Question #1:

Question #2:

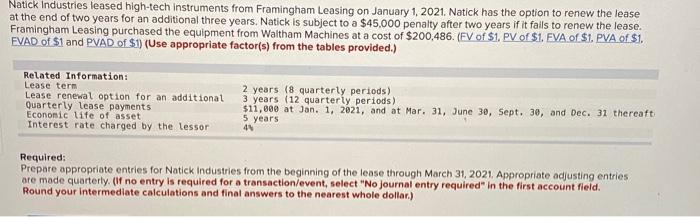

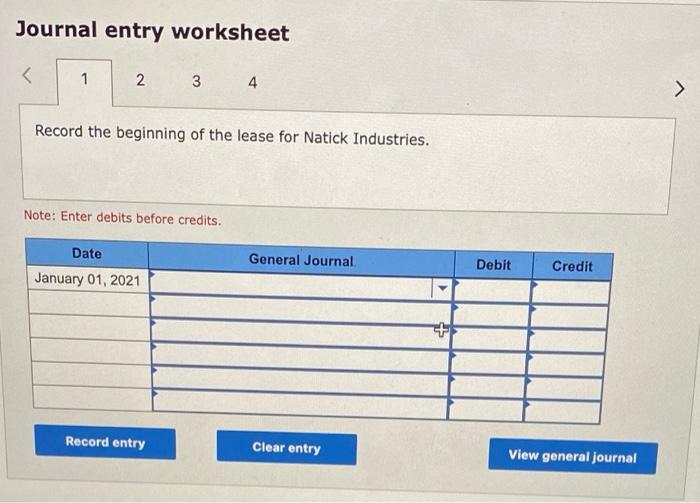

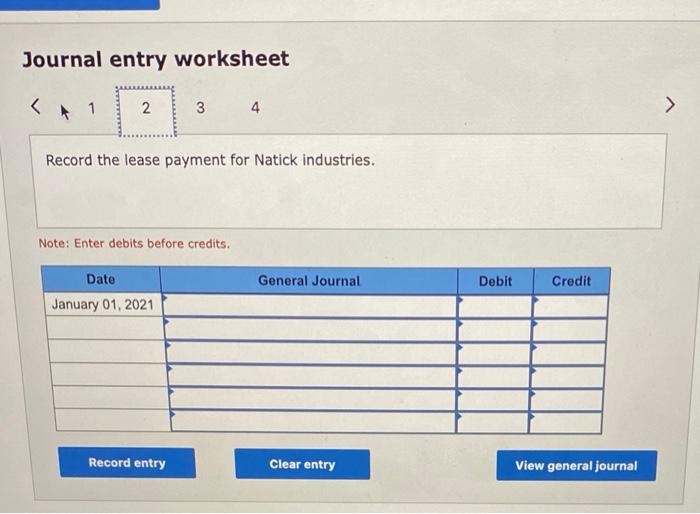

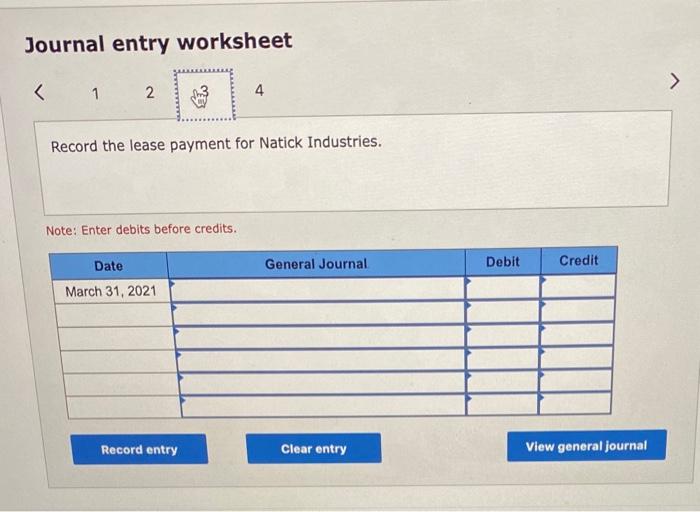

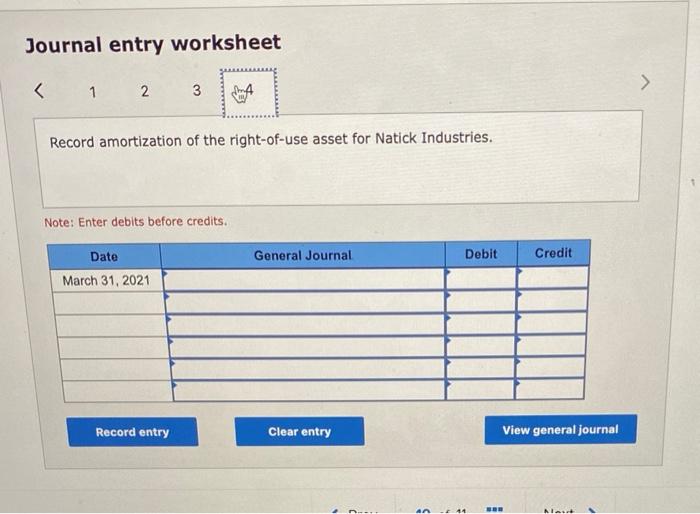

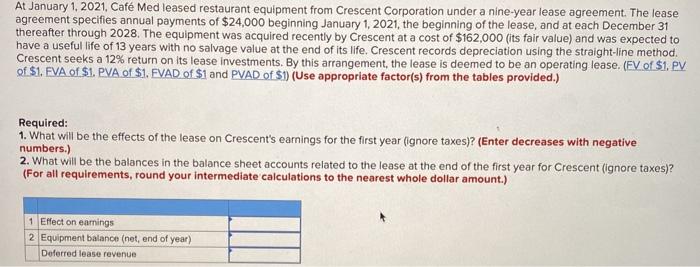

Natick Industries leased high-tech instruments from Framingham Leasing on January 1, 2021. Natick has the option to renew the lease at the end of two years for an additional three years. Natick is subject to a $45,000 penalty after two years if it fails to renew the lease. Framingham Leasing purchased the equipment from Waltham Machines at a cost of $200,486. (FV of $1. PV of $1. EVA of $1. PVA of $1. EVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Related Information: Lease term Lease renewal option for an additional Quarterly lease payments Economic life of asset Interest rate charged by the lessor 2 years (8 quarterly periods) 3 years (12 quarterly periods) $11,000 at Jan. 1, 2021, and at Mar. 31, June 30, Sept. 30, and Dec. 31 thereaft 5 years 44 Required: Prepare appropriate entries for Natick Industries from the beginning of the lease through March 31, 2021. Appropriate adjusting entries are made quarterly. (If no entry is required for a transaction/event, select "No journal entry required in the first account field. Round your intermediate calculations and final answers to the nearest whole dollar) Journal entry worksheet fort Record amortization of the right-of-use asset for Natick Industries. Note: Enter debits before credits. General Journal Debit Credit Date March 31, 2021 Record entry Clear entry View general journal an ! NA At January 1, 2021. Caf Med leased restaurant equipment from Crescent Corporation under a nine-year lease agreement. The lease agreement specifies annual payments of $24,000 beginning January 1, 2021, the beginning of the lease, and at each December 31 thereafter through 2028. The equipment was acquired recently by Crescent at a cost of $162,000 (its fair value) and was expected to have a useful life of 13 years with no salvage value at the end of its life. Crescent records depreciation using the straight-line method. Crescent seeks a 12% return on its lease investments. By this arrangement, the lease is deemed to be an operating lease. (EV of $1. PV of $1. EVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. What will be the effects of the lease on Crescent's earnings for the first year (ignore taxes)? (Enter decreases with negative numbers.) 2. What will be the balances in the balance sheet accounts related to the lease at the end of the first year for Crescent (ignore taxes)? (For all requirements, round your intermediate calculations to the nearest whole dollar amount.) 1 Effect on earnings 2 Equipment balance (net, end of year) Deferred lease revenue