Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1:- Question 2 Based on the information derived, would you recommend that the project be accepted? Advanta Bhd. is a medium-sized manufacturing company that

Question 1:-

Question 2

Based on the information derived, would you recommend that the project be accepted?

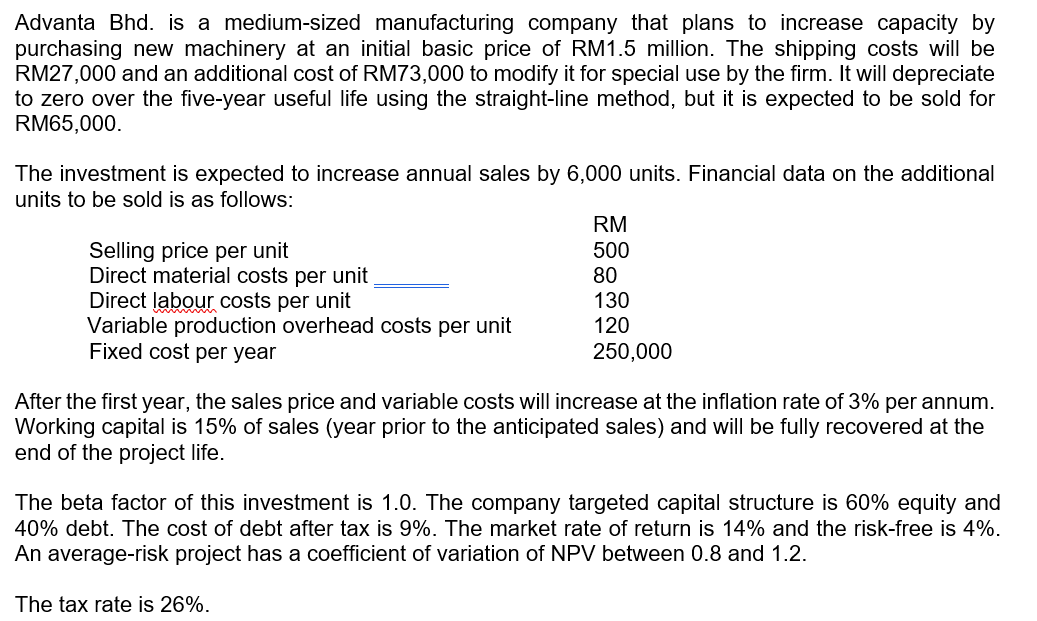

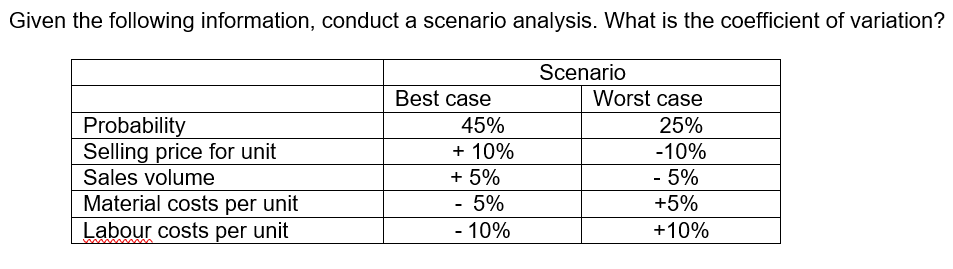

Advanta Bhd. is a medium-sized manufacturing company that plans to increase capacity by purchasing new machinery at an initial basic price of RM1.5 million. The shipping costs will be RM27,000 and an additional cost of RM73,000 to modify it for special use by the firm. It will depreciate to zero over the five-year useful life using the straight-line method, but it is expected to be sold for RM65,000. The investment is expected to increase annual sales by 6,000 units. Financial data on the additional units to be sold is as follows: After the first year, the sales price and variable costs will increase at the inflation rate of 3% per annum. Working capital is 15% of sales (year prior to the anticipated sales) and will be fully recovered at the end of the project life. The beta factor of this investment is 1.0 . The company targeted capital structure is 60% equity and 40% debt. The cost of debt after tax is 9%. The market rate of return is 14% and the risk-free is 4%. An average-risk project has a coefficient of variation of NPV between 0.8 and 1.2. The tax rate is 26%. Given the following information, conduct a scenario analysis. What is the coefficient of variationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started