Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 Peters has asked you to prepare a cash budget for the six months from 1 July 2021 to 31 December 2021 and has

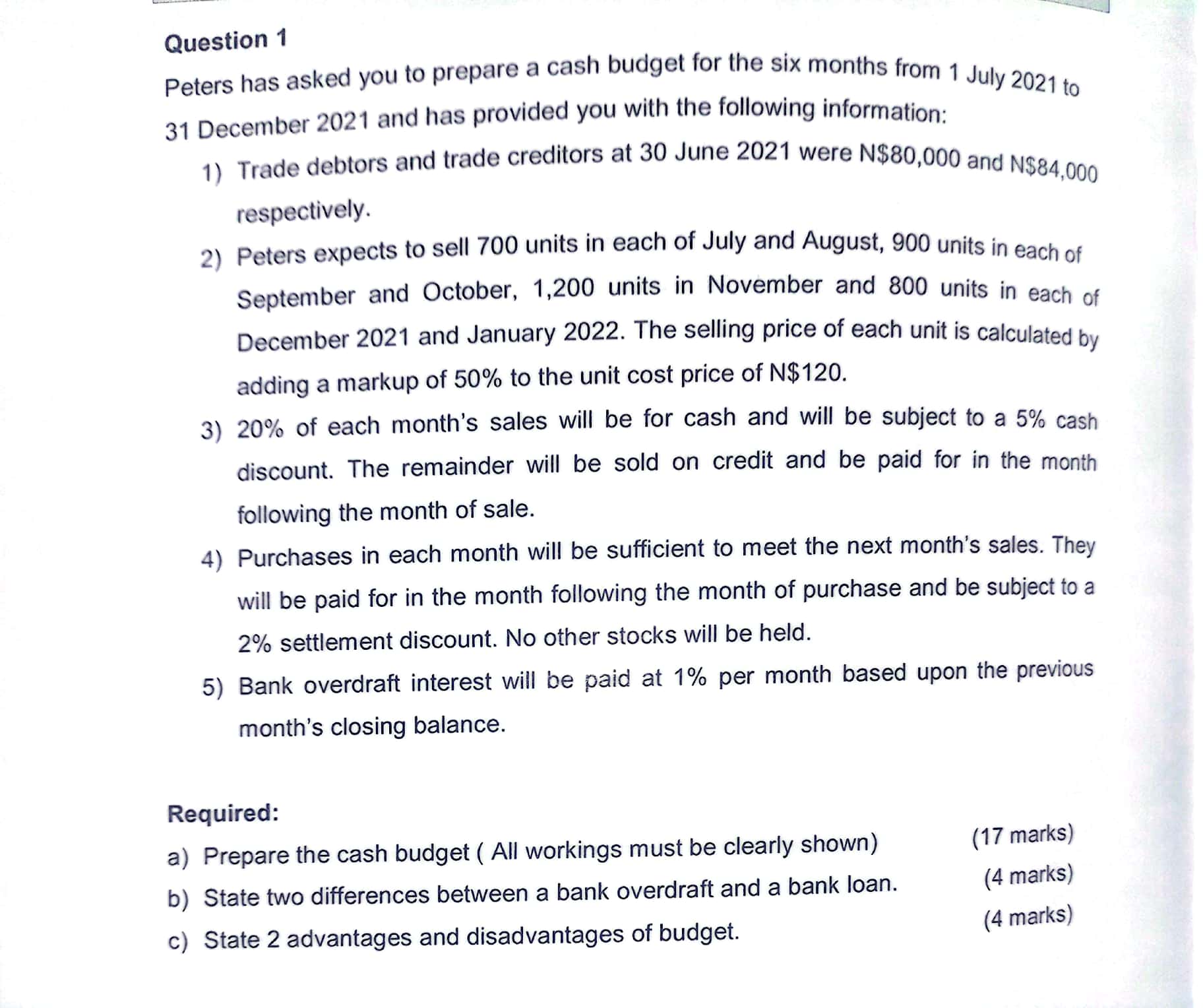

Question 1 Peters has asked you to prepare a cash budget for the six months from 1 July 2021 to 31 December 2021 and has provided you with the following information: 1) Trade debtors and trade creditors at 30 June 2021 were N$80,000 and N$84,000 respectively. 2) Peters expects to sell 700 units in each of July and August, 900 units in each of September and October, 1,200 units in November and 800 units in each of December 2021 and January 2022. The selling price of each unit is calculated by adding a markup of 50% to the unit cost price of N$120. 3) 20% of each month's sales will be for cash and will be subject to a 5% cash discount. The remainder will be sold on credit and be paid for in the month following the month of sale. 4) Purchases in each month will be sufficient to meet the next month's sales. They will be paid for in the month following the month of purchase and be subject to a 2% settlement discount. No other stocks will be held. 5) Bank overdraft interest will be paid at 1% per month based upon the previous month's closing balance. Required: a) Prepare the cash budget ( All workings must be clearly shown) (17 marks) b) State two differences between a bank overdraft and a bank loan. (4 marks) c) State 2 advantages and disadvantages of budget. (4 marks)

Question 1 Peters has asked you to prepare a cash budget for the six months from 1 July 2021 to 31 December 2021 and has provided you with the following information: 1) Trade debtors and trade creditors at 30 June 2021 were N$80,000 and N$84,000 respectively. 2) Peters expects to sell 700 units in each of July and August, 900 units in each of September and October, 1,200 units in November and 800 units in each of December 2021 and January 2022. The selling price of each unit is calculated by adding a markup of 50% to the unit cost price of N$120. 3) 20% of each month's sales will be for cash and will be subject to a 5% cash discount. The remainder will be sold on credit and be paid for in the month following the month of sale. 4) Purchases in each month will be sufficient to meet the next month's sales. They will be paid for in the month following the month of purchase and be subject to a 2% settlement discount. No other stocks will be held. 5) Bank overdraft interest will be paid at 1% per month based upon the previous month's closing balance. Required: a) Prepare the cash budget ( All workings must be clearly shown) (17 marks) b) State two differences between a bank overdraft and a bank loan. (4 marks) c) State 2 advantages and disadvantages of budget. (4 marks) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started