Question

QUESTION 1 Please refer to the article attached together with this question. The title of the article is The Banks Policy Considerations, published by Bank

QUESTION 1

Please refer to the article attached together with this question. The title of the article is The Banks Policy Considerations, published by Bank Negara Malaysia (BNM). You are required to read carefully the article and answer the questions below. You may also refer to BNMs website for additional information.

(a) Discuss what is the position of the financial sector in Malaysia, in terms of liquidity and capital, during COVID-19 pandemic.(12 marks)

(b) (i) Define what is a Statutory Reserve Requirement.(4 marks)

(ii) Explain how an adjustment in the Statutory Reserve Requirement facilitates financial intermediation activities?(8 marks)

(c) As mentioned in the article, part of the Financial Relief Measures introduced to assist individuals and SMEs affected by COVID-19 are a 6-months deferment offered by banking institutions on all loan/financing repayments (except credit card balances) on 1 April 2020.

(i) Explain what is the meaning of 6-months deferment on the loan/ financing repayments.(4 marks)

(ii) Discuss THREE (3) impacts of loan/ financing deferment on the loan/ financing account.(6 marks)

(d) Bank Negara Malaysia has also extended various types of assistance to facilitate Small Medium Enterprises (SMEs) in Malaysia that affected by the COVID-19 pandemic.

(i) Explain FOUR (4) types of assistance for SMEs.(4 marks)

(ii) Discuss FOUR (4) reasons why it is important to extend financial assistance to SMEs during the COVID-19 pandemic.(8 marks)

(e) As mentioned in the article, the Exposure Draft on Licensing Framework for Digital Banks was updated on 3 March 2020 (as attached). This is to incorporate further details on the simplified regulatory framework applicable to digital banks during the foundational phase, which includes, the simplified requirements on capital adequacy and liquidity risk. (i) Explain what is foundational phase for Digital Banks.(6 marks), (ii) Discuss what are the simplified capital adequacy and liquidity risk

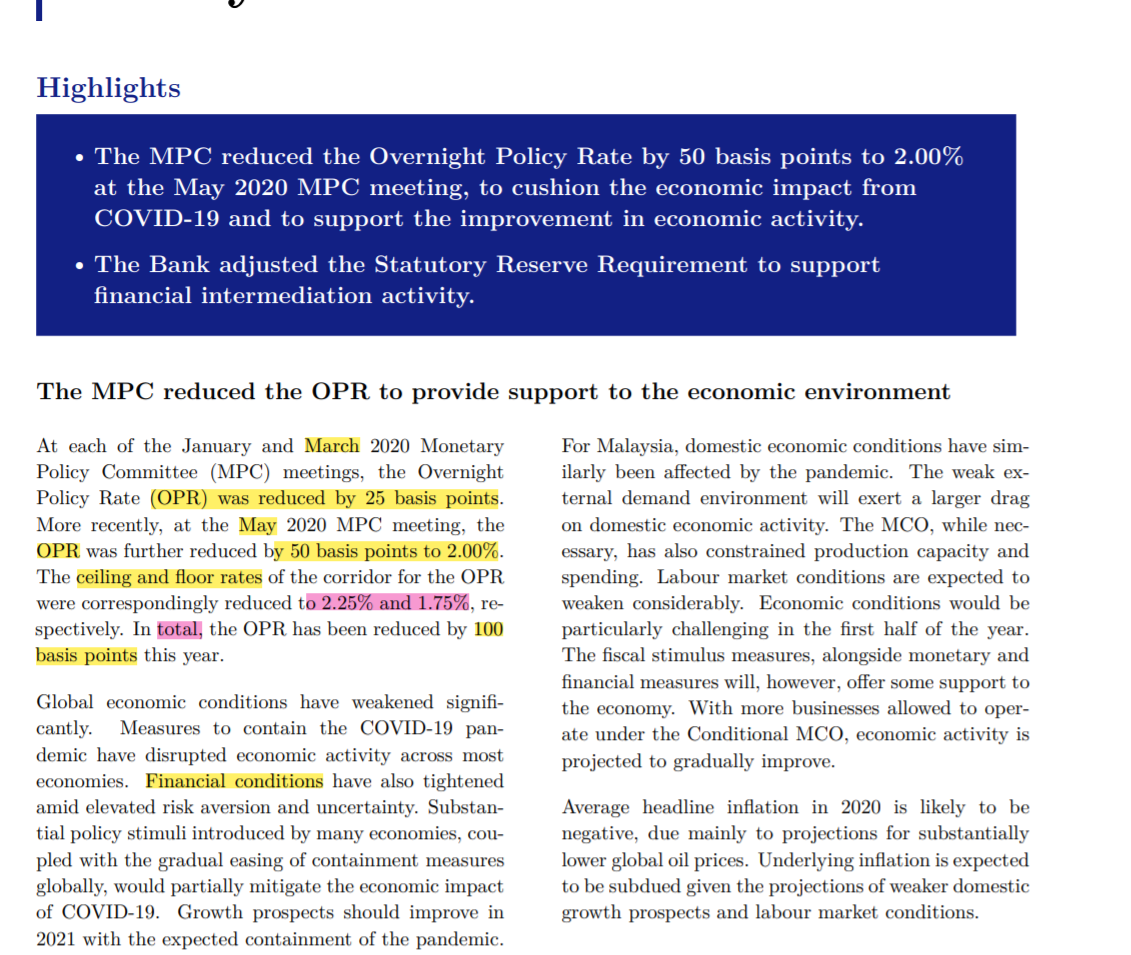

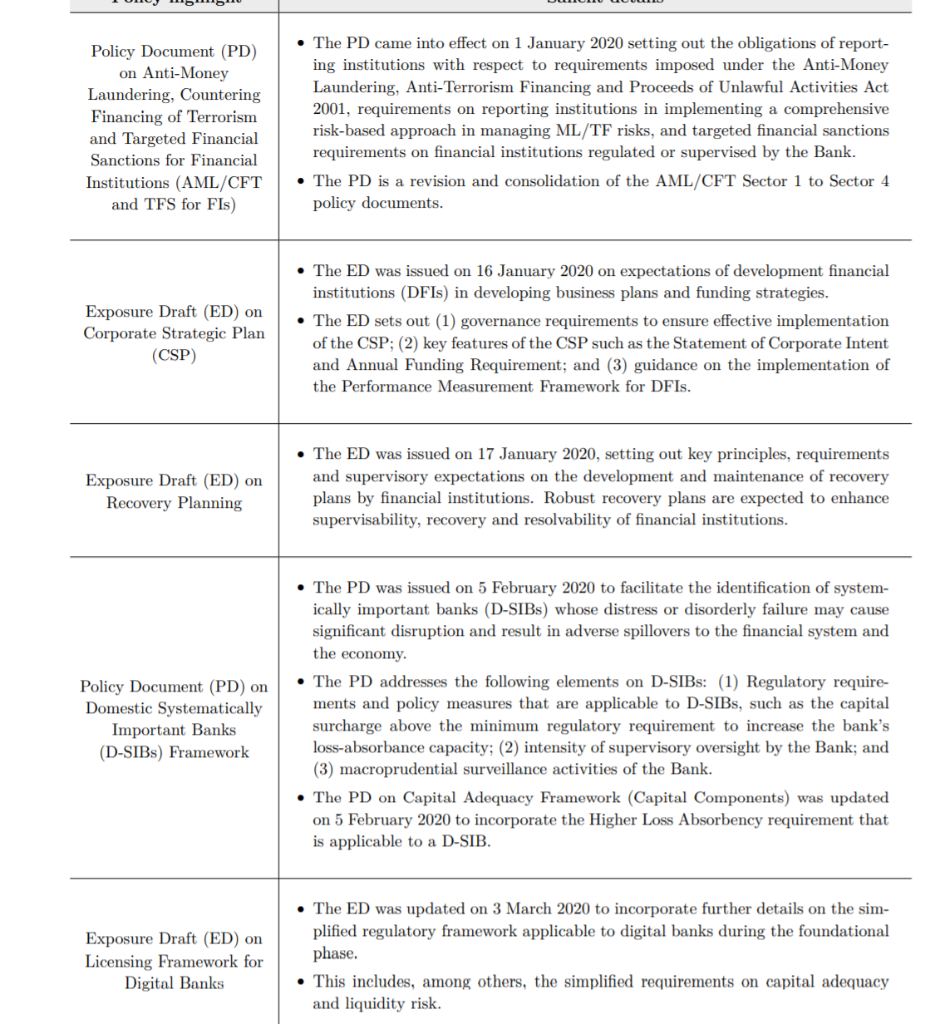

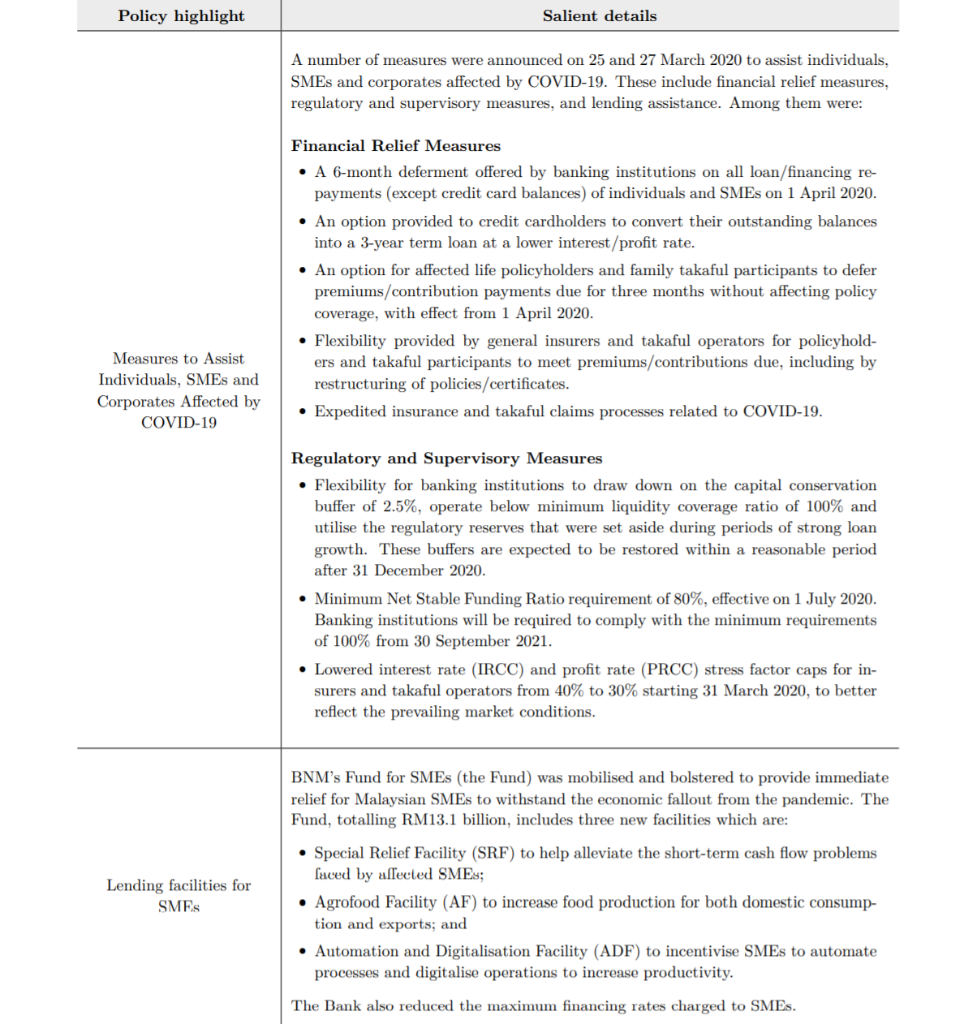

Highlights The MPC reduced the Overnight Policy Rate by 50 basis points to 2.00% at the May 2020 MPC meeting, to cushion the economic impact from COVID-19 and to support the improvement in economic activity. The Bank adjusted the Statutory Reserve Requirement to support financial intermediation activity. The MPC reduced the OPR to provide support to the economic environment At each of the January and March 2020 Monetary Policy Committee (MPC) meetings, the Overnight Policy Rate (OPR) was reduced by 25 basis points. More recently, at the May 2020 MPC meeting, the OPR was further reduced by 50 basis points to 2.00%. The ceiling and floor rates of the corridor for the OPR were correspondingly reduced to 2.25% and 1.75%, re- spectively. In total, the OPR has been reduced by 100 basis points this year. For Malaysia, domestic economic conditions have sim- ilarly been affected by the pandemic. The weak ex- ternal demand environment will exert a larger drag on domestic economic activity. The MCO, while nec- essary, has also constrained production capacity and spending. Labour market conditions are expected to weaken considerably. Economic conditions would be particularly challenging in the first half of the year. The fiscal stimulus measures, alongside monetary and financial measures will, however, offer some support to the economy. With more businesses allowed to oper- ate under the Conditional MCO, economic activity is projected to gradually improve. Global economic conditions have weakened signifi- cantly. Measures to contain the COVID-19 pan- demic have disrupted economic activity across most economies. Financial conditions have also tightened amid elevated risk aversion and uncertainty. Substan- tial policy stimuli introduced by many economies, cou- pled with the gradual easing of containment measures globally, would partially mitigate the economic impact of COVID-19. Growth prospects should improve in 2021 with the expected containment of the pandemic. Average headline inflation in 2020 is likely to be negative, due mainly to projections for substantially lower global oil prices. Underlying inflation is expected to be subdued given the projections of weaker domestic growth prospects and labour market conditions. BNM QB | 1Q 2020 The financial sector is sound, with financial insti- tutions operating with strong capital and liquidity buffers. Liquidity remains ample, augmented by liq- uidity injections by the Bank via various tools includ- ing outright purchases of government securities, re- verse repos and the reduction in the Statutory Reserve Requirement (SRR). The Bank stands ready to pro vide liquidity in the interbank market to ensure orderly market conditions, conducive to support financial in- termediation activity. Together, the total OPR reduction of 100 basis points, other monetary and financial measures undertaken by the Bank, as well as fiscal measures implemented this year will partly cushion the economic impact on busi- nesses and households and support the improvement in domestic economic activity. The MPC will continue to monitor the outlook for domestic growth and inflation. The Bank will utilise its policy levers as appropriate to create enabling conditions for a sustainable economic recovery. The Bank adjusted the SRR to support financial intermediation activity The Bank adjusted the SRR as part of the Bank's con- tinuous efforts to ensure sufficient liquidity to support financial intermediation activity. On 5 May 2020, the Bank announced that MGS and MGII can be used by all banking institutions to fully meet the SRR compliance effective 16 May 2020. This flexibility to the banking institutions is available until 31 May 2021. This measure will release approximately another RM16 billion worth of liquidity into the bank- ing system. On 19 March 2020, the Bank announced that the SRR ratio will be lowered by 100 basis points from 3.00% to 2.00% effective 20 March 2020. In addition to the SRR ratio reduction, each Principal Dealer is also able to recognise Malaysian Government Securities (MGS) and Malaysian Government Investment Issues (MGII) of up to RM1 billion as part of the SRR compliance. This flexibility to the Principal Dealers is available un- til 31 March 2021. These combined measures will re- lease approximately RM30 billion worth of liquidity into the banking system. The SRR is an instrument to manage liquidity and is not a signal on the stance of monetary policy. The OPR is the sole indicator used to signal the stance of monetary policy Policy Document (PD) on Anti-Money Laundering, Countering Financing of Terrorism and Targeted Financial Sanctions for Financial Institutions (AML/CFT and TFS for FIS) The PD came into effect on 1 January 2020 setting out the obligations of report- ing institutions with respect to requirements imposed under the Anti-Money Laundering, Anti-Terrorism Financing and Proceeds of Unlawful Activities Act 2001, requirements on reporting institutions in implementing a comprehensive risk-based approach in managing ML/TF risks, and targeted financial sanctions requirements on financial institutions regulated or supervised by the Bank. The PD is a revision and consolidation of the AML/CFT Sector 1 to Sector 4 policy documents. Exposure Draft (ED) on Corporate Strategic Plan (CSP) The ED was issued on 16 January 2020 on expectations of development financial institutions (DFIS) in developing business plans and funding strategies. The ED sets out (1) governance requirements to ensure effective implementation of the CSP; (2) key features of the CSP such as the Statement of Corporate Intent and Annual Funding Requirement; and (3) guidance on the implementation of the Performance Measurement Framework for DFIs. Exposure Draft (ED) on Recovery Planning The ED was issued on 17 January 2020, setting out key principles, requirements and supervisory expectations on the development and maintenance of recovery plans by financial institutions. Robust recovery plans are expected to enhance supervisability, recovery and resolvability of financial institutions. Policy Document (PD) on Domestic Systematically Important Banks (D-SIBs) Framework The PD was issued on 5 February 2020 to facilitate the identification of system- ically important banks (D-SIBs) whose distress or disorderly failure may cause significant disruption and result in adverse spillovers to the financial system and the economy. The PD addresses the following elements on D-SIBs: (1) Regulatory require- ments and policy measures that are applicable to D-SIBs, such as the capital surcharge above the minimum regulatory requirement to increase the bank's loss-absorbance capacity; (2) intensity of supervisory oversight by the Bank; and (3) macroprudential surveillance activities of the Bank. The PD on Capital Adequacy Framework (Capital Components) was updated on 5 February 2020 to incorporate the Higher Loss Absorbency requirement that is applicable to a D-SIB. Exposure Draft (ED) on Licensing Framework for Digital Banks The ED was updated on 3 March 2020 to incorporate further details on the sim- plified regulatory framework applicable to digital banks during the foundational phase. This includes, among others, the simplified requirements on capital adequacy and liquidity risk. Policy highlight Salient details A number of measures were announced on 25 and 27 March 2020 to assist individuals, SMEs and corporates affected by COVID-19. These include financial relief measures, regulatory and supervisory measures, and lending assistance. Among them were: Financial Relief Measures A 6-month deferment offered by banking institutions on all loan/financing re- payments (except credit card balances) of individuals and SMEs on 1 April 2020. An option provided to credit cardholders to convert their outstanding balances into a 3-year term loan at a lower interest/profit rate. An option for affected life policyholders and family takaful participants to defer premiums/contribution payments due for three months without affecting policy coverage, with effect from 1 April 2020. Flexibility provided by general insurers and takaful operators for policyhold- ers and takaful participants to meet premiums/contributions due, including by restructuring of policies/certificates. Expedited insurance and takaful claims processes related to COVID-19. Measures to Assist Individuals, SMEs and Corporates Affected by COVID-19 Regulatory and Supervisory Measures Flexibility for banking institutions to draw down on the capital conservation buffer of 2.5%, operate below minimum liquidity coverage ratio of 100% and utilise the regulatory reserves that were set aside during periods of strong loan growth. These buffers are expected to be restored within a reasonable period after 31 December 2020. Minimum Net Stable Funding Ratio requirement of 80%, effective on 1 July 2020. Banking institutions will be required to comply with the minimum requirements of 100% from 30 September 2021. Lowered interest rate (IRCC) and profit rate (PRCC) stress factor caps for in- surers and takaful operators from 40% to 30% starting 31 March 2020, to better reflect the prevailing market conditions. Lending facilities for SMEs BNM's Fund for SMEs (the Fund) was mobilised and bolstered to provide immediate relief for Malaysian SMEs to withstand the economic fallout from the pandemic. The Fund, totalling RM13.1 billion, includes three new facilities which are: Special Relief Facility (SRF) to help alleviate the short-term cash flow problems faced aflected SMEs; Agrofood Facility (AF) to increase food production for both domestic consump- tion and exports, and Automation and Digitalisation Facility (ADF) to incentivise SMEs to automate processes and digitalise operations to increase productivity. The Bank also reduced the maximum financing rates charged to SMEs. Highlights The MPC reduced the Overnight Policy Rate by 50 basis points to 2.00% at the May 2020 MPC meeting, to cushion the economic impact from COVID-19 and to support the improvement in economic activity. The Bank adjusted the Statutory Reserve Requirement to support financial intermediation activity. The MPC reduced the OPR to provide support to the economic environment At each of the January and March 2020 Monetary Policy Committee (MPC) meetings, the Overnight Policy Rate (OPR) was reduced by 25 basis points. More recently, at the May 2020 MPC meeting, the OPR was further reduced by 50 basis points to 2.00%. The ceiling and floor rates of the corridor for the OPR were correspondingly reduced to 2.25% and 1.75%, re- spectively. In total, the OPR has been reduced by 100 basis points this year. For Malaysia, domestic economic conditions have sim- ilarly been affected by the pandemic. The weak ex- ternal demand environment will exert a larger drag on domestic economic activity. The MCO, while nec- essary, has also constrained production capacity and spending. Labour market conditions are expected to weaken considerably. Economic conditions would be particularly challenging in the first half of the year. The fiscal stimulus measures, alongside monetary and financial measures will, however, offer some support to the economy. With more businesses allowed to oper- ate under the Conditional MCO, economic activity is projected to gradually improve. Global economic conditions have weakened signifi- cantly. Measures to contain the COVID-19 pan- demic have disrupted economic activity across most economies. Financial conditions have also tightened amid elevated risk aversion and uncertainty. Substan- tial policy stimuli introduced by many economies, cou- pled with the gradual easing of containment measures globally, would partially mitigate the economic impact of COVID-19. Growth prospects should improve in 2021 with the expected containment of the pandemic. Average headline inflation in 2020 is likely to be negative, due mainly to projections for substantially lower global oil prices. Underlying inflation is expected to be subdued given the projections of weaker domestic growth prospects and labour market conditions. BNM QB | 1Q 2020 The financial sector is sound, with financial insti- tutions operating with strong capital and liquidity buffers. Liquidity remains ample, augmented by liq- uidity injections by the Bank via various tools includ- ing outright purchases of government securities, re- verse repos and the reduction in the Statutory Reserve Requirement (SRR). The Bank stands ready to pro vide liquidity in the interbank market to ensure orderly market conditions, conducive to support financial in- termediation activity. Together, the total OPR reduction of 100 basis points, other monetary and financial measures undertaken by the Bank, as well as fiscal measures implemented this year will partly cushion the economic impact on busi- nesses and households and support the improvement in domestic economic activity. The MPC will continue to monitor the outlook for domestic growth and inflation. The Bank will utilise its policy levers as appropriate to create enabling conditions for a sustainable economic recovery. The Bank adjusted the SRR to support financial intermediation activity The Bank adjusted the SRR as part of the Bank's con- tinuous efforts to ensure sufficient liquidity to support financial intermediation activity. On 5 May 2020, the Bank announced that MGS and MGII can be used by all banking institutions to fully meet the SRR compliance effective 16 May 2020. This flexibility to the banking institutions is available until 31 May 2021. This measure will release approximately another RM16 billion worth of liquidity into the bank- ing system. On 19 March 2020, the Bank announced that the SRR ratio will be lowered by 100 basis points from 3.00% to 2.00% effective 20 March 2020. In addition to the SRR ratio reduction, each Principal Dealer is also able to recognise Malaysian Government Securities (MGS) and Malaysian Government Investment Issues (MGII) of up to RM1 billion as part of the SRR compliance. This flexibility to the Principal Dealers is available un- til 31 March 2021. These combined measures will re- lease approximately RM30 billion worth of liquidity into the banking system. The SRR is an instrument to manage liquidity and is not a signal on the stance of monetary policy. The OPR is the sole indicator used to signal the stance of monetary policy Policy Document (PD) on Anti-Money Laundering, Countering Financing of Terrorism and Targeted Financial Sanctions for Financial Institutions (AML/CFT and TFS for FIS) The PD came into effect on 1 January 2020 setting out the obligations of report- ing institutions with respect to requirements imposed under the Anti-Money Laundering, Anti-Terrorism Financing and Proceeds of Unlawful Activities Act 2001, requirements on reporting institutions in implementing a comprehensive risk-based approach in managing ML/TF risks, and targeted financial sanctions requirements on financial institutions regulated or supervised by the Bank. The PD is a revision and consolidation of the AML/CFT Sector 1 to Sector 4 policy documents. Exposure Draft (ED) on Corporate Strategic Plan (CSP) The ED was issued on 16 January 2020 on expectations of development financial institutions (DFIS) in developing business plans and funding strategies. The ED sets out (1) governance requirements to ensure effective implementation of the CSP; (2) key features of the CSP such as the Statement of Corporate Intent and Annual Funding Requirement; and (3) guidance on the implementation of the Performance Measurement Framework for DFIs. Exposure Draft (ED) on Recovery Planning The ED was issued on 17 January 2020, setting out key principles, requirements and supervisory expectations on the development and maintenance of recovery plans by financial institutions. Robust recovery plans are expected to enhance supervisability, recovery and resolvability of financial institutions. Policy Document (PD) on Domestic Systematically Important Banks (D-SIBs) Framework The PD was issued on 5 February 2020 to facilitate the identification of system- ically important banks (D-SIBs) whose distress or disorderly failure may cause significant disruption and result in adverse spillovers to the financial system and the economy. The PD addresses the following elements on D-SIBs: (1) Regulatory require- ments and policy measures that are applicable to D-SIBs, such as the capital surcharge above the minimum regulatory requirement to increase the bank's loss-absorbance capacity; (2) intensity of supervisory oversight by the Bank; and (3) macroprudential surveillance activities of the Bank. The PD on Capital Adequacy Framework (Capital Components) was updated on 5 February 2020 to incorporate the Higher Loss Absorbency requirement that is applicable to a D-SIB. Exposure Draft (ED) on Licensing Framework for Digital Banks The ED was updated on 3 March 2020 to incorporate further details on the sim- plified regulatory framework applicable to digital banks during the foundational phase. This includes, among others, the simplified requirements on capital adequacy and liquidity risk. Policy highlight Salient details A number of measures were announced on 25 and 27 March 2020 to assist individuals, SMEs and corporates affected by COVID-19. These include financial relief measures, regulatory and supervisory measures, and lending assistance. Among them were: Financial Relief Measures A 6-month deferment offered by banking institutions on all loan/financing re- payments (except credit card balances) of individuals and SMEs on 1 April 2020. An option provided to credit cardholders to convert their outstanding balances into a 3-year term loan at a lower interest/profit rate. An option for affected life policyholders and family takaful participants to defer premiums/contribution payments due for three months without affecting policy coverage, with effect from 1 April 2020. Flexibility provided by general insurers and takaful operators for policyhold- ers and takaful participants to meet premiums/contributions due, including by restructuring of policies/certificates. Expedited insurance and takaful claims processes related to COVID-19. Measures to Assist Individuals, SMEs and Corporates Affected by COVID-19 Regulatory and Supervisory Measures Flexibility for banking institutions to draw down on the capital conservation buffer of 2.5%, operate below minimum liquidity coverage ratio of 100% and utilise the regulatory reserves that were set aside during periods of strong loan growth. These buffers are expected to be restored within a reasonable period after 31 December 2020. Minimum Net Stable Funding Ratio requirement of 80%, effective on 1 July 2020. Banking institutions will be required to comply with the minimum requirements of 100% from 30 September 2021. Lowered interest rate (IRCC) and profit rate (PRCC) stress factor caps for in- surers and takaful operators from 40% to 30% starting 31 March 2020, to better reflect the prevailing market conditions. Lending facilities for SMEs BNM's Fund for SMEs (the Fund) was mobilised and bolstered to provide immediate relief for Malaysian SMEs to withstand the economic fallout from the pandemic. The Fund, totalling RM13.1 billion, includes three new facilities which are: Special Relief Facility (SRF) to help alleviate the short-term cash flow problems faced aflected SMEs; Agrofood Facility (AF) to increase food production for both domestic consump- tion and exports, and Automation and Digitalisation Facility (ADF) to incentivise SMEs to automate processes and digitalise operations to increase productivity. The Bank also reduced the maximum financing rates charged to SMEsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started