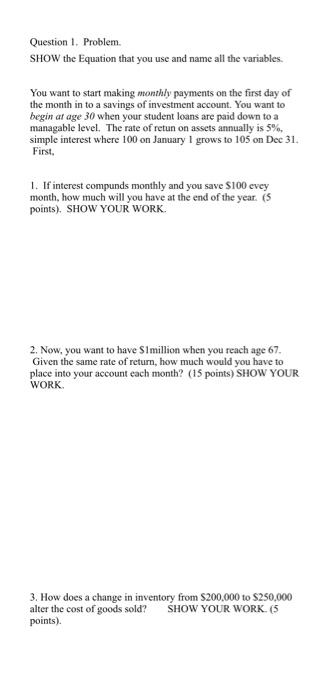

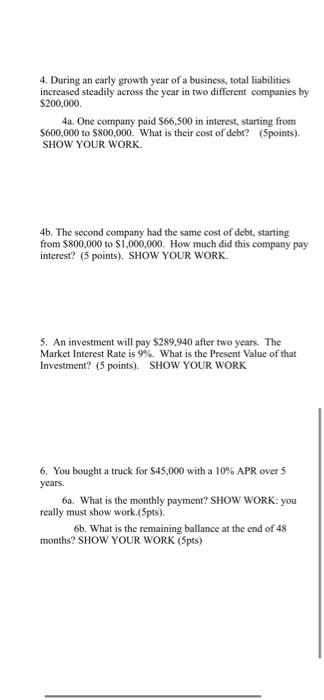

Question 1. Problem. SHOW the Equation that you use and name all the variables. You want to start making monthly payments on the first day of the month in to a savings of investment account. You want to begin at age 30 when your student loans are paid down to a managable level. The rate of retun on assets annually is 5%, simple interest where 100 on January 1 grows to 105 on Dec 31. First, 1. If interest compunds monthly and you save $100 evey month, how much will you have at the end of the year. (5 points). SHOW YOUR WORK. 2. Now, you want to have $1million when you reach age 67. Given the same rate of return, how much would you have to place into your account each month? (15 points) SHOW YOUR WORK. 3. How does a change in inventory from $200,000 to $250,000 alter the cost of goods sold? SHOW YOUR WORK. (5 points). 4. During an early growth year of a business, total liabilities increased steadily across the year in two different companies by $200,000. 4a. One company paid $66,500 in interest, starting from $600,000 to $800,000. What is their cost of debt? (Spoints). SHOW YOUR WORK. 4b. The second company had the same cost of debt, starting from $800,000 to $1,000,000. How much did this company pay. interest? (5 points). SHOW YOUR WORK. 5. An investment will pay $289,940 after two years. The Market Interest Rate is 9%. What is the Present Value of that Investment? (5 points). SHOW YOUR WORK 6. You bought a truck for $45,000 with a 10% APR over 5 years. 6a. What is the monthly payment? SHOW WORK: you really must show work.(5pts). 6b. What is the remaining ballance at the end of 48 months? SHOW YOUR WORK (5pts) Question 1. Problem. SHOW the Equation that you use and name all the variables. You want to start making monthly payments on the first day of the month in to a savings of investment account. You want to begin at age 30 when your student loans are paid down to a managable level. The rate of retun on assets annually is 5%, simple interest where 100 on January 1 grows to 105 on Dec 31. First, 1. If interest compunds monthly and you save $100 evey month, how much will you have at the end of the year. (5 points). SHOW YOUR WORK. 2. Now, you want to have $1million when you reach age 67. Given the same rate of return, how much would you have to place into your account each month? (15 points) SHOW YOUR WORK. 3. How does a change in inventory from $200,000 to $250,000 alter the cost of goods sold? SHOW YOUR WORK. (5 points). 4. During an early growth year of a business, total liabilities increased steadily across the year in two different companies by $200,000. 4a. One company paid $66,500 in interest, starting from $600,000 to $800,000. What is their cost of debt? (Spoints). SHOW YOUR WORK. 4b. The second company had the same cost of debt, starting from $800,000 to $1,000,000. How much did this company pay. interest? (5 points). SHOW YOUR WORK. 5. An investment will pay $289,940 after two years. The Market Interest Rate is 9%. What is the Present Value of that Investment? (5 points). SHOW YOUR WORK 6. You bought a truck for $45,000 with a 10% APR over 5 years. 6a. What is the monthly payment? SHOW WORK: you really must show work.(5pts). 6b. What is the remaining ballance at the end of 48 months? SHOW YOUR WORK (5pts)