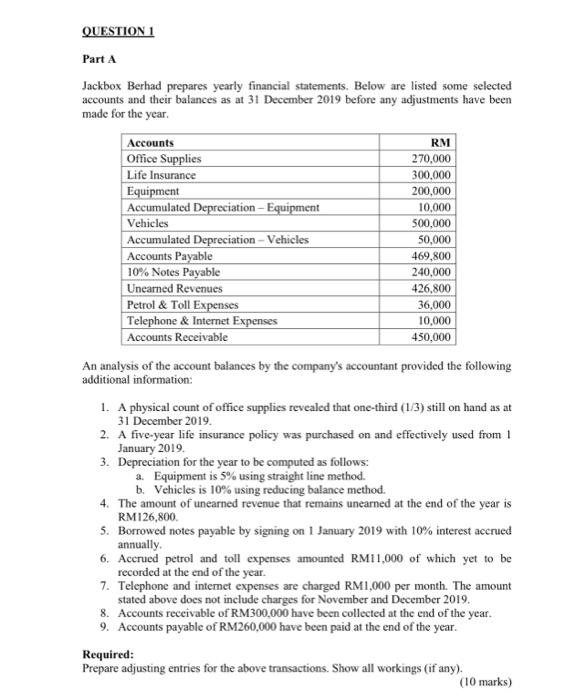

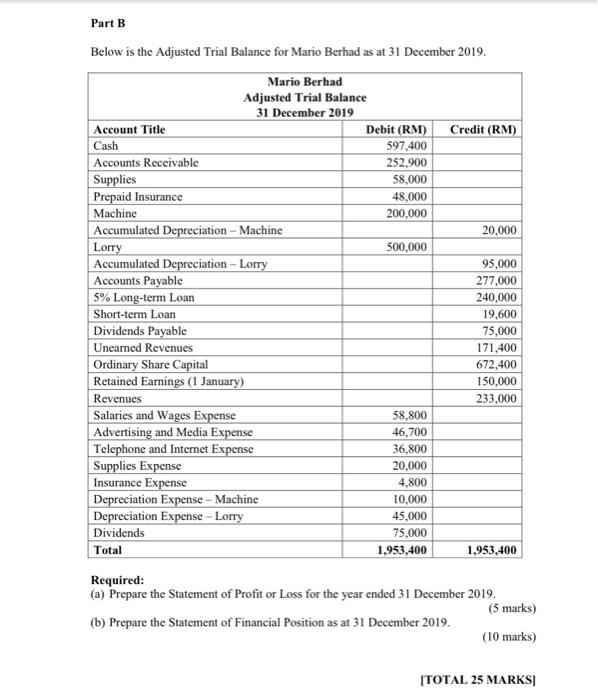

QUESTION 1 Part A Jackbox Berhad prepares yearly financial statements. Below are listed some selected accounts and their balances as at 31 December 2019 before any adjustments have been made for the year Accounts RM Office Supplies 270,000 Life Insurance 300.000 Equipment 200,000 Accumulated Depreciation - Equipment 10,000 Vehicles 500,000 Accumulated Depreciation - Vehicles 50,000 Accounts Payable 469,800 10% Notes Payable 240,000 Unearned Revenues 426,800 Petrol & Toll Expenses 36,000 Telephone & Internet Expenses 10,000 Accounts Receivable 450,000 An analysis of the account balances by the company's accountant provided the following additional information: 1. A physical count of office supplies revealed that one-third (1/3) still on hand as at 31 December 2019. 2. A five-year life insurance policy was purchased on and effectively used from 1 January 2019, 3. Depreciation for the year to be computed as follows: a. Equipment is 5% using straight line method. b. Vehicles is 10% using reducing balance method. 4. The amount of unearned revenue that remains unearned at the end of the year is RM126,800 5. Borrowed notes payable by signing on 1 January 2019 with 10% interest accrued annually. 6. Accrued petrol and toll expenses amounted RM11,000 of which yet to be recorded at the end of the year. 7. Telephone and internet expenses are charged RM 1,000 per month. The amount stated above does not include charges for November and December 2019. 8. Accounts receivable of RM300,000 have been collected at the end of the year. 9. Accounts payable of RM260,000 have been paid at the end of the year. Required: Prepare adjusting entries for the above transactions. Show all workings (if any). (10 marks) Part B Below is the Adjusted Trial Balance for Mario Berhad as at 31 December 2019. Mario Berhad Adjusted Trial Balance 31 December 2019 Account Title Debit (RM) Credit (RM) Cash 597,400 Accounts Receivable 252,900 Supplies 58,000 Prepaid Insurance 48,000 Machine 200,000 Accumulated Depreciation - Machine 20,000 Lorry 500,000 Accumulated Depreciation - Lorry 95,000 Accounts Payable 277,000 5% Long-term Loan 240,000 Short-term Loan 19,600 Dividends Payable 75,000 Unearned Revenues 171,400 Ordinary Share Capital 672,400 Retained Earnings (1 January) 150,000 Revenues 233,000 Salaries and Wages Expense 58,800 Advertising and Media Expense 46,700 Telephone and Internet Expense 36,800 Supplies Expense 20,000 Insurance Expense 4.800 Depreciation Expense - Machine 10,000 Depreciation Expense - Lorry 45,000 Dividends 75,000 Total 1,953,400 1,953,400 Required: (a) Prepare the Statement of Profit or Loss for the year ended 31 December 2019. (5 marks) (b) Prepare the Statement of Financial Position as at 31 December 2019. (10 marks) TOTAL 25 MARKS