Question

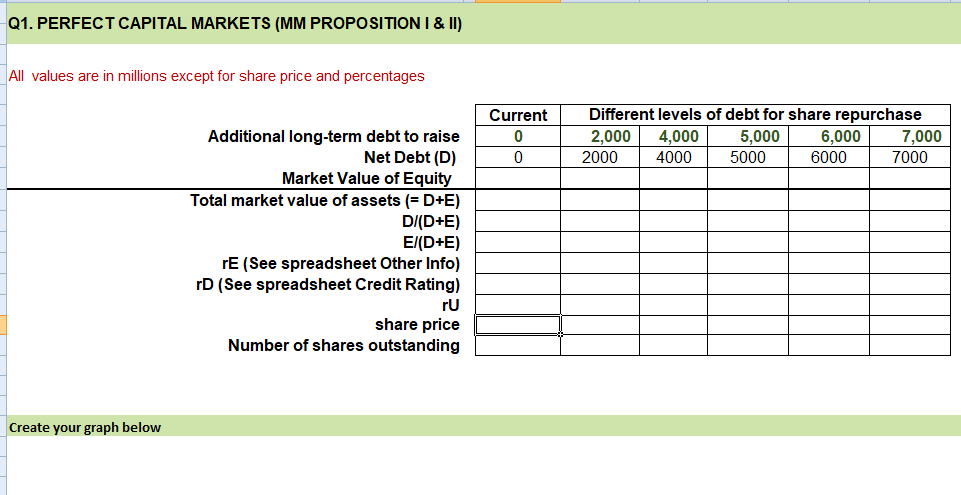

Question 1 (Q1) The basic theory of capital structure In perfect capital markets, what is the relationship between capital structure and cost of capital (WACC)?

Question 1 (Q1) The basic theory of capital structure In perfect capital markets, what is the relationship between capital structure and cost of capital (WACC)? Use the famous Miller-Modigliani proposition I and II, and WWJ as an example to explain this thoroughly.

Tips:

1. Complete the table in Excel spreadsheet Q1 Perfect Mkt.

2. Draw a chart using debt level (D) against rE and WACC to support the discussion of MM proposition I and II. (Paste the chart in appendix.)

3. Show your calculations for each variable in row (6) to (15) using debt = $3 billion.

Other information:

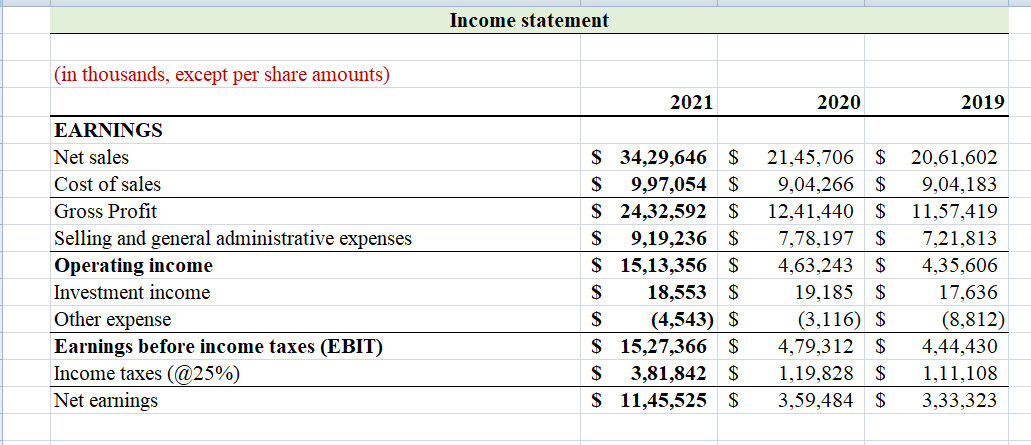

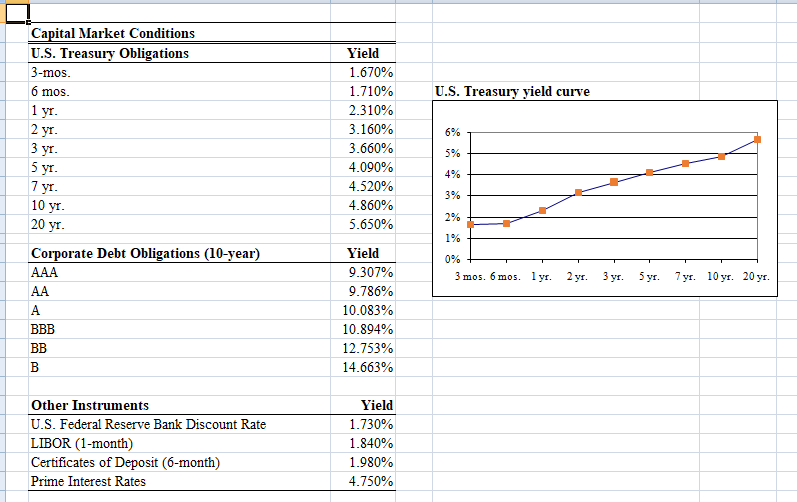

Propose tax rate: 25%

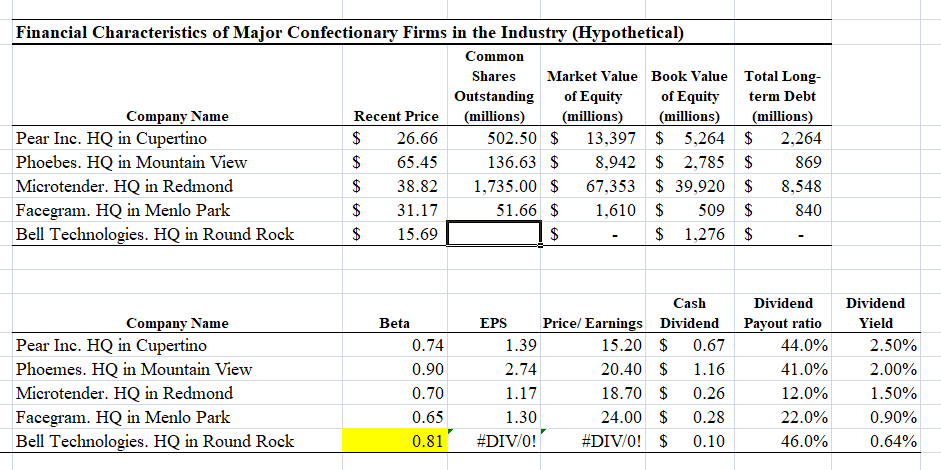

Market risk premium = (rm - rf) = 7%

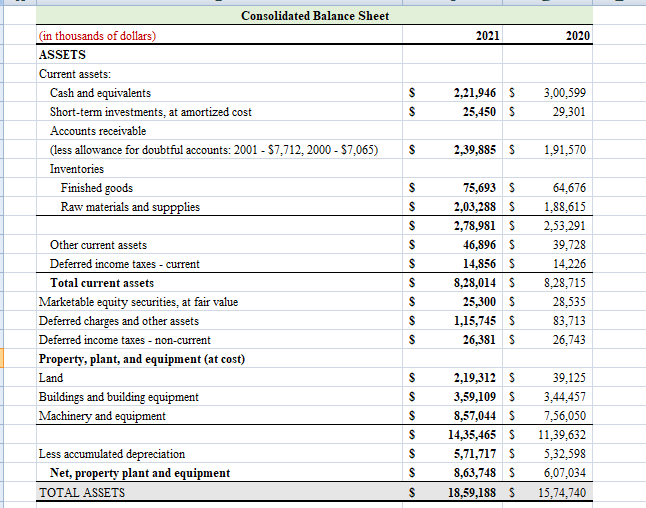

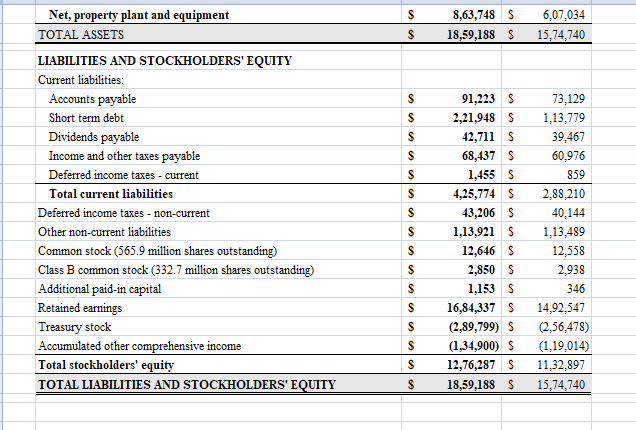

Instead of using total debt, we use net debt here to eliminate the complication from cash, that is, D = (Long-term debt + Short-term debt) Cash & Equivalents. The total number of shares outstanding = common stock + Class B common stock. The cost of debt (rD) is fixed for the life of the debt. While figures given in financial statements are in thousands, for simplicity, all numbers you calculate in the spreadsheet (Q1 to Q4) should be in millions with no decimal place, except for percentages and share prices, where two decimal places are needed.

Q1. PERFECT CAPITAL MARKETS (MM PROPOSITION I \& II) All values are in millions except for share price and percentages Income statement (in thousands, except per share amounts) Consolidated Balance Sheet \begin{tabular}{lrrrr} Net, property plant and equipment & $ & 8,63,748 & $ & 6,07,034 \\ \hline TOTAL ASSETS & $ & 18,59,188 & $ & 15,74,740 \\ \hline \end{tabular} LIABILITIES AND STOCKHOLDERS' EQUTTY Current liabilities: Q1. PERFECT CAPITAL MARKETS (MM PROPOSITION I \& II) All values are in millions except for share price and percentages Income statement (in thousands, except per share amounts) Consolidated Balance Sheet \begin{tabular}{lrrrr} Net, property plant and equipment & $ & 8,63,748 & $ & 6,07,034 \\ \hline TOTAL ASSETS & $ & 18,59,188 & $ & 15,74,740 \\ \hline \end{tabular} LIABILITIES AND STOCKHOLDERS' EQUTTY Current liabilities

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started