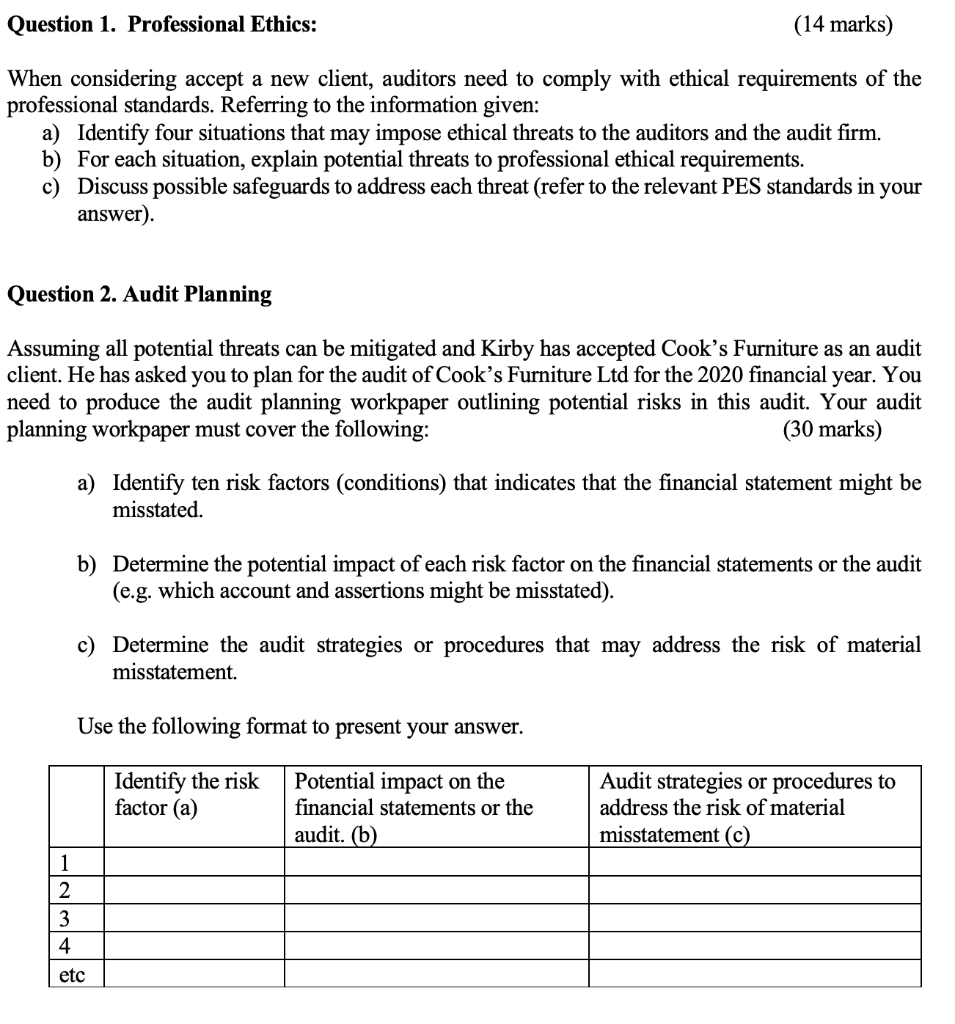

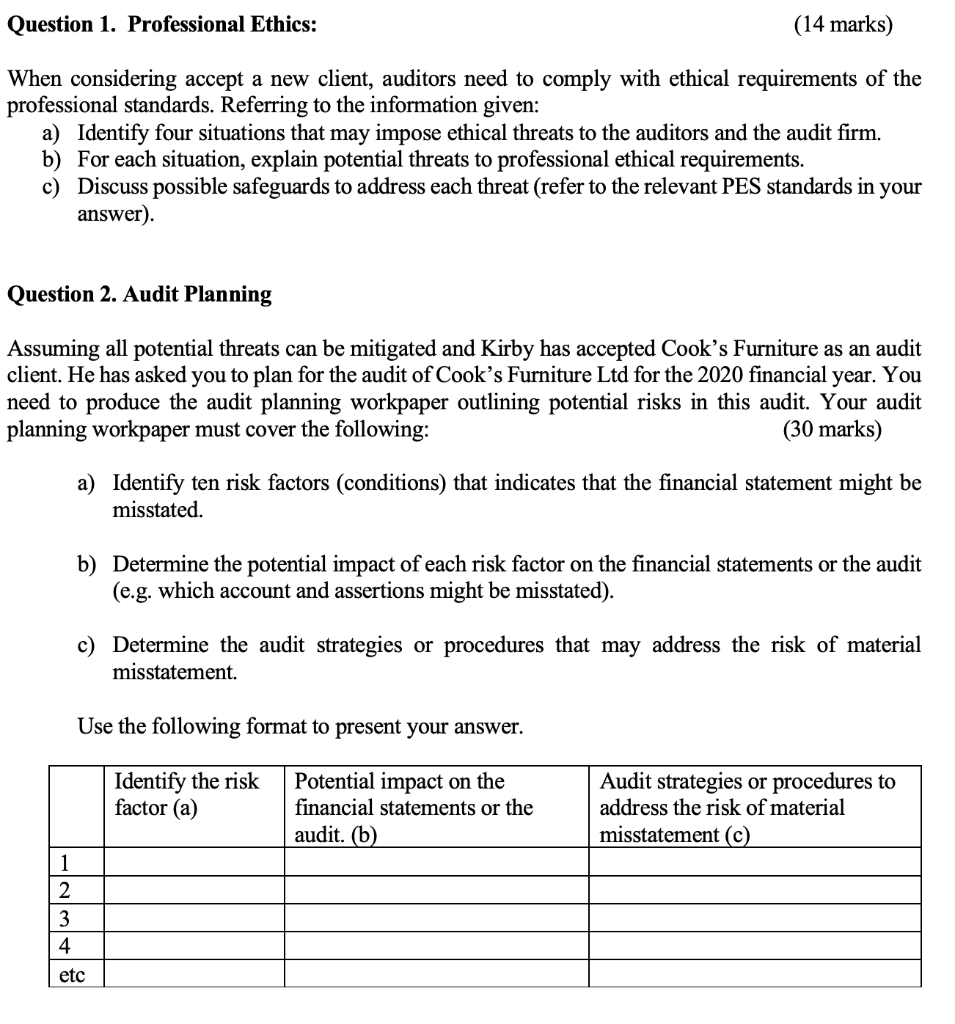

Question 1. Professional Ethics: (14 marks) When considering accept a new client, auditors need to comply with ethical requirements of the professional standards. Referring to the information given: a) Identify four situations that may impose ethical threats to the auditors and the audit firm. b) For each situation, explain potential threats to professional ethical requirements. c) Discuss possible safeguards to address each threat (refer to the relevant PES standards in your answer) Question 2. Audit Planning Assuming all potential threats can be mitigated and Kirby has accepted Cook's Furniture as an audit client. He has asked you to plan for the audit of Cook's Furniture Ltd for the 2020 financial year. You need to produce the audit planning workpaper outlining potential risks in this audit. Your audit planning workpaper must cover the following: (30 marks) a) Identify ten risk factors (conditions) that indicates that the financial statement might be misstated. b) Determine the potential impact of each risk factor on the financial statements or the audit (e.g. which account and assertions might be misstated). c) Determine the audit strategies or procedures that may address the risk of material misstatement. Use the following format to present your answer. Identify the risk factor (a) Potential impact on the financial statements or the audit. (b) Audit strategies or procedures to address the risk of material misstatement (C) 2 3 4 etc Question 1. Professional Ethics: (14 marks) When considering accept a new client, auditors need to comply with ethical requirements of the professional standards. Referring to the information given: a) Identify four situations that may impose ethical threats to the auditors and the audit firm. b) For each situation, explain potential threats to professional ethical requirements. c) Discuss possible safeguards to address each threat (refer to the relevant PES standards in your answer) Question 2. Audit Planning Assuming all potential threats can be mitigated and Kirby has accepted Cook's Furniture as an audit client. He has asked you to plan for the audit of Cook's Furniture Ltd for the 2020 financial year. You need to produce the audit planning workpaper outlining potential risks in this audit. Your audit planning workpaper must cover the following: (30 marks) a) Identify ten risk factors (conditions) that indicates that the financial statement might be misstated. b) Determine the potential impact of each risk factor on the financial statements or the audit (e.g. which account and assertions might be misstated). c) Determine the audit strategies or procedures that may address the risk of material misstatement. Use the following format to present your answer. Identify the risk factor (a) Potential impact on the financial statements or the audit. (b) Audit strategies or procedures to address the risk of material misstatement (C) 2 3 4 etc