Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 1 PLEASE PROVIDE FULL CALCULATIONS AND EXPLANATIONS ON THIS QUESTION. THANK YOU! PLEASE DO NOT USE EXCEL TO SOLVE THIS QUESTION. THANK YOU! HANDWRITTEN

QUESTION 1

PLEASE PROVIDE FULL CALCULATIONS AND EXPLANATIONS ON THIS QUESTION. THANK YOU!

PLEASE DO NOT USE EXCEL TO SOLVE THIS QUESTION. THANK YOU! HANDWRITTEN IS MORE PREFERABLE...

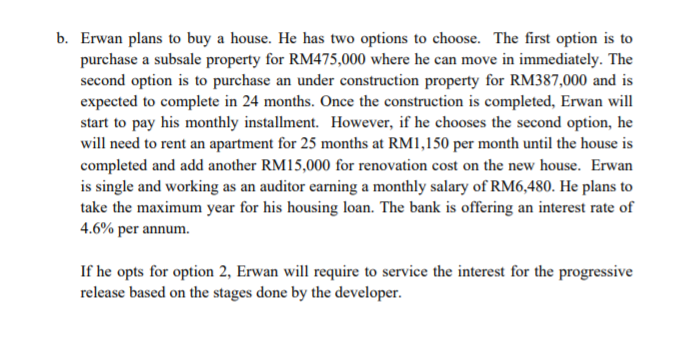

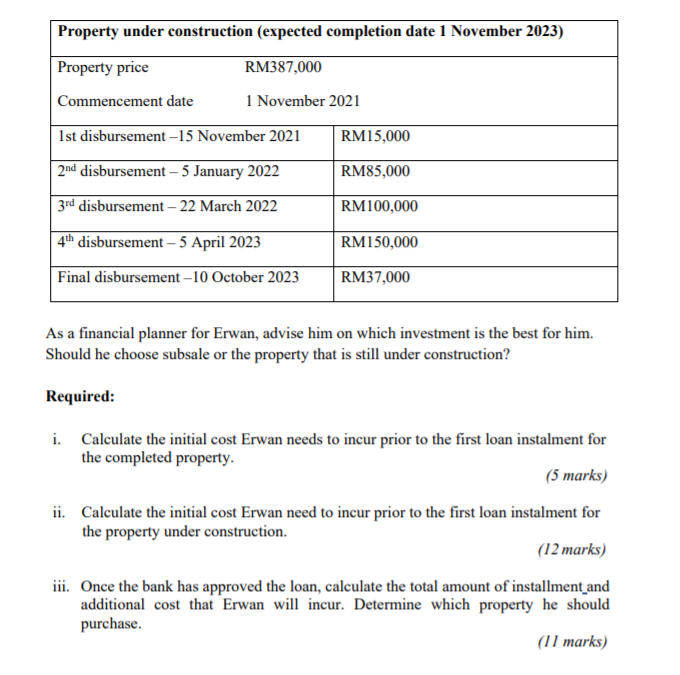

b. Erwan plans to buy a house. He has two options to choose. The first option is to purchase a subsale property for RM475,000 where he can move in immediately. The second option is to purchase an under construction property for RM387,000 and is expected to complete in 24 months. Once the construction is completed, Erwan will start to pay his monthly installment. However, if he chooses the second option, he will need to rent an apartment for 25 months at RM1,150 per month until the house is completed and add another RM15,000 for renovation cost on the new house. Erwan is single and working as an auditor earning a monthly salary of RM6,480. He plans to take the maximum year for his housing loan. The bank is offering an interest rate of 4.6% per annum. If he opts for option 2, Erwan will require to service the interest for the progressive release based on the stages done by the developer. Property under construction (expected completion date 1 November 2023) Property price RM387,000 Commencement date 1 November 2021 Ist disbursement -15 November 2021 RM15,000 2nd disbursement - 5 January 2022 RM85,000 3rd disbursement - 22 March 2022 RM100,000 4th disbursement - 5 April 2023 RM150,000 Final disbursement -10 October 2023 RM37,000 As a financial planner for Erwan, advise him on which investment is the best for him. Should he choose subsale or the property that is still under construction? Required: i. Calculate the initial cost Erwan needs to incur prior to the first loan instalment for the completed property. (5 marks) ii. Calculate the initial cost Erwan need to incur prior to the first loan instalment for the property under construction. (12 marks) iii. Once the bank has approved the loan, calculate the total amount of installment_and additional cost that Erwan will incur. Determine which property he should purchase. (11 marks) b. Erwan plans to buy a house. He has two options to choose. The first option is to purchase a subsale property for RM475,000 where he can move in immediately. The second option is to purchase an under construction property for RM387,000 and is expected to complete in 24 months. Once the construction is completed, Erwan will start to pay his monthly installment. However, if he chooses the second option, he will need to rent an apartment for 25 months at RM1,150 per month until the house is completed and add another RM15,000 for renovation cost on the new house. Erwan is single and working as an auditor earning a monthly salary of RM6,480. He plans to take the maximum year for his housing loan. The bank is offering an interest rate of 4.6% per annum. If he opts for option 2, Erwan will require to service the interest for the progressive release based on the stages done by the developer. Property under construction (expected completion date 1 November 2023) Property price RM387,000 Commencement date 1 November 2021 Ist disbursement -15 November 2021 RM15,000 2nd disbursement - 5 January 2022 RM85,000 3rd disbursement - 22 March 2022 RM100,000 4th disbursement - 5 April 2023 RM150,000 Final disbursement -10 October 2023 RM37,000 As a financial planner for Erwan, advise him on which investment is the best for him. Should he choose subsale or the property that is still under construction? Required: i. Calculate the initial cost Erwan needs to incur prior to the first loan instalment for the completed property. (5 marks) ii. Calculate the initial cost Erwan need to incur prior to the first loan instalment for the property under construction. (12 marks) iii. Once the bank has approved the loan, calculate the total amount of installment_and additional cost that Erwan will incur. Determine which property he should purchase. (11 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started