Question 1

PART A

As part of your analysis, you are required to investigate Virtuoso Corporations cash flows. Required: Using the financial statements provided

(a) Calculate the following for 2021:

- Operating Cash Flow

- Net Capital Spending

- Change in Net Working Capital

- Cash Flow from Assets

- Cash Flow to Creditors

- Cash Flow to Stockholders

(b) Analyse the companys sources and uses of cash for the year 2021 by preparing Virtuoso Corporation Cash Flow Statement for the year ended June 30, 2021.

PART B

To further analyse Virtuosos cash flow position, the Finance Manager is seeking to determine if the company can comfortably meet any upcoming obligations.

Required: Compute the following liquidity ratios for 2020 and 2021:

- Current ratio

- Quick ratio

- Cash ratio

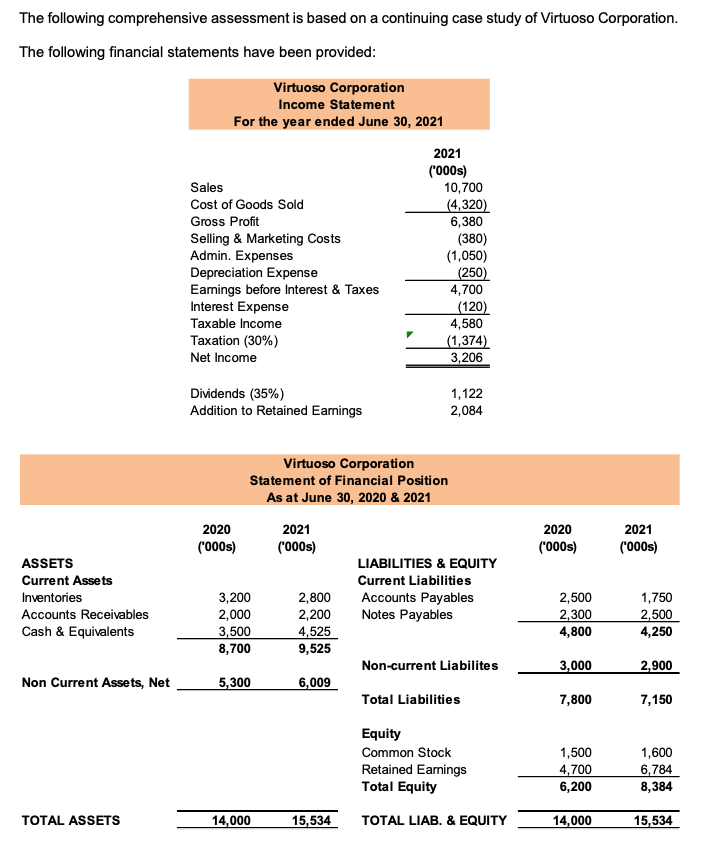

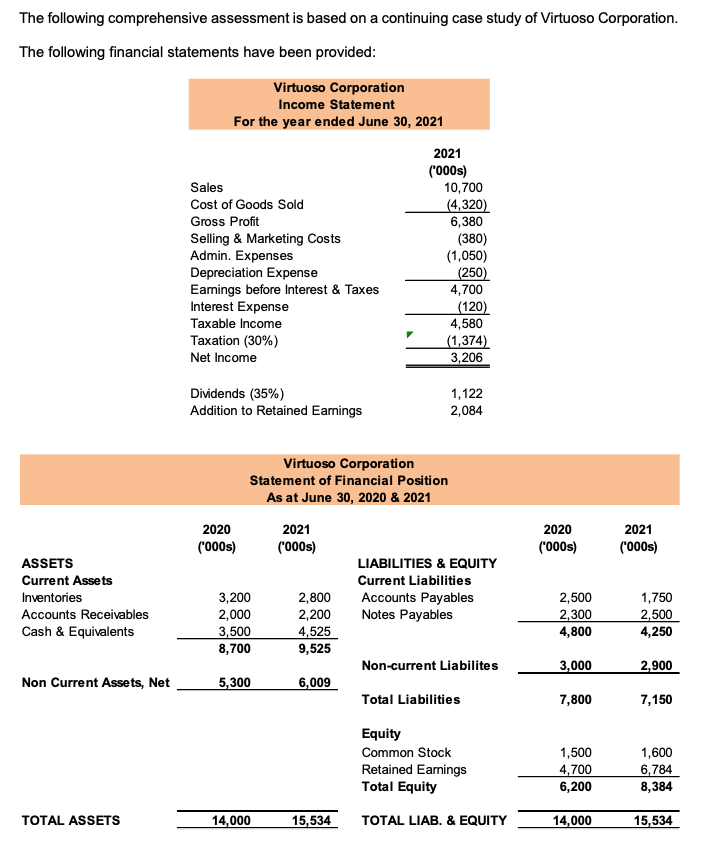

The following comprehensive assessment is based on a continuing case study of Virtuoso Corporation. The following financial statements have been provided: Virtuoso Corporation Income Statement For the year ended June 30, 2021 2021 Sales Cost of Goods Sold Gross Profit Selling & Marketing Costs Admin. Expenses Depreciation Expense Earnings before Interest & Taxes Interest Expense Taxable income Taxation (30%) Net Income (000s) 10,700 (4,320) 6,380 (380) (1,050) (250) 4,700 (120) 4,580 (1,374) 3,206 Dividends (35%) Addition to Retained Earnings 1,122 2,084 Virtuoso Corporation Statement of Financial Position As at June 30, 2020 & 2021 2020 2021 ('000s) 2020 ('000s) 2021 ('000s) ('000s) ASSETS Current Assets Inventories Accounts Receivables Cash & Equivalents LIABILITIES & EQUITY Current Liabilities Accounts Payables Notes Payables 3,200 2,000 3,500 8,700 2,800 2,200 4,525 9,525 2,500 2,300 4,800 1,750 2,500 4,250 Non-current Liabilites 3,000 2,900 Non Current Assets, Net 5,300 6,009 Total Liabilities 7,800 7,150 Equity Common Stock Retained Earnings Total Equity 1,500 4,700 6,200 1,600 6,784 8,384 TOTAL ASSETS 14,000 15,534 TOTAL LIAB. & EQUITY 14,000 15,534 The following comprehensive assessment is based on a continuing case study of Virtuoso Corporation. The following financial statements have been provided: Virtuoso Corporation Income Statement For the year ended June 30, 2021 2021 Sales Cost of Goods Sold Gross Profit Selling & Marketing Costs Admin. Expenses Depreciation Expense Earnings before Interest & Taxes Interest Expense Taxable income Taxation (30%) Net Income (000s) 10,700 (4,320) 6,380 (380) (1,050) (250) 4,700 (120) 4,580 (1,374) 3,206 Dividends (35%) Addition to Retained Earnings 1,122 2,084 Virtuoso Corporation Statement of Financial Position As at June 30, 2020 & 2021 2020 2021 ('000s) 2020 ('000s) 2021 ('000s) ('000s) ASSETS Current Assets Inventories Accounts Receivables Cash & Equivalents LIABILITIES & EQUITY Current Liabilities Accounts Payables Notes Payables 3,200 2,000 3,500 8,700 2,800 2,200 4,525 9,525 2,500 2,300 4,800 1,750 2,500 4,250 Non-current Liabilites 3,000 2,900 Non Current Assets, Net 5,300 6,009 Total Liabilities 7,800 7,150 Equity Common Stock Retained Earnings Total Equity 1,500 4,700 6,200 1,600 6,784 8,384 TOTAL ASSETS 14,000 15,534 TOTAL LIAB. & EQUITY 14,000 15,534