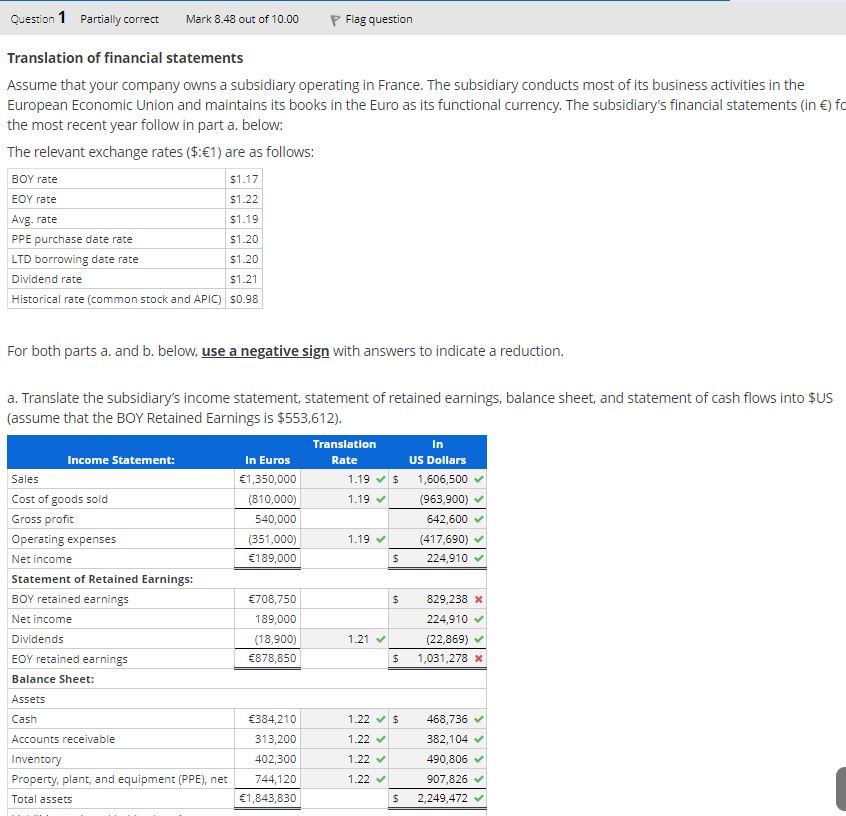

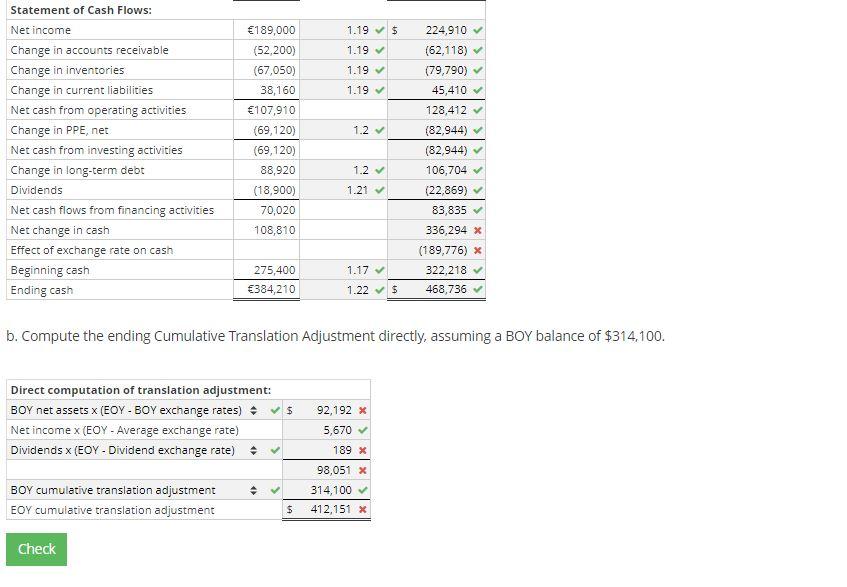

Question 1 Partially correct Mark 8.48 out of 10.00 P Flag question Translation of financial statements Assume that your company owns a subsidiary operating in France. The subsidiary conducts most of its business activities in the European Economic Union and maintains its books in the Euro as its functional currency. The subsidiary's financial statements (in ) fc the most recent year follow in part a. below: The relevant exchange rates ($:1) are as follows: BOY rate EOY rate Avg. rate PPE purchase date rate LTD borrowing date rate Dividend rate Historical rate (common stock and APIC) 50.98 $1.17 $1.22 $1.19 $1.20 $1.20 $1.21 For both parts a. and b. below, use a negative sign with answers to indicate a reduction. $ a. Translate the subsidiary's income statement, statement of retained earnings, balance sheet, and statement of cash flows into $US (assume that the BOY Retained Earnings is $553,612). Translation In Income Statement: In Euros Rate US Dollars Sales 1,350,000 1.19 $ 1,606,500 Cost of goods sold (810,000) 1.19 (963,900) Gross profit 540,000 642,600 Operating expenses (351,000) 1.19 (417,690) Net income 189,000 224,910 Statement of Retained Earnings: BOY retained earnings 708,750 829,238 x Net income 189,000 224,910 Dividends (18,900) 1.21 (22,869) EOY retained earnings 878,850 $ 1,031,278 x Balance Sheet: Assets Cash 384,210 1.22 468,736 Accounts receivable 313,200 1.22 382,104 Inventory 402,300 1.22 490,806 Property, plant, and equipment (PPE), net 744,120 1.22 907,826 Total assets 1,843,830 2,249,472 $ $ $ 1.19 $ 1.19 189,000 (52,200) (67,050) 38,160 1.19 1.19 1.2 Statement of Cash Flows: Net income Change in accounts receivable Change in inventories Change in current liabilities Net cash from operating activities Change in PPE, net Net cash from investing activities Change in long-term debt Dividends Net cash flows from financing activities Net change in cash Effect of exchange rate on cash Beginning cash Ending cash 107,910 (69,120) (69,120) 88,920 (18,900) 70,020 108,810 224,910 (62,118) (79,790) 45,410 128,412 (82,944) (82,944) 106,704 (22,869) 83,835 336,294 x (189,776) * 322,218 468,736 1.2 1.21 1.17 275,400 384,210 1.22 $ b. Compute the ending Cumulative Translation Adjustment directly, assuming a BOY balance of $314,100. $ Direct computation of translation adjustment: BOY net assets x (EOY - BOY exchange rates) Net income (EOY - Average exchange rate) Dividends x (EOY - Dividend exchange rate) 92,192 X 5,670 189 X 98,051 x 314,100 412,151 x BOY cumulative translation adjustment EOY cumulative translation adjustment $ Check