QUESTION 1 :

QUESTION 2 :

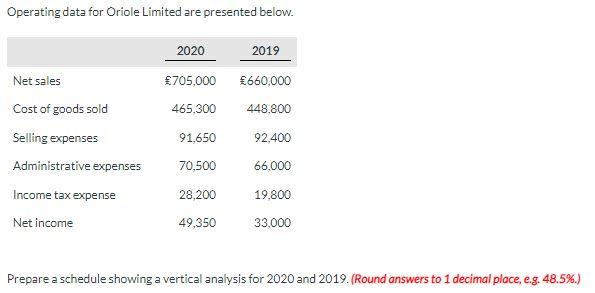

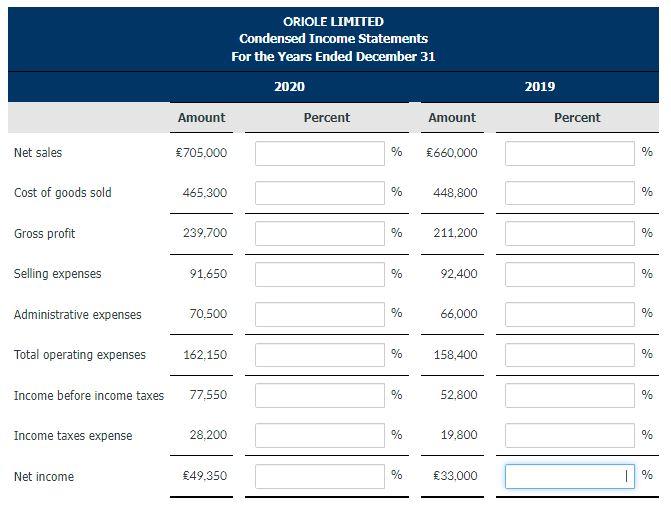

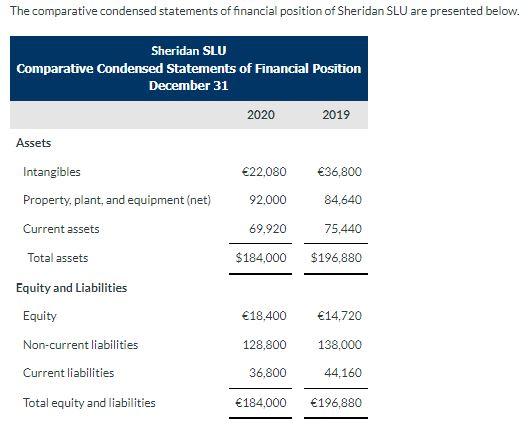

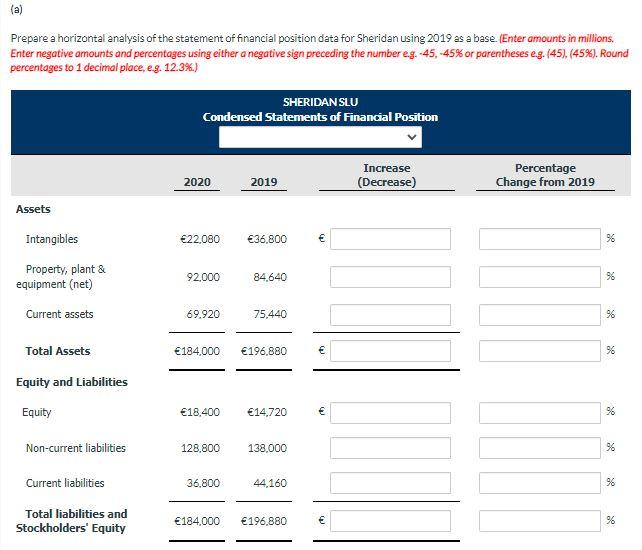

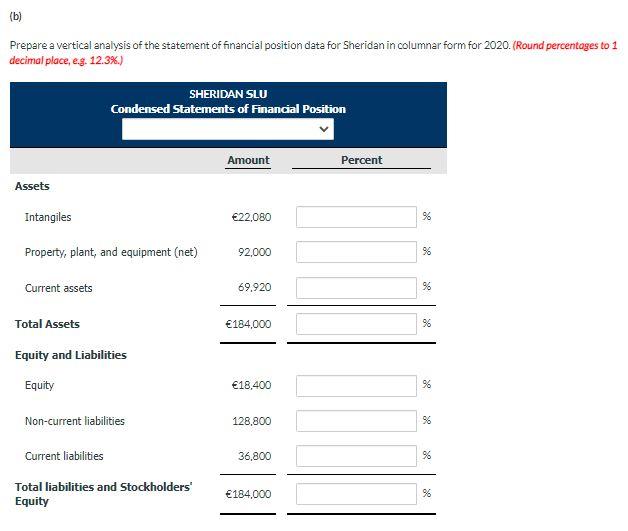

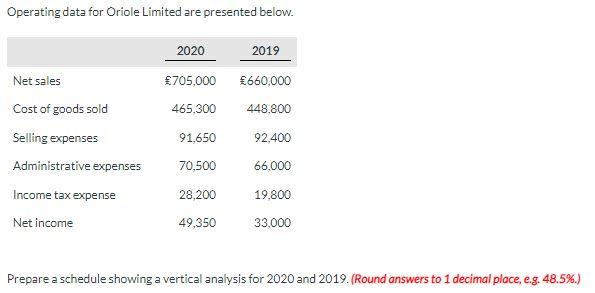

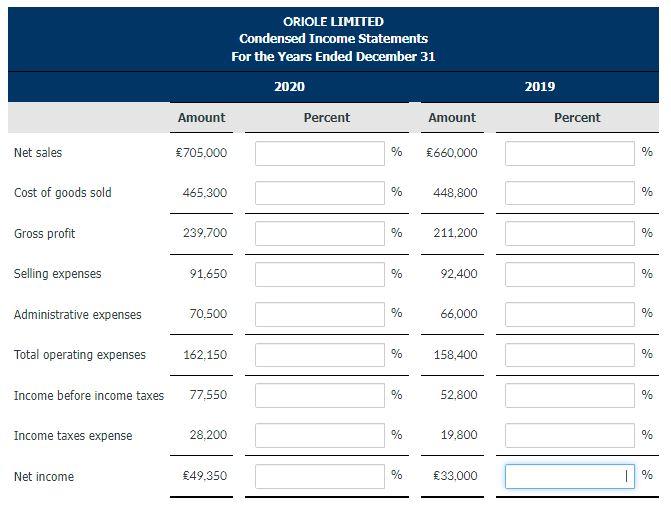

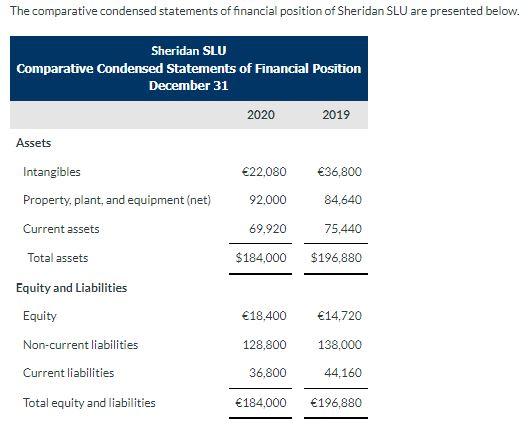

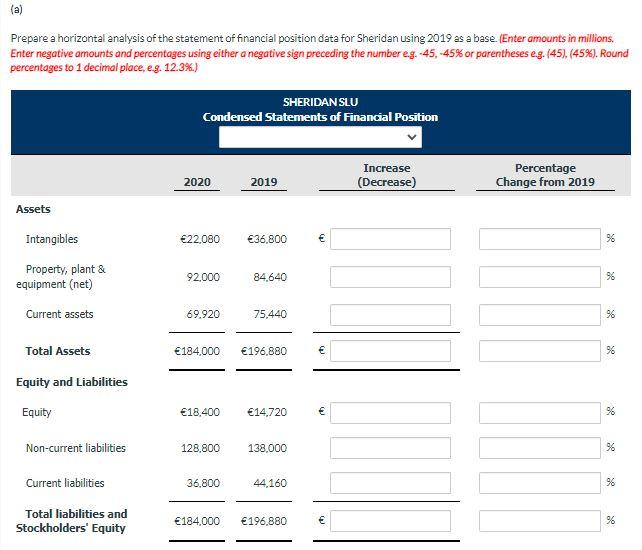

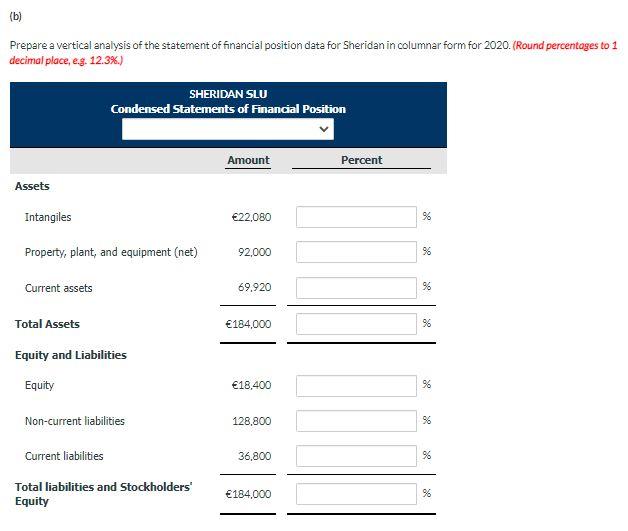

Operating data for Oriole Limited are presented below. 2020 2019 705,000 660,000 Net sales Cost of goods sold 465.300 448,800 92,400 Selling expenses Administrative expenses 91,650 70,500 66,000 28,200 19.800 Income tax expense Net income 49,350 33,000 Prepare a schedule showing a vertical analysis for 2020 and 2019. (Round answers to 1 decimal place, e.g. 48.5%) ORIOLE LIMITED Condensed Income Statements For the Years Ended December 31 2020 2019 Amount Percent Amount Percent Net sales 705.000 % 660,000 % Cost of goods sold 465,300 % 448,800 % Gross profit 239,700 % 211,200 % Selling expenses 91.650 % 92.400 % Administrative expenses 70.500 % 66,000 % Total operating expenses 162.150 % 158,400 % Income before income taxes 77.550 % 52.800 % Income taxes expense 28,200 % 19,800 % Net income 49.350 % 33.000 1% The comparative condensed statements of financial position of Sheridan SLU are presented below. Sheridan SLU Comparative Condensed Statements of Financial Position December 31 2020 2019 Assets 22,080 36,800 92.000 84.640 69.920 75.440 $184,000 $196,880 Intangibles Property, plant, and equipment (net) Current assets Total assets Equity and Liabilities Equity Non-current liabilities Current liabilities Total equity and liabilities 18.400 14,720 128,800 138.000 36,800 44,160 184.000 196.880 (a) Prepare a horizontal analysis of the statement of financial position data for Sheridan using 2019 as a base. (Enter amounts in millions. Enter negative amounts and percentages using either a negative sign preceding the number eg.-45, -45% or parentheses eg. (45), (45%). Round percentages to 1 decimal place, eg. 12.3%.) SHERIDAN SLU Condensed Statements of Financial Position Percentage Change from 2019 2020 Increase (Decrease) 2019 Assets Intangibles 22,080 36.800 96 Property, plant & equipment (net) 92.000 84,640 96 Current assets 69.920 75,440 96 Total Assets 184.000 196.880 96 Equity and Liabilities Equity 18.400 14,720 96 Non-current liabilities 128.800 138.000 96 Current liabilities 36,800 44,160 96 Total liabilities and Stockholders' Equity 184.000 196.880 % (b) Prepare a vertical analysis of the statement of financial position date for Sheridan in columnar form for 2020. (Round percentages to 1 decimal place, eg. 12.3%.) SHERIDAN SLU Condensed Statements of Financial Position Amount Percent Assets Intangiles 22.080 % Property, plant, and equipment (net) 92,000 o 96 Current assets 69,920 % OS Total Assets 184,000 6 Equity and Liabilities Equity 18,400 % Non-current liabilities 128,800 %% Current liabilities 36.800 6 % Total liabilities and Stockholders' Equity 184,000 % %