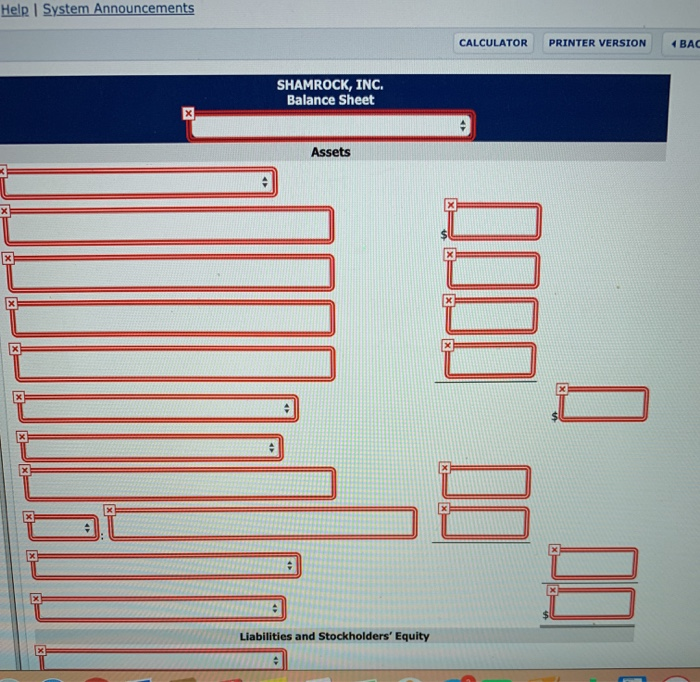

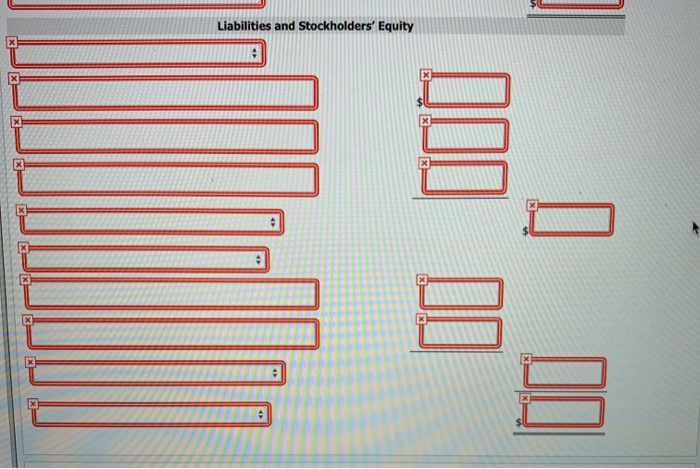

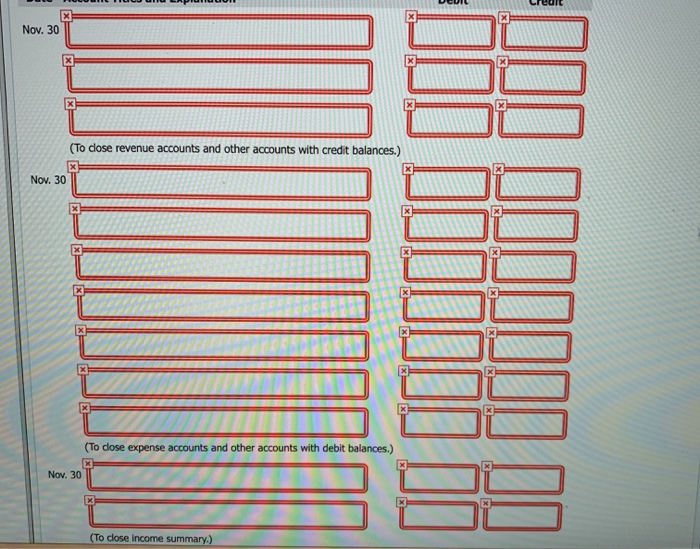

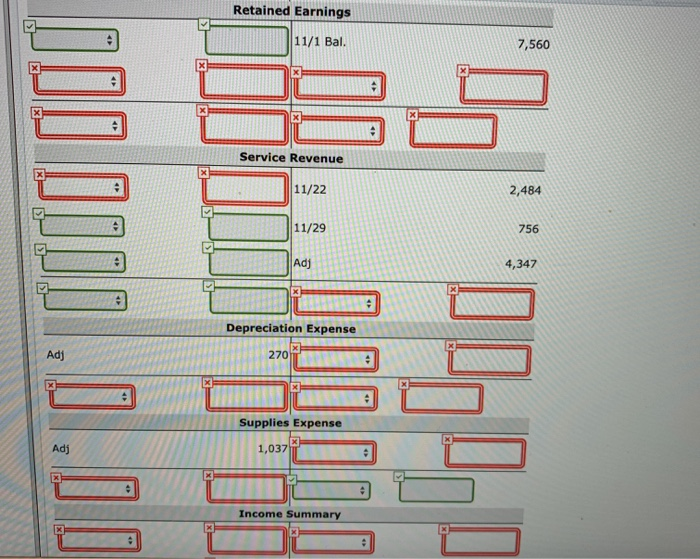

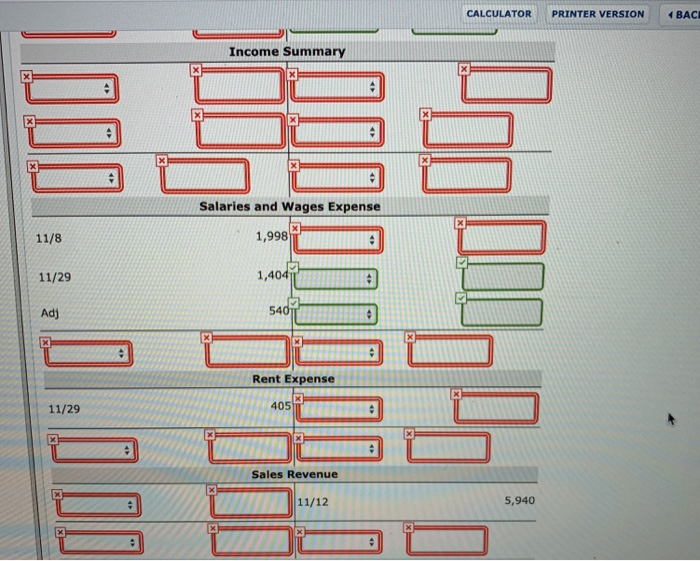

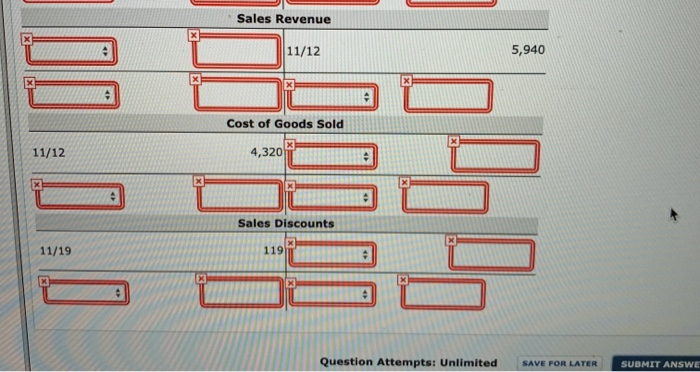

Question 1 On November 1, 2017, Shamrock, Inc. had the following account balances. The company uses the perpetual inventory method. Credit Debit $1,080 $9,720 Accumulated Depreciation-Equipment Cash 3,672 2,419 Accounts Payable Accounts Receivable 4,320 929 Unearned Service Revenue Supplies 1,836 27,000 Salaries and Wages Payable Equipment 21,600 $40,068 Common Stock 7,560 Retained Earnings $40,068 During November, the following summary transactions were completed. unt Paid $3,834 for salaries due employees, of which $1,998 is for November and $1,836 is for October. Den Nov. 8 Received $2,052 cash from customers in payment of account. 10 Purchased merchandise on account from Dimas Discount Supply for $8,640, terms 2/10, n/30. 11 Sold merchandise on account for $5,940, terms 2/10, n/30. The cost of the merchandise sold was $4,320. 12 Received credit from Dimas Discount Supply for merchandise returned $324. 15 Received collections in full, less discounts, from customers billed on sales of $5,940 on November 12. 19 Paid Dimas Discount Supply in full, less discount. 20 Received $2,484 cash for services performed in November. 22 Purchased equipment on account $5,400. 25 Purchased supplies on account $1,836. 27 Paid creditors $3,240 of accounts payable due. 28 Paid November rent $405. 29 Paid salaries $1,404. 29 Performed services on account and billed customers $756 for those services. 29 Received $729 from customers for services to be performed in the future. 29 Return to Blackboard Kimmel, Financial Accounting, 8e Help System Announcements PRINTER VERSION CALCULATOR BACK For the Month Ended November 30, 2017 Revenues 5940 Sales Revenue 119 Sales Discounts Less 5821 Net Sales 7587 Service Revenue 13408 Total Revenues 4320 Cost of Goods Sold Less 9088 Gross Profit Expenses 270 Depreciation Expense 1037 Supplies Expense 3942 Salaries and Wages Expense 405 Rent Expense 5654 Total Expenses 3434 Net Income / (Loss) XYour answer is incorrect. Try again. Prepare a retained earnings statement for November. SHAMROCK, INC. Retained Earnings Statement X Help System Announcements CALCULATOR PRINTER VERSION BAC SHAMROCK, INC. Balance Sheet Assets Liabilities and Stockholders' Equity Liabilities and Stockholders' Equity Nov. 30 (To dose revenue accounts and other accounts with credit balances.) Nov. 30 (To close expense accounts and other accounts with debit balances.) ov . 30 (To close income summary.) Retained Earnings 11/1 Bal. 7,560 Service Revenue |11/22 2,484 11/29 756 Adj 4,347 x Depreciation Expense 270 Adj Supplies Expense Adj 1,037 Income Summary BACI CALCULATOR PRINTER VERSION Income Summary e Salaries and Wages Expense 1,998 11/8 1,404j 11/29 540 Adj Rent Expense 405 11/29 Sales Revenue 5,940 11/12 4 Sales Revenue 11/12 5,940 Cost of Goods Sold 11/12 4,320 Sales Discounts 11/19 119 Question Attempts: Unlimited SAVE FOR LATER SUBMIT ANSWE x