Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1: Question 2: Need help on these last two problems. ! Required information [The following information applies to the questions displayed below.] On January

Question 1:

Question 2:

Need help on these last two problems.

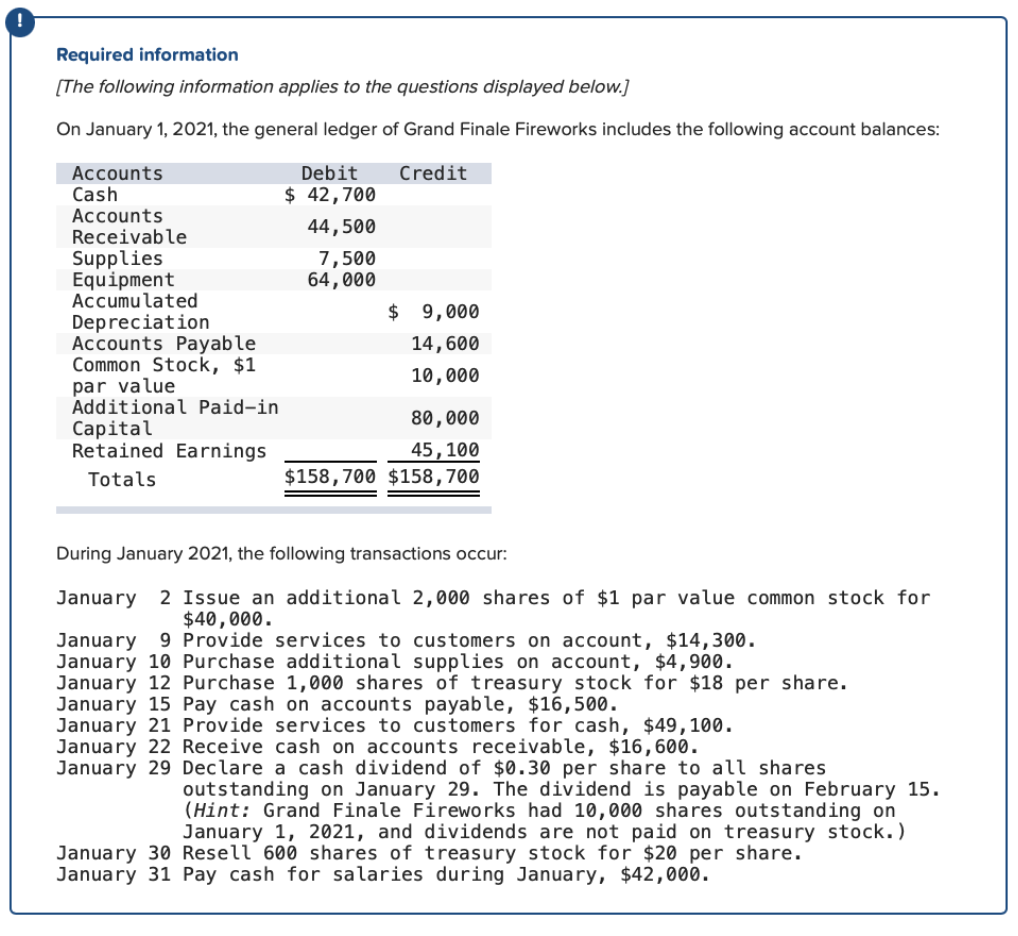

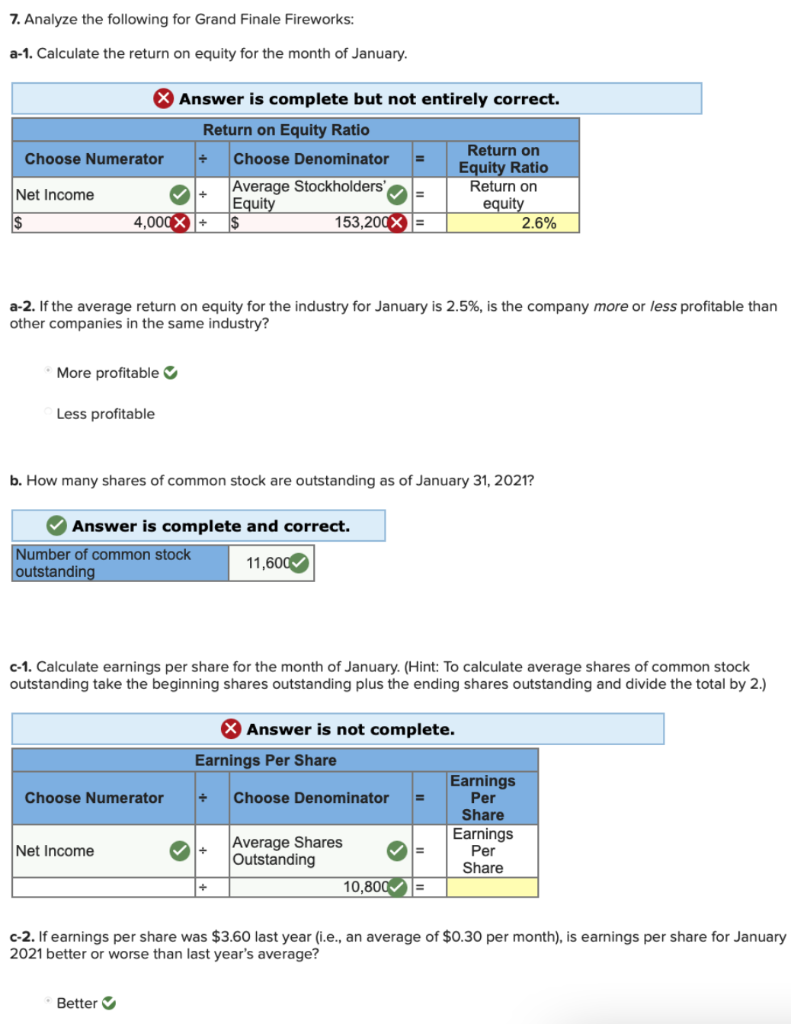

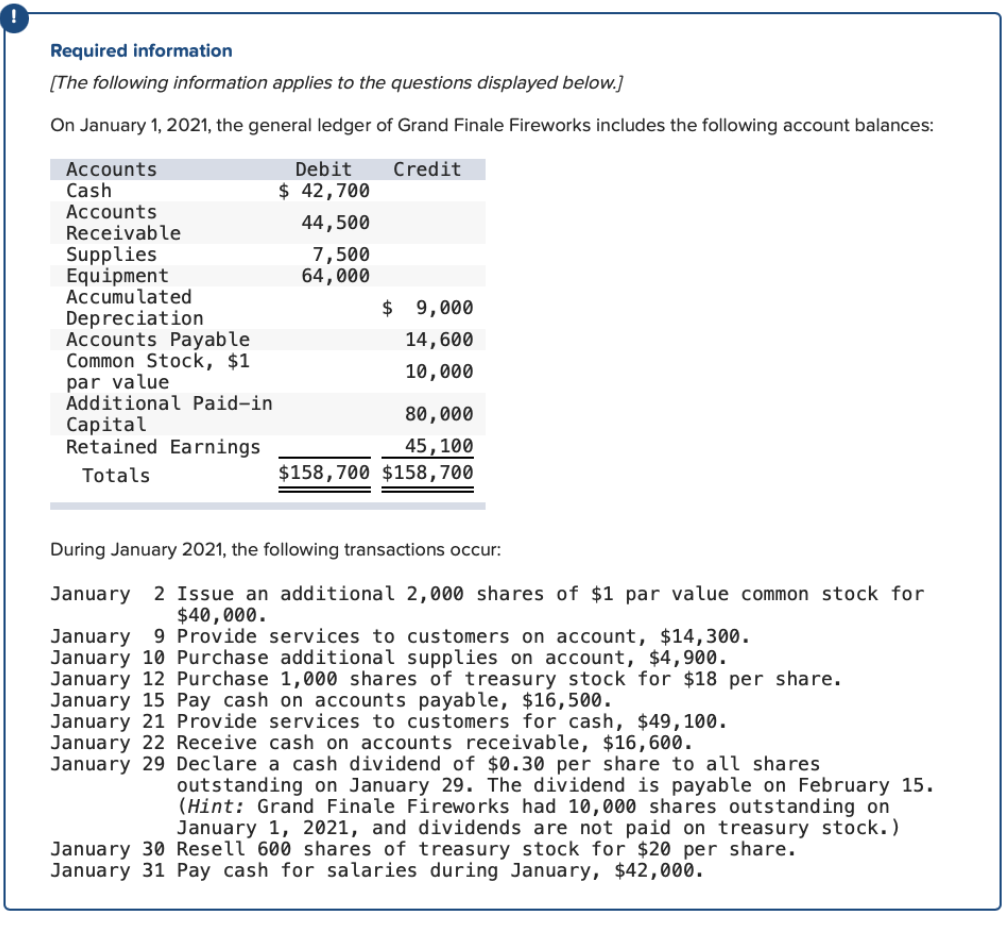

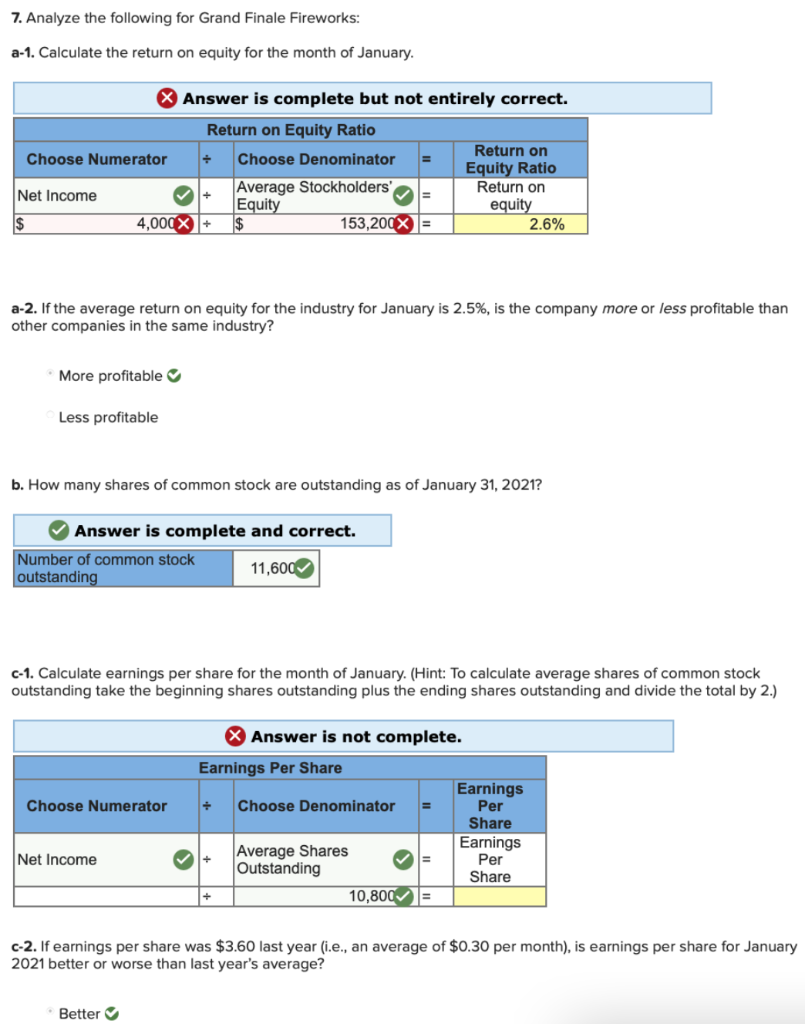

! Required information [The following information applies to the questions displayed below.] On January 1, 2021, the general ledger of Grand Finale Fireworks includes the following account balances: Accounts Debit Credit Cash $ 42,700 Accounts Receivable 44,500 Supplies 7,500 Equipment 64,000 Accumulated Depreciation $ 9,000 Accounts Payable 14,600 Common Stock, $1 par value 10,000 Additional Paid-in 80,000 Capital Retained Earnings 45, 100 Totals $158,700 $158,700 During January 2021, the following transactions occur: January 2 Issue an additional 2,000 shares of $1 par value common stock for $40,000. January 9 Provide services to customers on account, $14,300. January 10 Purchase additional supplies on account, $4,900. January 12 Purchase 1,000 shares of treasury stock for $18 per share. January 15 Pay cash on accounts payable, $16,500. January 21 Provide services to customers for cash, $49, 100. January 22 Receive cash on accounts receivable, $16,600. January 29 Declare a cash dividend of $0.30 per share to all shares outstanding on January 29. The dividend is payable on February 15. (Hint: Grand Finale Fireworks had 10,000 shares outstanding on January 1, 2021, and dividends are not paid on treasury stock.) January 30 Resell 600 shares of treasury stock for $20 per share. January 31 Pay cash for salaries during January, $42,000. 7. Analyze the following for Grand Finale Fireworks: a-1. Calculate the return on equity for the month of January Answer is complete but not entirely correct. Return on Equity Ratio Return on Choose Numerator Choose Denominator Equity Ratio Net Income Return on Average Stockholders + = Equity equity 4,000x $ 153,200x = 2.6% = a-2. If the average return on equity for the industry for January is 2.5%, is the company more or less profitable than other companies in the same industry? More profitable Less profitable b. How many shares of common stock are outstanding as of January 31, 2021? Answer is complete and correct. Number of common stock outstanding 11,600 c-1. Calculate earnings per share for the month of January (Hint: To calculate average shares of common stock outstanding take the beginning shares outstanding plus the ending shares outstanding and divide the total by 2.) Choose Numerator Answer is not complete. Earnings Per Share Earnings Choose Denominator Per Share Earnings Average Shares Per Outstanding Share 10,800= Net Income c-2. If earnings per share was $3.60 last year (i.e., an average of $0.30 per month), is earnings per share for January 2021 better or worse than last year's average? Better Required information [The following information applies to the questions displayed below.) On January 1, 2021, the general ledger of Grand Finale Fireworks includes the following account balances: Accounts Debit Credit Cash $ 42,700 Accounts Receivable 44,500 Supplies 7,500 Equipment 64,000 Accumulated Depreciation $ 9,000 Accounts Payable 14,600 Common Stock, $1 par value 10,000 Additional Paid-in Capital 80,000 Retained Earnings 45, 100 Totals $ 158,700 $158,700 During January 2021, the following transactions occur: January 2 Issue an additional 2,000 shares of $1 par value common stock for $40,000. January 9 Provide services to customers on account, $14,300. January 10 Purchase additional supplies on account, $4,900. January 12 Purchase 1,000 shares of treasury stock for $18 per share. January 15 Pay cash on accounts payable, $16,500. January 21 Provide services to customers for cash, $49, 100. January 22 Receive cash on accounts receivable, $16,600. January 29 Declare a cash dividend of $0.30 per share to all shares outstanding on January 29. The dividend is payable on February 15. (Hint: Grand Finale Fireworks had 10,000 shares outstanding on January 1, 2021, and dividends are not paid on treasury stock.) January 30 Resell 600 shares of treasury stock for $20 per share. January 31 Pay cash for salaries during January, $42,000. 7. Analyze the following for Grand Finale Fireworks: a-1. Calculate the return on equity for the month of January. Answer is complete but not entirely correct. Return on Equity Ratio Choose Numerator Return on Choose Denominator Equity Ratio Net Income Average Stockholders' Return on Equity equity 4,000+ $ 153,200X= 2.6% E a-2. If the average return on equity for the industry for January is 2.5%, is the company more or less profitable than other companies in the same industry? More profitable Less profitable b. How many shares of common stock are outstanding as of January 31, 2021? Answer is complete and correct. Number of common stock outstanding 11,600 c-1. Calculate earnings per share for the month of January. (Hint: To calculate average shares of common stock outstanding take the beginning shares outstanding plus the ending shares outstanding and divide the total by 2.) Choose Numerator + X Answer is not complete. Earnings Per Share Earnings Choose Denominator Per Share Earnings Average Shares Outstanding Share 10,800= Net Income + Per c-2. If earnings per share was $3.60 last year (i.e., an average of $0.30 per month), is earnings per share for January 2021 better or worse than last year's average? BetterStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started