Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 1 Papa Kojo is a self-employed who paid all his taxes raised on him by the Ghana Revenue Authority without submitting any accounts. Adongo

QUESTION 1

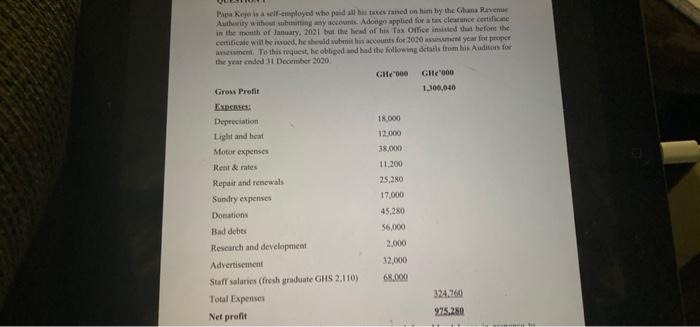

Papa Kojo is a self-employed who paid all his taxes raised on him by the Ghana Revenue Authority without submitting any accounts. Adongo applied for a tax clearance certificate in the month of January, 2021 but the head of his Tax Office insisted that before the certificate will be issued, he should submit his accounts for 2020 assessment year for proper assessment. To this request, he obliged and had the following details from his Auditors for the year ended 31 December 2020.

Gross Profit Expenses: Depreciation

Light and heat Motor expenses Rent & rates

Repair and renewals Sundry expenses Donations

Bad debts

Research and development

Advertisement

Staff salaries (fresh graduate GHS 2,110)

Total Expenses

Net profit

GH000 GH000 1,300,040

18,000 12,000 38,000 11,200 25,280 17,000 45,280 56,000

2,000 32,000 68,000

324,760

975,280

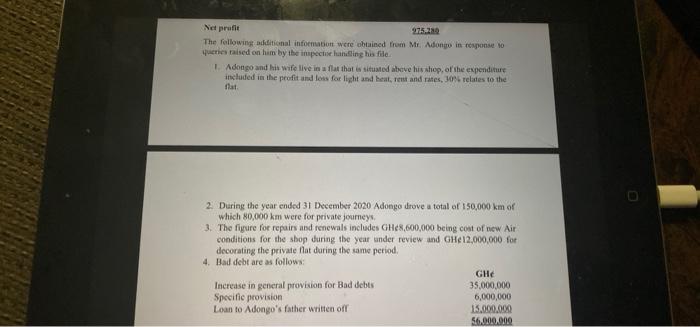

The following additional information were obtained from Mr. Adongo in response to

queries raised on him by the inspector handling his file.

1. Adongo and his wife live in a flat that is situated above his shop, of the expenditure included in the profit and loss for light and heat, rent and rates, 30% relates to the flat.

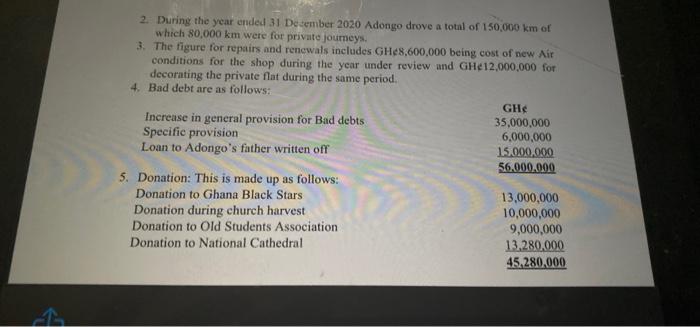

2. During the year ended 31 December 2020 Adongo drove a total of 150,000 km of which 80,000 km were for private journeys.

3. The figure for repairs and renewals includes GH8,600,000 being cost of new Air conditions for the shop during the year under review and GH12,000,000 for decorating the private flat during the same period.

4. Bad debt are as follows:

Increase in general provision for Bad debts Specific provision

Loan to Adongos father written off

5. Donation: This is made up as follows: Donation to Ghana Black Stars Donation during church harvest Donation to Old Students Association Donation to National Cathedral

GH

35,000,000 6,000,000 15,000,000 56,000,000

13,000,000 10,000,000 9,000,000 13,280,000 45,280,000

6. Research and development: Included in this expenditure is an amount of GH 900,000 was spent on acquiring equipment for the purpose of the business.

7. Staff salaries: The total workforce. of Mr. Adongo is made up of twenty- five (25) existing employees and five (5) employees who are fresh graduates from a tertiary institution.

8. Advertisement: this is made-up as follows:

Permanent Neon Sign Newspaper advertisement Tax

GH

12,000,000 8,000,000 12,000,000 32,000,000

9. During the year under review, Mr. Adongo took goods out of his shop for his personal use without paying for them. The cost of these goods was GH20,560,000 which was recorded in the books and they had a selling price of GH30,500,000.

10.Adongo received dividend of GH45,800,000 (net) from his investment with Consolidated Bank of Ghana. The amount was included in arriving at his Gross Profit.

11. Capital allowance agreed amounted to GH202,740

Required:

a. Calculate the chargeable income of Papa Kojo for the assessment year 31 December 2020.

b. Assuming he has no other source of income, compute his tax liability for 2020 year assessment.

2020 ANNUAL INCOME TAX RATES APPLICABLE TO RESIDENT INDIVIDUALS

CHARGEABLE INCOME

RATE

TAX

CUMULATIVE CHARGEABLE INCOME

CUMULATIVE TAX

GH

%

GH

GH

GH

First 3,828

Nil

3,828

Next 1,200

5

60

5,028

60

Next 1,440

10

144

6,468

204

Next 36,000

17.5

6,300

42,468

6,504

Next 197,532

25

49,383

240,000

55,887

Exceeding 240,000

30

.

Papa Roje is a self-employed who paid all hi testised on him by the Ghana Rene Authority with big ny accounts. Adongo applied for a tax clearance orifice in the month of January, 2021 from the head of the Tax Office inside that before the certificate will be dhe shedsmithis accounts for 2000 year for proper ant To this request, he obligedd had the following details from his Andes for the year anded 31 December 2000 GRE000 GH000 Gross Profit 1.300.000 Expert Depreciation 18.000 Light and heat 12.000 Motor expenses 38.000 Rent & rates 11.200 Repair and renewals 25.280 Sundry expenses 17.000 Donations 45.280 Bad debts 56,000 Research and development 2,000 Advertisement 32.000 Staff salaries (fresh graduate GHS 2.110) Total Expenses 324,260 Net profit 975.280 Net profile 975.21 The following additional information were obtained from Mr. Adongo in response 10 Queries raised on him by the inspecte handling his file Adongo and his wife live in a flat that is situated above his shop, of the expenditure included in the profit and loss for light and heat, rent and rates, 30 relates to the at 2. During the year ended 31 December 2020 Adongo drove a total of 150,000 km of which 80,000 km were for private journeys 3. The figure for repairs and renewals includes GH48,600,000 being cost of new Air conditions for the shop during the year under review and GHe 12,000,000 for decorating the private flat during the same period 4. Bad debt are as follows: GH Increase in general provision for Bad debts 35,000,000 Specific provision 6,000,000 Loan to Adongo's father written off 15.000.000 56.000.000 2. During the year ended 31 December 2020 Adongo drove a total of 150.000 km of which 80.000 km were for private joumeys. 3. The figure for repairs and renewals includes GH48,600,000 being cost of new Air conditions for the shop during the year under review and GH12,000,000 for decorating the private flat during the same period. 4. Bad debt are as follows: GH Increase in general provision for Bad debts 35,000,000 Specific provision 6,000,000 Loan to Adongo's father written off 15.000.000 56,000,000 5. Donation: This is made up as follows: Donation to Ghana Black Stars 13,000,000 Donation during church harvest 10,000,000 Donation to Old Students Association 9,000,000 Donation to National Cathedral 13,280,000 45,280,000 Papa Roje is a self-employed who paid all hi testised on him by the Ghana Rene Authority with big ny accounts. Adongo applied for a tax clearance orifice in the month of January, 2021 from the head of the Tax Office inside that before the certificate will be dhe shedsmithis accounts for 2000 year for proper ant To this request, he obligedd had the following details from his Andes for the year anded 31 December 2000 GRE000 GH000 Gross Profit 1.300.000 Expert Depreciation 18.000 Light and heat 12.000 Motor expenses 38.000 Rent & rates 11.200 Repair and renewals 25.280 Sundry expenses 17.000 Donations 45.280 Bad debts 56,000 Research and development 2,000 Advertisement 32.000 Staff salaries (fresh graduate GHS 2.110) Total Expenses 324,260 Net profit 975.280 Net profile 975.21 The following additional information were obtained from Mr. Adongo in response 10 Queries raised on him by the inspecte handling his file Adongo and his wife live in a flat that is situated above his shop, of the expenditure included in the profit and loss for light and heat, rent and rates, 30 relates to the at 2. During the year ended 31 December 2020 Adongo drove a total of 150,000 km of which 80,000 km were for private journeys 3. The figure for repairs and renewals includes GH48,600,000 being cost of new Air conditions for the shop during the year under review and GHe 12,000,000 for decorating the private flat during the same period 4. Bad debt are as follows: GH Increase in general provision for Bad debts 35,000,000 Specific provision 6,000,000 Loan to Adongo's father written off 15.000.000 56.000.000 2. During the year ended 31 December 2020 Adongo drove a total of 150.000 km of which 80.000 km were for private joumeys. 3. The figure for repairs and renewals includes GH48,600,000 being cost of new Air conditions for the shop during the year under review and GH12,000,000 for decorating the private flat during the same period. 4. Bad debt are as follows: GH Increase in general provision for Bad debts 35,000,000 Specific provision 6,000,000 Loan to Adongo's father written off 15.000.000 56,000,000 5. Donation: This is made up as follows: Donation to Ghana Black Stars 13,000,000 Donation during church harvest 10,000,000 Donation to Old Students Association 9,000,000 Donation to National Cathedral 13,280,000 45,280,000 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started