Question

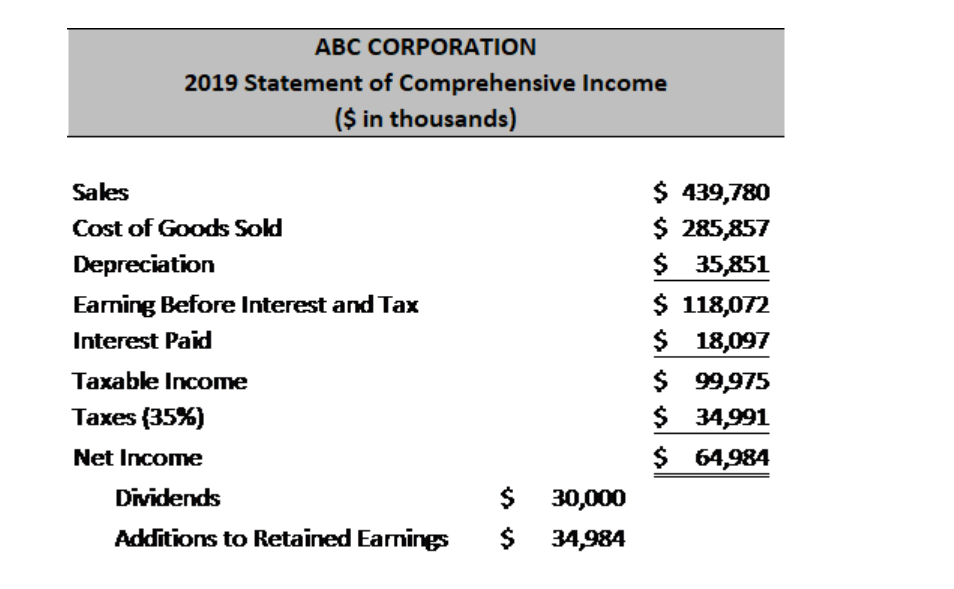

Question 1: Prepare the common size Statement of Comprehensive Income for 2019. (5 pts) Question 2: For 2019, calculate the Cash Flow from Assets, Cash

Question 1: Prepare the common size Statement of Comprehensive Income for 2019. (5 pts)

Question 2: For 2019, calculate the Cash Flow from Assets, Cash Flow from Creditors, and Cash Flow to Shareholders. Show that the cash flow identity holds. (11 pts)

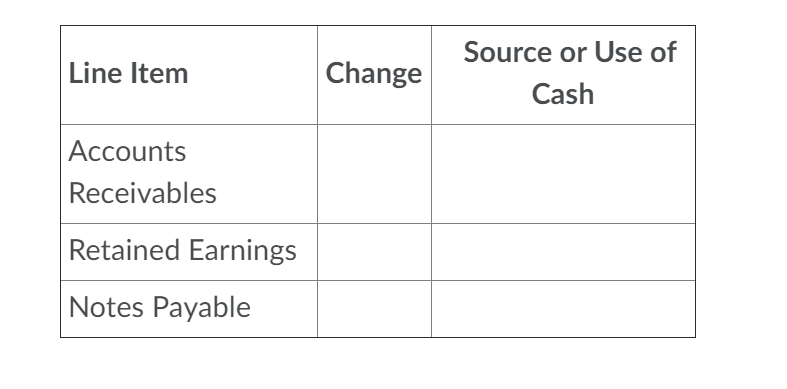

Question 3: Calculate the dollar change for the following line items from 2018 to 2019, and state whether the change represents a source or use of cash. (3 pts)

Question 4: For 2019, calculate the following ratios and in one sentence, provide an interpretation of the value. (10 pts)

- Current Ratio

- Total Asset Turnover

- Total Debt Ratio

- Profit Margin

- Interest Coverage

Question 5: Use the Du Pont Identity to calculate the Return on Equity for 2019 (3 pts)

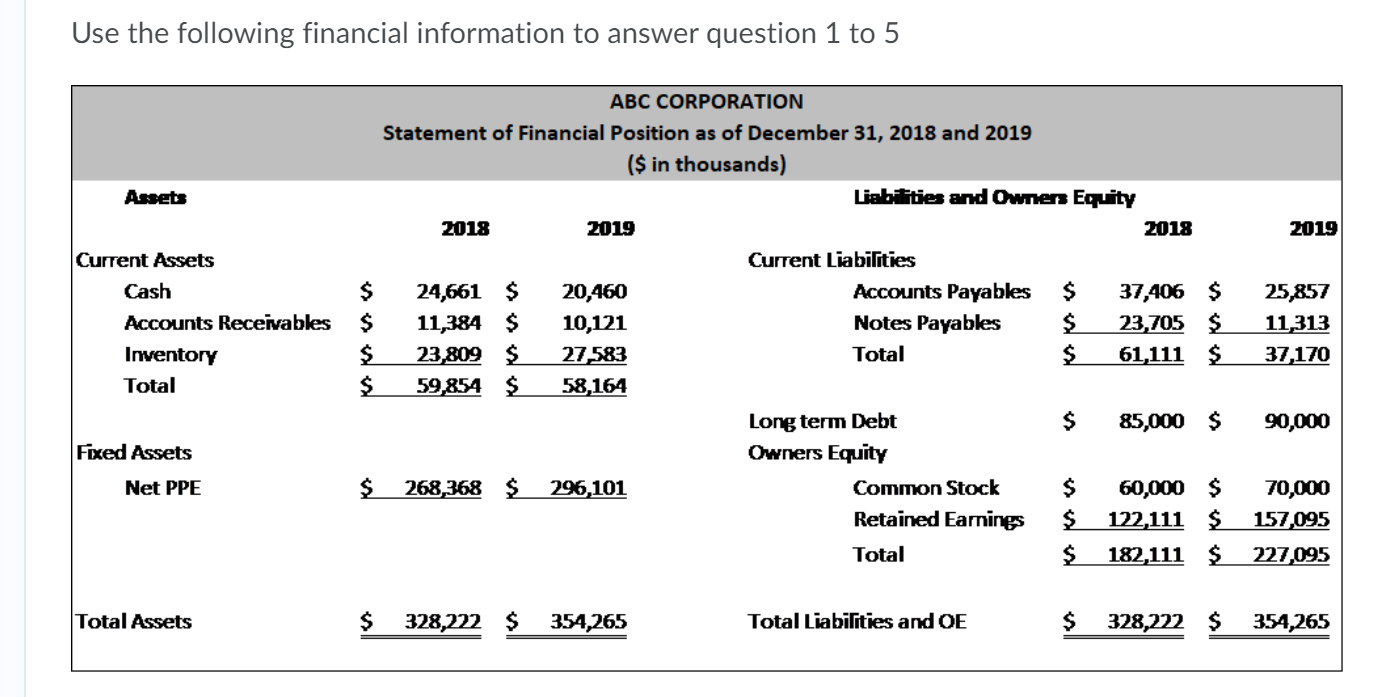

Use the following financial information to answer question 1 to 5 Assets 2019 Current Assets Cash Accounts Receivables Inventory Total $ $ $ $ ABC CORPORATION Statement of Financial Position as of December 31, 2018 and 2019 ($ in thousands) Liabilities and Owners Equity 2018 2019 2018 Current Liabilities 24,661 $ 20,460 Accounts Payables $ 37,406 $ 11,384 $ 10,121 Notes Payables $ 23,705 $ 23,809 $ 27 583 Total $ 61,111 $ 59,854 $ 58,164 Long term Debt $ 85,000 $ Owners Equity 268,368 $ 296, 101 Common Stock $ 60,000 $ Retained Earnings $ 122,111 $ Total $ 182,111 $ 25,857 11,313 37,170 90,000 Fixed Assets Net PPE $ 70,000 157,095 227,095 Total Assets $ 328,222 $ 354,265 Total Liabilities and OE $ 328,222 $ 354,265 ABC CORPORATION 2019 Statement of Comprehensive Income ($ in thousands) Sales Cost of Goods Sold Depreciation Earning Before Interest and Tax Interest Paid $ 439,780 $ 285,857 $ 35,851 $ 118,072 $ 18,097 $ 99,975 $ 34,991 $ 64,984 Taxable income Taxes (35%) Net Income Dividends Additions to Retained Earnings $ $ 30,000 34,984 Line Item Change Source or Use of Cash Accounts Receivables Retained Earnings Notes PayableStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started