Question #1

Question #2

Please answer both questions in full if you know how to do it! Please allign the answers how the questions are so it's not confusing for me to figute out where it goes! I will give thumbs up if the answers are correct! If you have trouble reading any of the images please let me know so that I can post another picute! Thank you

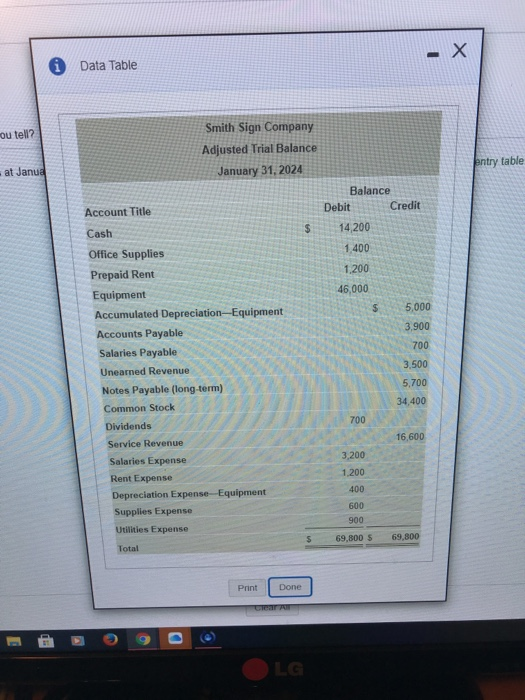

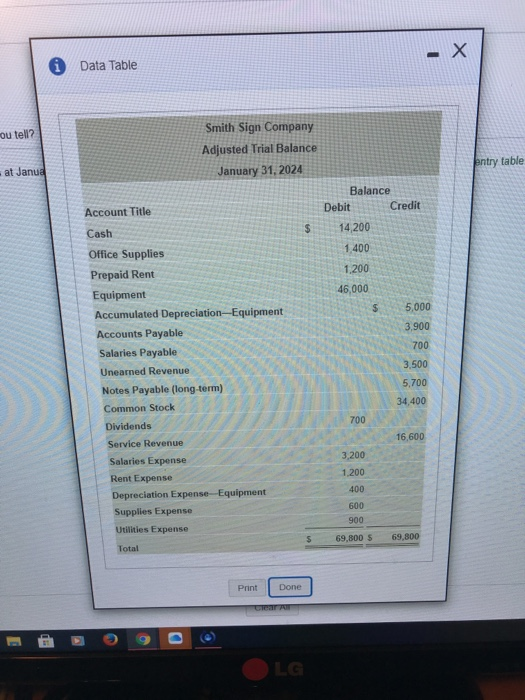

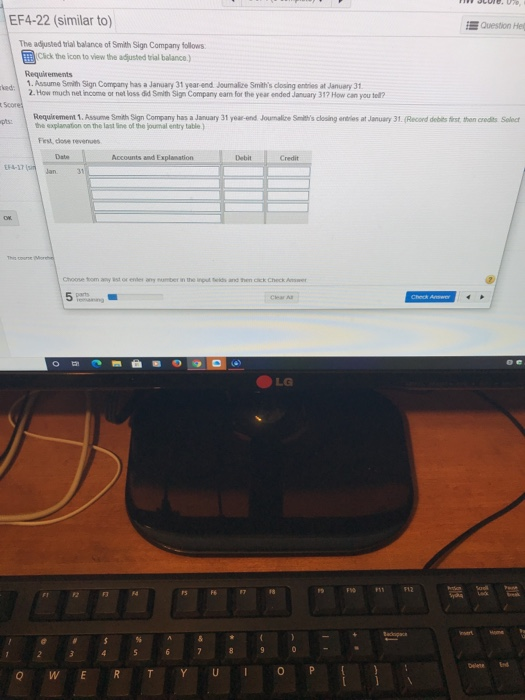

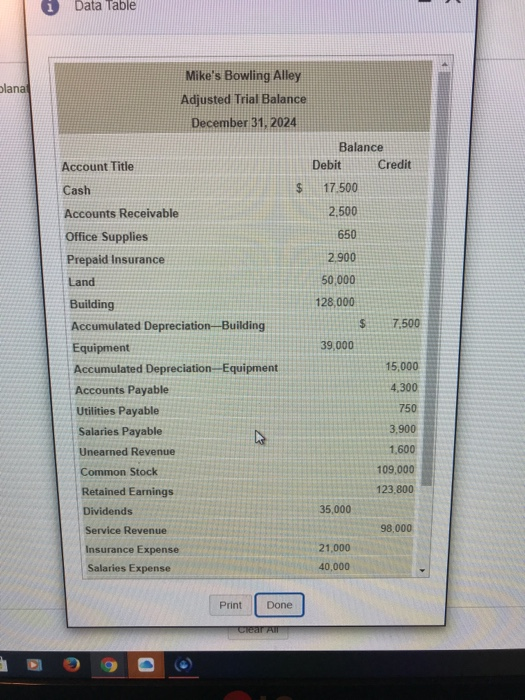

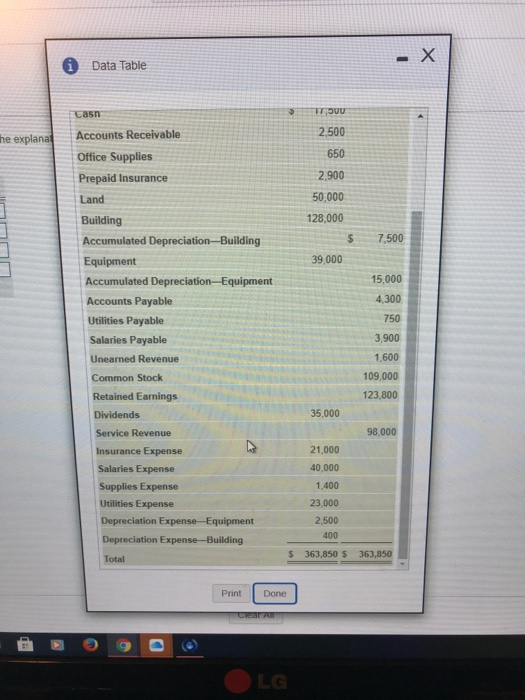

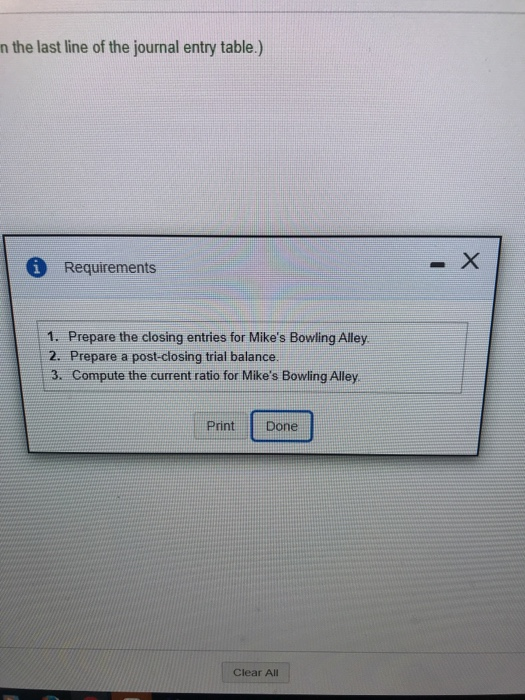

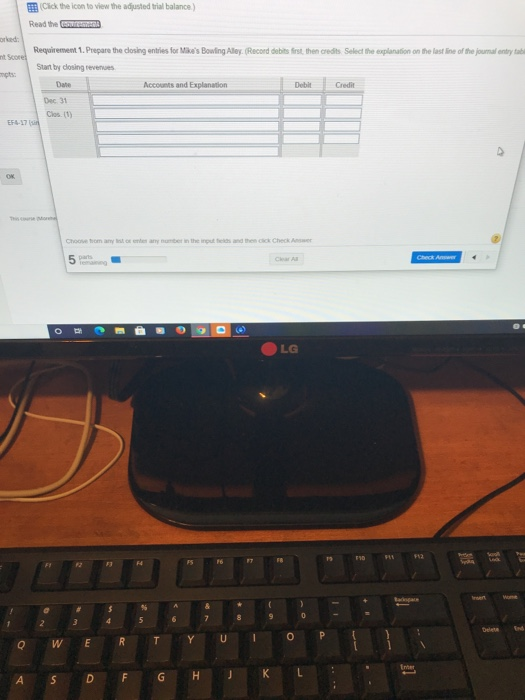

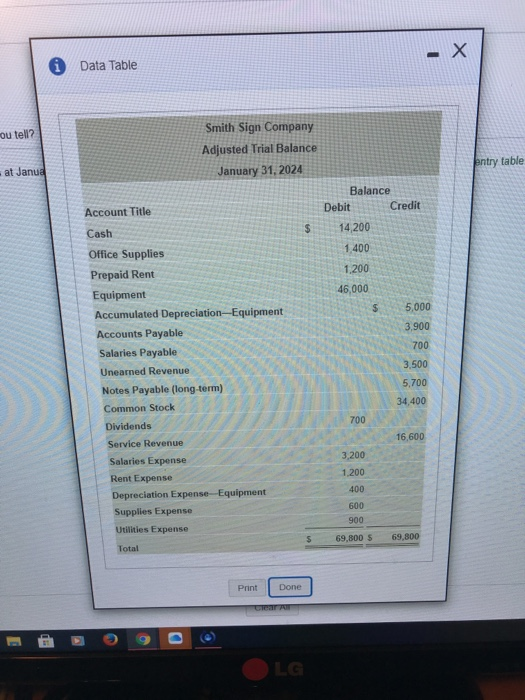

i Data Table ou tell? Smith Sign Company Adjusted Trial Balance January 31, 2024 antry table at Janua Account Title Balance Debit Credit 14 200 Cash $ 1,400 1,200 46,000 $ 5,000 3,900 700 3,500 5,700 Office Supplies Prepaid Rent Equipment Accumulated Depreciation--Equipment Accounts Payable Salaries Payable Unearned Revenue Notes Payable (long-term) Common Stock Dividends Service Revenue Salaries Expense Rent Expense Depreciation Expense Equipment Supplies Expense Utilities Expense 34,400 700 16,600 3,200 1.200 400 600 900 $ 69,800 $ 69,800 Total Print Done Done LG . EF4-22 (similar to) Question He The adjusted trial balance of Smith Sign Company follows: Click the icon to view the adjusted trial balance.) Requirements sked: 1. Assume Smith Sign Company has a January 31 year end. Joumalize Smith's closing entries at January 31 2. How much net income or not loss did Smith Sign Company cam for the year ended January 317 How can you tell? Score Requirement 1. Assume Smith Sign Company has a January 31 year and Journalize Smith's closing entries at January 31. (Record debits first the credits Select pts the explanation on the last of the journal entry table) Fest, done even Accounts and Explanation Debit FIT Credit Jan 31 DW Choose from our honden Check C Check Answer LG o F12 w 4 5 Delen tod 0 Q P W T E Data Table blana Mike's Bowling Alley Adjusted Trial Balance December 31, 2024 Account Title Balance Debit Credit 17.500 2.500 Cash $ 650 2.900 50,000 128,000 $ 7,500 39,000 Accounts Receivable Office Supplies Prepaid Insurance Land Building Accumulated Depreciation-Building Equipment Accumulated Depreciation Equipment Accounts Payable Utilities Payable Salaries Payable Unearned Revenue Common Stock Retained Earnings Dividends 15,000 4,300 750 3,900 1,600 109,000 123,800 35,000 98,000 Service Revenue Insurance Expense Salaries Expense 21,000 40,000 Print Done Clear All i Data Table -X > , 2,500 the explana 650 2.900 50,000 128,000 $ 7,500 39,000 15,000 4,300 750 Casn Accounts Receivable Office Supplies Prepaid Insurance Land Building Accumulated Depreciation--Building Equipment Accumulated Depreciation-Equipment Accounts Payable Utilities Payable Salaries Payable Unearned Revenue Common Stock Retained Earnings Dividends Service Revenue Insurance Expense Salaries Expense Supplies Expense Utilities Expense Depreciation Expense-Equipment Depreciation Expense-Building Total 3,900 1,600 109,000 123,800 35,000 98,000 21,000 40,000 1,400 23,000 2,500 400 $363,850 $ 363,850 Print Done Creal LG in the last line of the journal entry table.) * Requirements - X 1. Prepare the closing entries for Mike's Bowling Alley 2. Prepare a post-closing trial balance. 3. Compute the current ratio for Mike's Bowling Alley Print Done Clear All Click the icon to view the adjusted trial balance) Read the worked Requirement. 1. Prepare the closing entries for Mike's Bowing Aley. (Record debits first, then credits Select the explanation on the last line of the journal entry tab int Score Accounts and Explanation Debit Credit Start by dosing revenues Date Dec 31 Clost) EF-17 OK Choose from any to enter any number in the inputs and then click Checker 5 parts CA o LG 190 FIL F12 0 3 Y U o Q W E R Ener S D F H