Answered step by step

Verified Expert Solution

Question

1 Approved Answer

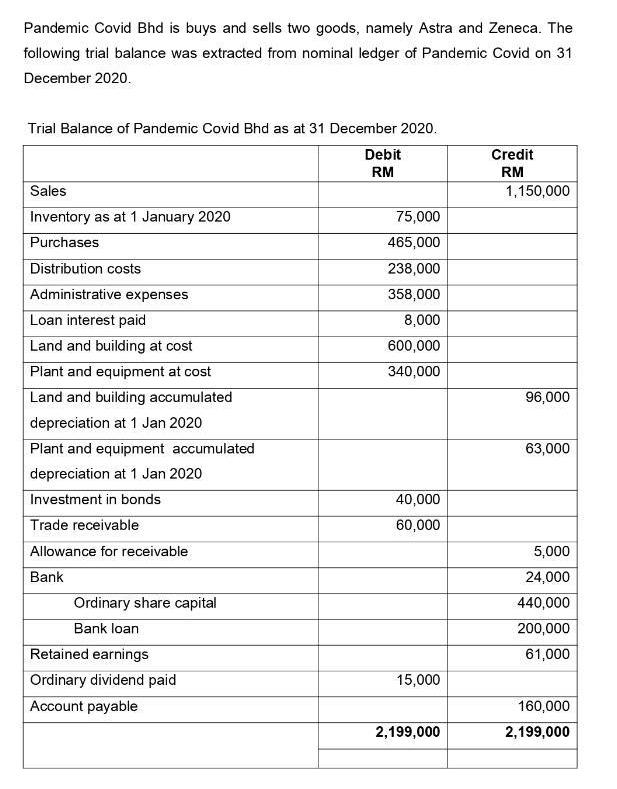

Pandemic Covid Bhd is buys and sells two goods, namely Astra and Zeneca. The following trial balance was extracted from nominal ledger of Pandemic

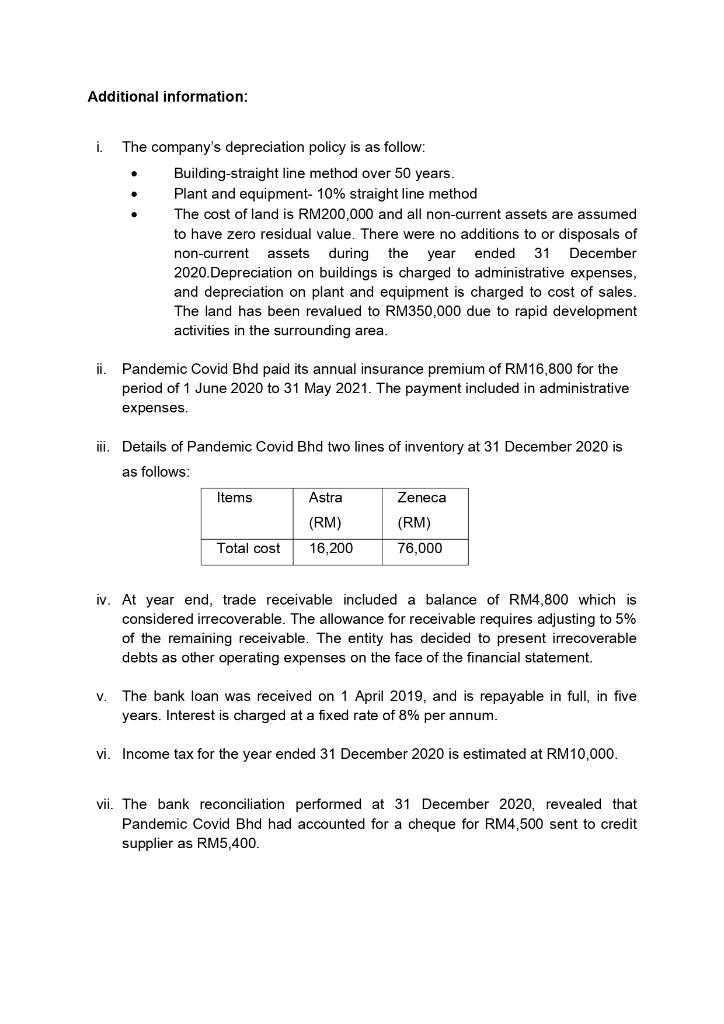

Pandemic Covid Bhd is buys and sells two goods, namely Astra and Zeneca. The following trial balance was extracted from nominal ledger of Pandemic Covid on 31 December 2020. Trial Balance of Pandemic Covid Bhd as at 31 December 2020. Debit Credit RM RM Sales 1,150,000 Inventory as at 1 January 2020 75,000 Purchases 465,000 Distribution costs 238,000 Administrative expenses 358,000 Loan interest paid 8,000 Land and building at cost 600,000 Plant and equipment at cost 340,000 Land and building accumulated 96,000 depreciation at 1 Jan 2020 Plant and equipment accumulated 63,000 depreciation at 1 Jan 2020 Investment in bonds Trade receivable Allowance for receivable 40,000 60,000 5,000 Bank 24,000 Ordinary share capital 440,000 Bank loan 200,000 Retained earnings 61,000 Ordinary dividend paid 15,000 Account payable 160,000 2,199,000 2,199,000 Additional information: i. The company's depreciation policy is as follow: Building-straight line method over 50 years. Plant and equipment- 10% straight line method The cost of land is RM200,000 and all non-current assets are assumed to have zero residual value. There were no additions to or disposals of non-current assets during the year ended 31 December 2020.Depreciation on buildings is charged to administrative expenses, and depreciation on plant and equipment is charged to cost of sales. The land has been revalued to RM350,000 due to rapid development activities in the surrounding area. ii. Pandemic Covid Bhd paid its annual insurance premium of RM16,800 for the period of 1 June 2020 to 31 May 2021. The payment included in administrative expenses. iIi. Details of Pandemic Covid Bhd two lines of inventory at 31 December 2020 is as follows: Items Astra Zeneca (RM) (RM) Total cost 16,200 76,000 iv. At year end, trade receivable included a balance of RM4,800 which is considered irrecoverable. The allowance for receivable requires adjusting to 5% of the remaining receivable. The entity has decided to present irrecoverable debts as other operating expenses on the face of the financial statement. V. The bank loan was received on 1 April 2019, and is repayable in full, in five years. Interest is charged at a fixed rate of 8% per annum. vi. Income tax for the year ended 31 December 2020 is estimated at RM10,000. vii. The bank reconciliation performed at 31 December 2020, revealed that Pandemic Covid Bhd had accounted for a cheque for RM4,500 sent to credit supplier as RM5,400.

Step by Step Solution

★★★★★

3.45 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started