Question 1

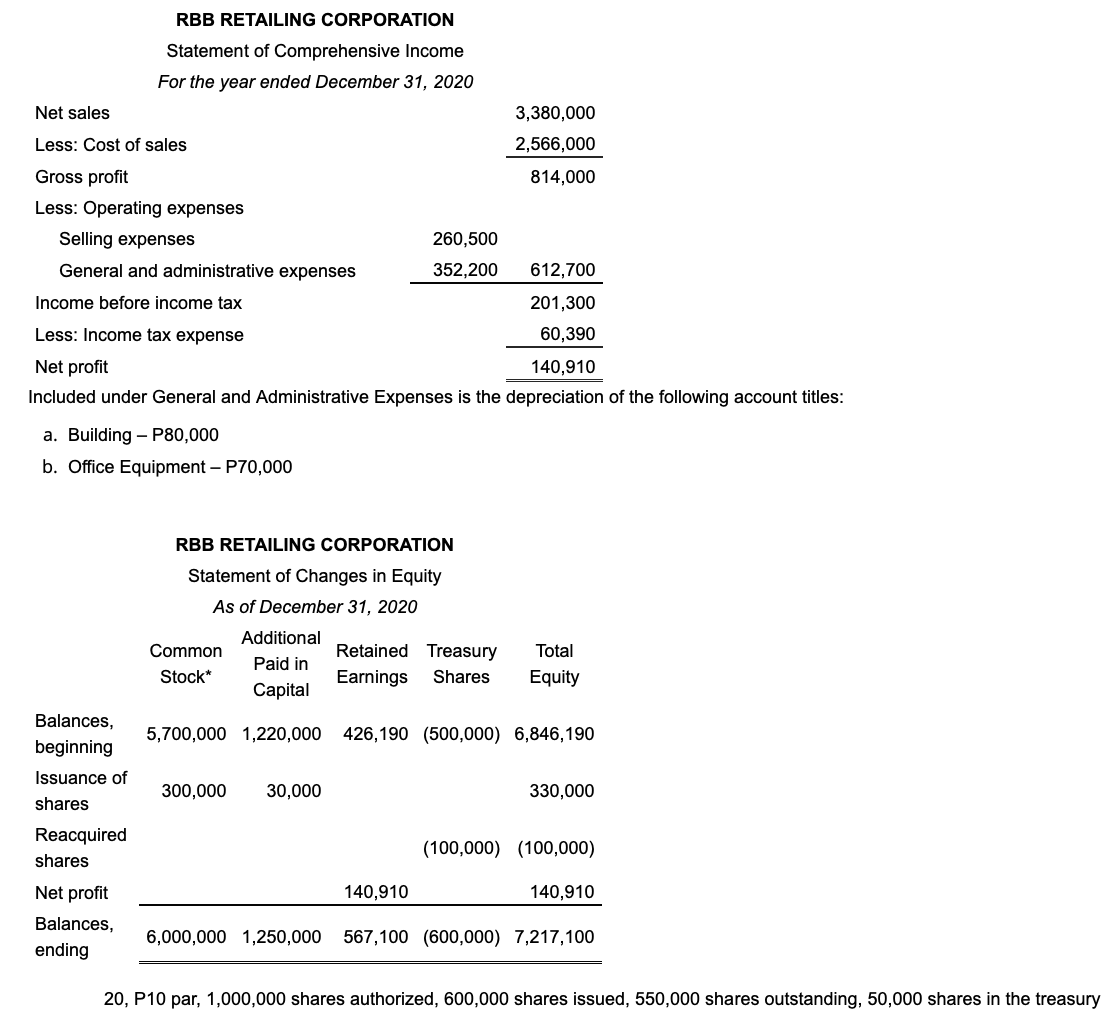

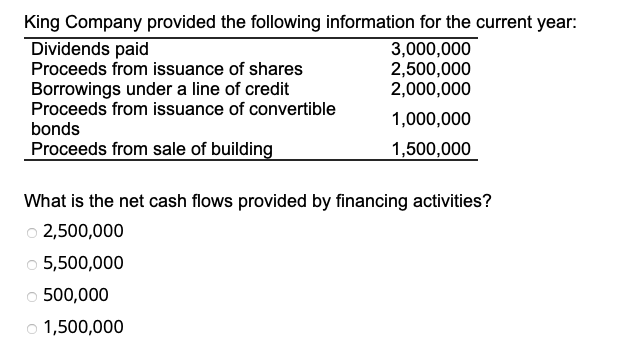

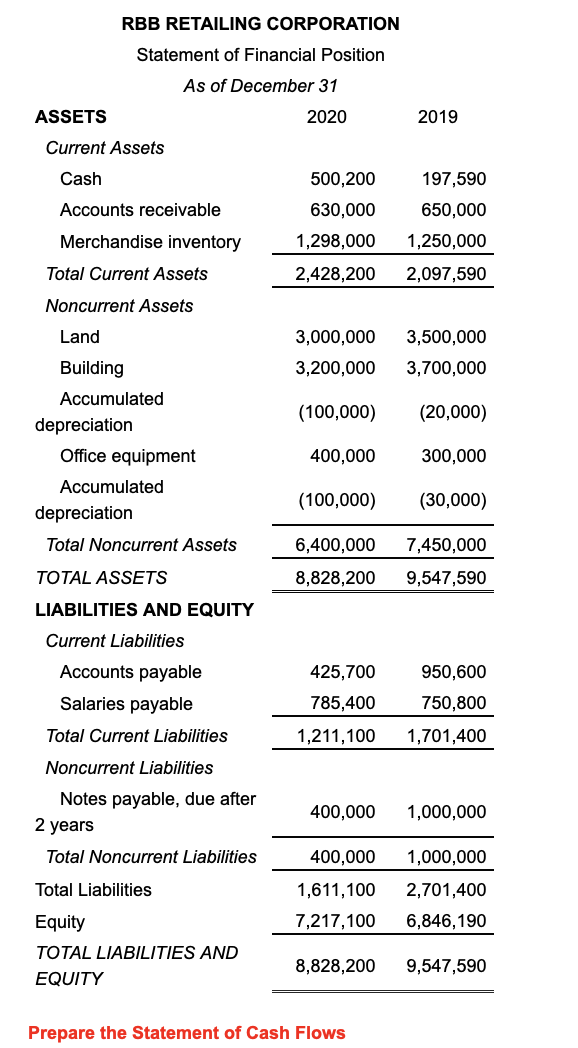

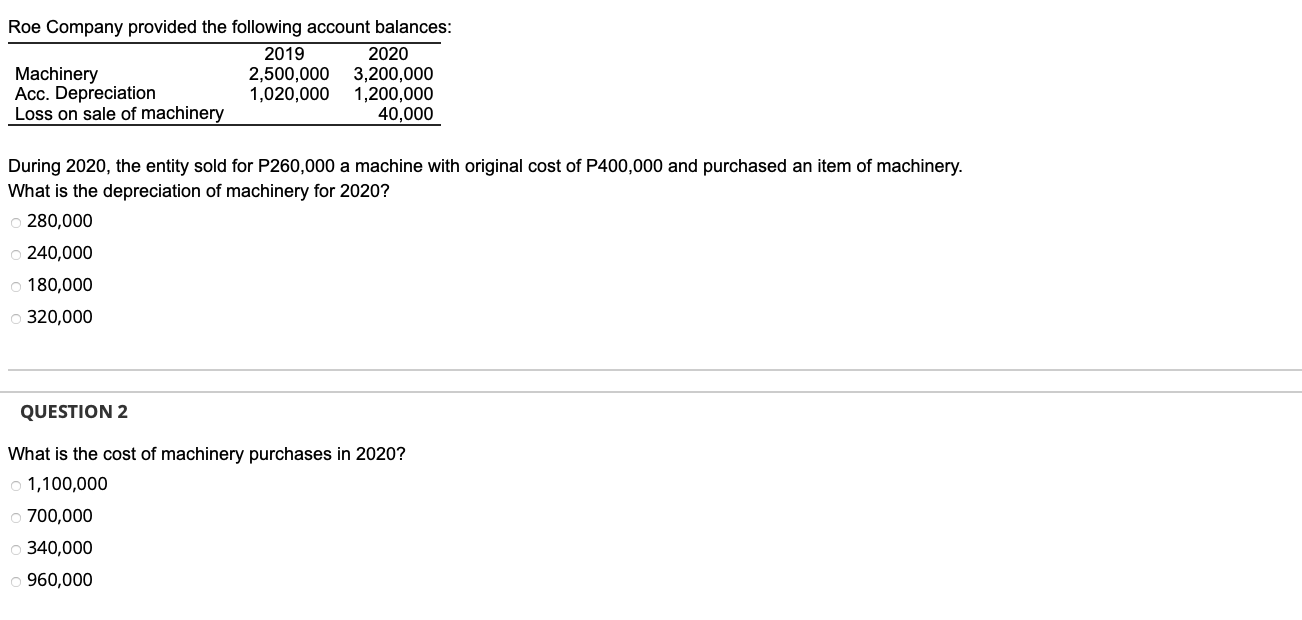

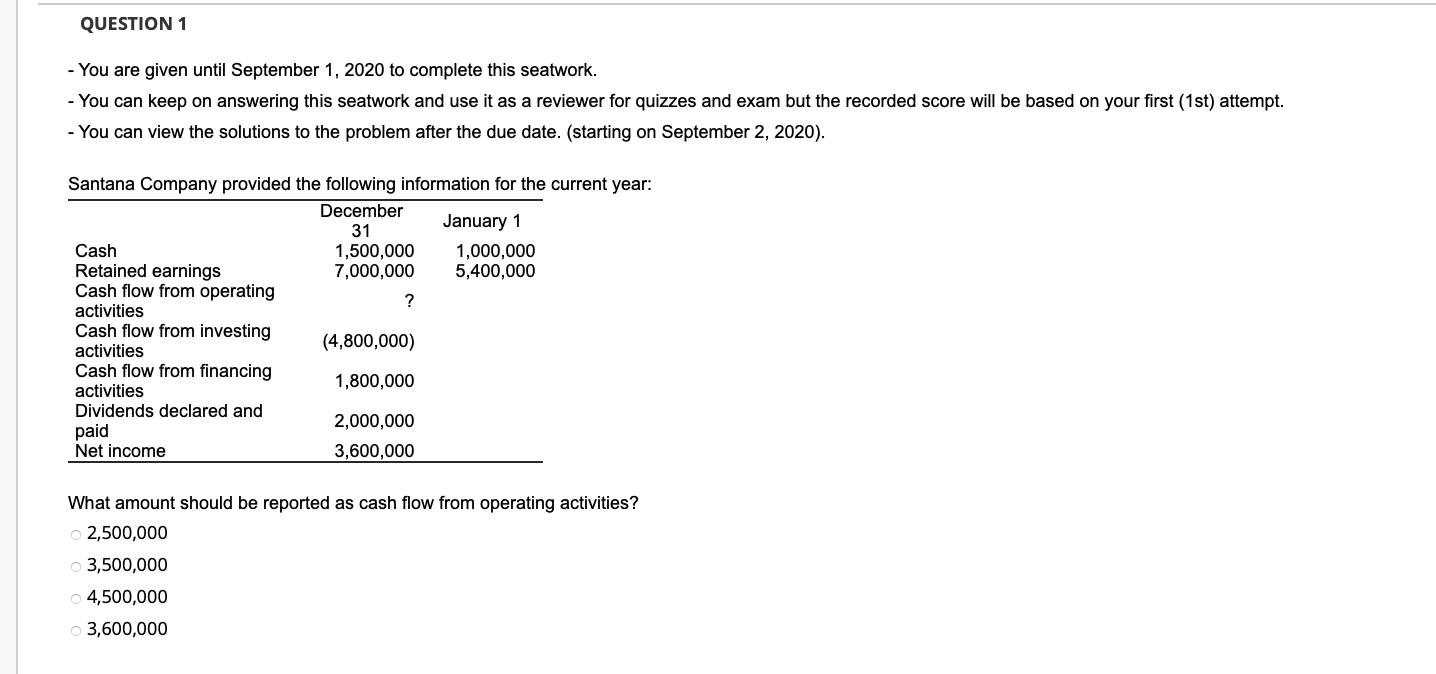

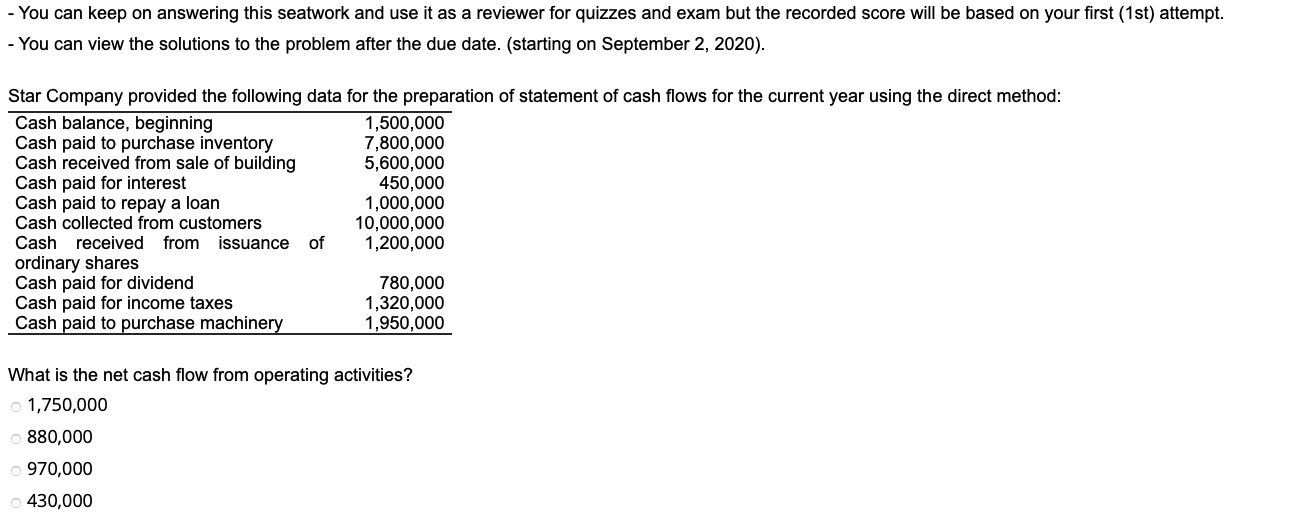

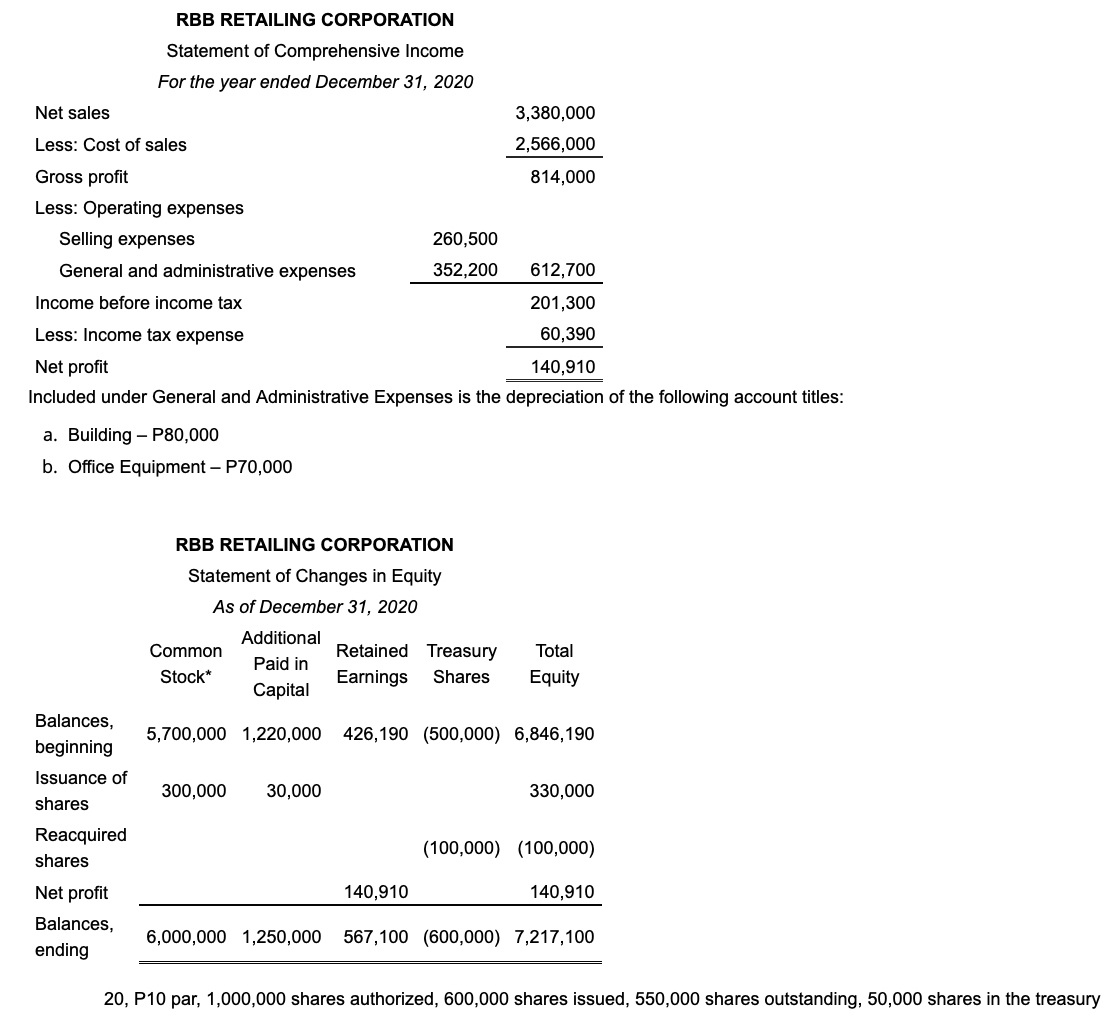

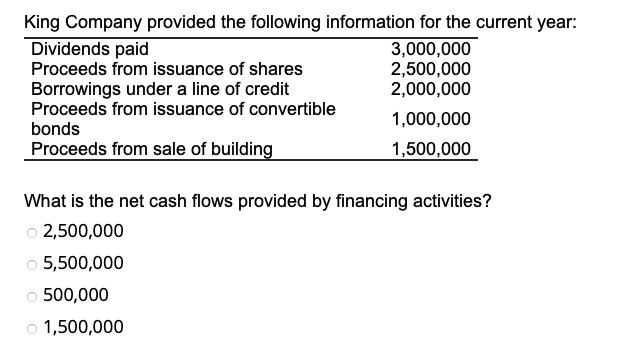

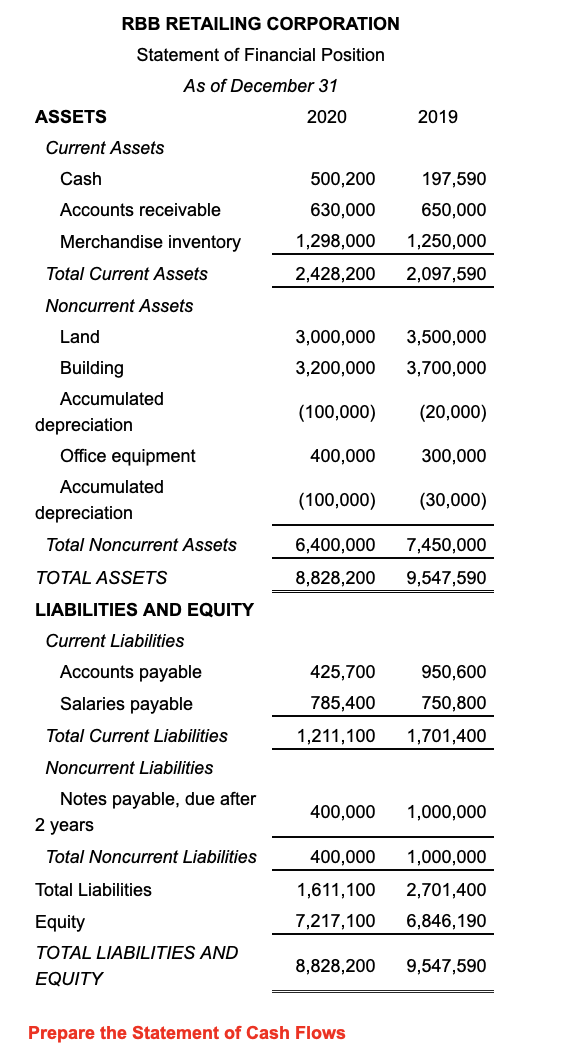

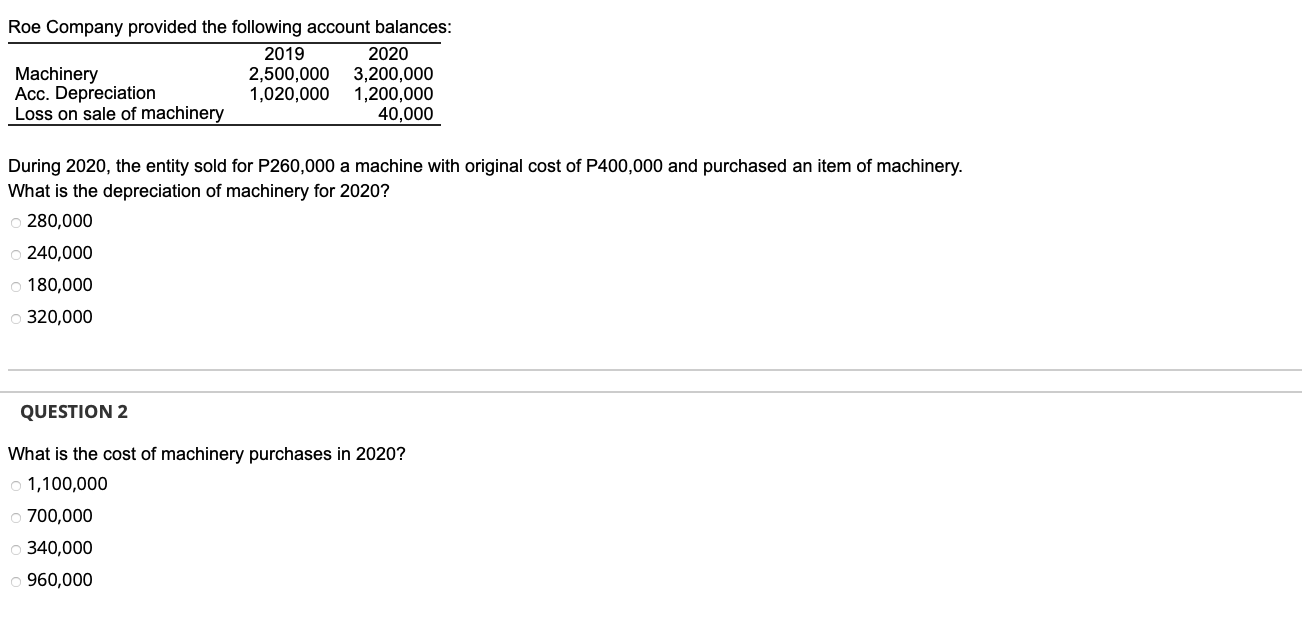

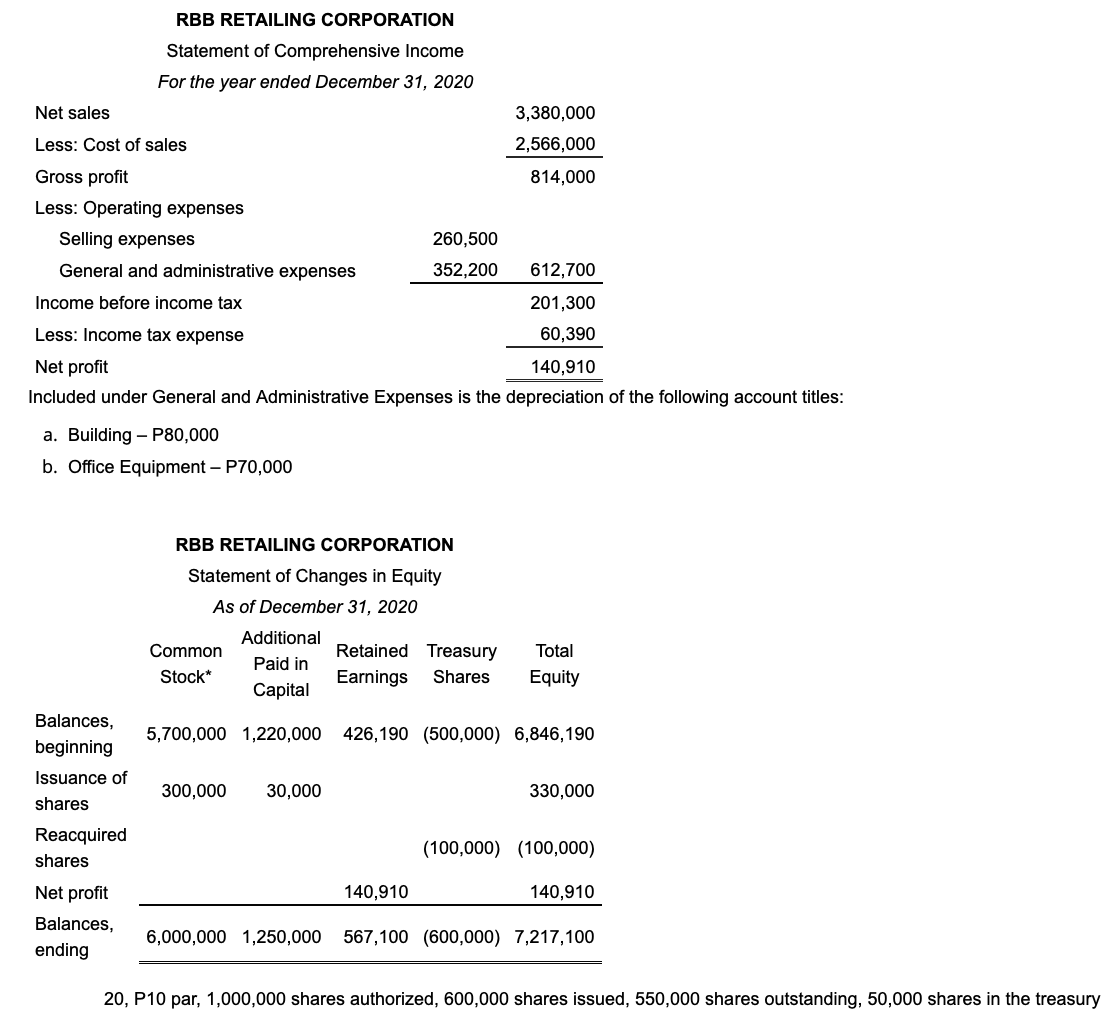

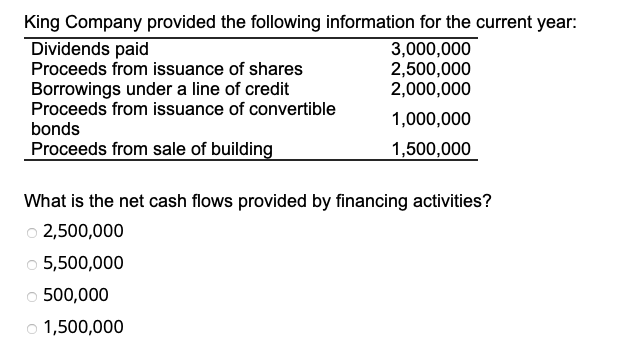

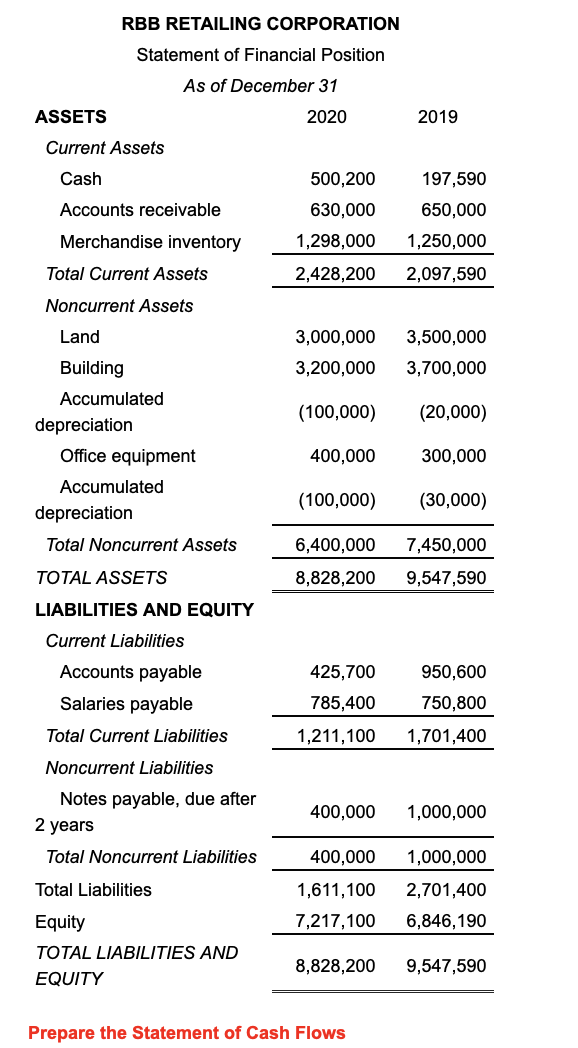

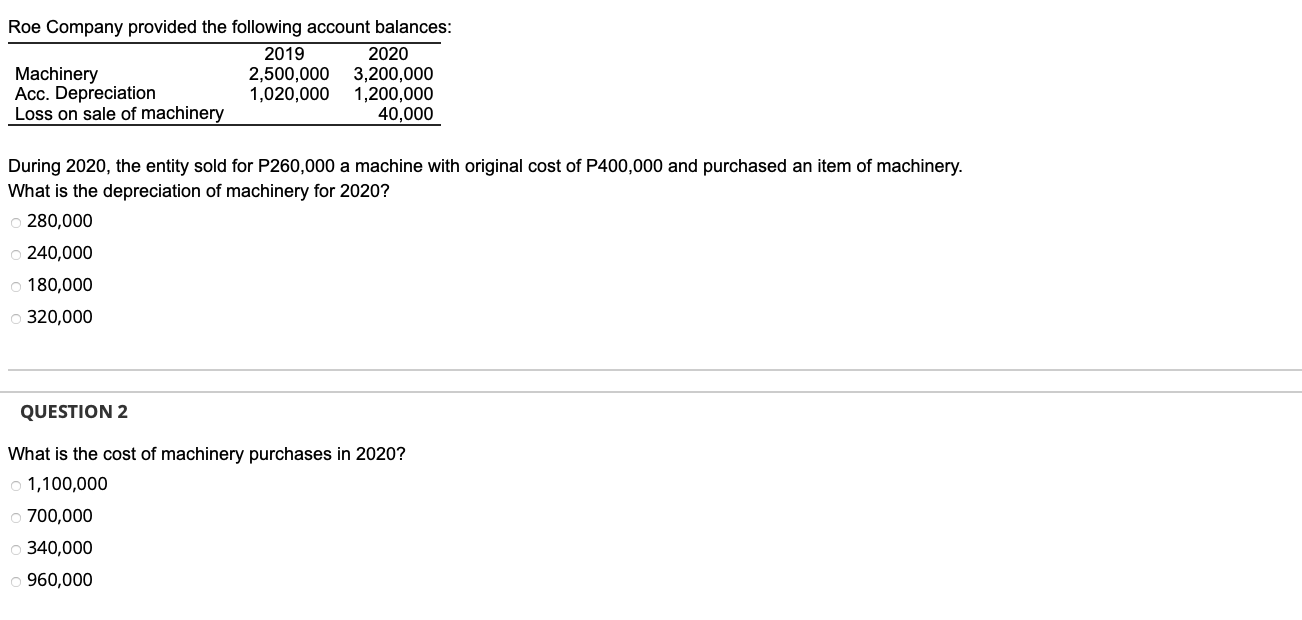

QUESTION 1 - You are given until September 1, 2020 to complete this seatwork. - You can keep on answering this seatwork and use it as a reviewer for quizzes and exam but the recorded score will be based on your first (1st) attempt. - You can view the solutions to the problem after the due date. (starting on September 2, 2020). Santana Company provided the following information for the current year: December 31 January 1 Cash 1,500,000 1,000,000 Retained earnings 7,000,000 5,400,000 Cash flow from operating activities ? Cash flow from investing activities (4,800,000) Cash flow from financing activities 1,800,000 Dividends declared and paid 2,000,000 Net income 3,600,000 What amount should be reported as cash flow from operating activities? o 2,500,000 o 3,500,000 o 4,500,000 o 3,600,000- You can keep on answering this seatwork and use it as a reviewer for quizzes and exam but the recorded score will be based on your rst (1st) attempt. - You can view the solutions to the problem after the due date. (starting on September 2, 2020). Star Company provided the following data for the preparation of statement of cash ows for the current year using the direct method: Cash balance, beginning 1,500,000 Cash paid to purchase inventory 7,800,000 Cash received from sale of building 5,600,000 Cash paid for interest 450,000 Cash paid to repay a loan 1,000,000 Cash collected lrom customers 10,000,000 Cash received from issuance of 1,200,000 ordinary shares Cash paid for dividend 780,000 Cash paid for income taxes 1,320,000 Cash aid to purchase machinery 1,950,000 What is the net cash ow from operating activities? ' 1,750,000 ' 880,000 ' 970,000 ' 430,000 RBB RETAILING CORPORATION Statement of Comprehensive Income For the year ended December 31, 2020 Net sales 3,380,000 Less: Cost of sales 2,566,000 Gross profit 814,000 Less: Operating expenses Selling expenses 260,500 General and administrative expenses 352,200 612,700 Income before income tax 201,300 Less: Income tax expense 60,390 Net profit 140,910 Included under General and Administrative Expenses is the depreciation of the following account titles: a. Building - P80,000 b. Office Equipment - P70,000 RBB RETAILING CORPORATION Statement of Changes in Equity As of December 31, 2020 Common Additional Paid in Retained Treasury Total Stock* Capital Earnings Shares Equity Balances, beginning 5,700,000 1,220,000 426,190 (500,000) 6,846, 190 Issuance of 30,000 330,000 shares 300,000 Reacquired shares (100,000) (100,000) Net profit 140,910 140,910 Balances, ending 6,000,000 1,250,000 567,100 (600,000) 7,217,100 20, P10 par, 1,000,000 shares authorized, 600,000 shares issued, 550,000 shares outstanding, 50,000 shares in the treasuryKing Company provided the following information for the current year: Dividends paid 3,000,000 Proceeds from issuance of shares 2,500,000 Borrowings under a line of credit 2,000,000 Proceeds from issuance of convertible bonds 1,000,000 Proceeds from sale of building 1,500,000 What is the net cash flows provided by financing activities? o 2,500,000 o 5,500,000 o 500,000 o 1,500,000RBB RETAILING CORPORATION Statement of Financial Position As of December 31 ASSETS 2020 2019 Current Assets Cash 500,200 197,590 Accounts receivable 630,000 650,000 Merchandise inventory 1,298,000 1,250,000 Total Current Assets 2,428,200 2,097,590 Noncurrent Assets Land 3,000,000 3,500,000 Building 3,200,000 3,700,000 Accumulated depreciation (100,000) (20,000) Office equipment 400,000 300,000 Accumulated depreciation (100,000) (30,000) Total Noncurrent Assets 6,400,000 7,450,000 TOTAL ASSETS 8,828,200 9,547,590 LIABILITIES AND EQUITY Current Liabilities Accounts payable 425,700 950,600 Salaries payable 785,400 750,800 Total Current Liabilities 1,211, 100 1,701,400 Noncurrent Liabilities Notes payable, due after 2 years 400,000 1,000,000 Total Noncurrent Liabilities 400,000 1,000,000 Total Liabilities 1,611, 100 2,701,400 Equity 7,217, 100 6,846, 190 TOTAL LIABILITIES AND EQUITY 8,828,200 9,547,590 Prepare the Statement of Cash FlowsRoe Company provided the following account balances: 2019 2020 Machinery 2,500,000 3,200,000 Acc. Depreciation 1,020,000 1,200,000 Loss on sale of machinery 40,000 During 2020, the entity sold for P260000 a machine with original cost of P400,000 and purchased an item of machinery. What is the depreciation of machinery for 2020'? - 230,000 - 240,000 - 100,000 - 320,000 QUESTION 2 What is the cost of machinery purchases in 2020'? ' 1,100,000 ' 700,000 ' 340,000 ' 960,000