Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 Please assist Tab 4 A Q 5 w E R Caps Lock T Y S U D - F O O Shift G

Question 1 Please assist

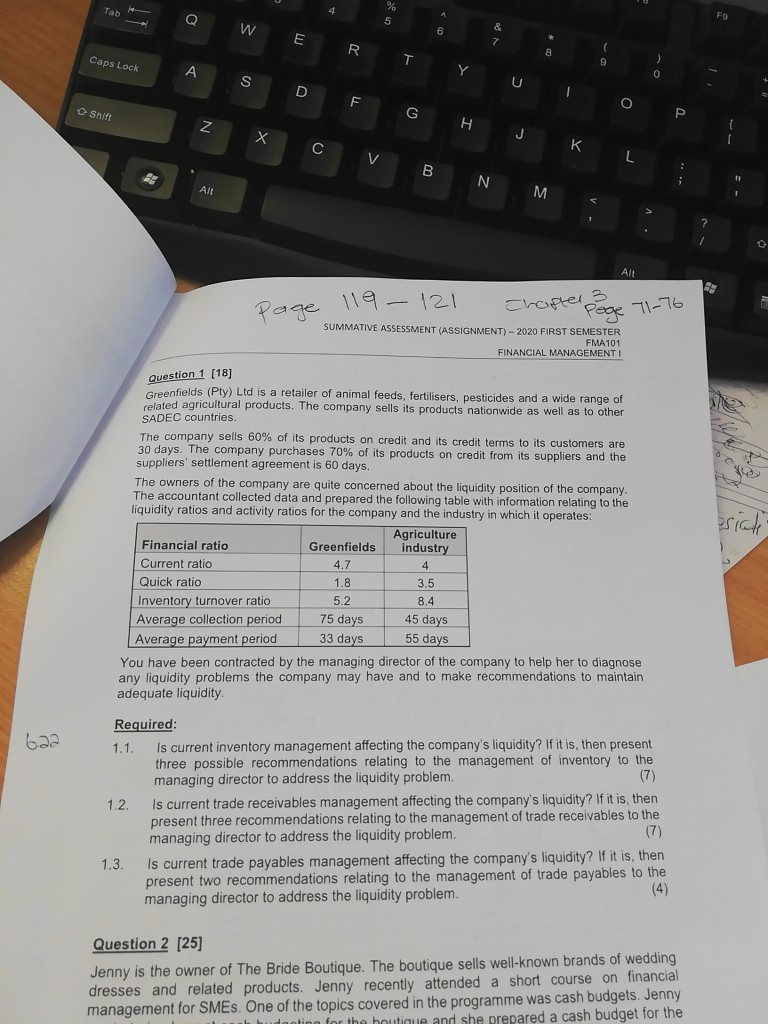

Tab 4 A Q 5 w E R Caps Lock T Y S U D - F O O Shift G Z X J C V B N Alt M Alt page Chapter 71-76 119-121 SUMMATIVE ASSESSMENT (ASSIGNMENT) - 2020 FIRST SEMESTER FMA 101 FINANCIAL MANAGEMENT I Question 1 [18] sich Greenfields (Pty) Ltd is a retailer of animal feeds, fertilisers, pesticides and a wide range of related agricultural products. The company sells its products nationwide as well as to other SADEC countries. The company sells 60% of its products on credit and its credit terms to its customers are 30 days. The company purchases 70% of its products on credit from its suppliers and the suppliers' settlement agreement is 60 days. The owners of the company are quite concerned about the liquidity position of the company. The accountant collected data and prepared the following table with information relating to the liquidity ratios and activity ratios for the company and the industry in which it operates: Agriculture Financial ratio Greenfields industry Current ratio 4.7 4 Quick ratio 1.8 3.5 Inventory turnover ratio 5.2 8.4 Average collection period 75 days Average payment period 33 days 55 days You have been contracted by the managing director of the company to help her to diagnose any liquidity problems the company may have and to make recommendations to maintain adequate liquidity 45 days Required: 1.1. Is current inventory management affecting the company's liquidity? If it is, then present three possible recommendations relating to the management of inventory to the managing director to address the liquidity problem. 1.2. Is current trade receivables management affecting the company's liquidity? If it is, then present three recommendations relating to the management of trade receivables to the managing director to address the liquidity problem (7) 1.3. Is current trade payables management affecting the company's liquidity? If it is, then present two recommendations relating to the management of trade payables to the managing director to address the liquidity problem. (4) Question 2 [25] Jenny is the owner of The Bride Boutique. The boutique sells well-known brands of wedding dresses and related products. Jenny recently attended a short course on financial management for SMEs. One of the topics covered in the programme was cash budgets. Jenny danting for the boutique and she prepared a cash budget for the Tab 4 A Q 5 w E R Caps Lock T Y S U D - F O O Shift G Z X J C V B N Alt M Alt page Chapter 71-76 119-121 SUMMATIVE ASSESSMENT (ASSIGNMENT) - 2020 FIRST SEMESTER FMA 101 FINANCIAL MANAGEMENT I Question 1 [18] sich Greenfields (Pty) Ltd is a retailer of animal feeds, fertilisers, pesticides and a wide range of related agricultural products. The company sells its products nationwide as well as to other SADEC countries. The company sells 60% of its products on credit and its credit terms to its customers are 30 days. The company purchases 70% of its products on credit from its suppliers and the suppliers' settlement agreement is 60 days. The owners of the company are quite concerned about the liquidity position of the company. The accountant collected data and prepared the following table with information relating to the liquidity ratios and activity ratios for the company and the industry in which it operates: Agriculture Financial ratio Greenfields industry Current ratio 4.7 4 Quick ratio 1.8 3.5 Inventory turnover ratio 5.2 8.4 Average collection period 75 days Average payment period 33 days 55 days You have been contracted by the managing director of the company to help her to diagnose any liquidity problems the company may have and to make recommendations to maintain adequate liquidity 45 days Required: 1.1. Is current inventory management affecting the company's liquidity? If it is, then present three possible recommendations relating to the management of inventory to the managing director to address the liquidity problem. 1.2. Is current trade receivables management affecting the company's liquidity? If it is, then present three recommendations relating to the management of trade receivables to the managing director to address the liquidity problem (7) 1.3. Is current trade payables management affecting the company's liquidity? If it is, then present two recommendations relating to the management of trade payables to the managing director to address the liquidity problem. (4) Question 2 [25] Jenny is the owner of The Bride Boutique. The boutique sells well-known brands of wedding dresses and related products. Jenny recently attended a short course on financial management for SMEs. One of the topics covered in the programme was cash budgets. Jenny danting for the boutique and she prepared a cash budget for theStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started