Answered step by step

Verified Expert Solution

Question

1 Approved Answer

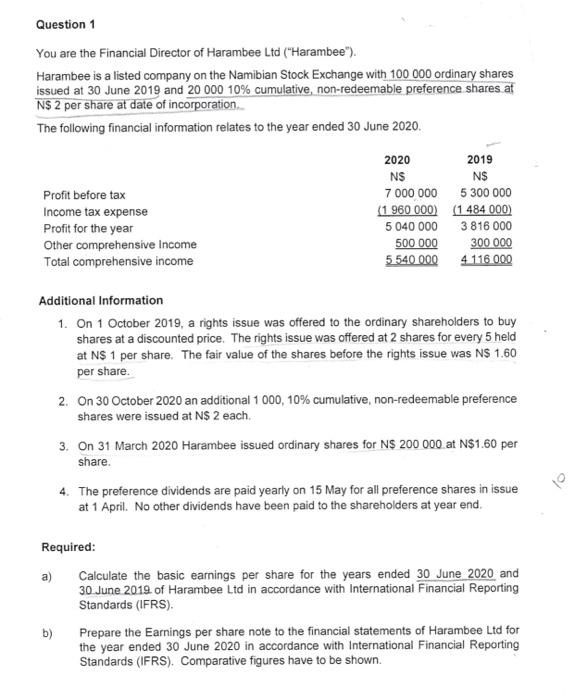

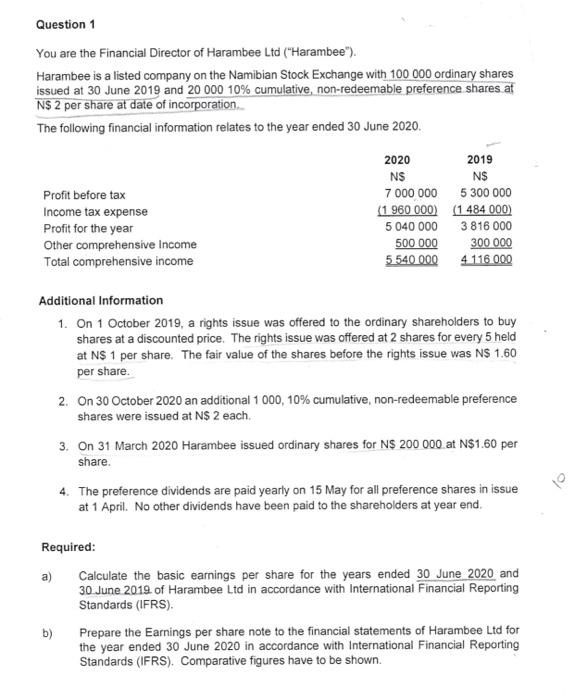

QUESTION 1 Question 1 You are the Financial Director of Harambee Ltd (Harambee). Harambee is a listed company on the Namibian Stock Exchange with 100

QUESTION 1

Question 1 You are the Financial Director of Harambee Ltd ("Harambee). Harambee is a listed company on the Namibian Stock Exchange with 100 000 ordinary shares issued at 30 June 2019 and 20 000 10% cumulative, non-redeemable preference shares af N$ 2 per share at date of incorporation The following financial information relates to the year ended 30 June 2020. NS Profit before tax Income tax expense Profit for the year Other comprehensive Income Total comprehensive income 2020 2019 NS 7 000 000 5 300 000 (1 960 000) (1 484 000) 5 040 000 3 816 000 500 000 300 000 5 540 000 4116 000 Additional Information 1. On 1 October 2019, a rights issue was offered to the ordinary shareholders to buy shares at a discounted price. The rights issue was offered at 2 shares for every 5 held at N$ 1 per share. The fair value of the shares before the rights issue was N$ 1.60 per share. 2. On 30 October 2020 an additional 1000, 10% cumulative, non-redeemable preference shares were issued at N$ 2 each. 3. On 31 March 2020 Harambee issued ordinary shares for NS 200 000 at N$1.60 per share. 4. The preference dividends are paid yearly on 15 May for all preference shares in issue at 1 April. No other dividends have been paid to the shareholders at year end. Required: a) Calculate the basic earnings per share for the years ended 30 June 2020 and 30 June 2019 of Harambee Ltd in accordance with International Financial Reporting Standards (IFRS). b) Prepare the Earnings per share note to the financial statements of Harambee Ltd for the year ended 30 June 2020 in accordance with International Financial Reporting Standards (IFRS). Comparative figures have to be shown

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started