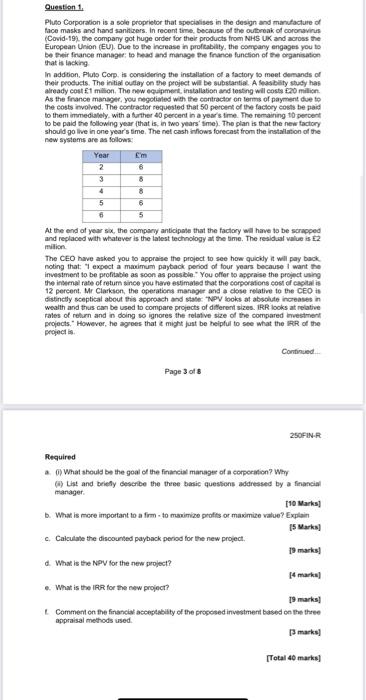

Question 1 Pluto Corporation is a sole proprietor that specialises in the design and manufacture of face masks and hand Sanitizers. In recent time because of the outbreak of coronavirus (Covid-19), the company got huge order for their products from NHS UK and across the European Union (EU). Due to the increase in profitability, the company engages you to be the finance manager to head and manage the finance function of the organisation that is taking In addition, Pluto Corp. is considering the installation of a factory to meet demands of their products. The niti tay on the project wil be substantial. A feasibility study has As the the costs involved. The contractor requested that 50 percent of the factory costs be paid to be paid the following year that is in two years' ime). The plan is that the new factory should go live in one years time. The net cash flows forecast from the installation of the new systems are as follows: Year 6 2 3 4 5 8 6 5 At the end of years, the company anticipate that the factory will have to be scrapped and replaced with whatever is the latest technology at the time. The residual value is E2 milion The CEO have asked you to appraise the project to see how quickly it will pay back noting that expect a maximum payback period of four years because I want the investment to be profitable as soon as possible. You offer to appraise the project using the internal rate of retum since you have estimated that the corporations cost of capital is 12 percent. Mr Clarkson, the operation manager and a close relative to the CEO is distinctly sceptical about this approach and state NPV books at absoluto increases in wealth and thus can be used to compare projects of different sizes. IRR looks at relative tates of return and in doing so ignore the relative size of the compared westment projects. However, he agrees that might just be helpful to to see what the IRR of the project is Continued Page 3 of 8 250FINR Required a. What should be the goal of the financial manager of a corporation? Why List and briefly describe the three basic questions addressed by a financial manager 110 Marks What is more important to a fim . to maximize profits or maximize value? Explain 15 Marks c. Calculate the discounted payback period for the new project. 19 marks What is the NPV for the new project? (4 marks] .. What is the IRR for the new project? 19 marks Comment on the financial acceptability of the proposed investment based on the three appraisal methods used mark [Total 40 marks]