Velson Limited produces three main products using the same production methods and equipment for each. At present, Velson uses a traditional product costing system,

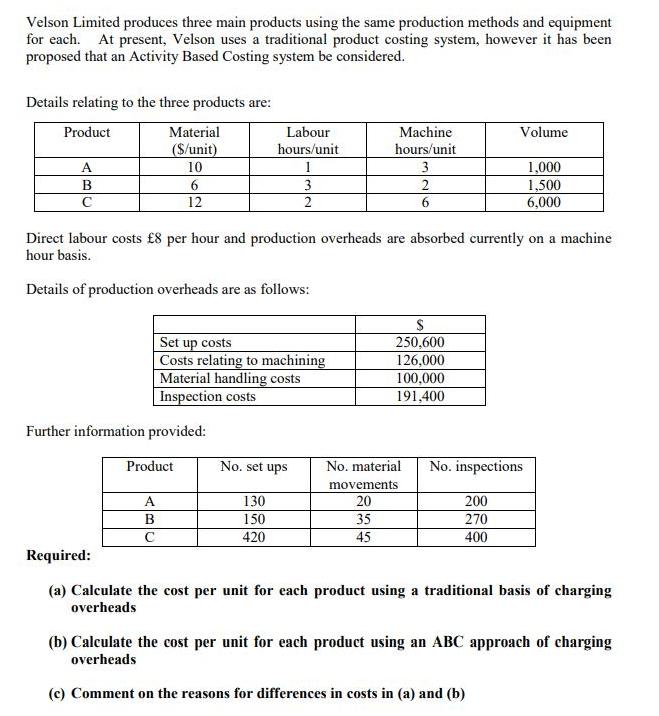

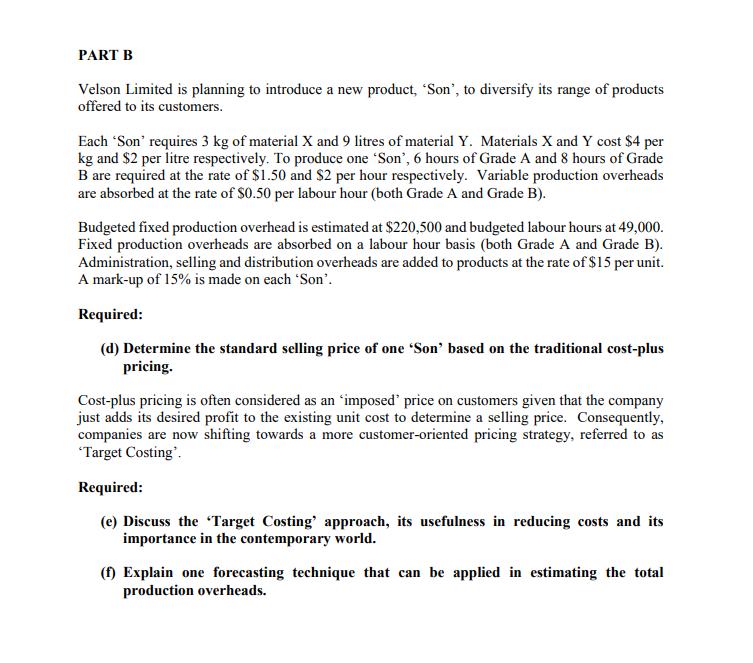

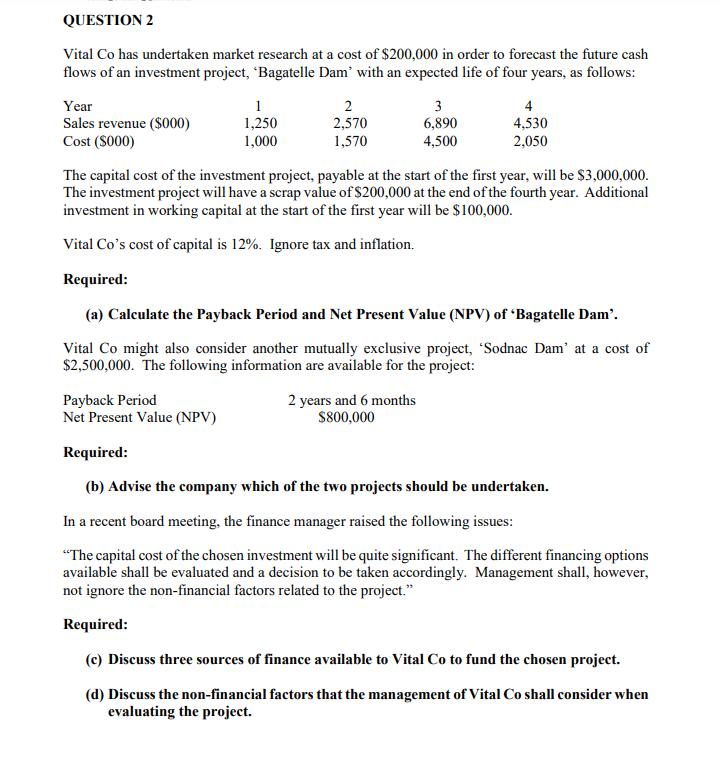

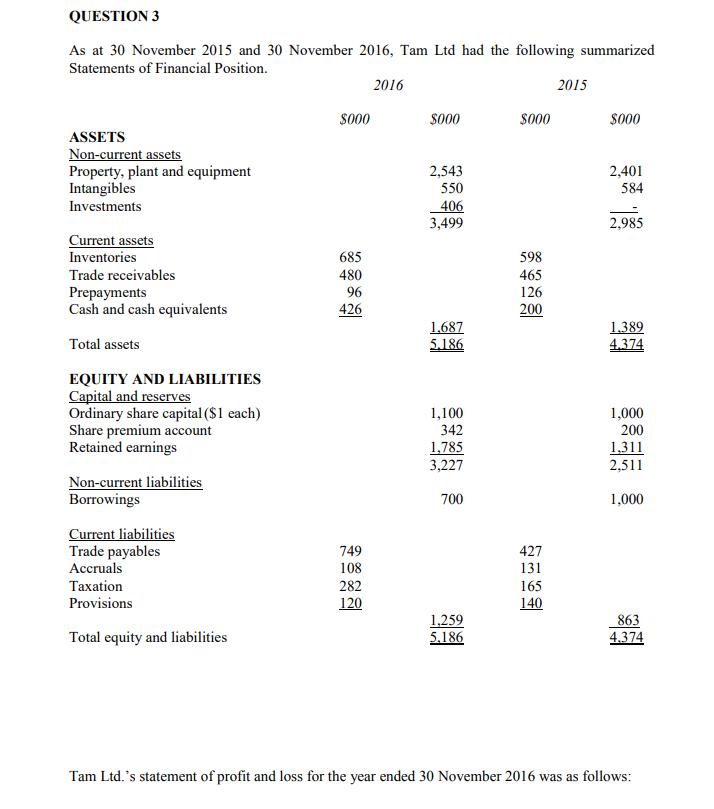

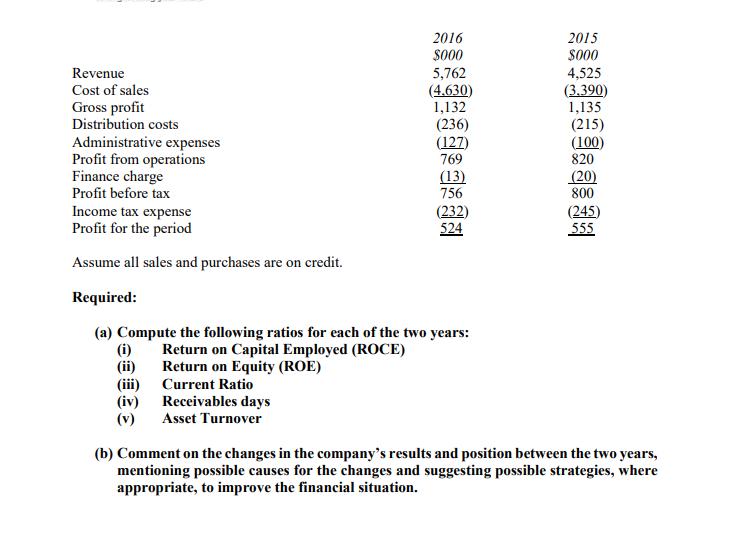

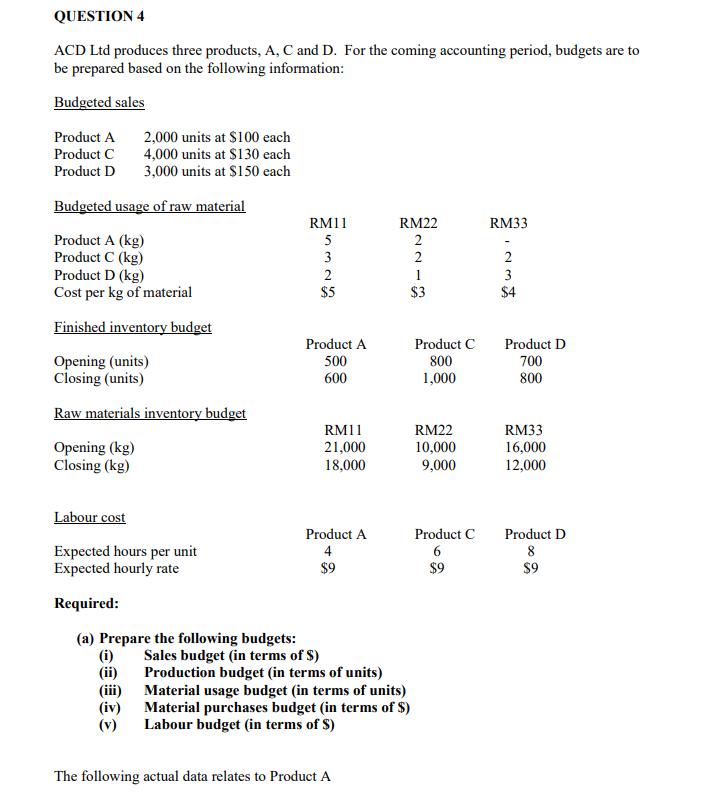

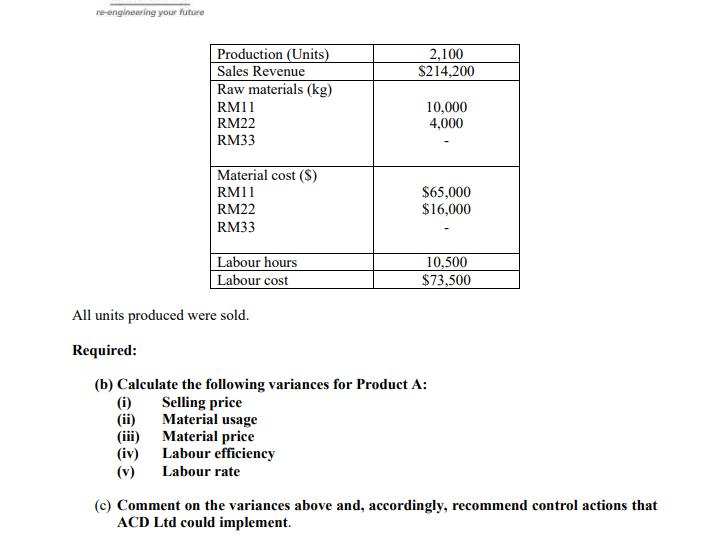

Velson Limited produces three main products using the same production methods and equipment for each. At present, Velson uses a traditional product costing system, however it has been proposed that an Activity Based Costing system be considered. Details relating to the three products are: Product A B Material ($/unit) 10 6 12 A B C Further information provided: Product Labour hours/unit Set up costs Costs relating to machining Material handling costs Inspection costs Direct labour costs 8 per hour and production overheads are absorbed currently on a machine hour basis. Details of production overheads are as follows: 1 3 2 No. set ups 130 150 420 Machine hours/unit 35 45 3. 2 6 No. material movements 20 $ 250,600 126,000 100,000 191,400 Volume No. inspections 200 270 400 1,000 1,500 6,000 Required: (a) Calculate the cost per unit for each product using a traditional basis of charging overheads (b) Calculate the cost per unit for each product using an ABC approach of charging overheads (c) Comment on the reasons for differences in costs in (a) and (b) PART B Velson Limited is planning to introduce a new product, "Son', to diversify its range of products offered to its customers. Each 'Son' requires 3 kg of material X and 9 litres of material Y. Materials X and Y cost $4 per kg and $2 per litre respectively. To produce one 'Son', 6 hours of Grade A and 8 hours of Grade B are required at the rate of $1.50 and $2 per hour respectively. Variable production overheads are absorbed at the rate of $0.50 per labour hour (both Grade A and Grade B). Budgeted fixed production overhead is estimated at $220,500 and budgeted labour hours at 49,000. Fixed production overheads are absorbed on a labour hour basis (both Grade A and Grade B). Administration, selling and distribution overheads are added to products at the rate of $15 per unit. A mark-up of 15% is made on each 'Son'. Required: (d) Determine the standard selling price of one 'Son' based on the traditional cost-plus pricing. Cost-plus pricing is often considered as an 'imposed' price on customers given that the company just adds its desired profit to the existing unit cost to determine a selling price. Consequently, companies are now shifting towards a more customer-oriented pricing strategy, referred to as 'Target Costing'. Required: (e) Discuss the 'Target Costing' approach, its usefulness in reducing costs and its importance in the contemporary world. (f) Explain one forecasting technique that can be applied in estimating the total production overheads. QUESTION 2 Vital Co has undertaken market research at a cost of $200,000 in order to forecast the future cash flows of an investment project, "Bagatelle Dam' with an expected life of four years, as follows: Year Sales revenue ($000) Cost ($000) 1 1,250 1,000 2 2,570 1,570 Payback Period Net Present Value (NPV) 3 6,890 4,500 The capital cost of the investment project, payable at the start of the first year, will be $3,000,000. The investment project will have a scrap value of $200,000 at the end of the fourth year. Additional investment in working capital at the start of the first year will be $100,000. Vital Co's cost of capital is 12%. Ignore tax and inflation. 4 4,530 2,050 Required: (a) Calculate the Payback Period and Net Present Value (NPV) of 'Bagatelle Dam'. Vital Co might also consider another mutually exclusive project, 'Sodnac Dam' at a cost of $2,500,000. The following information are available for the project: 2 years and 6 months $800,000 Required: (b) Advise the company which of the two projects should be undertaken. In a recent board meeting, the finance manager raised the following issues: "The capital cost of the chosen investment will be quite significant. The different financing options available shall be evaluated and a decision to be taken accordingly. Management shall, however, not ignore the non-financial factors related to the project." Required: (c) Discuss three sources of finance available to Vital Co to fund the chosen project. (d) Discuss the non-financial factors that the management of Vital Co shall consider when evaluating the project. QUESTION 3 As at 30 November 2015 and 30 November 2016, Tam Ltd had the following summarized Statements of Financial Position. ASSETS Non-current assets Property, plant and equipment Intangibles Investments Current assets Inventories Trade receivables Prepayments Cash and cash equivalents Total assets EQUITY AND LIABILITIES Capital and reserves Ordinary share capital ($1 each) Share premium account Retained earnings Non-current liabilities Borrowings Current liabilities Trade payables Accruals Taxation Provisions Total equity and liabilities $000 685 480 96 426 749 108 282 120 2016 $000 2,543 550 406 3,499 1,687 5.186 1,100 342 1,785 3,227 700 1,259 5,186 $000 598 465 126 200 427 131 165 140 2015 $000 2,401 584 2,985 1.389 4.374 1,000 200 1,311 2,511 1,000 863 4.374 Tam Ltd.'s statement of profit and loss for the year ended 30 November 2016 was as follows: Revenue Cost of sales Gross profit Distribution costs Administrative expenses Profit from operations Finance charge Profit before tax (i) (ii) 2016 $000 5,762 (4.630) 1,132 (236) (127) 769 (iv) (v) (13) 756 Income tax expense Profit for the period Assume all sales and purchases are on credit. Required: (a) Compute the following ratios for each of the two years: Return on Capital Employed (ROCE) Return on Equity (ROE) Current Ratio Receivables days Asset Turnover (232) 524 2015 $000 4,525 (3.390) 1,135 (215) (100) 820 (20) 800 (245) 555 (b) Comment on the changes in the company's results and position between the two years, mentioning possible causes for the changes and suggesting possible strategies, where appropriate, to improve the financial situation. QUESTION 4 ACD Ltd produces three products, A, C and D. For the coming accounting period, budgets are to be prepared based on the following information: Budgeted sales Product A Product C 2,000 units at $100 each 4,000 units at $130 each Product D 3,000 units at $150 each Budgeted usage of raw material Product A (kg) Product C (kg) Product D (kg) Cost per kg of material Finished inventory budget Opening (units) Closing (units) Raw materials inventory budget Opening (kg) Closing (kg) Labour cost Expected hours per unit Expected hourly rate Required: (a) Prepare the following budgets: (i) (iii) (iv) (v) RM11 5 3 2 $5 Product A 500 600 RM11 21,000 18,000 Product A 4 $9 Sales budget (in terms of $) Production budget (in terms of units) RM22 Material usage budget (in terms of units) Material purchases budget (in terms of $) Labour budget (in terms of S) The following actual data relates to Product A 2213 $3 Product C 800 1,000 RM22 10,000 9,000 Product C 6 $9 RM33 $4 Product D 700 800 RM33 16,000 12,000 Product D 8 $9 re-engineering your future Production (Units) Sales Revenue Raw materials (kg) RM11 RM22 RM33 (i) (ii) (iii) (iv) (v) Material cost (S) RM11 RM22 RM33 Labour hours Labour cost 2,100 $214,200 10,000 4,000 $65,000 $16,000 10,500 $73,500 All units produced were sold. Required: (b) Calculate the following variances for Product A: Selling price Material usage Material pric Labour efficiency Labour rate (c) Comment on the variances above and, accordingly, recommend control actions that ACD Ltd could implement.

Step by Step Solution

3.47 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

Part A a Traditional Basis of Charging Overhead Product A Direct Material Cost 10 per unit Direct Labour Cost 8 per hour 1 hour per unit Machine Hours 3 hours per unit traditional Overhead Calculation ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started