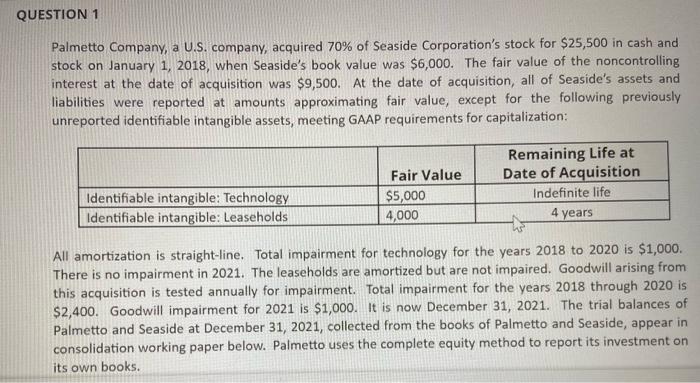

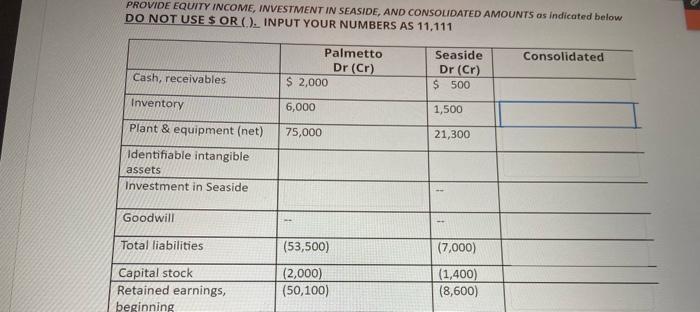

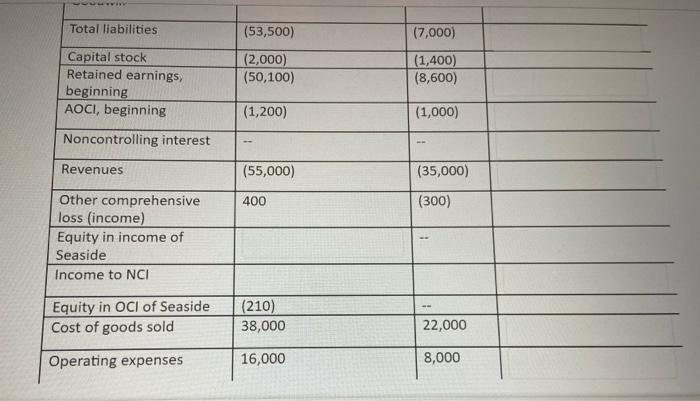

QUESTION 1 Palmetto Company, a U.S. company, acquired 70% of Seaside Corporation's stock for $25,500 in cash and stock on January 1, 2018, when Seaside's book value was $6,000. The fair value of the noncontrolling interest at the date of acquisition was $9,500. At the date of acquisition, all of Seaside's assets and liabilities were reported at amounts approximating fair value, except for the following previously unreported identifiable intangible assets, meeting GAAP requirements for capitalization: Remaining Life at Date of Acquisition Indefinite life Fair Value $5,000 4,000 Identifiable intangible: Technology Identifiable intangible: Leaseholds 4 years All amortization is straight-line. Total impairment for technology for the years 2018 to 2020 is $1,000. There is no impairment in 2021. The leaseholds are amortized but are not impaired. Goodwill arising from this acquisition is tested annually for impairment. Total impairment for the years 2018 through 2020 is $2,400. Goodwill impairment for 2021 is $1,000. It is now December 31, 2021. The trial balances of Palmetto and Seaside at December 31, 2021, collected from the books of Palmetto and Seaside, appear in consolidation working paper below. Palmetto uses the complete equity method to report its investment on its own books. PROVIDE EQUITY INCOME, INVESTMENT IN SEASIDE, AND CONSOLIDATED AMOUNTS os indicated below DO NOT USE SOR). INPUT YOUR NUMBERS AS 11,111 Consolidated Palmetto Dr (Cr) $ 2,000 Seaside Dr (Cr) $ 500 Cash, receivables Inventory 6,000 1,500 75,000 21,300 Plant & equipment (net) Identifiable intangible assets Investment in Seaside Goodwill Total liabilities (53,500) (7,000) Capital stock Retained earnings, beginning (2,000) (50,100) (1,400) (8,600) Total liabilities (53,500) Capital stock Retained earnings, beginning AOCI, beginning (2,000) (50,100) (7,000) (1,400) (8,600) (1,200) (1,000) Noncontrolling interest Revenues (55,000) (35,000) 400 (300) Other comprehensive loss (income) Equity in income of Seaside Income to NCI Equity in OCI of Seaside Cost of goods sold (210) 38,000 22,000 Operating expenses 16,000 8,000 QUESTION 1 Palmetto Company, a U.S. company, acquired 70% of Seaside Corporation's stock for $25,500 in cash and stock on January 1, 2018, when Seaside's book value was $6,000. The fair value of the noncontrolling interest at the date of acquisition was $9,500. At the date of acquisition, all of Seaside's assets and liabilities were reported at amounts approximating fair value, except for the following previously unreported identifiable intangible assets, meeting GAAP requirements for capitalization: Remaining Life at Date of Acquisition Indefinite life Fair Value $5,000 4,000 Identifiable intangible: Technology Identifiable intangible: Leaseholds 4 years All amortization is straight-line. Total impairment for technology for the years 2018 to 2020 is $1,000. There is no impairment in 2021. The leaseholds are amortized but are not impaired. Goodwill arising from this acquisition is tested annually for impairment. Total impairment for the years 2018 through 2020 is $2,400. Goodwill impairment for 2021 is $1,000. It is now December 31, 2021. The trial balances of Palmetto and Seaside at December 31, 2021, collected from the books of Palmetto and Seaside, appear in consolidation working paper below. Palmetto uses the complete equity method to report its investment on its own books. PROVIDE EQUITY INCOME, INVESTMENT IN SEASIDE, AND CONSOLIDATED AMOUNTS os indicated below DO NOT USE SOR). INPUT YOUR NUMBERS AS 11,111 Consolidated Palmetto Dr (Cr) $ 2,000 Seaside Dr (Cr) $ 500 Cash, receivables Inventory 6,000 1,500 75,000 21,300 Plant & equipment (net) Identifiable intangible assets Investment in Seaside Goodwill Total liabilities (53,500) (7,000) Capital stock Retained earnings, beginning (2,000) (50,100) (1,400) (8,600) Total liabilities (53,500) Capital stock Retained earnings, beginning AOCI, beginning (2,000) (50,100) (7,000) (1,400) (8,600) (1,200) (1,000) Noncontrolling interest Revenues (55,000) (35,000) 400 (300) Other comprehensive loss (income) Equity in income of Seaside Income to NCI Equity in OCI of Seaside Cost of goods sold (210) 38,000 22,000 Operating expenses 16,000 8,000