Question

Question 1 options:1&2 On Worksheet Try This 7.4 This is a 9 year investment that spans 108 months. Sometimes you get money (positive quantities), and

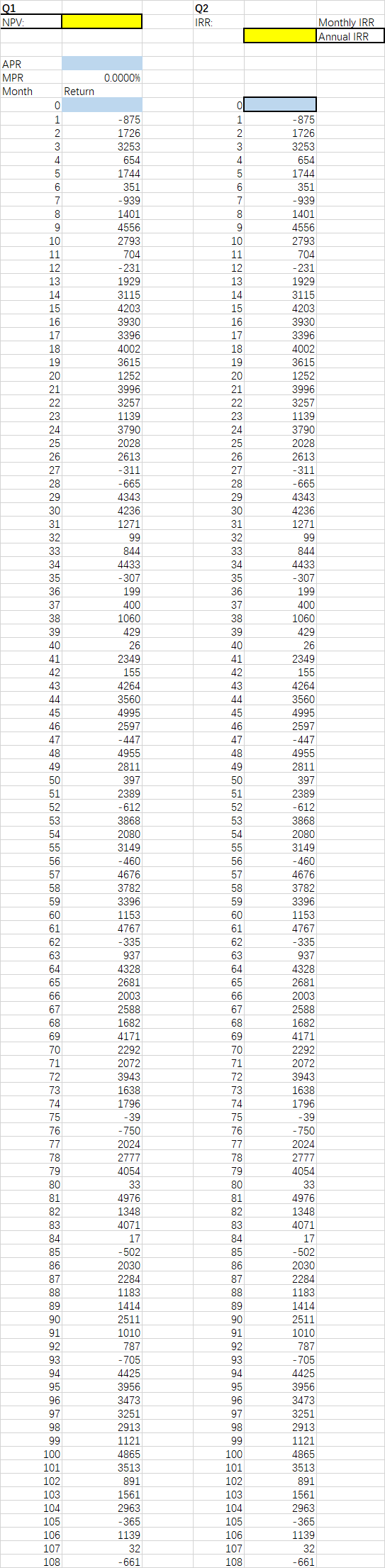

Question 1 options:1&2 On Worksheet Try This 7.4

This is a 9 year investment that spans 108 months. Sometimes you get money (positive quantities), and sometimes you must put more money into the business (negative quantities). It is a family business, so you are obligated to do so. Your initial investment is $100,000. Put -100000 into the blue cell corresponding to Month 0. Be sure to make this quantity negative as you pay it. The APR is 7%. Put this in the designated blue cell for the APR. Compute the MPR (Monthly Percent Rate) and put it in the designated cell before you begin and use it in your computation because these payments are monthly. Compute the Net Present Value of this investment. Remember not to put the initial investment (Month 0 cash flow) inside the NPV function. It belongs outside the function when you compute this. People often make this mistake on 02 and when evaluating real investments. 1 What is the Net Present Value of this investment? (TWO decimal places, NO commas, NO dollar signs ($))

options:2 Using the data to the right of where you computed the Net Present Value, put the negative of the initial investment in the blue cell. Put the amount of -100000 in that cell. Using the IRR function, first compute the Monthly Internal Rate of Return. Then multiply your result by 12 to compute the Annual Internal Rate of Return. The Annual Internal Rate of Return is: (FOUR decimal places, NO commas, NO percent signs (%)) (Four Decimal Places Example, 27.5672% is entered as 27.5672)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started