question 1

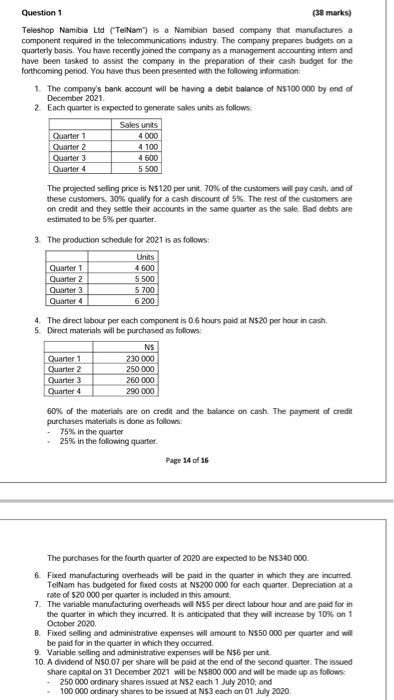

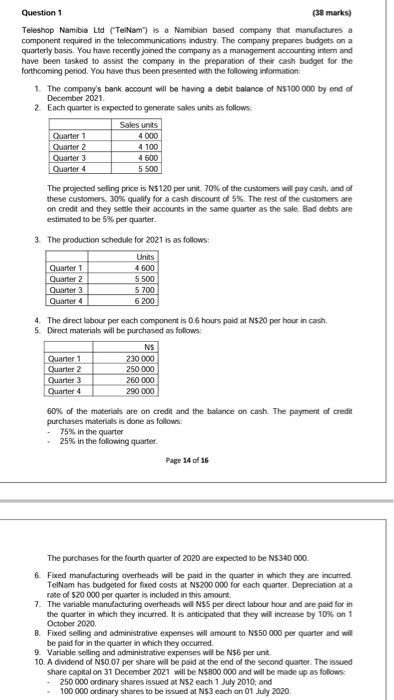

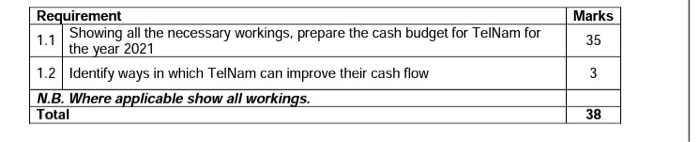

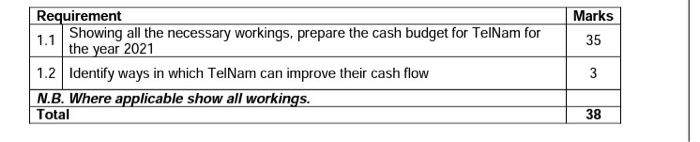

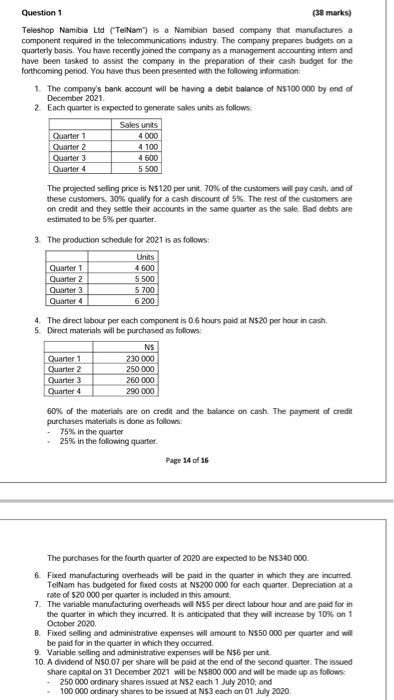

Question 1 (38 marks) Teleshop Namibia Lid (TelNam") is a Namibian based company that manufactures a component required in the telecommunications industry. The company prepares budgets on a quarterly basis. You have recently joined the company as a management accounting intern and have been tasked to assist the company in the preparation of their cash budget for the forthcoming period. You have thus been presented with the following information: 1. The company's bank account will be having a debit balance of NS 100 000 by end of December 2021 2. Each quarter is expected to generate sales units as follows: Sales units Quarter 1 4000 Quarter 2 4 100 Quarter 3 4 600 Quarter 4 5 500 The projected selling price is N$120 per unit. 70% of the customers will pay cash, and of these customers, 30% qualify for a cash discount of 5%. The rest of the customers are on credit and they settle their accounts in the same quarter as the sale. Bad debts are estimated to be 5% per quarter. 3. The production schedule for 2021 is as follows: Units Quarter 1 4600 Quarter 2 5500 Quarter 3 5 700 Quarter 4 6 200 4. The direct labour per each component is 0.6 hours paid at N$20 per hour in cash. 5. Direct materials will be purchased as follows: NS Quarter 1 230 000 Quarter 2 250 000 Quarter 3 260 000 Quarter 4 290 000 60% of the materials are on credit and the balance on cash. The payment of credit purchases materials is done as follows: 75% in the quarter 25% in the following quarter. Page 14 of 16 The purchases for the fourth quarter of 2020 are expected to be N5340 000 6. Fixed manufacturing overheads will be paid in the quarter in which they are incurred. TelNam has budgeted for foed costs at NS200 000 for each quarter. Depreciation at a rate of 520 000 per quarter is included in this amount. 7. The variable manufacturing overheads wil NSS per direct labour hour and are paid for in the quarter in which they incurred. It is anticipated that they will increase by 10% on 1 October 2020 & Fixed selling and administrative expenses will amount to NS50 000 per quarter and will be paid for in the quarter in which they occurred. 9. Variable selling and administrative expenses will be NSG per unit. 10. A dividend of NSO.07 per share will be paid at the end of the second quarter. The issued share capital on 31 December 2021 will be NS 800 000 and will be made up as follows: 250 000 ordinary shares issued at $2 each 1 July 2010, and 100 000 ordinary shares to be issued at $3 each on 01 July 2020 Marks 35 Requirement 1.1 Showing all the necessary workings, prepare the cash budget for TelNam for the year 2021 1.2 Identify ways in which TelNam can improve their cash flow N.B. Where applicable show all workings. Total 3 38 Marks 35 Requirement 1.1 Showing all the necessary workings, prepare the cash budget for TelNam for the year 2021 1.2 Identify ways in which TelNam can improve their cash flow N.B. Where applicable show all workings. Total 3 38 Question 1 (38 marks) Teleshop Namibia Lid (TelNam") is a Namibian based company that manufactures a component required in the telecommunications industry. The company prepares budgets on a quarterly basis. You have recently joined the company as a management accounting intern and have been tasked to assist the company in the preparation of their cash budget for the forthcoming period. You have thus been presented with the following information: 1. The company's bank account will be having a debit balance of NS 100 000 by end of December 2021 2. Each quarter is expected to generate sales units as follows: Sales units Quarter 1 4000 Quarter 2 4 100 Quarter 3 4 600 Quarter 4 5 500 The projected selling price is N$120 per unit. 70% of the customers will pay cash, and of these customers, 30% qualify for a cash discount of 5%. The rest of the customers are on credit and they settle their accounts in the same quarter as the sale. Bad debts are estimated to be 5% per quarter. 3. The production schedule for 2021 is as follows: Units Quarter 1 4600 Quarter 2 5500 Quarter 3 5 700 Quarter 4 6 200 4. The direct labour per each component is 0.6 hours paid at N$20 per hour in cash. 5. Direct materials will be purchased as follows: NS Quarter 1 230 000 Quarter 2 250 000 Quarter 3 260 000 Quarter 4 290 000 60% of the materials are on credit and the balance on cash. The payment of credit purchases materials is done as follows: 75% in the quarter 25% in the following quarter. Page 14 of 16 The purchases for the fourth quarter of 2020 are expected to be N5340 000 6. Fixed manufacturing overheads will be paid in the quarter in which they are incurred. TelNam has budgeted for foed costs at NS200 000 for each quarter. Depreciation at a rate of 520 000 per quarter is included in this amount. 7. The variable manufacturing overheads wil NSS per direct labour hour and are paid for in the quarter in which they incurred. It is anticipated that they will increase by 10% on 1 October 2020 & Fixed selling and administrative expenses will amount to NS50 000 per quarter and will be paid for in the quarter in which they occurred. 9. Variable selling and administrative expenses will be NSG per unit. 10. A dividend of NSO.07 per share will be paid at the end of the second quarter. The issued share capital on 31 December 2021 will be NS 800 000 and will be made up as follows: 250 000 ordinary shares issued at $2 each 1 July 2010, and 100 000 ordinary shares to be issued at $3 each on 01 July 2020 Marks 35 Requirement 1.1 Showing all the necessary workings, prepare the cash budget for TelNam for the year 2021 1.2 Identify ways in which TelNam can improve their cash flow N.B. Where applicable show all workings. Total 3 38 Marks 35 Requirement 1.1 Showing all the necessary workings, prepare the cash budget for TelNam for the year 2021 1.2 Identify ways in which TelNam can improve their cash flow N.B. Where applicable show all workings. Total 3 38