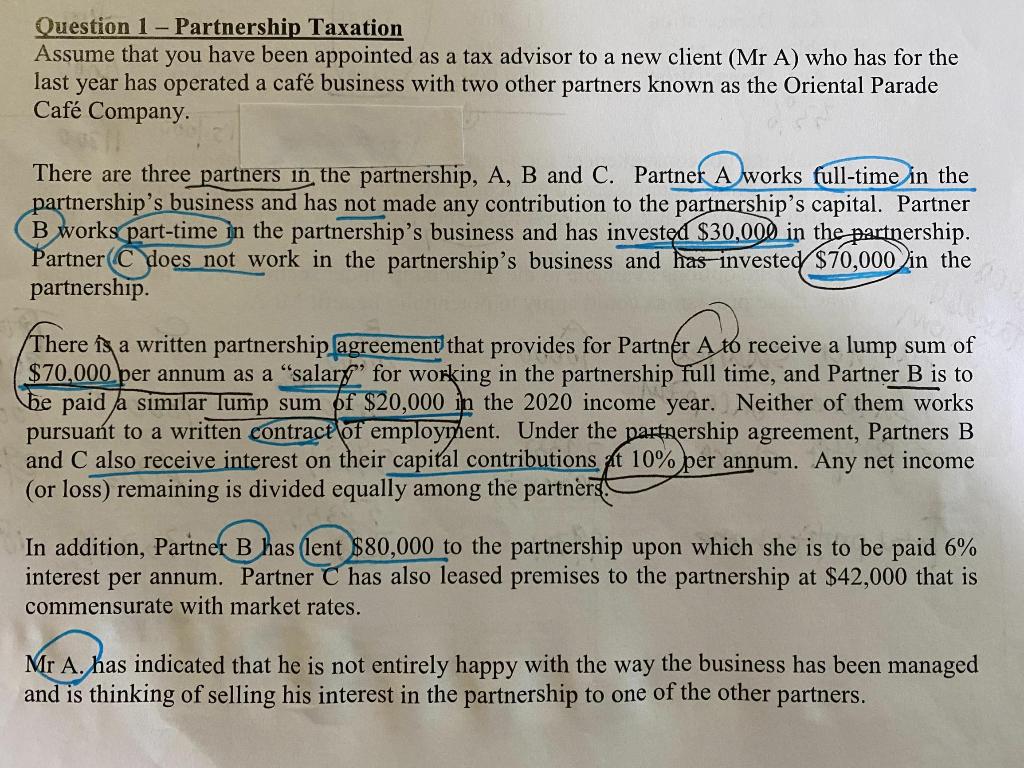

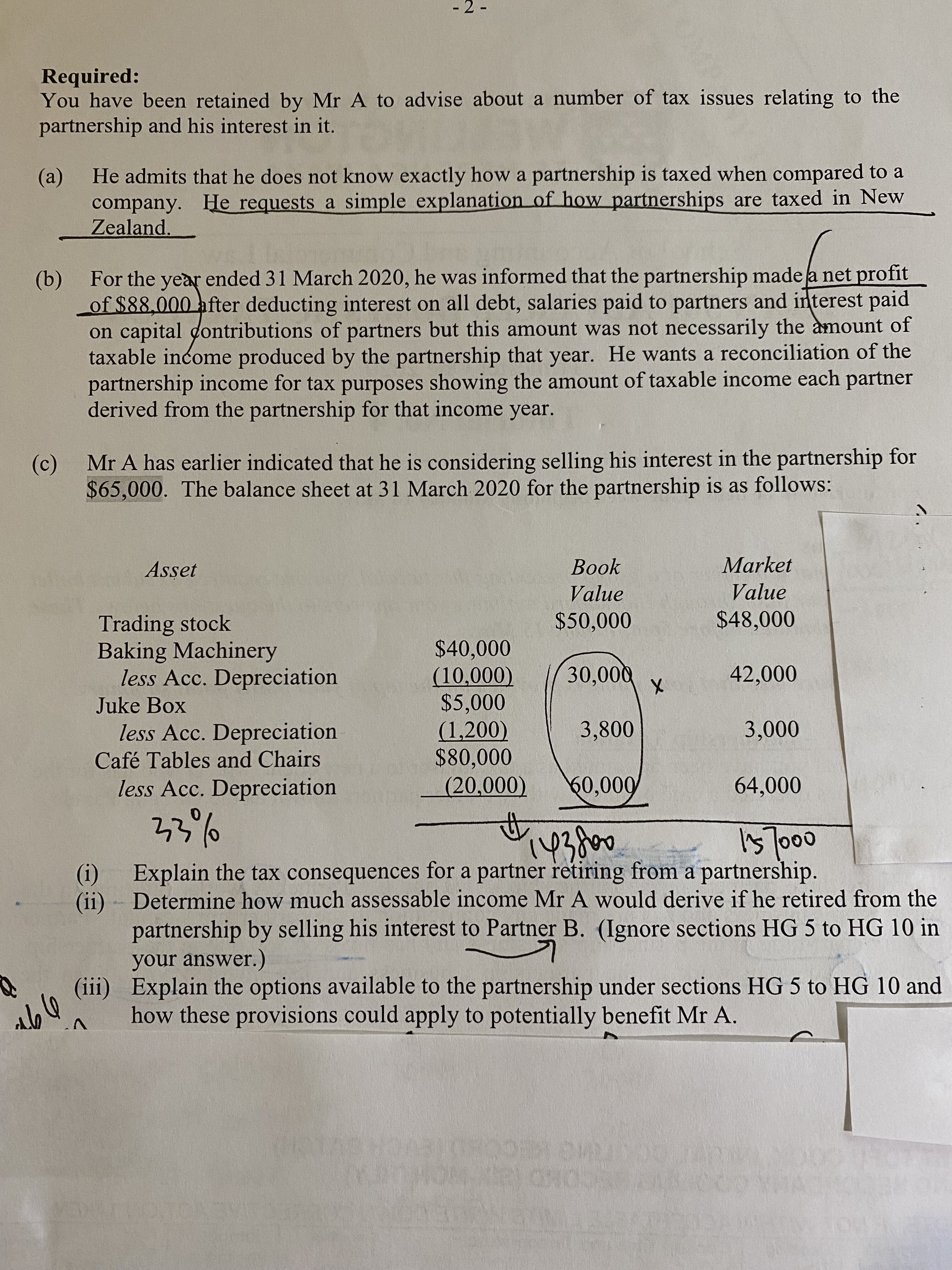

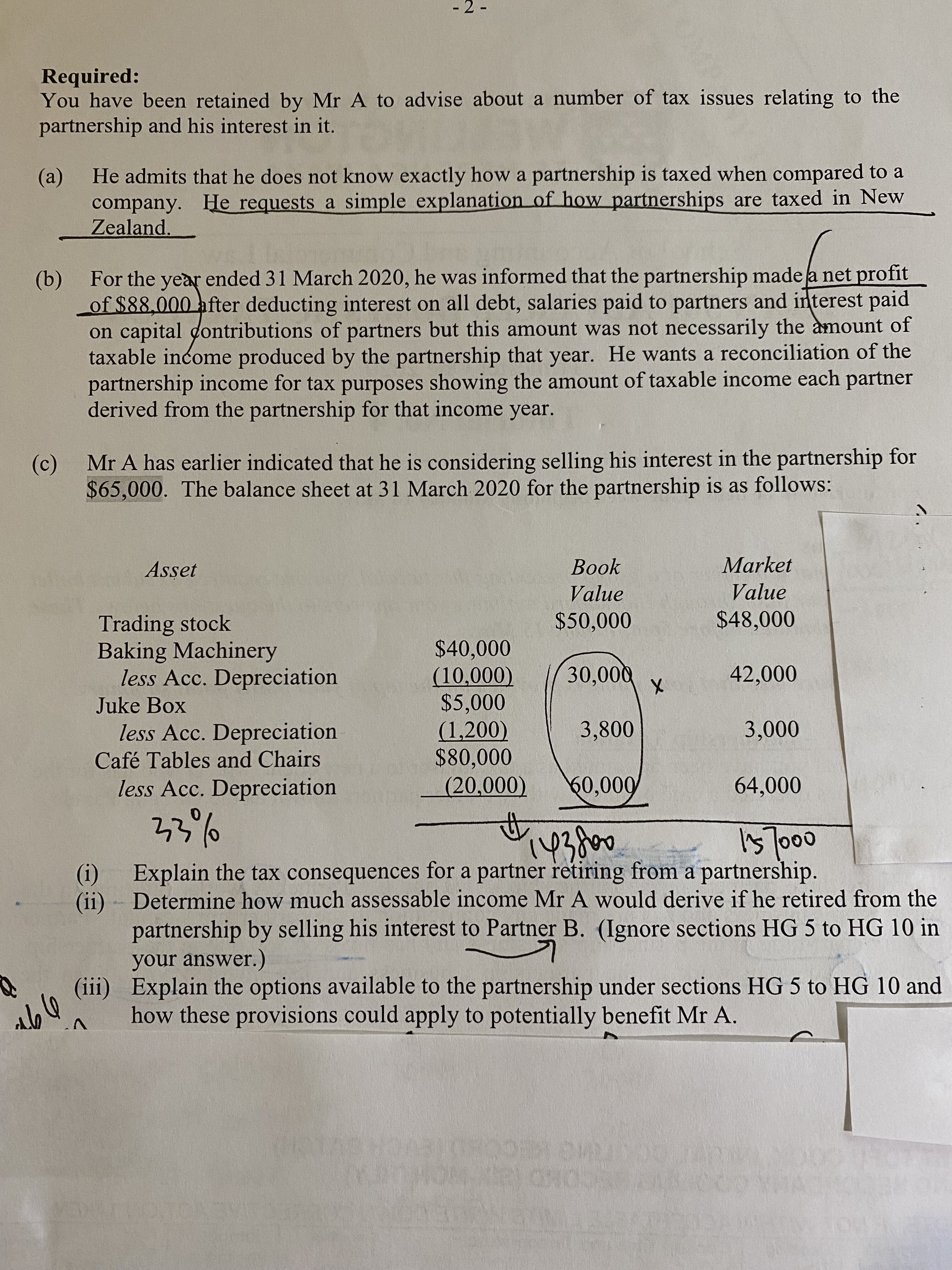

Question 1 - Partnership Taxation Assume that you have been appointed as a tax advisor to a new client (Mr A) who has for the last year has operated a caf business with two other partners known as the Oriental Parade Caf Company. There are three partners in the partnership, A, B and C. Partner A works full-time in the partnership's business and has not made any contribution to the partnerships capital. Partner B works part-time in the partnership's business and has invested $30,000 in the partnership. Partner(C does not work in the partnership's business and has invested $70,000 in the partnership There is a written partnership agreement that provides for Partner A to receive a lump sum of $70,000 per annum as a "salary for working in the partnership full time, and Partner B is to be paid a similar lump sum of $20,000 in the 2020 income year. Neither of them works pursuant to a written contract of employment. Under the partnership agreement, Partners B and C also receive interest on their capital contributions at 10% per annum. Any net income (or loss) remaining is divided equally among the partners. In addition, Partner B has lent $80,000 to the partnership upon which she is to be paid 6% interest per annum. Partner C has also leased premises to the partnership at $42,000 that is commensurate with market rates. Mr A. has indicated that he is not entirely happy with the way the business has been managed and is thinking of selling his interest in the partnership to one of the other partners. -2- Required: You have been retained by Mr A to advise about a number of tax issues relating to the partnership and his interest in it. (a) He admits that he does not know exactly how a partnership is taxed when compared to a company. He requests a simple explanation of how partnerships are taxed in New Zealand. (b) For the year ended 31 March 2020, he was informed that the partnership made a net profit of $88,000 after deducting interest on all debt, salaries paid to partners and interest paid on capital contributions of partners but this amount was not necessarily the amount of taxable income produced by the partnership that year. He wants a reconciliation of the partnership income for tax purposes showing the amount of taxable income each partner derived from the partnership for that income year. (c) Mr A has earlier indicated that he is considering selling his interest in the partnership for $65,000. The balance sheet at 31 March 2020 for the partnership is as follows: Asset Book Market Value Value Trading stock $50,000 $48,000 Baking Machinery $40,000 less Acc. Depreciation (10,000) 30,000 42,000 X Juke Box $5,000 less Acc. Depreciation (1,200. 3,800 3,000 Caf Tables and Chairs $80,000 less Acc. Depreciation (20,000) 60,000 64,000 23% 5700 (1) Explain the tax consequences for a partner retiring from a partnership. (ii) - Determine how much assessable income Mr A would derive if he retired from the partnership by selling his interest to Partner B. (Ignore sections HG 5 to HG 10 in your answer.) (iii) Explain the options available to the partnership under sections HG 5 to HG 10 and how these provisions could apply to potentially benefit Mr A. 143800 Question 1 - Partnership Taxation Assume that you have been appointed as a tax advisor to a new client (Mr A) who has for the last year has operated a caf business with two other partners known as the Oriental Parade Caf Company. There are three partners in the partnership, A, B and C. Partner A works full-time in the partnership's business and has not made any contribution to the partnerships capital. Partner B works part-time in the partnership's business and has invested $30,000 in the partnership. Partner(C does not work in the partnership's business and has invested $70,000 in the partnership There is a written partnership agreement that provides for Partner A to receive a lump sum of $70,000 per annum as a "salary for working in the partnership full time, and Partner B is to be paid a similar lump sum of $20,000 in the 2020 income year. Neither of them works pursuant to a written contract of employment. Under the partnership agreement, Partners B and C also receive interest on their capital contributions at 10% per annum. Any net income (or loss) remaining is divided equally among the partners. In addition, Partner B has lent $80,000 to the partnership upon which she is to be paid 6% interest per annum. Partner C has also leased premises to the partnership at $42,000 that is commensurate with market rates. Mr A. has indicated that he is not entirely happy with the way the business has been managed and is thinking of selling his interest in the partnership to one of the other partners. -2- Required: You have been retained by Mr A to advise about a number of tax issues relating to the partnership and his interest in it. (a) He admits that he does not know exactly how a partnership is taxed when compared to a company. He requests a simple explanation of how partnerships are taxed in New Zealand. (b) For the year ended 31 March 2020, he was informed that the partnership made a net profit of $88,000 after deducting interest on all debt, salaries paid to partners and interest paid on capital contributions of partners but this amount was not necessarily the amount of taxable income produced by the partnership that year. He wants a reconciliation of the partnership income for tax purposes showing the amount of taxable income each partner derived from the partnership for that income year. (c) Mr A has earlier indicated that he is considering selling his interest in the partnership for $65,000. The balance sheet at 31 March 2020 for the partnership is as follows: Asset Book Market Value Value Trading stock $50,000 $48,000 Baking Machinery $40,000 less Acc. Depreciation (10,000) 30,000 42,000 X Juke Box $5,000 less Acc. Depreciation (1,200. 3,800 3,000 Caf Tables and Chairs $80,000 less Acc. Depreciation (20,000) 60,000 64,000 23% 5700 (1) Explain the tax consequences for a partner retiring from a partnership. (ii) - Determine how much assessable income Mr A would derive if he retired from the partnership by selling his interest to Partner B. (Ignore sections HG 5 to HG 10 in your answer.) (iii) Explain the options available to the partnership under sections HG 5 to HG 10 and how these provisions could apply to potentially benefit Mr A. 143800