Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 1. PARTA. [3 points] Suppose a company borrows $1 million debt to invest in a project that generates uncertain cash flow (revenue) of 0$2

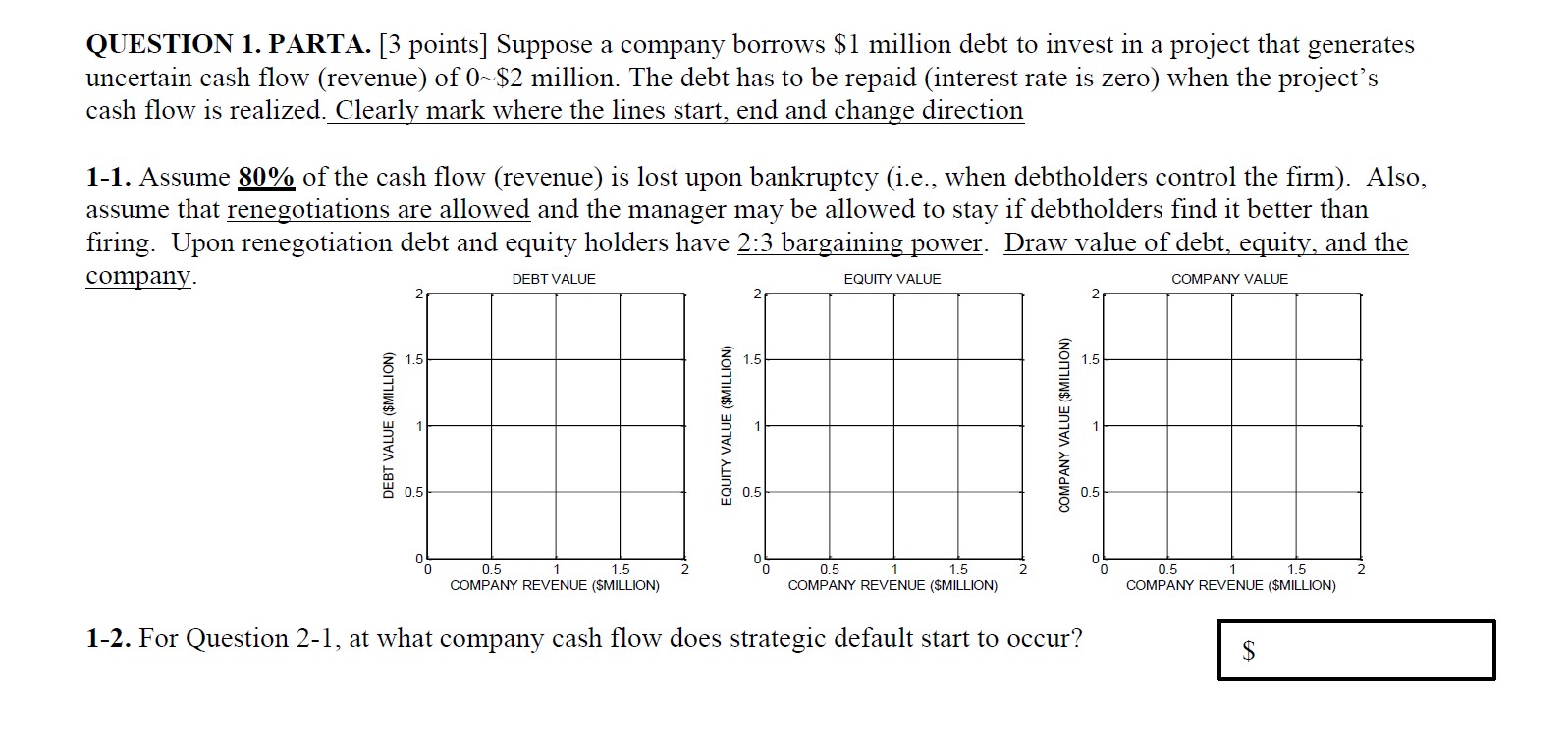

QUESTION 1. PARTA. [3 points] Suppose a company borrows $1 million debt to invest in a project that generates uncertain cash flow (revenue) of 0$2 million. The debt has to be repaid (interest rate is zero) when the project's cash flow is realized. Clearly mark where the lines start, end and change direction 1-1. Assume 80% of the cash flow (revenue) is lost upon bankruptcy (i.e., when debtholders control the firm). Also, assume that renegotiations are allowed and the manager may be allowed to stay if debtholders find it better than firing. Upon renegotiation debt and equity holders have 2:3 bargaining power. Draw value of debt, equity, and the company. 1-2. For Question 2-1, at what company cash flow does strategic default start to occur

QUESTION 1. PARTA. [3 points] Suppose a company borrows $1 million debt to invest in a project that generates uncertain cash flow (revenue) of 0$2 million. The debt has to be repaid (interest rate is zero) when the project's cash flow is realized. Clearly mark where the lines start, end and change direction 1-1. Assume 80% of the cash flow (revenue) is lost upon bankruptcy (i.e., when debtholders control the firm). Also, assume that renegotiations are allowed and the manager may be allowed to stay if debtholders find it better than firing. Upon renegotiation debt and equity holders have 2:3 bargaining power. Draw value of debt, equity, and the company. 1-2. For Question 2-1, at what company cash flow does strategic default start to occur Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started