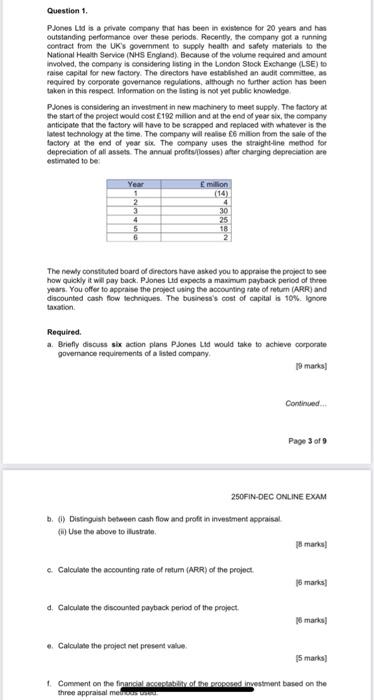

Question 1 PJones Lsd is a private company that has been instance for 20 years and has outstanding performance over these periods. Recently, the company got a running contract from the UK's government to supply health and safety materials to the National Health Service (NHS England) Because of the volume required and amount involved, the company is considering listing in the London Stock Exchange (LSE) to raise capital for new factory. The directors have established an audit committee, as required by corporate govomance regulations, although no further action has been taken in this respect. Information on the listing is not yet public knowledge Pjones is considering an investment in new machinery to meet supply. The factory at the start of the project would cost 192 million and at the end of year six, the company anticipate that the factory will have to be scrapped and replaced with whatever is the latest technology at the time. The company will realise 6 milion from the sale of the factory at the end of year sie. The company uses the straight-line method for depreciation of all ages. The annual profitsfosses) after charging depreciation are estimated to be Year 1 2 3 4 5 Emillion (14) 4 30 25 18 The newly constituted board of directors have asked you to appraise the project to see how quickly it will pay back. PJones Lld expects a maximum payback period of three years. You offer to appraise the project using the accounting rate of return (ARR) and discounted cash flow techniques. The business's cost of capital is 10% ignore taxation Required. a Briefly discuss six action plans Pjones Lid would take to achieve corporate governance requirements of a sted company 19 marks! Continued Page 3 of 9 250FIN DEC ONLINE EXAM b. (1) Distinguish between cash flow and protein investment appraisal Use the above to illustrate marks! c. Calculate the accounting rate of retum (ARR) of the project 15 marks d. Calculate the discounted payback period of the project 18 marks e Calculate the project niet present value 15 marks Comment on the financial accesibility of Brood investment based on the three appraisal menos Question 1 PJones Lsd is a private company that has been instance for 20 years and has outstanding performance over these periods. Recently, the company got a running contract from the UK's government to supply health and safety materials to the National Health Service (NHS England) Because of the volume required and amount involved, the company is considering listing in the London Stock Exchange (LSE) to raise capital for new factory. The directors have established an audit committee, as required by corporate govomance regulations, although no further action has been taken in this respect. Information on the listing is not yet public knowledge Pjones is considering an investment in new machinery to meet supply. The factory at the start of the project would cost 192 million and at the end of year six, the company anticipate that the factory will have to be scrapped and replaced with whatever is the latest technology at the time. The company will realise 6 milion from the sale of the factory at the end of year sie. The company uses the straight-line method for depreciation of all ages. The annual profitsfosses) after charging depreciation are estimated to be Year 1 2 3 4 5 Emillion (14) 4 30 25 18 The newly constituted board of directors have asked you to appraise the project to see how quickly it will pay back. PJones Lld expects a maximum payback period of three years. You offer to appraise the project using the accounting rate of return (ARR) and discounted cash flow techniques. The business's cost of capital is 10% ignore taxation Required. a Briefly discuss six action plans Pjones Lid would take to achieve corporate governance requirements of a sted company 19 marks! Continued Page 3 of 9 250FIN DEC ONLINE EXAM b. (1) Distinguish between cash flow and protein investment appraisal Use the above to illustrate marks! c. Calculate the accounting rate of retum (ARR) of the project 15 marks d. Calculate the discounted payback period of the project 18 marks e Calculate the project niet present value 15 marks Comment on the financial accesibility of Brood investment based on the three appraisal menos